Amid PancakeSwap’s proposal to burn 300 million CAKE and reduce total supply from 750 million to 450 million CAKE, on-chain data indicates that a whale has moved a significant amount of CAKE, the decentralized exchange’s governance token .

Whale moves tokens as the Key PancakeSwap voting event continues

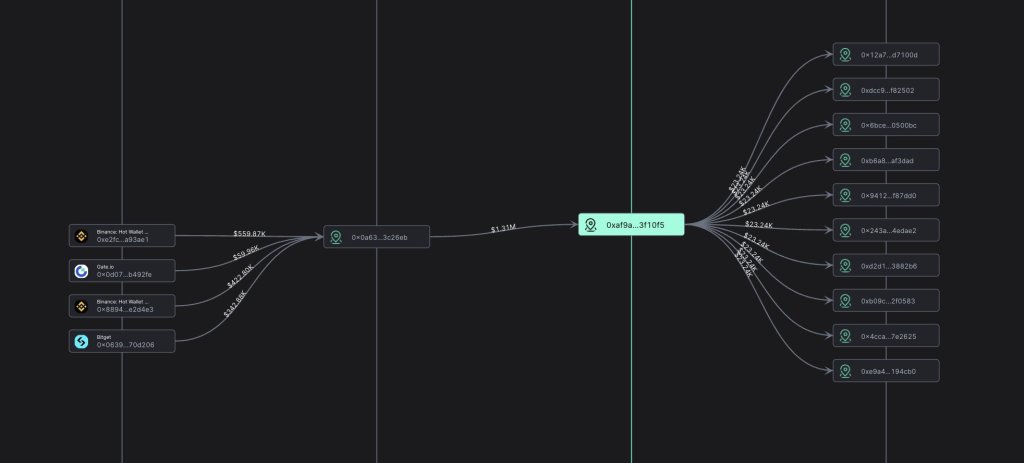

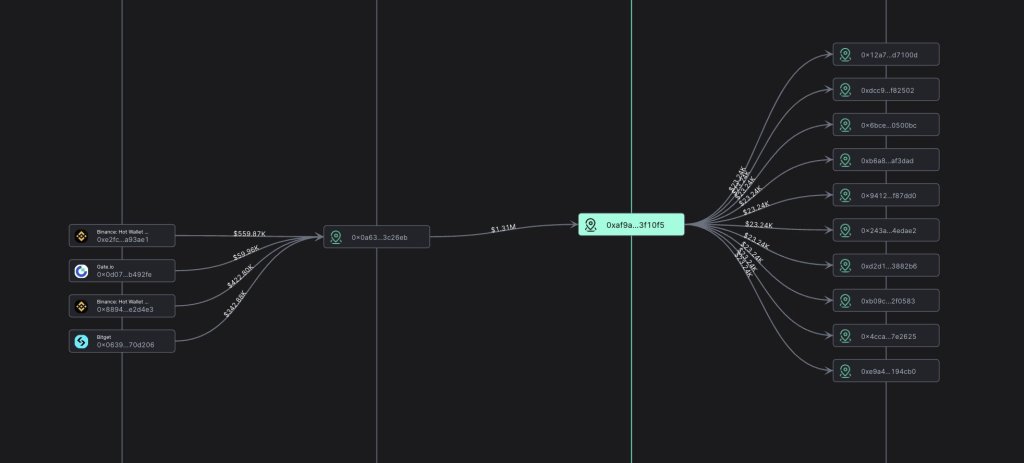

According to a report from Scope scan, a blockchain analytics platform, a whale moved approximately 1.7 million CAKE worth $1.3 million from Binance, Gate.io, and Bitget to a range of crypto addresses over the past week. The timing of this transfer is notable as it coincides with key votes that would permanently shape PancakeSwap’s tokenomics.

The proposed token burn has significant support, with more than 90% of CAKE holders agreeing. According to the proposer, it is reasonable to reduce the total supply to 450 million CAKE. It would also ensure sufficient supply for future growth while achieving ‘ultrasound CAKE’.

The idea here is to make CAKE deflationary in the long term, and this could support prices as PancakeSwap continues to play a crucial role in token exchanges in the broader BNB Chain ecosystem.

According to DeFiLlama factsPancakeSwap is the largest DEX in the BNB Chain ecosystem, with a total value locked (TVL) of $1.6 billion, controlling roughly half of the network’s TVL of approximately $3.5 billion. Notably, PancakeSwap has been resilient and continues to evolve, shaking off the competition even after the implementation of Uniswap v3 on the BNB Chain.

In the last 24 hours, PancakeSwap has generated more than $815,000 in fees, more than 7.5 times that of Venus, a lending protocol, the second largest in the BNB Chain ecosystem.

Is CAKE ready for $10?

Notably, the token burning proposal also comes as PancakeSwap is undergoing significant changes, including the recent one introduction of veCAKE and voting meters, the voting of which ended on November 22. With this proposal having passed with over 99% community support, veCAKE holders can now vote on where future emissions from CAKE farms will be directed.

This gives CAKE holders greater influence on the board. Supporters argue that this crucial decision makes the DEX more decentralized and community-oriented.

In anticipation of PancakeSwap’s plans to burn 300 million CAKE, prices have risen. On the weekly chart, CAKE is up over 260% from its 2023 low, and growing as demand increases. Although bullish, the bulls cannot yet make up for this year’s losses. A critical resistance level remains around $5. A solid break above this line in large volumes could push CAKE to around $10 in the coming months.

Feature image from Canva, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.