A new era for the crypto industry is approaching as the world’s largest exchange, Binance, changes leadership. Yesterday, the company’s founder and CEO, Changpeng “CZ” Zhao, resigned as part of an agreement with the US government.

The deal could have ushered in a new era of adoption and legitimacy for the emerging industry, at the cost of CZ’s position and a $4 billion fine. New data has examined Binance’s trades to check whether users believe in the company’s future after the historic decision.

Binance safe for FTX like bank run?

This is evident from data from crypto analysis company Nansen, Binance included nearly $1 billion in negative net flow after yesterday’s news. The data shows that the platform’s USDT value fell by $246 million, followed by Bitcoin’s value, which fell by $76 million.

Users feeling uncertain about the future of the platform are withdrawing their funds, potentially causing a bank run. However, Nansen’s data shows that this scenario is far from materializing on this trading platform.

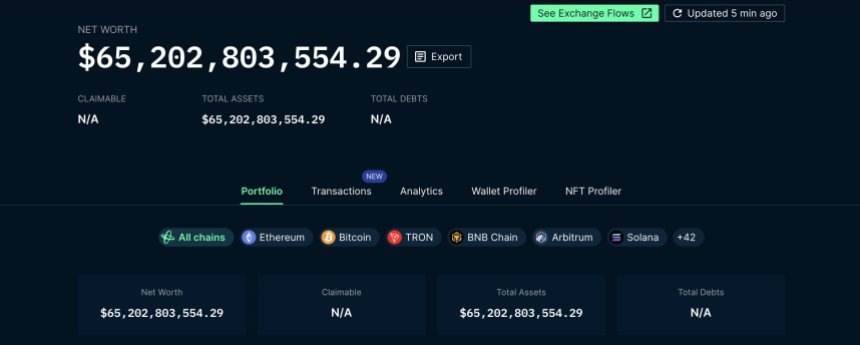

Although negative net flows amount to $955 million, there is no “mass exodus” or panic among users trading on Binance. Nansen claims the platform’s value has increased from $64.6 billion to $65.2 billion.

The analytics firm previously stated that Binance was handling larger net flows. First when the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the company, and later, when FTX went bankrupt after a massive bank run.

As mentioned, it seems unlikely that Binance will follow a similar fate. Nansen stated:

In the past, Binance has handled higher outflow volumes and negative net flows: June 2023 after the SEC sued Binance, December 2022 after rumors of insolvency, and the immediate aftermath of FTX. We will provide another update 24 hours after the news was originally announced.

CZ’s Departure Prediction Good times for Crypto

Within the crypto community, the debate surrounding CZ’s departure has been intense. However, the consensus is optimistic.

a report from The Block quotes major banking institution JPMorgan as saying the Binance deal removes a “systemic risk” to the sector. In 2022, when FTX collapsed, Bitcoin’s price plunged to a low of $15,000 and took months to recover.

With 150 million users on the platform and millions of capital injected into multiple ecosystems. Binance’s collapse would have been as, if not more, catastrophic than FTX for the nascent industry.

JPMorgan analyst Nikolaos Panigirtziglou told The Block:

We view the prospect of a settlement as positive as uncertainty surrounding Binance itself would decrease and its trading and Smart Chain operations would benefit. For crypto investors, the prospect of a settlement would mean the elimination of a potential systemic risk arising from a hypothetical collapse of Binance.

Cover image from Unsplash, chart from Tradingview