- XRP remains less than $ 2.50 despite the last sec winning of Ripple, confronted with resistance with important advancing averages.

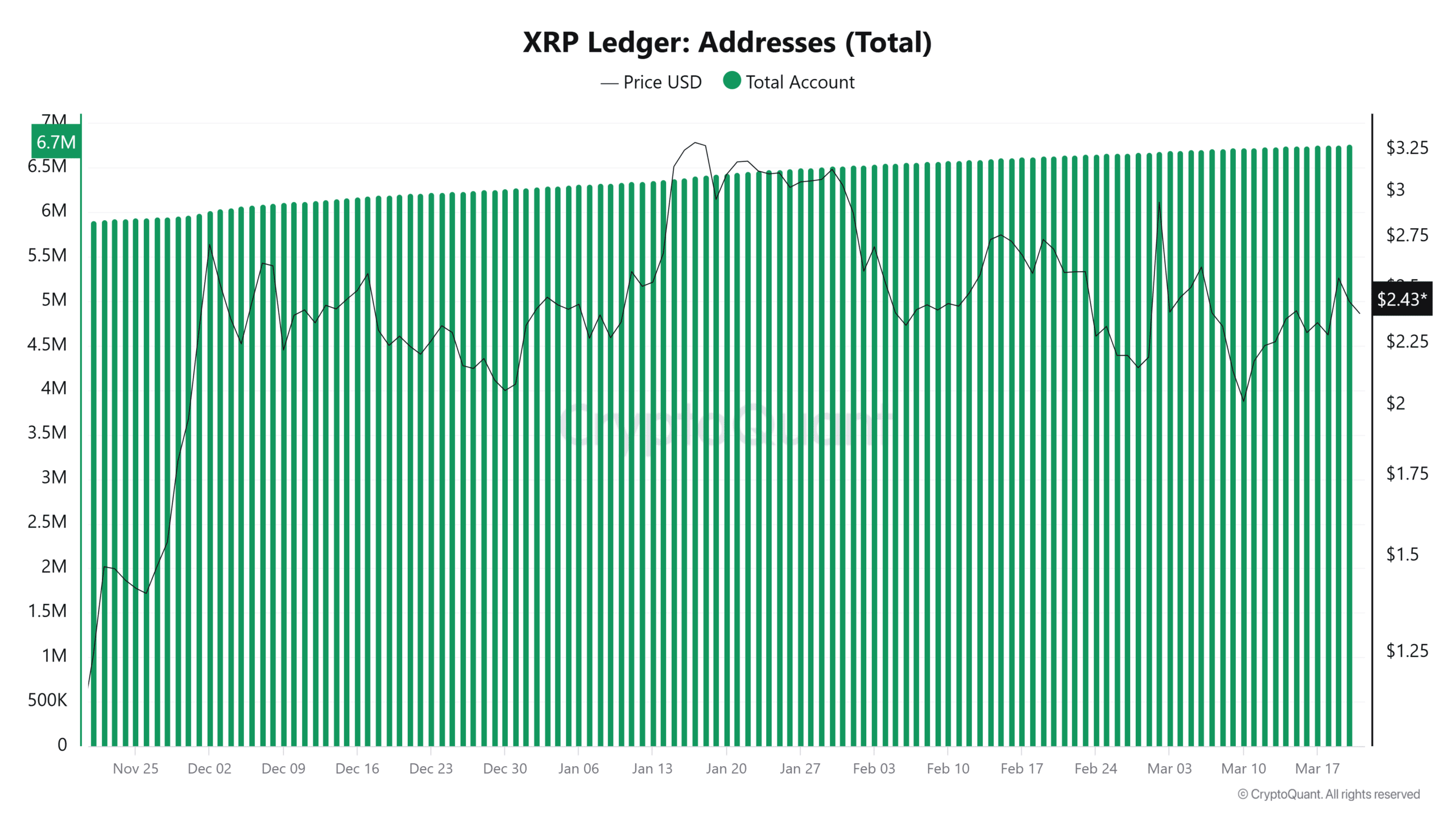

- XRP whides is addressing 6.7 m, due to long-term interest rate but no large storage in the short term.

Despite Ripple [XRP] Recently securing a favorable development in its long -standing struggle with the US Securities and Exchange Commission [SEC]The market reaction is relatively muted.

While the victory injected temporarily optimism, the price performance of XRP and the address activity suggest a more tempered response.

XRP is slowly moving despite the legal progress

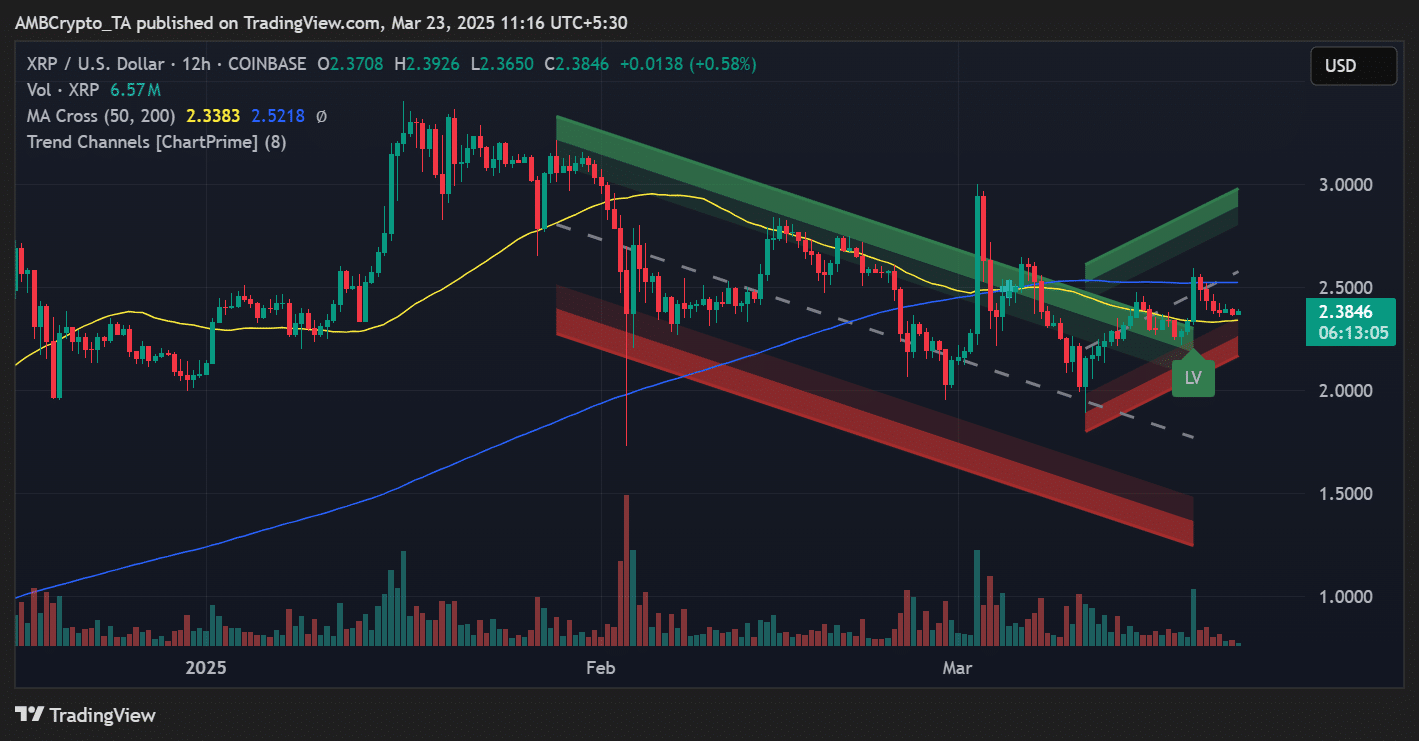

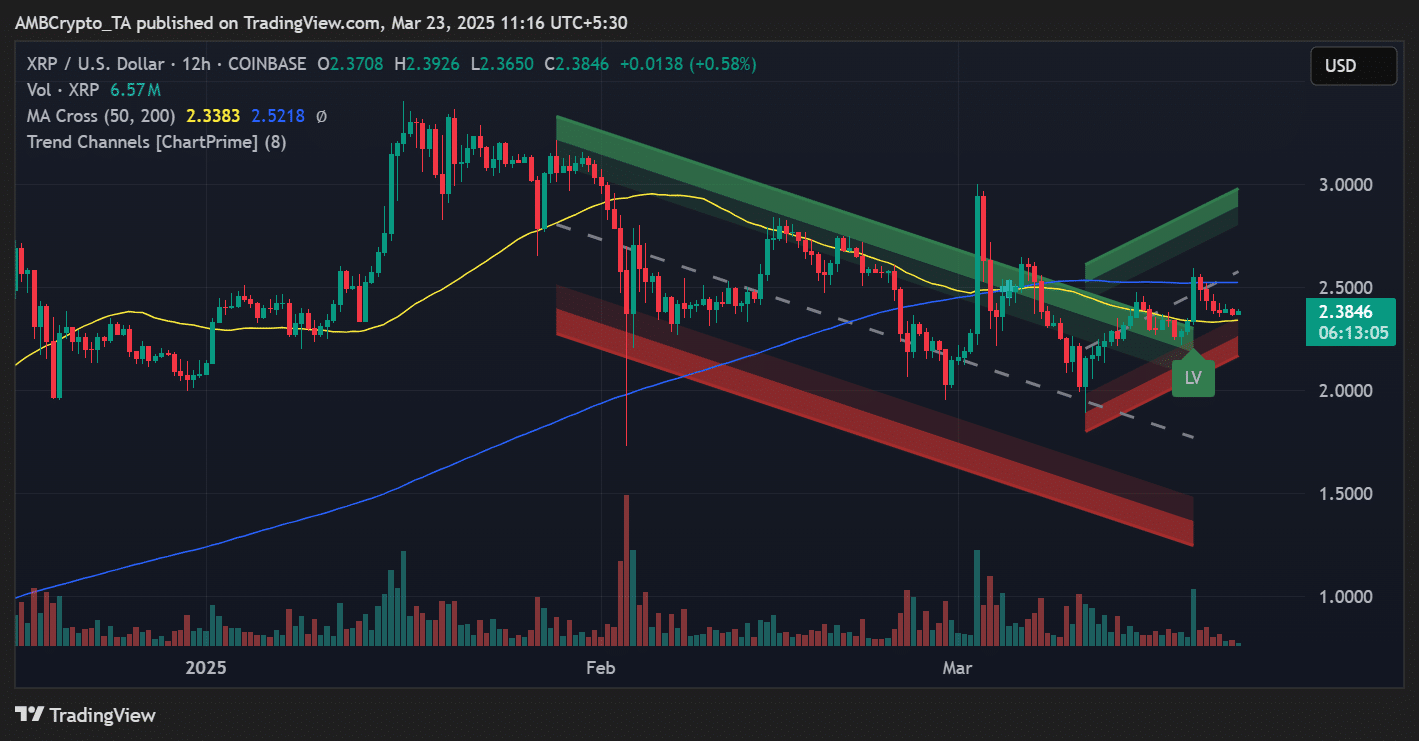

After the positive sec-related news, XRP climbed briefly to $ 2.43, but has since stabilized around $ 2.38.

On the 24-hour graph it remained active just above the 50-day advancing average [at $2.33]Yet traded under the 200-day advancing average [$2.52]A sign that no definitive bullish breakout has occurred.

Source: TradingView

Trend channel indicators showed that XRP tried to bounce within a narrow rising range.

If the price does not quickly reside the $ 2.50 level back, this can run the risk of running back into the falling channel with which it is struggling in March.

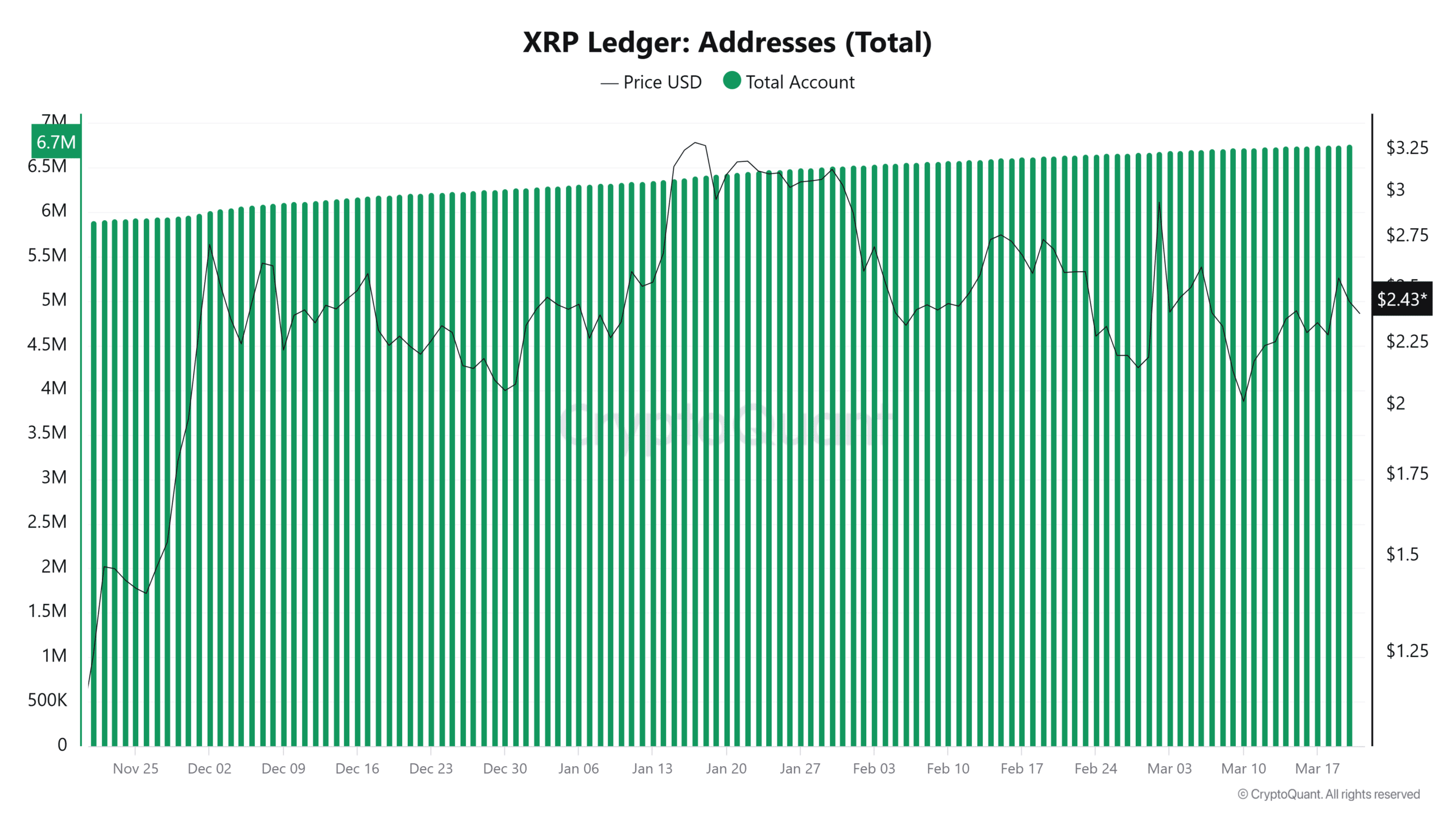

Active addresses rise, but the growth is gradual

According to Cryptoquant Data, the total number of addresses on the XRP whides has steadily risen to 6.7 million.

Although this growth is positive, it is not an explosive increase, which means that the interest in long-term is intact, there is no overwhelming stream of new participants who enter the ecosystem after the SEC news.

Source: Cryptuquant

This modest growth in the chain reinforces the idea that, although the regulatory clarity is a long -term nearby, the market still consumes the implications.

What this means for XRP, ahead

For XRP to regain a considerable momentum, the price must be convincingly above $ 2.50 breaking and determining support. Otherwise the lateral movement can persist, especially since a wider market sentiment remains careful.

Statistics on chains suggest that XRP holders use a wait-and-see approach. The rising address number offers a solid basis, but profits can be covered in the short term without an increase in active users or volume.

Ultimately, Ripple’s legal clarity is a strong story, but the translation of that in price action and network activity will depend on ongoing investor confidence.

It will also depend on whether buyers consider XRP as a long -term department or a short -term game.