- Popcat was recently violated by a falling channel and can look at a large prize push

- Despite the support of the whales of Bybit, Binance and Hyperliquid, spot traders will play a key role in the market

Popcat has won 37% for the past 24 hours, in addition to his bullish movement in the past week. Due to the same, the Altcoin now returns 41% for investors who have actually bought it in the past month.

Although the sentiment remains predominantly bullish, especially with a high whale interest and a bullish technical setup, Ambcrypto saw some factors that could hinder the potential rally of the active.

Bullish breakout on the edge

Popcat has presented a setup for a possible price rally on the graph, with the formation of a falling price channel. This pattern is formed by parallel support and resistance lines.

According to the same, as the momentum that controls the Popcat movement, is maintained and the actual in it succeeds in breaking through the resistance level, the price could reach $ 0.9822. This would represent a price tree of 370%.

Source: TradingView

To make a 3.7x rally take place, it is likely that the price will recover on the way, instead of a single revival. However, if the total bullish market sentiment is true, Popcat could eventually break this level and act as high as $ 2.08.

Whales are after a rally

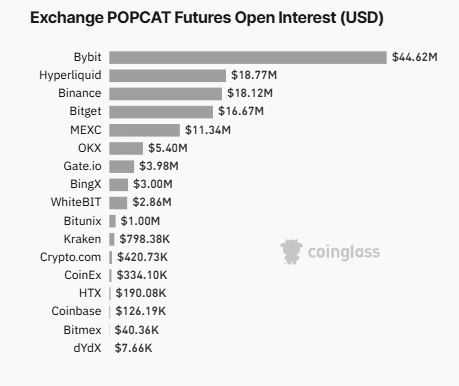

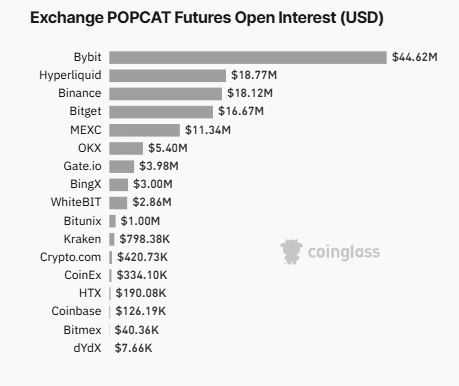

An analysis of the long-to-go ratio of Coinglass and the open interest of the market showed that whales had insisted on a large price rally.

Firstly, the wider market sentiment Bullish, with the purchase volume on the market that exceeds it from sellers. This was demonstrated by the long-to-korter relationship with a lecture of 1,0513.

When this ratio crosses 1, this implies a bullish market phase. On the contrary, under 1 means that bears or sellers are dominant, with more disadvantage.

Further analysis showed that a majority of purchase contracts in the derivatives market are powered by whales or top traders who have important positions that have been opened on the active.

Source: Coinglass

At the time of writing, Bybit, Binance and Hyperliquid whales dominated the uncertain contracts in the market. This cohort of traders had a collective position of $ 80.7 million out of $ 127.89 million in open interest in the market.

Because the general market Bullish is – especially with purchase volume dominating – this means that these whales have opened more long contracts than short.

Traders who bet against these whales actually saw large market losses because their positions were closed strongly. Short traders in the last 24 hours have lost $ 1.24 million as the price moved against them. This type of Grote Markt liquidation underlined the strength of the bulls.

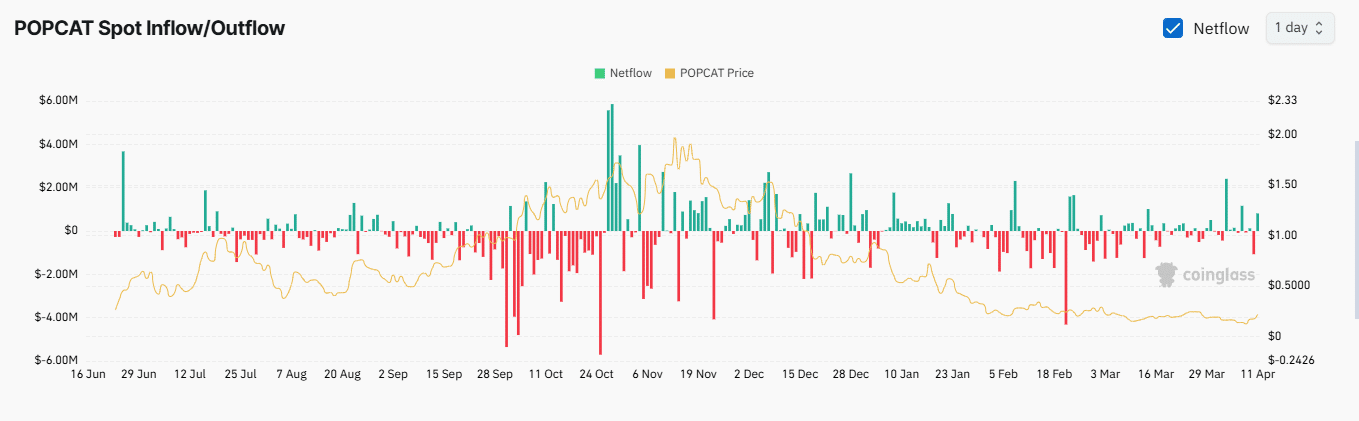

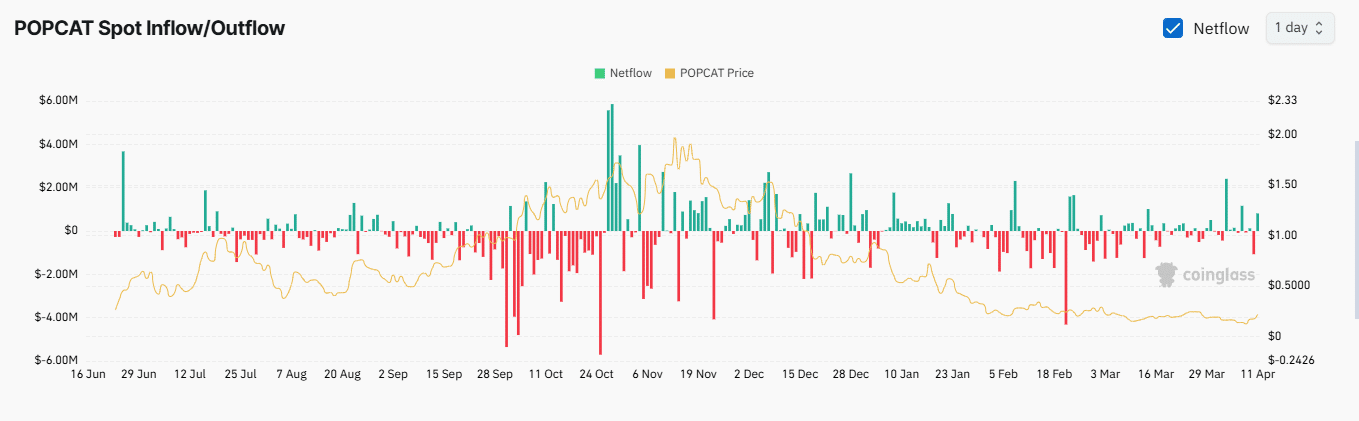

Making a profit can delay the rally

Worth to point out that the bullish sentiment does not match spot traders on the market. At the time of the press there was a remarkable sales activities among spot traders – it reached around $ 850,000 according to the Exchange Netflows.

Source: Coinglass

When a large amount of an active one is sold in the midst of a bullish market setup, this means that traders will probably achieve a profit in the long term. Especially because they move their popcat from private wallet to fairs to sell.

If this trend continues between long -term spot traders, this could hinder the potential infringement of Popcat from the upper resistance level on the graph. This would delay the bullish outlook, as predicted.