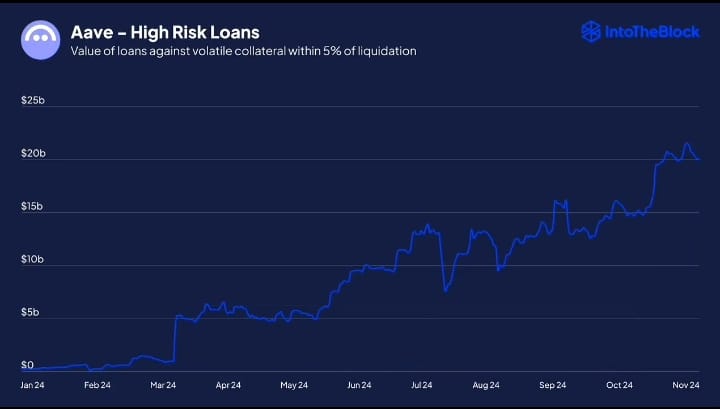

- High-risk DeFi loans rose sharply as market sentiment drove demand for leverage.

- DeFi token active addresses hitting new all-time highs.

High-risk loans rose like Bitcoin [BTC] hitting new ATH, driving demand for leverage. DeFi lending platforms Aave and Moonwell showed significant increases in the value of risky loans InHetBlokwhere the collateral was within 5% of the liquidation date.

The upward trend suggested an increased demand for leverage within the crypto market as participants seek higher returns, especially during bullish phases.

Notably, the rise in risky loans suggested that similar behavior was widespread on other DeFi lending platforms. This meant that broader market sentiment was tilting towards aggressive investment strategies.

Source: IntoTheBlock

However, the recent outcome of the US elections brought with it potential volatility that could negatively impact these leveraged positions.

Large-scale political events often lead to unpredictable market movements, increasing the risk of liquidations of these high-stakes loans.

The scenario illustrated the precarious balance that DeFi participants navigate between pursuing high returns and managing significant risks in an increasingly volatile market environment.

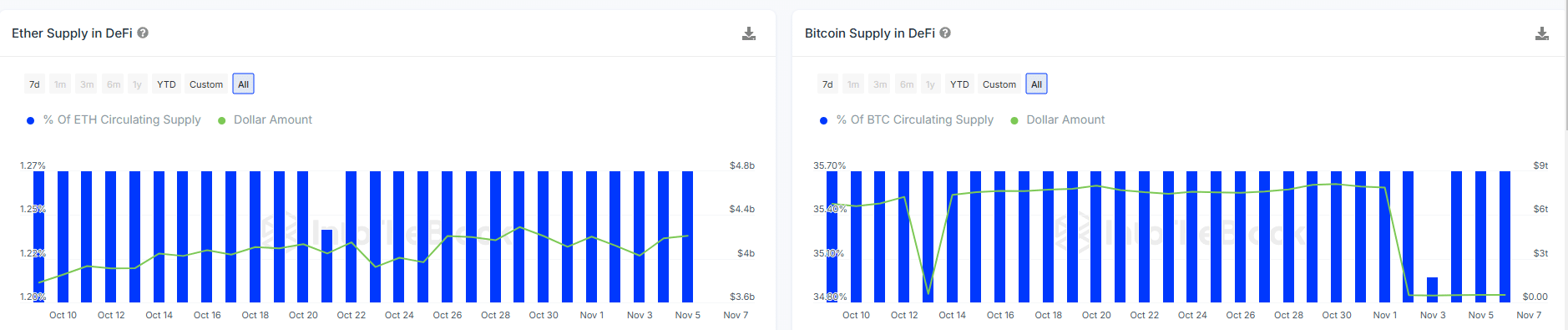

Difference in supply of ETH and BTC in DeFi

Despite a slight decline in Bitcoin’s overall dollar value in DeFi, it remained significantly higher than Ethereum’s. This suggested deeper market penetration and greater commitment from participants using Bitcoin on DeFi platforms.

This indicated that Bitcoin could be more sensitive to the impact of high-risk lending, especially as market sentiment drives demand for leverage.

Source: IntoTheBlock

With Bitcoin’s greater presence in DeFi, any significant market corrections or volatility could lead to more pronounced effects on Bitcoin’s price and stability compared to Ether.

Thus, Bitcoin stakeholders must remain especially vigilant about potential market movements that could trigger these risky financial activities in the DeFi space.

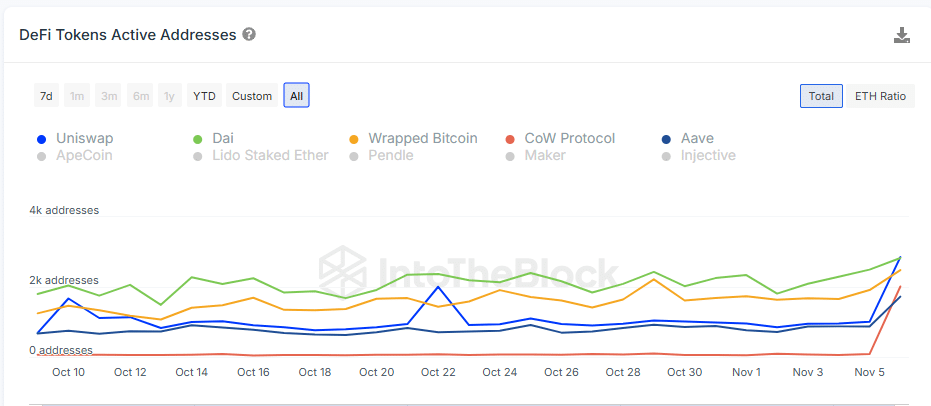

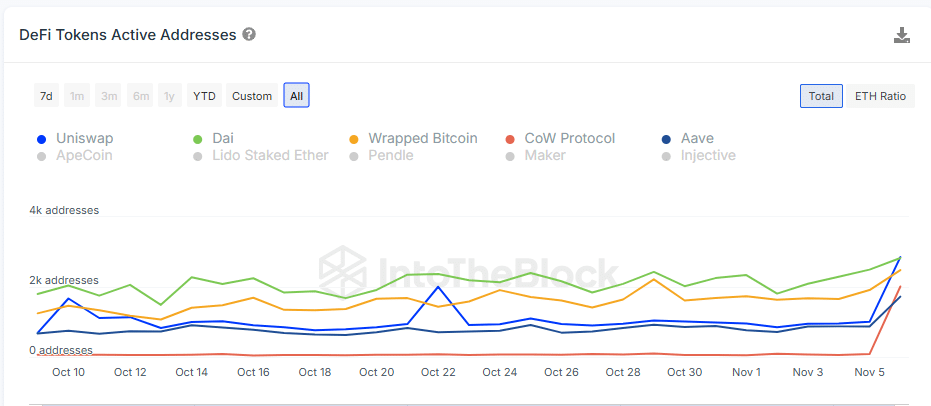

DeFi token active addresses at ATH

The chart showed a large increase in the number of active addresses for various DeFi tokens, likely due to more users speculating and looking for high-leverage opportunities in DeFi.

The notable increase in activity, especially in Wrapped Bitcoin (WBTC), highlighted the market’s increasing use of leverage and fear of missing out, which could drive up asset prices.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price forecast 2024–2025

Historically, increased activity has often come before market peaks. A sudden realization of overpricing or a major economic event could send BTC prices plummeting.

Investors and traders should be careful. The current increase in active addresses and leverage shows a higher volatility risk. This could soon impact Bitcoin’s movements and lead to a local top that could trigger a correction.