- Polkadot’s falling wedge signaled a bullish reversal, with traders eyeing a possible breakout.

- The accumulation of whales and rising volume indicated that Polkadot was gearing up for a significant price move.

Polka dot [DOT] showed potential upside momentum as technical indicators and market activity point to a shift in sentiment.

DOT’s daily chart showed a falling wedge pattern, a bullish reversal structure that typically indicates a possible breakout on the horizon.

This pattern, formed by converging trend lines with lower highs and lower lows, indicates a weakening of bearish momentum. DOT at the time of writing was trading near the top of the wedge, where a breakout could occur soon.

Source: TradingView

Key resistance and support levels

The key resistance level to watch was $4.50 at press time, marking the upper limit of the falling wedge.

A breakout above this level would confirm a bullish reversal and could drive the price towards the expected target towards $10.

This represented a potential gain of around 129.73% from current levels, underscoring the importance of this resistance zone.

The support level at $3,911 is crucial for maintaining the bullish setup. Staying above this zone is essential; Failure to move above could offset the positive outlook and increase the risk of further downside pressure.

Traders are closely watching these levels as DOT approaches a crucial decision point.

Traders are taking action again

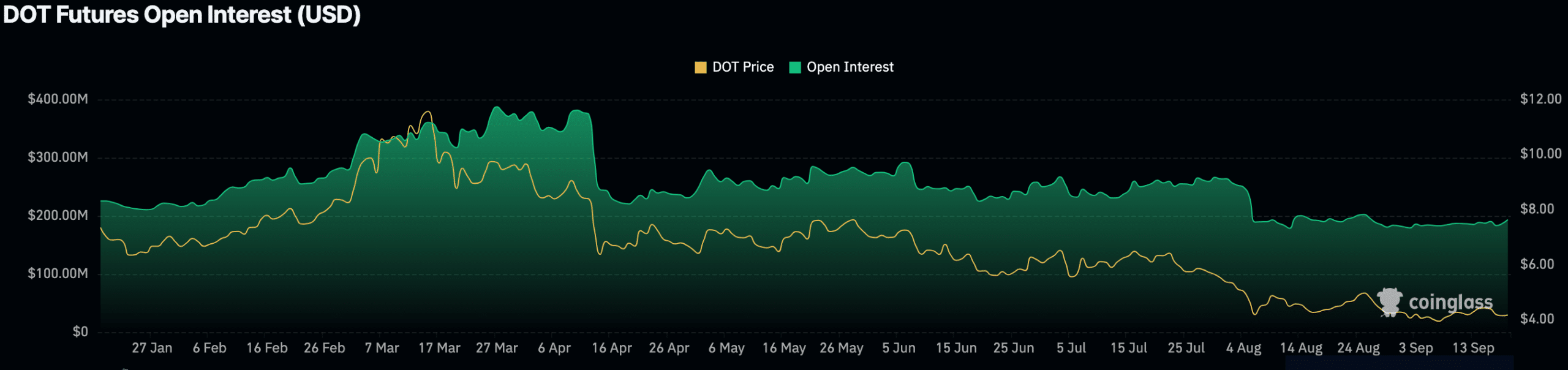

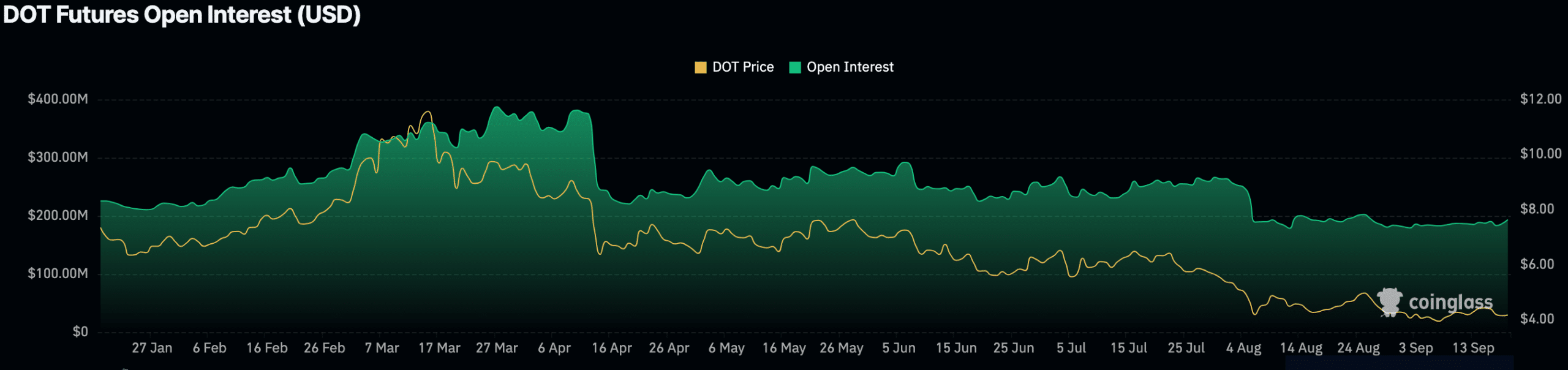

Recent Coinglass data indicated increased market activity, with trading volume increasing 29.77% to $241.40 million. Open interest also rose 11.29% to $206.04 million.

These increases indicated growing engagement and interest from traders, often seen before major price moves.

Source: Coinglass

Rising volume and Open Interest reflected the renewed focus on DOT, indicating traders may be positioning for a potential breakout.

However, a broader look at DOT Futures Open Interest shows a decline from highs of nearly $400 million in mid-April to current levels around $150-$200 million.

This downward trend indicated reduced trader involvement and cautious market sentiment amid DOT’s price decline.

Whales are shifting, the market is waiting to move

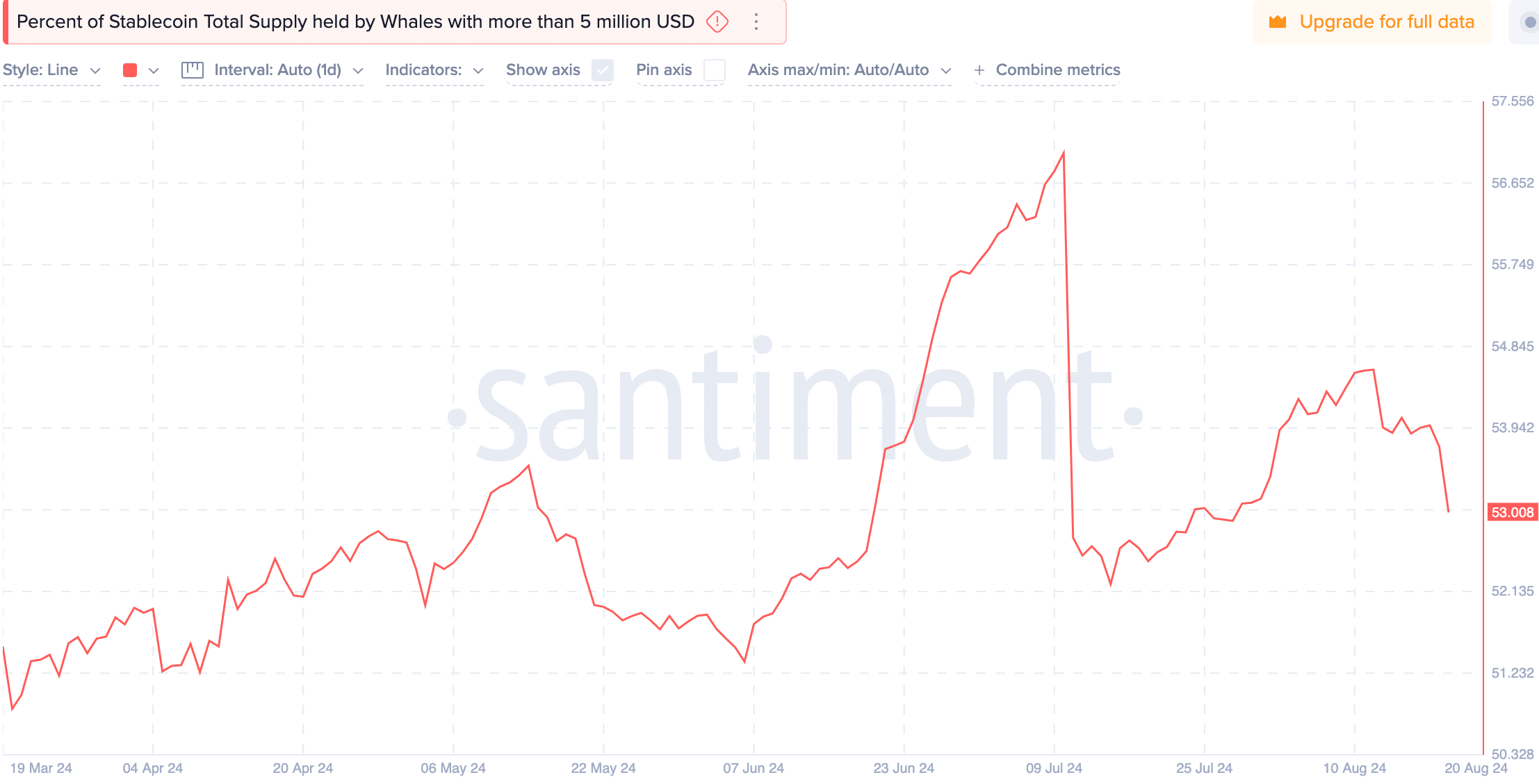

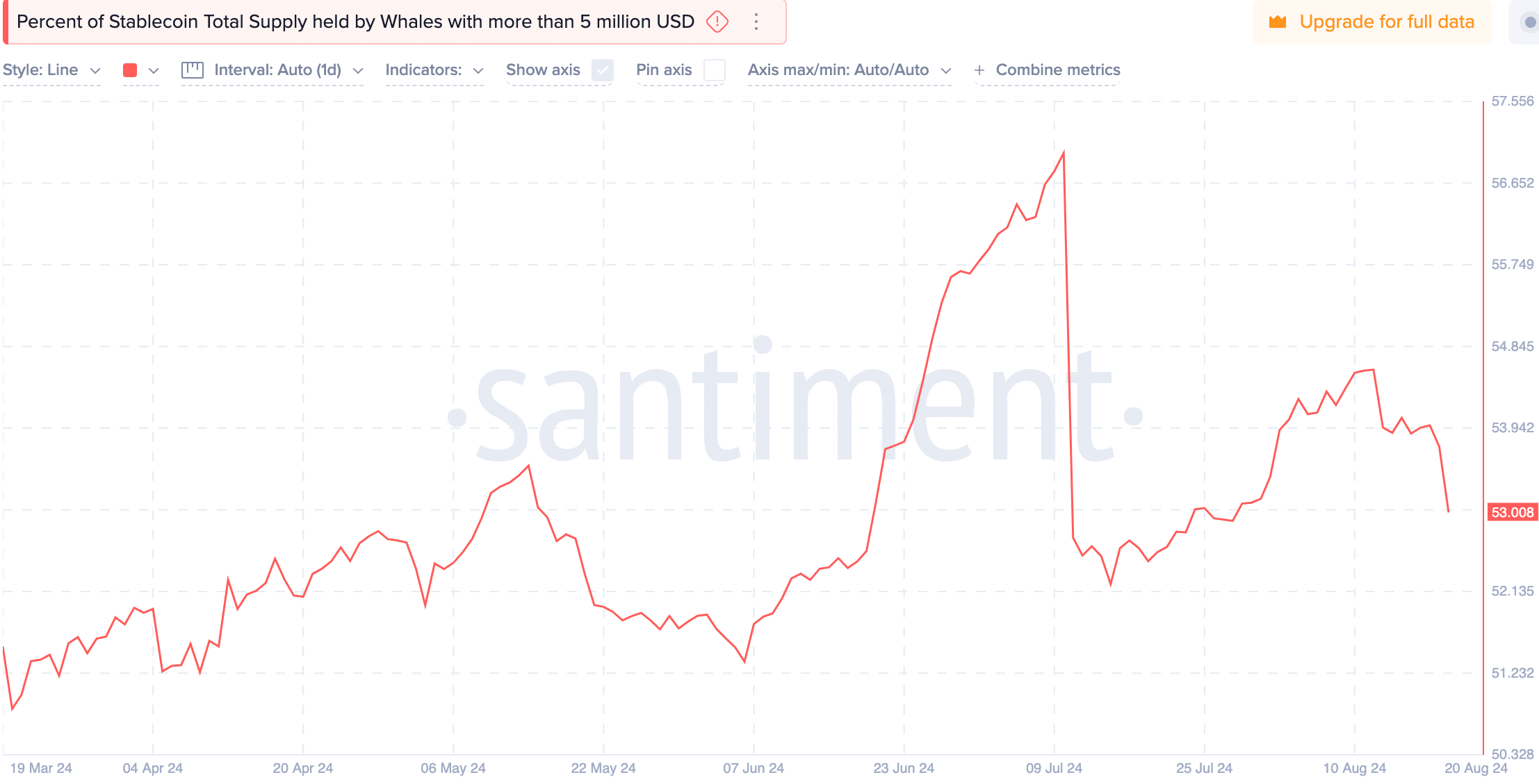

The behavior of the large holders was also striking. Data showed that whales holding stablecoins worth more than $5 million accumulated significantly between late April and mid-June 2024, especially as DOT’s price fell.

This pattern suggested that whales were preparing to deploy capital during periods of lower prices.

Source: Santiment

Read Polkadots [DOT] Price forecast 2024–2025

However, recent declines in whaling indicate possible caution or profit-taking, highlighting continued uncertainty about the market’s direction.

Polkadot is at a critical juncture, with technical patterns, volume and market activity indicating a major move is on the horizon.