- Bitcoin is expected to trade within the established range in the weeks following the halving.

- In the short term, the $66.8k level was crucial resistance, and another support level was worth watching.

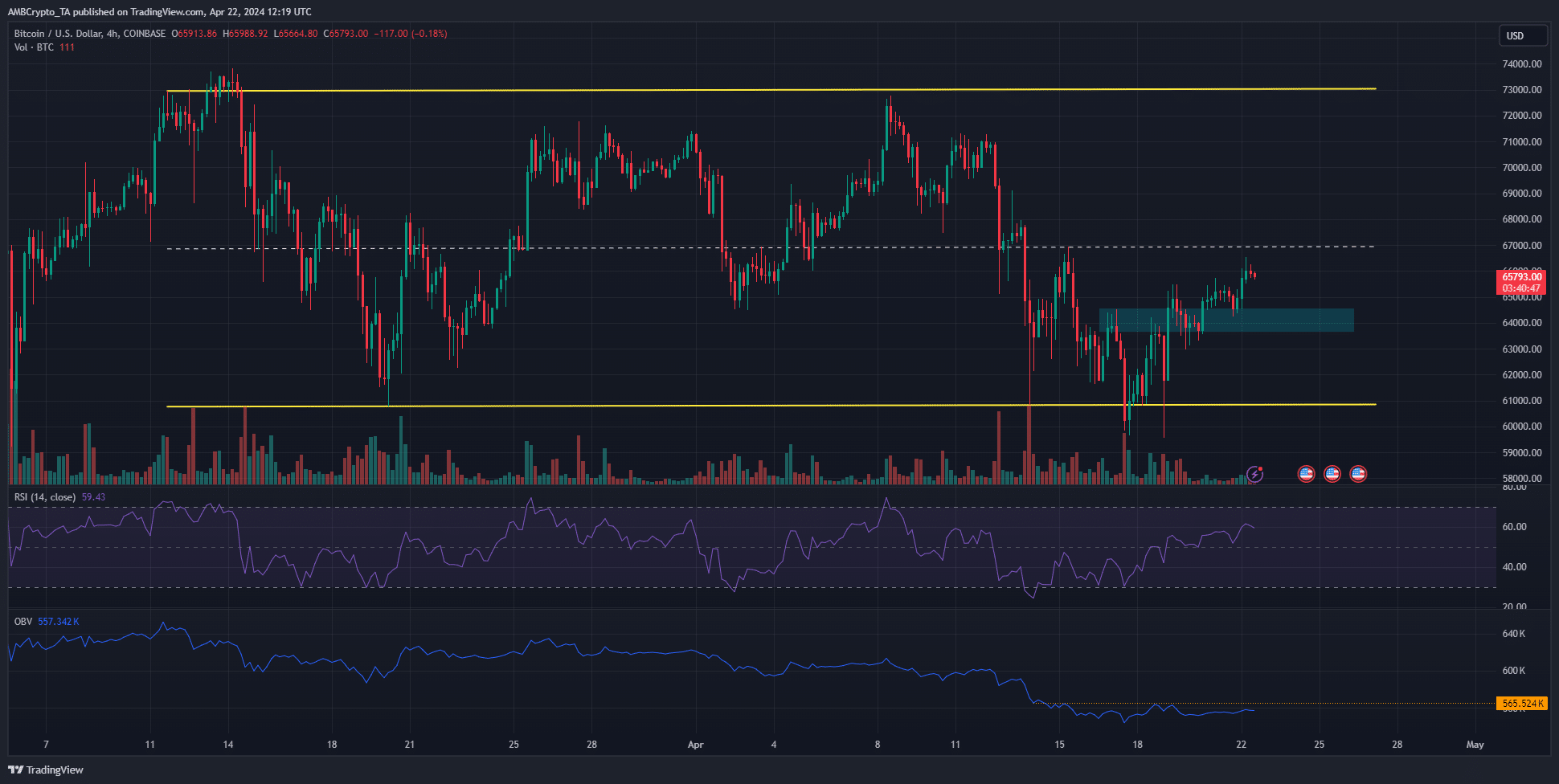

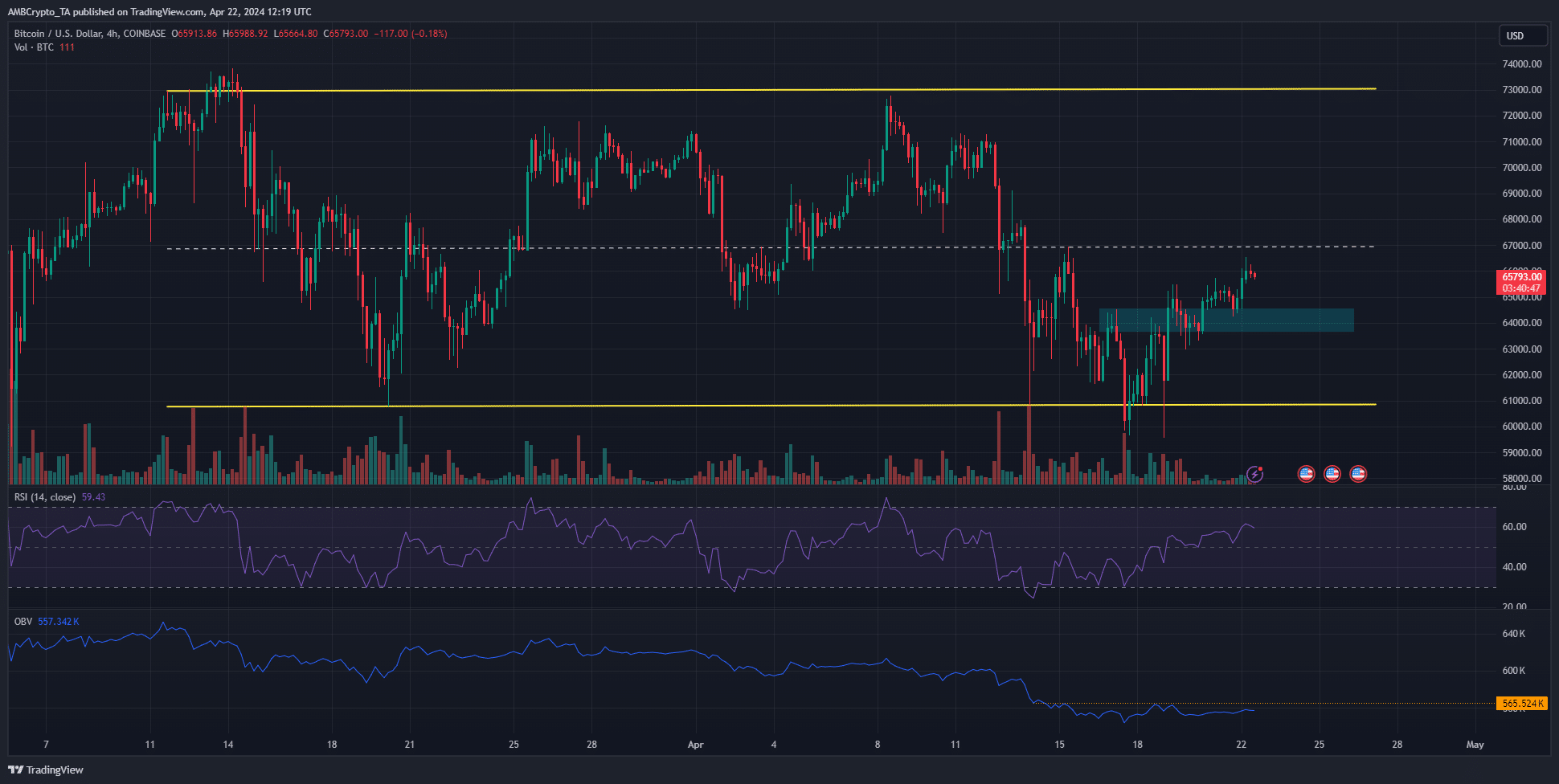

Bitcoin [BTC] formed a range between $73k and $60.7k. The midpoint of this range was at $66.9k.

Bitcoin was seeing a healthy uptrend at the time of writing, but the New York Open on Monday, April 22 had not yet taken place.

On Sunday, crypto analyst CrypNuevo Posted on X (formerly Twitter) that he expected a move to $66,000 to occur.

This happened and AMBCrypto decided to investigate where BTC prices would go next within this range.

The conditions for a move past $66k

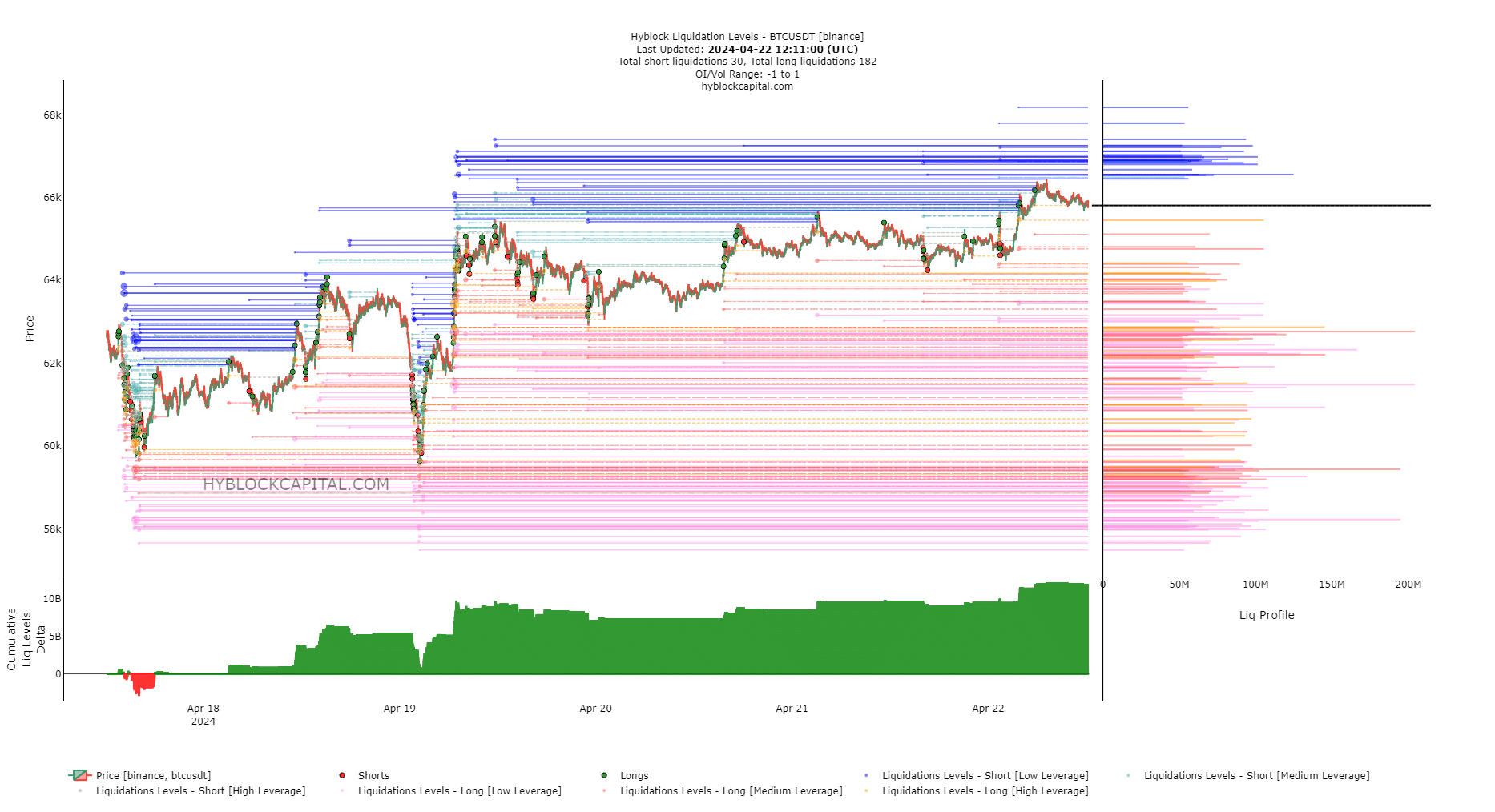

CrypNuevo commented that the seven-day liquidation heatmap showed a cluster of liquidation levels at the $66,000 level.

This level is also less than 1% below the mid-level of the aforementioned range formation.

This was a good place for a bearish price reversal. During the New York open session, prices could rise above $66,000 and gather liquidity there.

It would likely follow up by diving lower to take out the eager bulls waiting for a move past the near-term resistance zone of $65,000-$66,000.

Reversing such a bearish reversal would mean a continued move past $66k. A move below $64.5k would indicate that $63k was the next target.

The liquidation levels showed that long positions far exceeded short positions. This indicated that a downward move was favorable. The $66.8k region had a high concentration of large short liquidations.

Meanwhile, the $62.8k area also saw a cluster of long liquidation levels. Therefore, a drop below $64.5k would likely lead to a dip to $62.8k.

Combining technical indicators with range formation

Source: BTC/USDT on TradingView

CrypNuevo marked that a deviation below the lows usually causes prices to move to the other extreme of the range.

We saw such an anomaly on April 17, when prices fell to $59.8k. Since then, the direction has reversed.

The RSI on the 4-hour chart also highlighted the bullish momentum. Yet the OBV was unable to scale up the local resistance level. This indicated a lack of buying volume over the past week.

Is your portfolio green? Check out the BTC profit calculator

The highs and lows in the range coincide with the liquidity pockets $73.2k and $56k. Therefore, these are the higher timeframe levels of interest.

Bitcoin is expected to consolidate within these levels for a few weeks and gather strength for its breakout after the selling pressure that accompanied the halving.