Recent events have caused the Bitcoin market to exhibit new vitality; the price of the coin is over $63,000. This spike coincides with a slew of notable events that experts and investors alike have noticed.

Related reading

Sleeping wallet turns into action

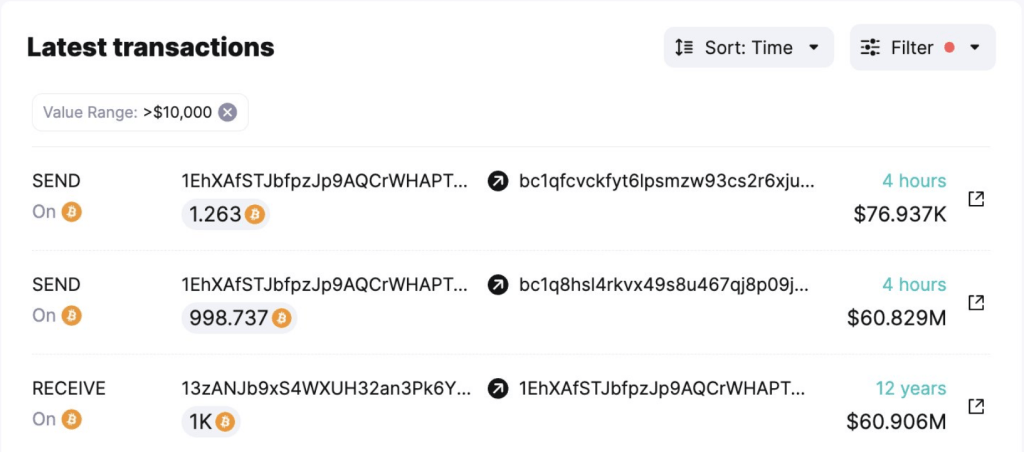

Enabling a long-dormant Bitcoin wallet is one of the most interesting events. Known as ‘1 EhXAfST’, the wallet had been inactive for almost twelve years until 1,000 BTC – worth around $60 million – was abruptly sent to two new wallets.

Given the background of the wallet, this shift is very important; each BTC was only worth $12.06, hence the initial investment was $12,060. With a current value of $60 million, Bitcoin’s price rise over the past decade is clearly astonishing.

4 hours ago the sleeping wallet “1EhXAfST” woke up after 11.8 years and moved 1,000 $BTC (~$60M) for 2 new wallets!

The wallet received this $BTC on September 25, 2012, when the price was just $12.06 ($12.06K).

Watch out for more #Bitcoin updates by following @spotonchain and set… pic.twitter.com/0YUVUWFKdJ

— Spot On Chain (@spotonchain) July 15, 2024

Although the causes of this move are still unknown, it has sparked debate about possible profit-taking or strategic repositioning by long-term owners. Nevertheless, experts believe that this one transaction is not expected to have a major impact on the overall price of Bitcoin on the market.

Increased whale activity and accumulation

Along with the revival of the dormant wallet, Bitcoin whale activity has clearly increased. When Bitcoin’s price fell to around $53,500 last week, major investors bought more than 71,000 BTC, or almost $4.3 billion in total.

This pace of accumulation, which is reported to be the fastest since April 2023, indicates a very positive attitude among key market participants.

The increase in whale activity corresponds to a period of price volatility, suggesting that these major players may be viewing the recent price declines as buying prospects. This behavior usually provides certainty about the long-term future of the item.

ETFs increase market momentum

The function of spot Bitcoin ETFs is another important determinant of the dynamics of the current market. Having only acquired $1.1 billion worth of Bitcoin in the last week, these fairly young investment vehicles have seen great success. The entire Bitcoin holdings of US ETFs have been driven to new all-time highs by this flood of institutional interest.

The great success of Bitcoin ETFs is interpreted as a good indication of the general acceptance of Bitcoin. It offers conventional investors a controlled way to gain exposure to Bitcoin without actually owning the asset, perhaps expanding the investor base and increasing overall market liquidity.

Overview of Bitcoin Prices

Of Bitcoin is trading at $63,165 according to the most recent statistics, it is above a significant trend line. Market players are closely watching this current price point as it could suggest the direction of further price swings.

Technical experts say there is a possibility for another 8% price gain if Bitcoin maintains its position above the $59,500 support level. Current patterns of accumulation and growing institutional interest support this perspective.

Yet the market is vulnerable to changes. A dip below $56,405 could signal a turn toward a negative stance, perhaps resulting in a 7.5% price drop. This highlights how crucial current support levels are in determining temporary price movements.

Related reading

The road ahead

Meanwhile, rising ETF participation, awakened dormant portfolios and increased whale activity all point to a market in flux. While these developments are generally seen as encouraging signs, the bitcoin market is notoriously fickle.

In the coming weeks, experts and investors will keep a close eye on various aspects. They will look for more movements of once-inactive wallets to understand the long-term mood of holders.

Featured image from CNBC, chart from TradingView