- Polkadot’s revenues and fees held steady last month and TVL rose.

- Statistics and market indicators were bullish on the token.

Dot [DOT] outperformed the rest of the crypto market as it lagged alone Ethereum [ETH] at press time, due to higher acceptance. Not only that, but the main network metrics of the blockchain also remained stable. While this was happening, the price of DOT gained upward momentum, thanks to the bullish market.

Read Polka dots [DOT] Price prediction 2023-24

However, aside from the network activity and the bullish market, there were also quite a few other metrics in play that could have played their part in supporting the uptrend.

Polkadot’s network activity is high

On July 13, Polkadot Insider announced that Polkadot had outperformed several cryptos and trailed only Ethereum in terms of daily active addresses in the last 30 days. While Ethereum had 350,000 daily active addresses, DOT had over 172,000.

arbitration [ARB], Avalanche [AVAX]And Optimism [OP] complete the top 5 of the list.

⛏️ Let’s take a look at the best blockchains based on active addresses in the last 30 days

👉A high number of active addresses indicates a thriving and growing blockchain ecosystem, highlighting the potential for long-term success and adoption

Top 3 includes:

🥇 @ethereum: 357,844

🥈 @Dot:… pic.twitter.com/8s2aKFapKa— Polkadot Insider (@PolkadotInsider) July 13, 2023

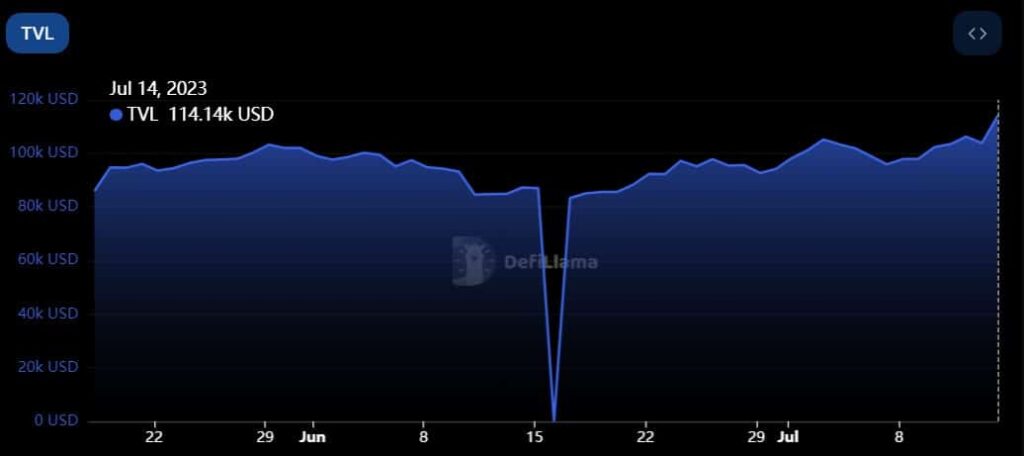

In addition, Token Terminal’s facts revealed that the blockchain’s revenue and fees have remained stable over the past month. In fact, the chart peaked on July 3, 2023. The network value of the blockchain also increased as the TVL rose, as noted by DeFiLlama.

Source: DeFiLlama

While these developments were taking place, Polkadot’s price action turned positive, thanks to the continued bullish market. From CoinMarketCapDOT rose more than 6% and 9% in the past 24 hours and week, respectively.

At the time of writing, it was trading at $5.63 with a market cap of over $6 billion, making it the 13th largest cryptocurrency. A look at DOT’s statistics provided insight into the cause of this increase.

As the price of DOT fell, so did Open Interest. Similarly, the price increase trend was accompanied by an increase in volume. Additionally, POINT1-week price volatility was high, supporting the chances of a sustained uptrend.

Source: Sentiment

Realistic or not, here it is DOT’s market cap in terms of BTC

Should DOT Investors Be Cautious?

Polkadot’s uptrend could last longer as the Exponential Moving Average (EMA) ribbon showed a bullish crossover. Not only that, but the Relative Strength Index (RSI) was also relatively high, indicating continued northward movement.

Nevertheless POINTAlthough the Money Flow Index (MFI) was high, it fell slightly. This can cause problems and prevent the price of the token from rising further.

Source: TradingView