- Bitcoin consolidated around a key psychological level of $70,000.

- At the beginning of April, long-term investors became quiet, similar to November.

Bitcoin [BTC] continued to witness massive inflows into the Exchange Traded Funds (ETFs).

a Santiment post on

BTC had a strong start to the week, gaining 4.8% at the time of writing.

The halving is just around the corner, and combined with steady ETF inflows, a strong bullish performance is expected for the entire market.

Yet the immediate aftermath of the halving could still be tumultuous.

This is why we could see a strong rally over the next six weeks

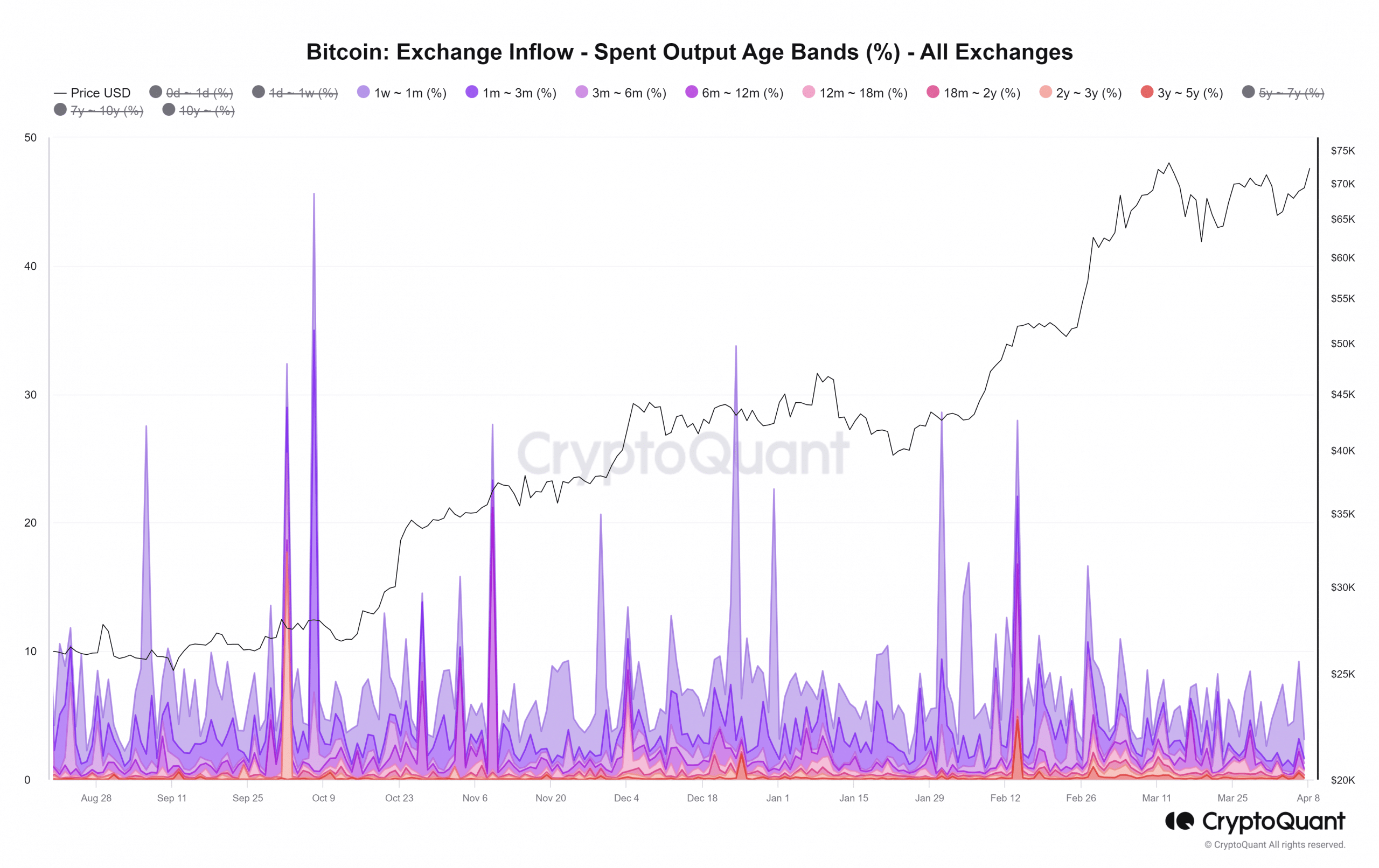

The age categories for spent production showed that activity in the age categories above one month has been subdued since March 24, compared to the rest of 2024.

There was also a similar lull in spent production in the period from November 12 to 29.

While holders whose BTC was less than a month old were active, older ones became quieter during that period.

On November 30, there was a flurry of activity among 1-3 month holders as prices crossed the psychological barrier of $40,000.

Therefore, it was possible that the recent lull would be followed by a significant rally in the short term.

BTC’s consolidation phase could be further extended

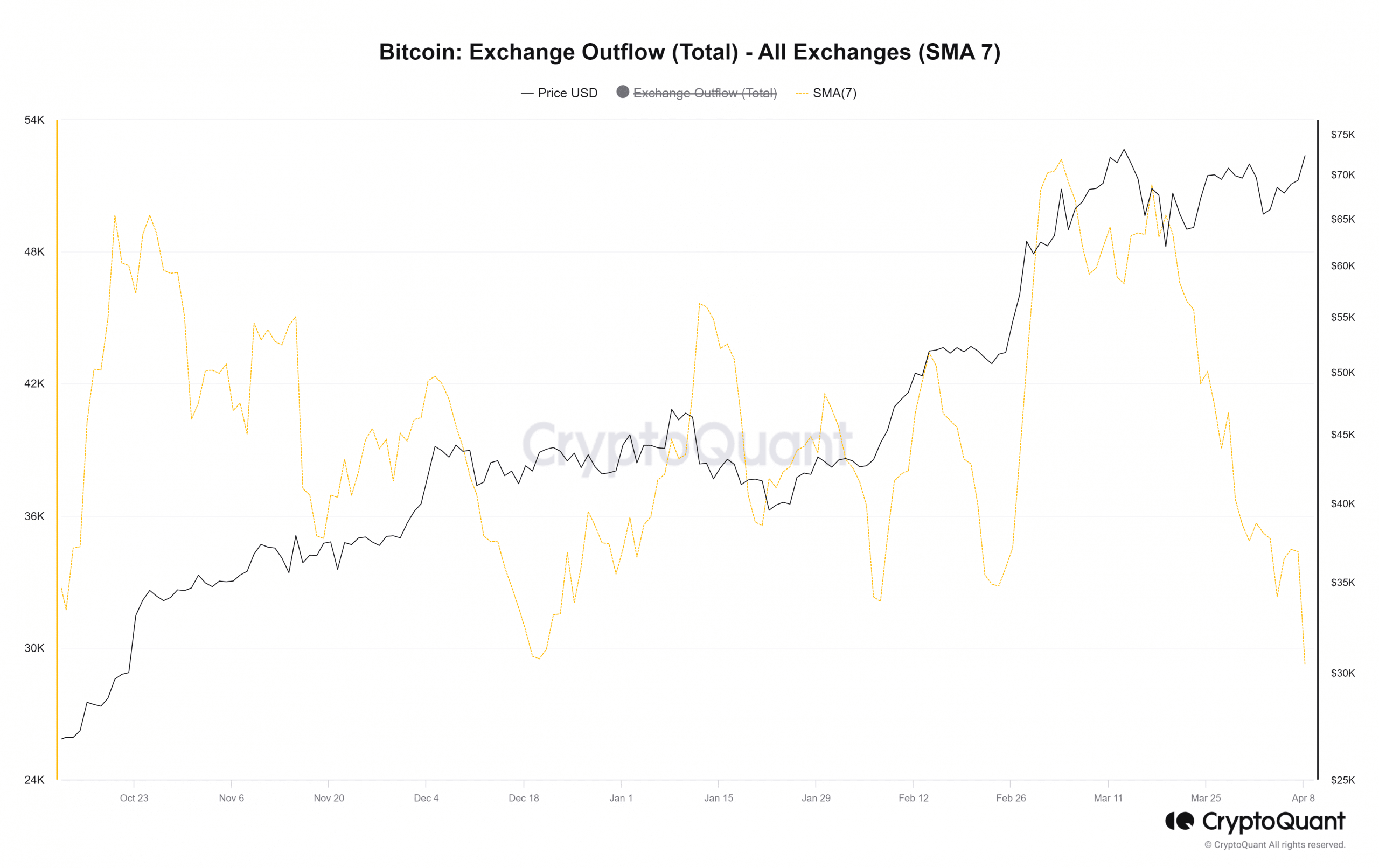

Since mid-March, BTC has largely fluctuated between $64,000 and $70,000. However, the seven-day simple moving average of foreign exchange outflows declined significantly during this consolidation period.

This does not mean that selling pressure increased. However, the rapid decline in outflows suggested that consolidation was not going hand in hand with accumulation from centralized exchanges.

The uncertainty surrounding the market’s reaction to the halving may be a reason for this. Once the benchmark starts moving higher, such as after December 18, 2023, further price gains can be expected.

Bulls eagerly await the next ATH: will it be $80,000?

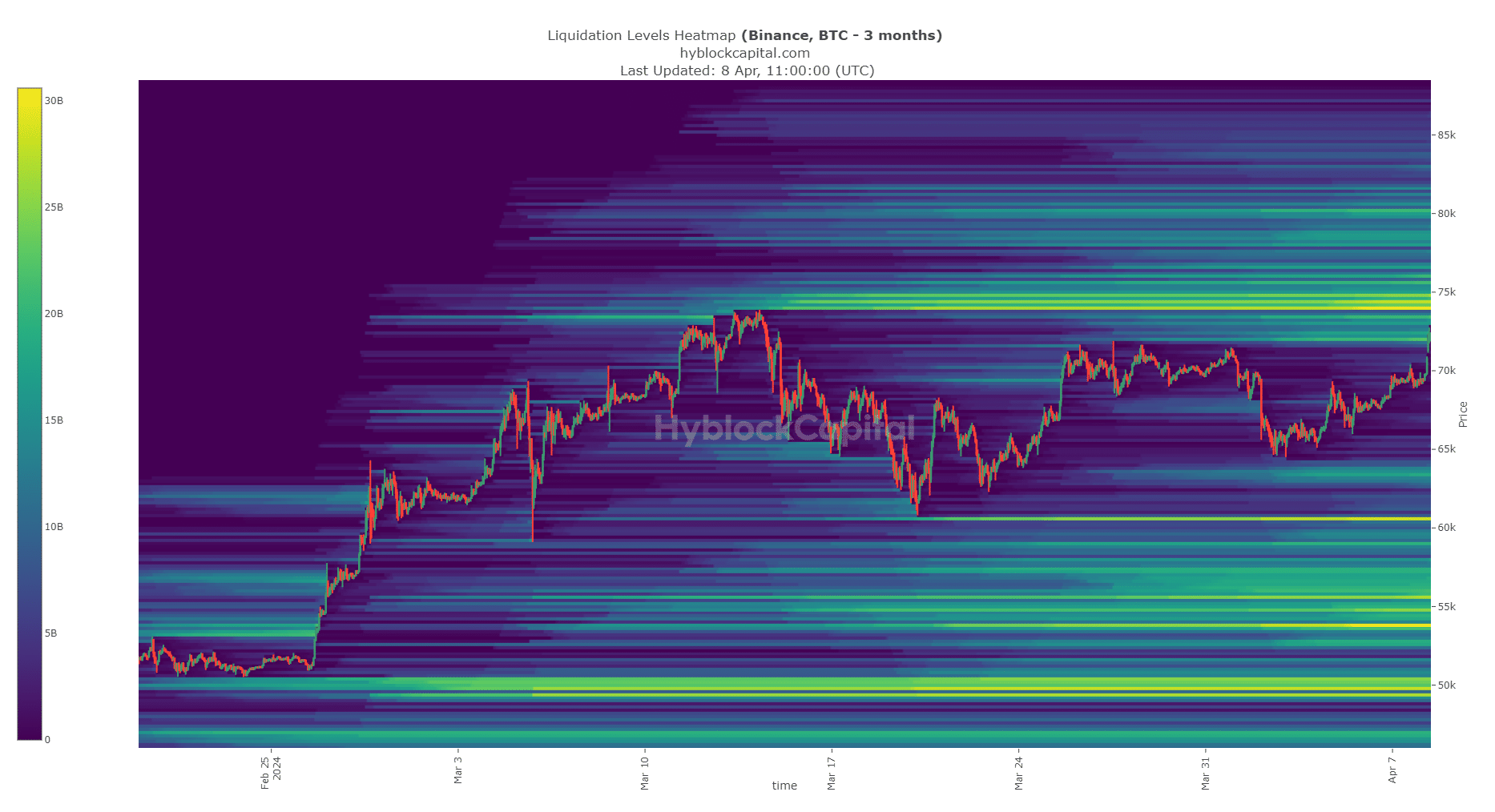

The liquidation heatmap showed that the $75k area is a strong magnet for Bitcoin. The high number of liquidations in that region could pick up prices before a bearish reversal occurs.

Alternatively, the $80.4k region, which was the second largest liquidity position in the North, could also be visited.

Read Bitcoin’s [BTC] Price forecast 2024-25

All told, the halving event created significant uncertainty for traders in its immediate aftermath.

Investors, on the other hand, would be cheering as the numbers showed that more gains could come after the market calms down after the halving.