Polygon (MATIC), a blockchain scalability platform, is in the throes of negative sentiment casting a shadow over the prospects for a strong price recovery. The crypto market has been a volatile space, prone to sudden shifts in sentiment, and MATIC is no exception.

The recent downturn in sentiment surrounding MATIC has caused investors and traders to take a cautious look at the price charts.

Once considered a promising project in the crypto space, Polygon’s growth potential has been hampered by the U.S. Securities and Exchange Commission’s recent actions against altcoins.

Will negative sentiment continue to hamper MATIC’s potential for a strong price recovery?

Polygonal whales unimpressed by US regulatory pressure?

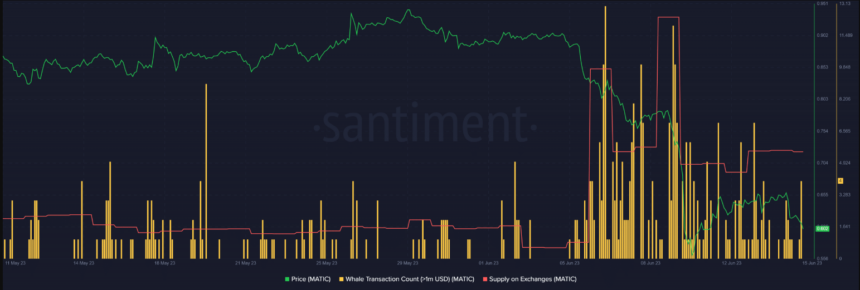

The latest data on MATIC reveals that pressure from U.S. regulators doesn’t seem to have completely upset some high-profile investors, as evidenced by a notable increase in whale transactions of more than $1 million in recent days.

Source: Santiment

Despite the increased appetite of whales, the cryptocurrency has not held strong upside at the time of writing.

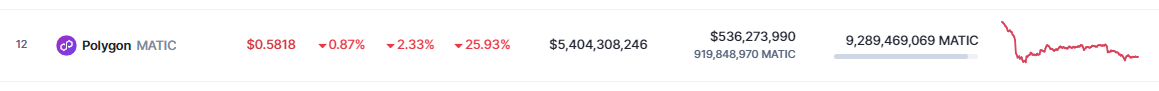

Source: CoinMarketCap

CoinMarketCap reports MATIC’s current price as $0.5818, reflecting a decrease of 2.33% within the last 24 hours. In addition, the cryptocurrency has witnessed a significant slump of 25.93% over the past seven days.

In addition to the impact of regulatory pressures, the movements of MATIC’s supply on exchanges, which serves as an indicator of near-term selling pressure, showed rapid swings over the same period.

MATIC 24-hour price movement. Source: CoinMarketCap

It experienced a sharp rise, followed by a decline, then another peak before finally decreasing at the time of publication.

These developments indicate that selling pressure on MATIC remains a major concern, mainly due to the prevailing regulatory uncertainty.

MATIC market cap currently at $5.4 billion. Chart: TradingView.com

Fed’s pause on rate hikes fails to stabilize crypto markets

Overall, financial markets continue to experience volatile movements, leaving cryptocurrencies disconnected from the performance of traditional stock markets.

The recent downturn in the crypto market appears to be related to the press conference held by Federal Reserve Chairman Jerome Powell on June 14, announcing that the central bank would temporarily halt rate hikes for the month of June.

While this decision was in line with investor expectations, it had an unexpected effect on the crypto market. Instead of stabilizing, the market reversed course and resumed the persistent sell-off that had lasted for the past three weeks.

The presence of substantial macroeconomic challenges, coupled with the anticipation of future rate hikes and low trading volume, suggests that volatility in the cryptocurrency market is likely to continue for the foreseeable future.

The prevailing headwinds, including economic factors on a larger scale, have contributed to the unpredictability and turbulence in the crypto market.

Featured image from Analytics Insight