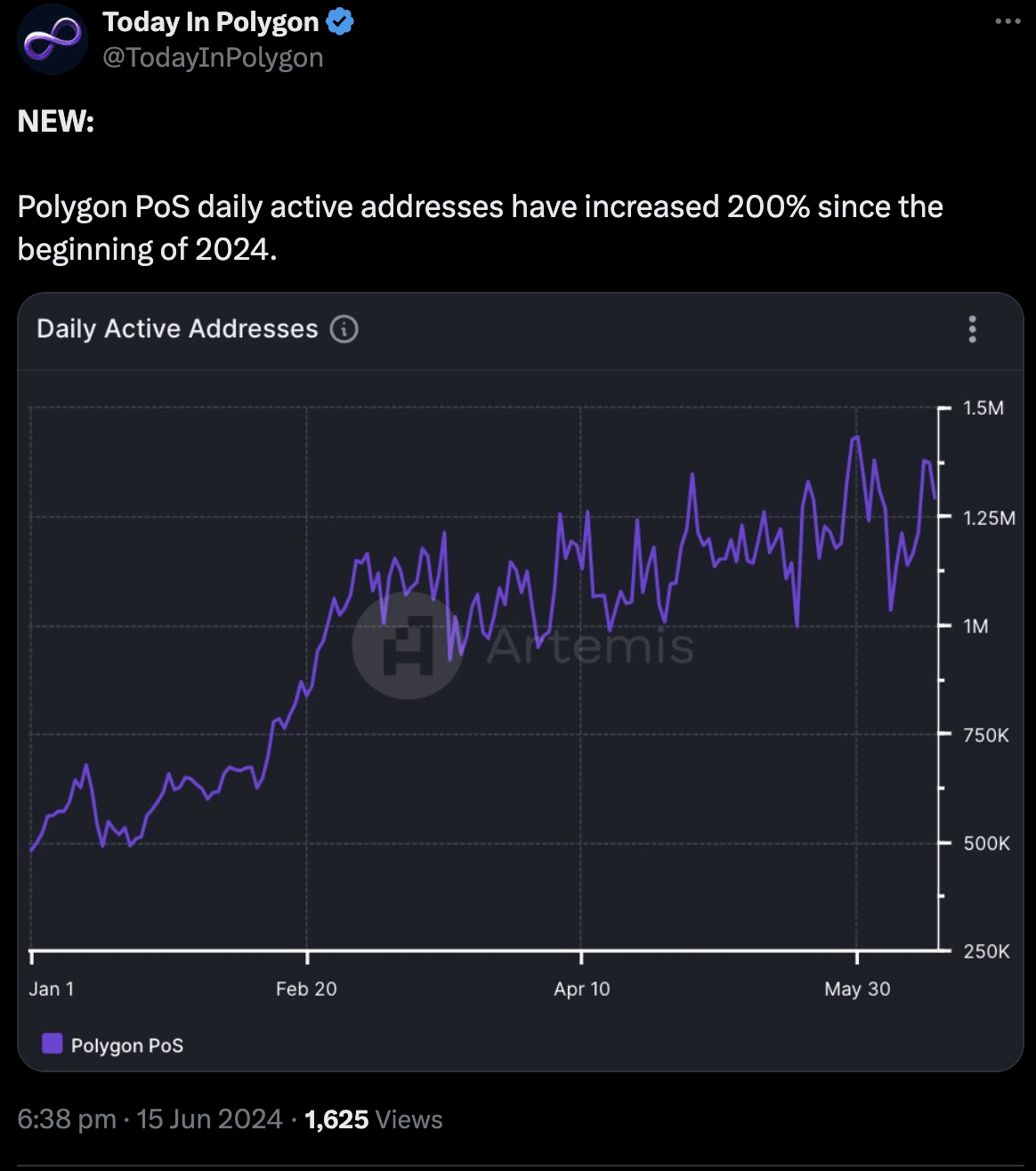

- Polygon witnessed a 200% increase in active addresses since the beginning of the year.

- Trader interest in MATIC declined, evidenced by declining open interest.

While Bitcoin[BTC]Ethereum[ETH] and Solana[SOL] have attracted attention thanks to ETFs and memecoins, Polygon[MATIC] There has also been significant growth since the beginning of the year.

Activity increases

Data showed a staggering 200% increase in the number of daily active addresses since the start of the year.

Source:

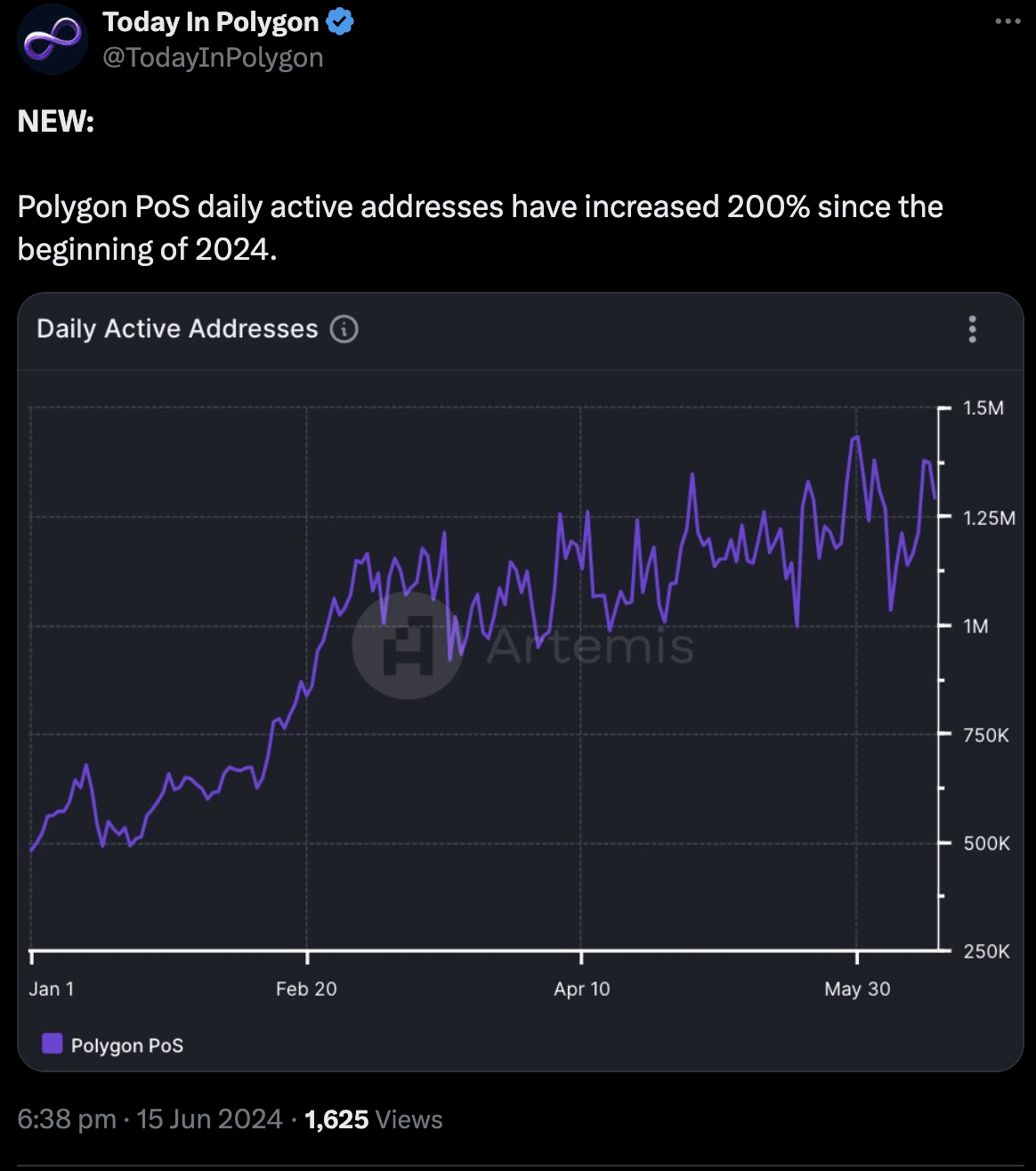

Despite the surge in activity, MATIC’s price movement was not correlated with the growth of activity on the Polygon network. MATIC’s price fell by 19%.

Before the price of MATIC crashed, it was showing sideways movement without any clear indication that a trend was forming. However, after the correction, MATIC showed a bearish trend, indicated by the lower lows and lower highs it formed.

To break this trend and ensure that MATIC has a chance of a reversal, MATIC would have to retest and break past the $0.6346 level and aim for the $0.6886 level.

The RSI (Relative Strength Index) was on MATIC’s side at 52.65, implying that there was bullish momentum supporting MATIC.

However, the Awesome Oscillator (AO) was negative, indicating that the short-term price movement was weaker than the long-term trend, possibly indicating a decrease in buying pressure and a higher chance of prices continuing to fall.

Source: trading view

MATIC’s signs on the chain

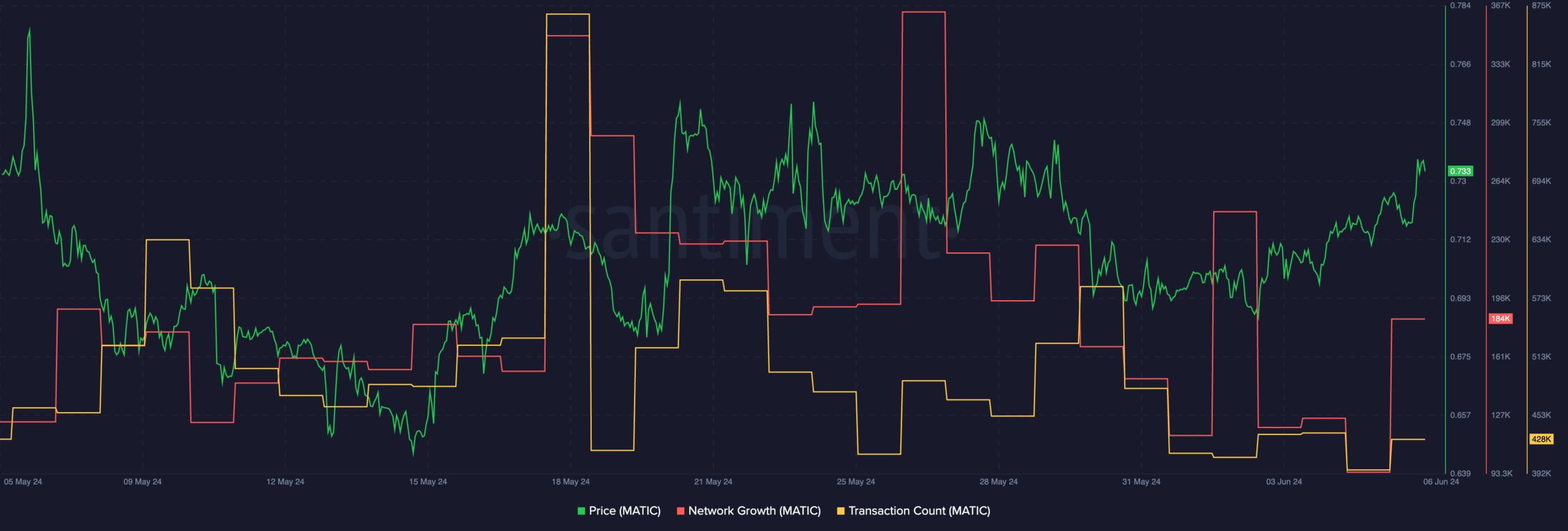

However, the on-chain metrics showed some positives for MATIC. In recent days, network growth for MATIC has grown significantly, implying that the number of new addresses building interest in MATIC has increased.

Increasing network growth also suggested that new users were willing to purchase MATIC at the current discounted prices.

The speed at which MATIC traded had also increased, implying that the number of times MATIC was traded also showed an increase.

Source: Santiment

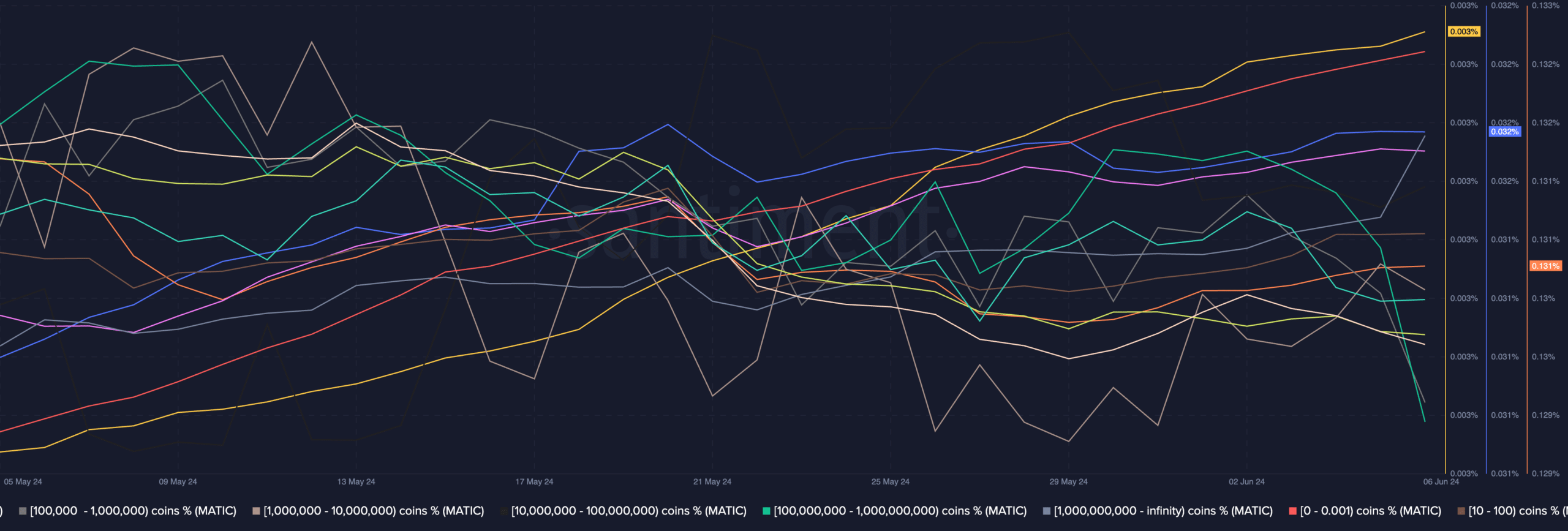

The new addresses that MATIC collected were not large addresses. AMBCrypto’s examination of Santiment’s data found that the cohorts who held more than 10,000 MATIC tokens actually sold their holdings.

It was retail interest that had driven MATIC’s recent surge in price growth.

Source: Santiment

Is your portfolio green? View the MATIC Profit Calculator

How do traders feel?

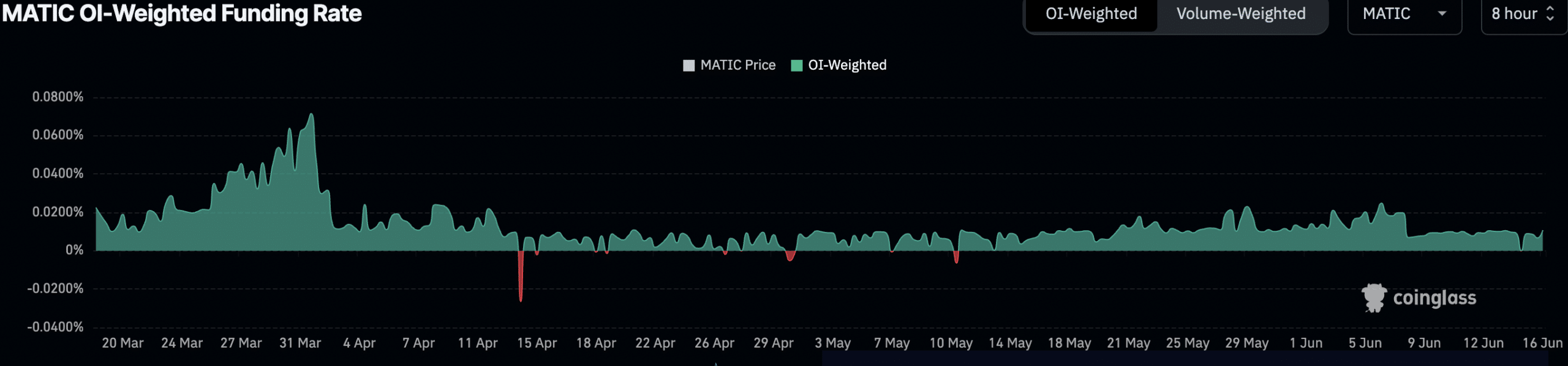

Although retail spot traders were interested in accumulating MATIC, the same enthusiasm was not seen among futures and options traders.

An analysis of Coinglass data showed that open interest in MATIC dropped significantly after April 1.

Source: Coinglass