- The integration of the Akash network into NVIDIA’s Brev product increased the former’s trading volume by 573%.

- The AKT also rose 20.18% over the past seven days.

On August 23, all cryptocurrencies had strong upside potential. Since then, markets have seen bigger swings, with investors looking for external forces to influence another upside potential.

Amid these market fluctuations, Akash Network also experienced a strong upward movement.

The price movement has everyone wondering what factors will influence the AI-themed altcoin for a rally.

Akash Network integrates into NVIDIA’s Brev

As reported by NVIDIA Director of Tech Development Nader Khalil, the AI company has done just that integrated Akash in the company’s new product, Brev.

Because AKT now has a direct correlation with NVIDIA products, it is well positioned to benefit from the AI boom.

Similarly, Akash Network is at the cross-section of AI and blockchain technology as it is a decentralized blockchain-powered computer network.

The prevailing market sentiment

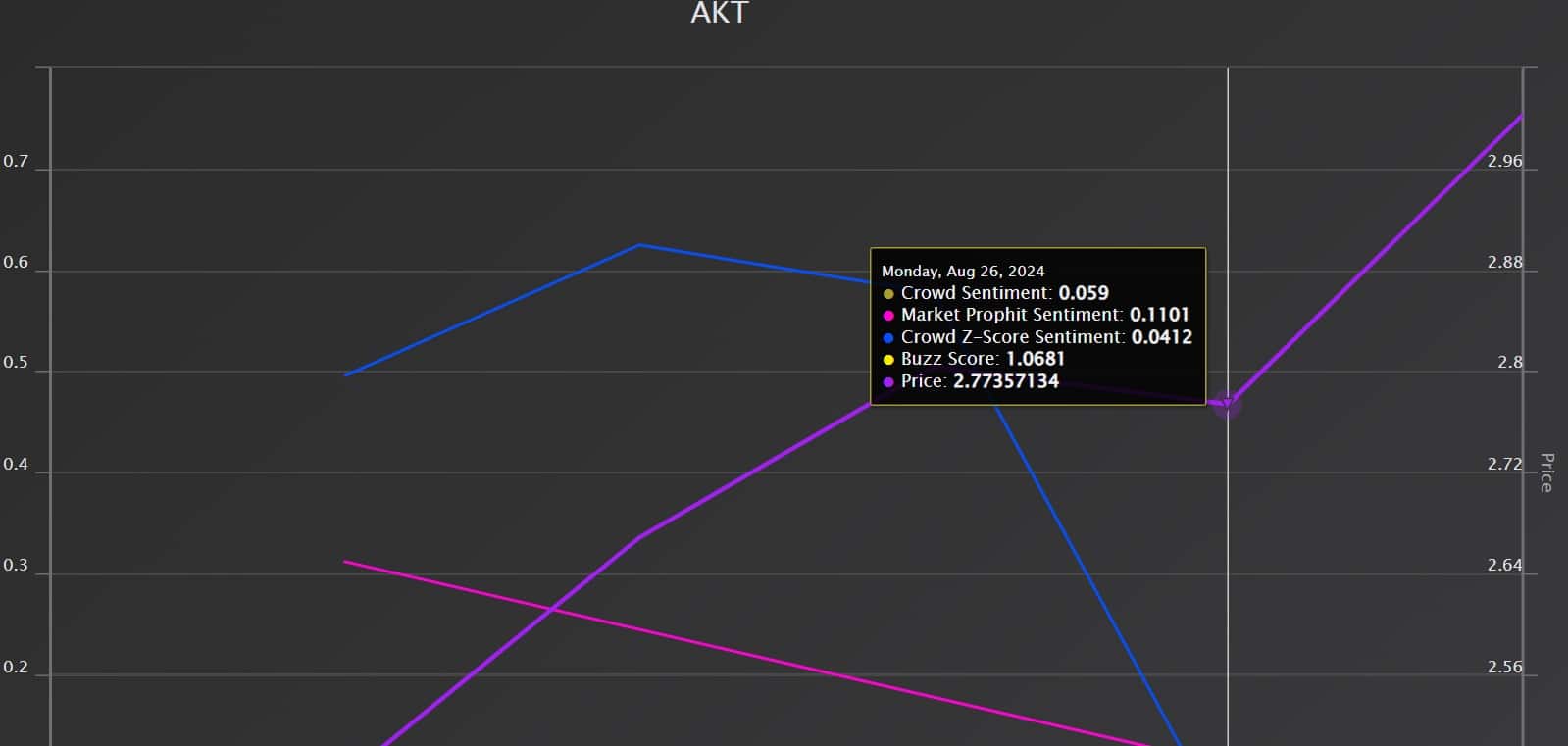

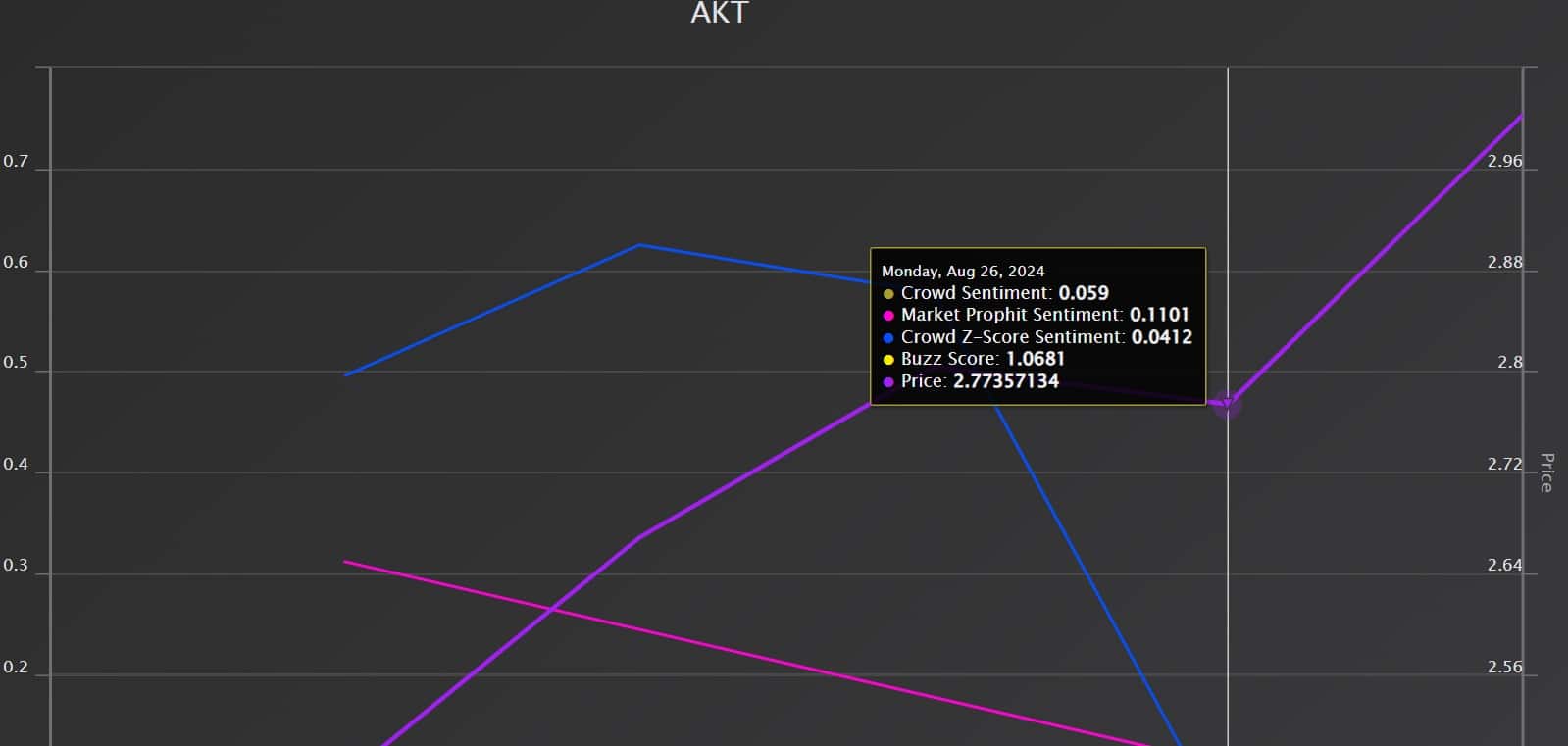

Source: Markt Profhit

In addition to the integration by NVIDIA, AKT enjoys high market favorability, with investors showing very positive prospects. AMBCrypto’s analysis of Market Prophit showed that the altcoin was enjoying positive market sentiment.

AKT had a crowd sentiment of 0.059, a buzz score of 1.06, and a crowd Z-score of 0.04 at the time of writing. This suggested that investors had confidence in the altcoin’s direction.

What AKT’s price charts suggest

AKT has shown a moderate recovery on the price charts. At the time of writing, the AI-themed altcoin was trading at $3.03, up 11.8% in the past 24 hours. Trading volume increased by 573.17% to $55.5 million in 24 hours.

Prior to these peaks, the crypto saw sustained price increases over the past seven days with an increase of 20.18%. After hitting a low of $1.80 during the market crash on August 5, AKT has gained 68.33%.

Despite the recent rebound, the altcoin’s prices remained relatively low from last month’s high of $3.77 and down 63.7% from $8.7 ATH.

So it is essential to determine whether the recent gains are sustained in the long term or are merely a market correction.

Source: TradingView

Looking at the altcoin’s Directional Movement Index (DMI), the positive index of 35.75 sat above the negative index of 16.59. This suggested that ATK was on a strong upward move, with recent highs surpassing lows.

This trend was further proven by the Aroon line. At the time of writing, Aroon Up’s 92.86% was ahead of Aroon Down’s 42.8%.

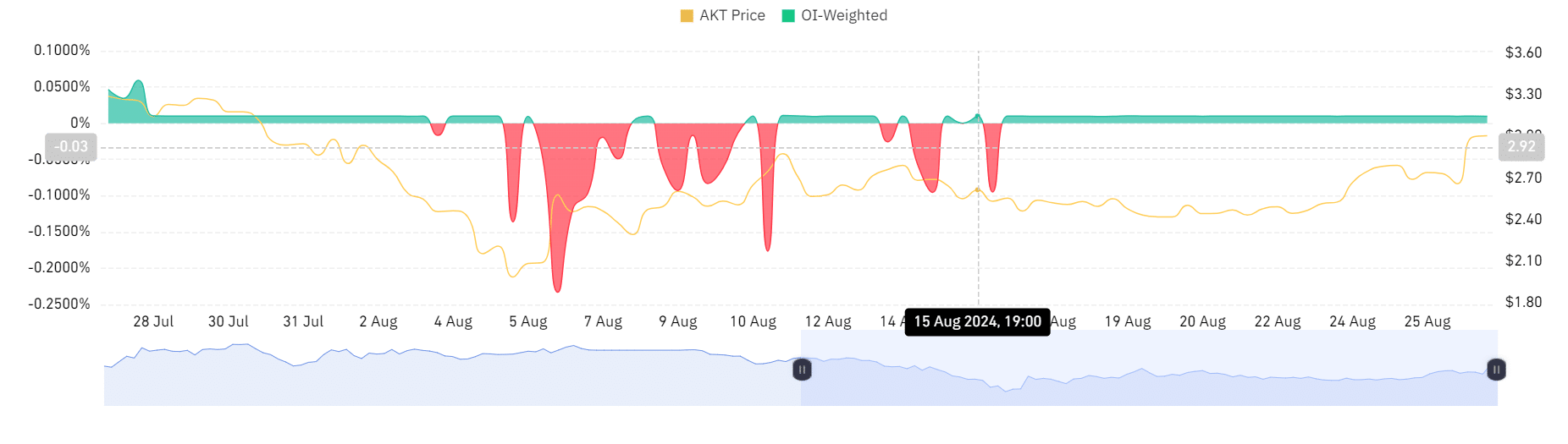

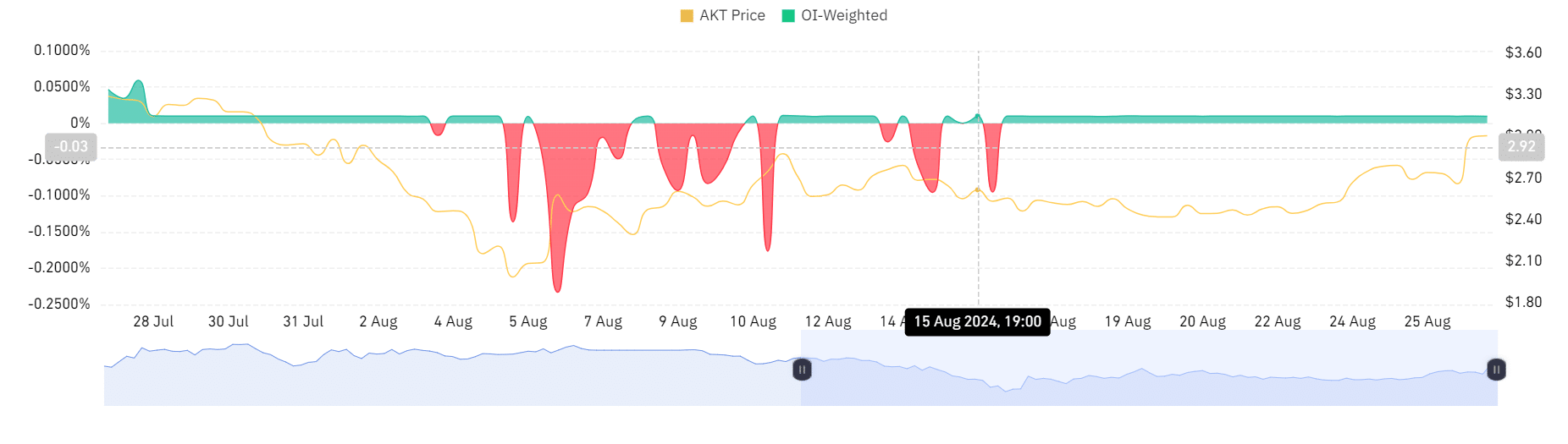

Source: Coinglass

Looking further, AKT’s OI-weighted funding rate has been positive over the past two weeks.

This showed increased demand for long positions, with investors willing to pay a premium for their positions, which is bullish market sentiment.

Source: Santiment

In addition, demand for long positions was further supported by positive financing rates on the stock exchange. This reflected investor confidence in the rising AKT price and overall future potential.

Read the one from Akash Network [AKT] Price forecast 2024–2025

Therefore, after consolidating just above $2.70, the price of the Akash Network coin rose past $3. In recent weeks, the $2.70 level has proven to be crucial support.

So, if current market sentiment holds, ATK may break the $3.4 resistance level and attempt the $3.8 resistance level.