- XRP’s impressive rally allows for short liquidations, but increases the risk of a long-term squeeze

- Increased risk metrics and limited liquidity below $2.50 indicated greater volatility going forward

XRP investors have made significant gains lately following the token’s impressive rally. However, the emerging risk numbers seemed to point to possible future turbulence. With over 90% of bearish liquidation levels exhausted and normalized risk reaching extreme levels, could this be the perfect time to lock in gains before momentum shifts?

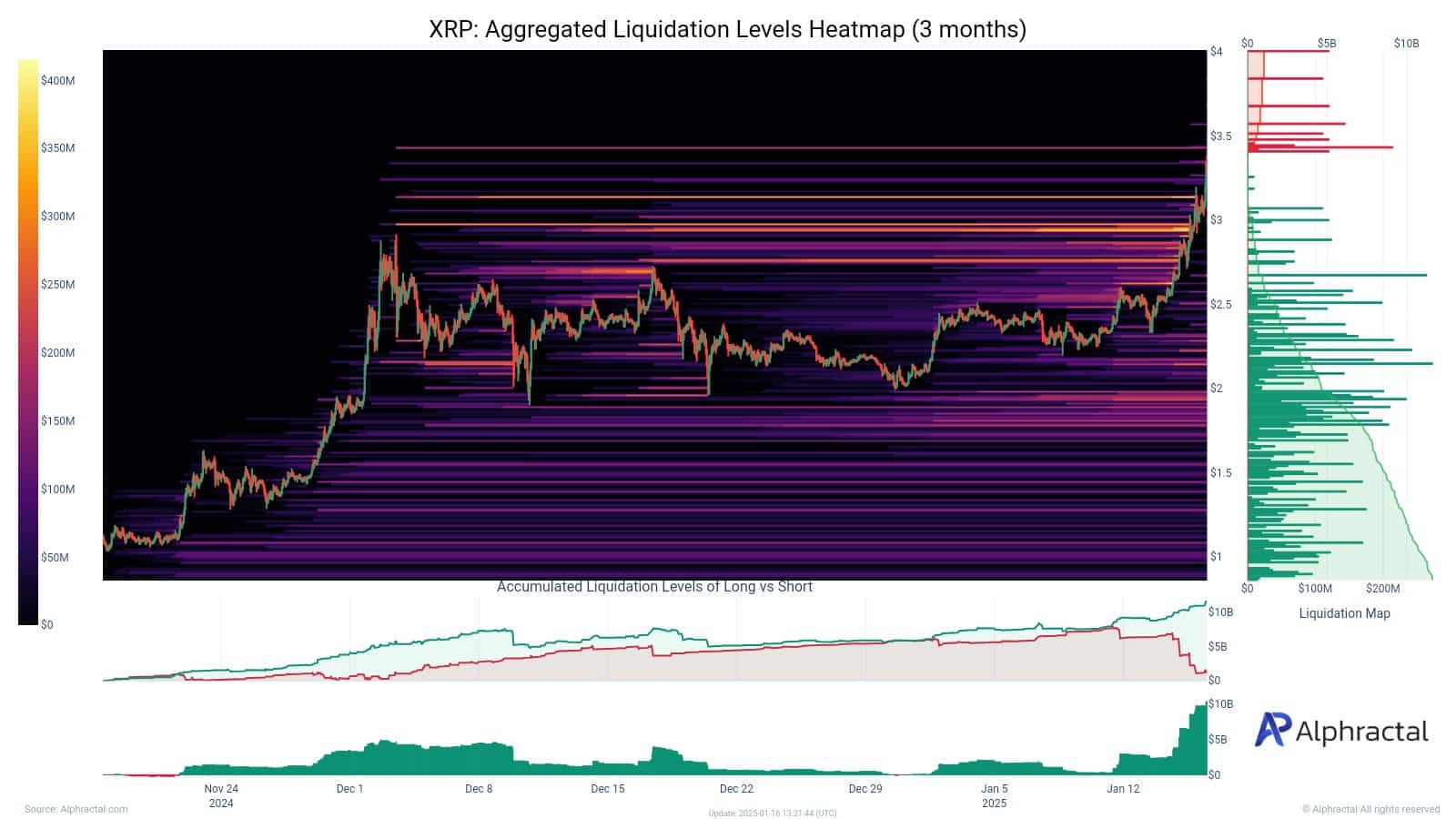

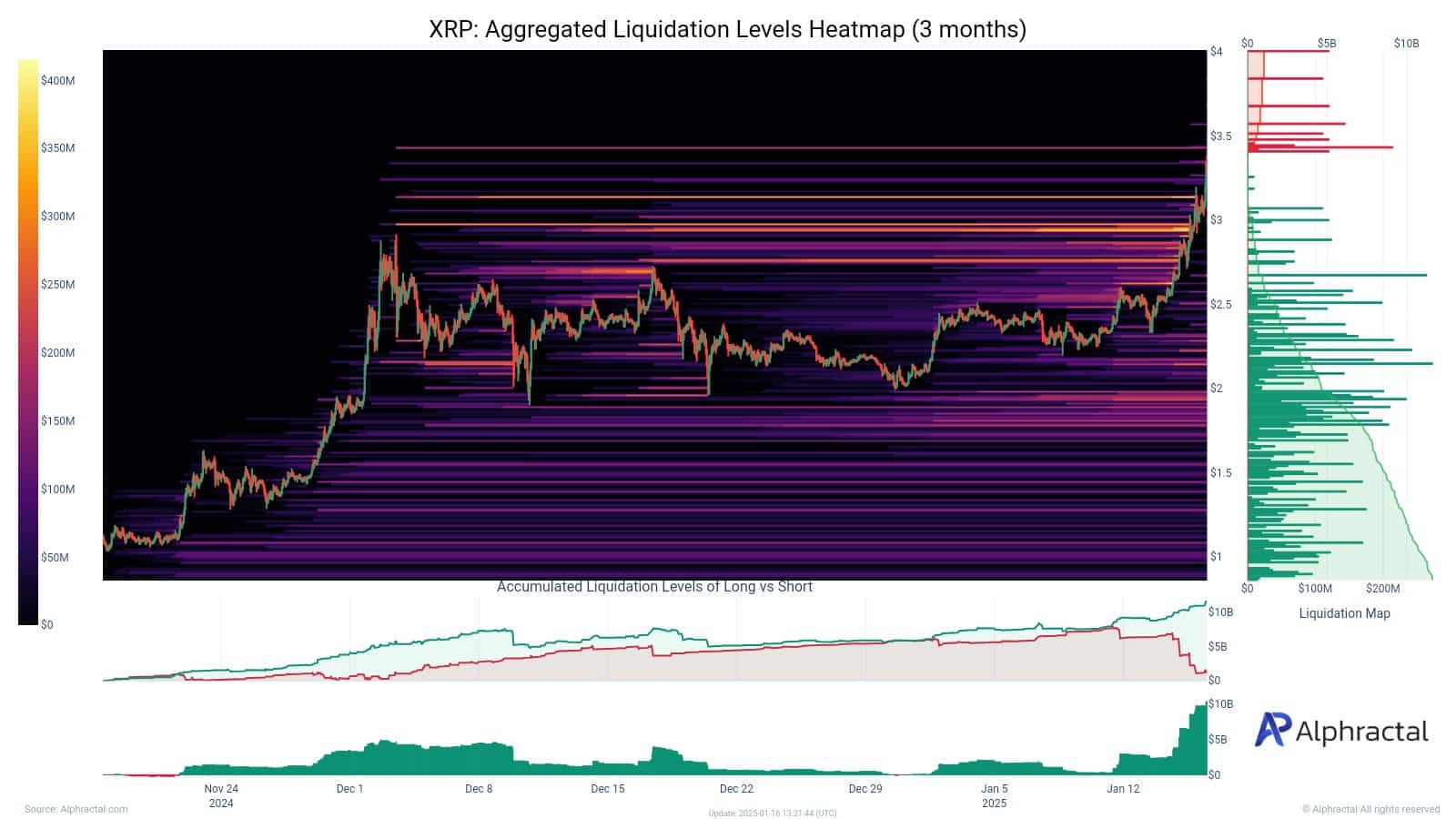

Liquidation heatmaps reveal XRP’s fragile market dynamics

While XRP’s liquidation heatmaps highlighted the token’s impressive rally, they also exposed growing market vulnerabilities. The three-month heatmap revealed dense liquidation clusters in the $3.00-$3.50 range, where most short positions have been cleared, fueling the rally.

Below $2.50, however, liquidity decreases significantly, indicating limited support if the price falls on the charts.

Source: Alpharactal

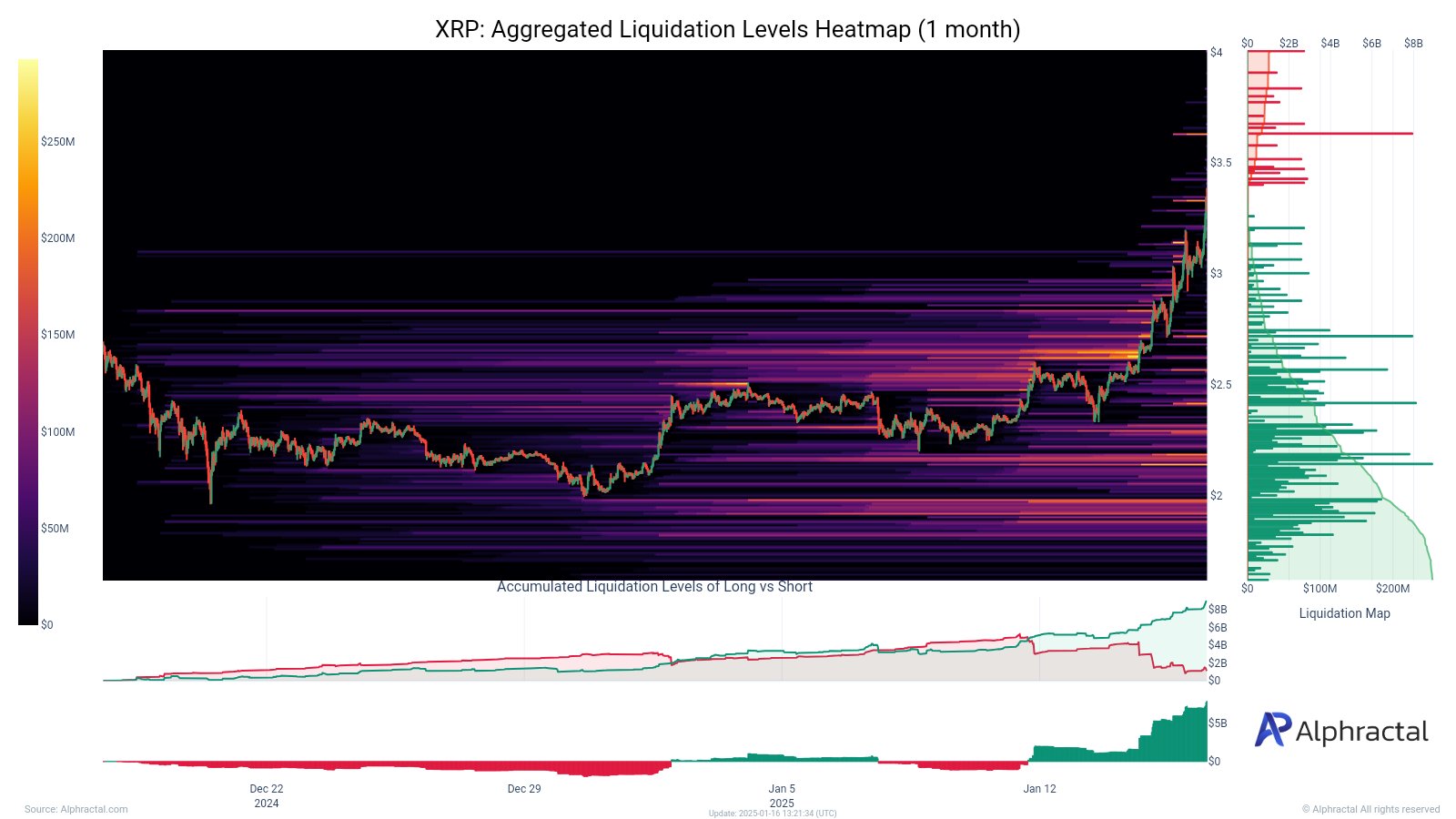

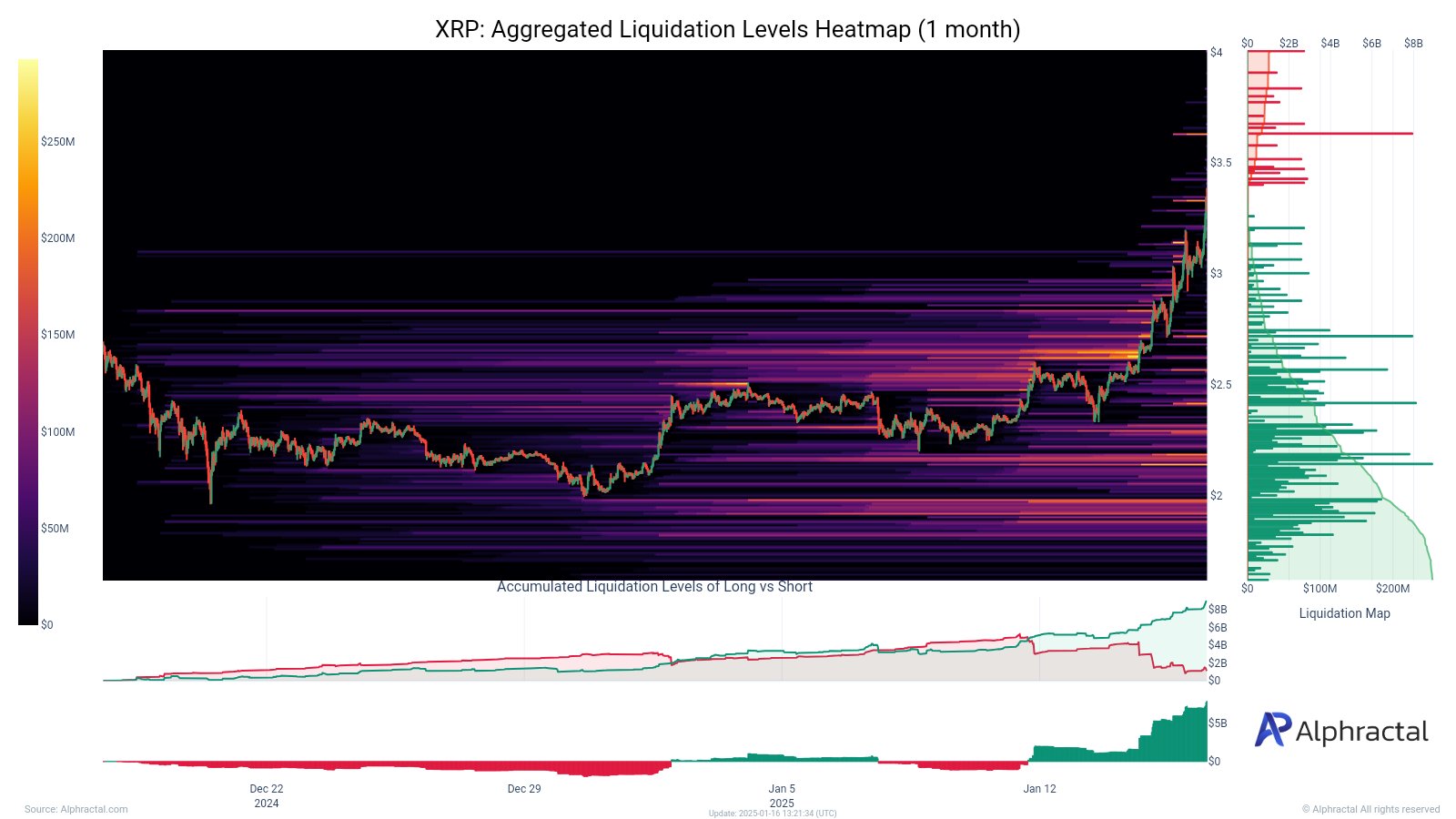

The one-month heatmap reinforced this view, revealing a near-total exhaustion of bearish liquidation levels and a build-up of long positions in the $3.25-$3.50 range.

This increases the risk of a prolonged squeeze if XRP loses momentum, potentially causing a sharp sell-off.

Source: Alpharactal

Furthermore, the imbalance between leveling off short liquidations and rising long liquidations is a sign of a market that is trending towards bullish sentiment.

While XRP’s rally thrived on short squeezes, the lack of bearish liquidity and concentrated long positions means increased volatility may be in store.

XRP’s increased risk metrics

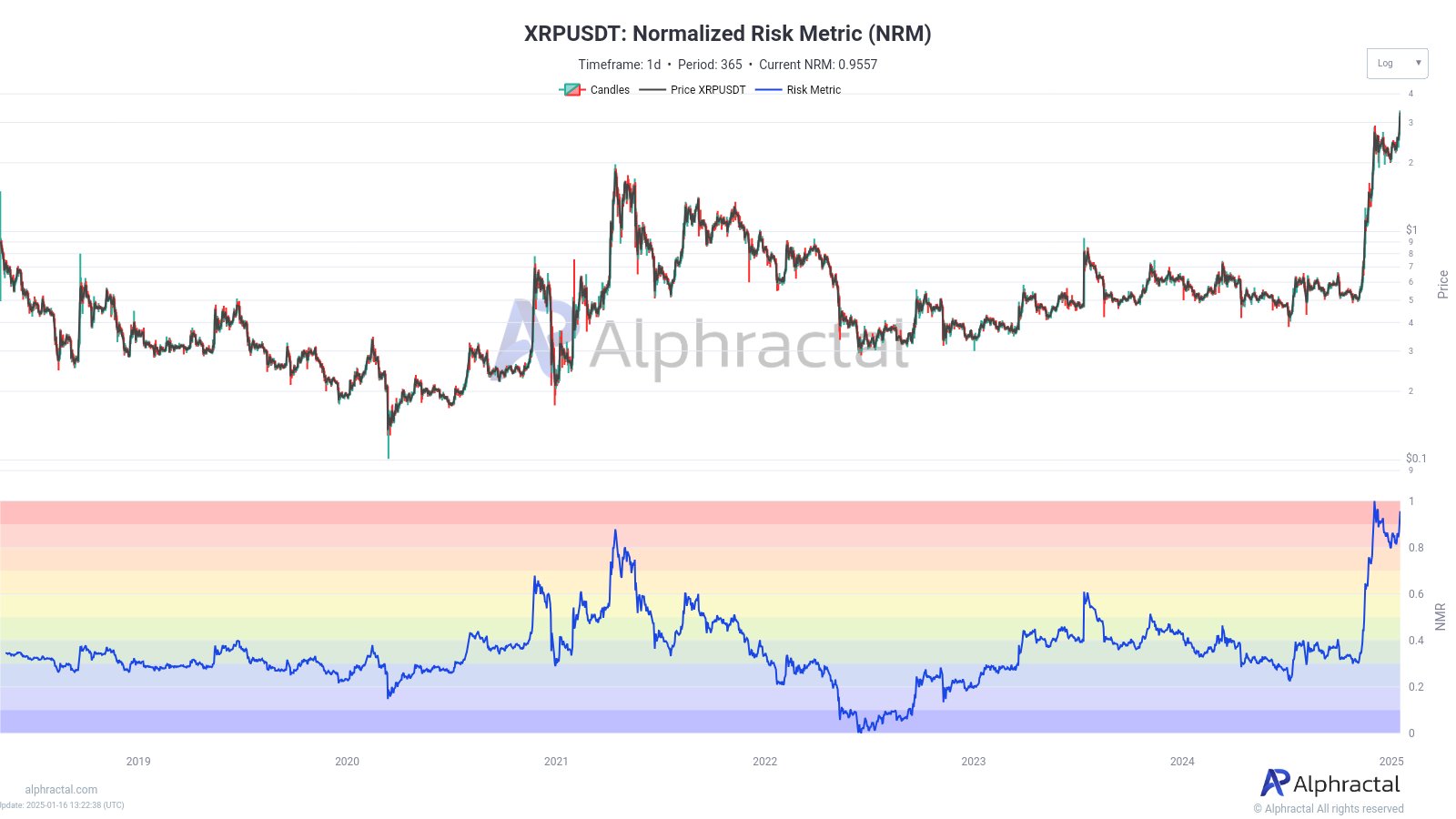

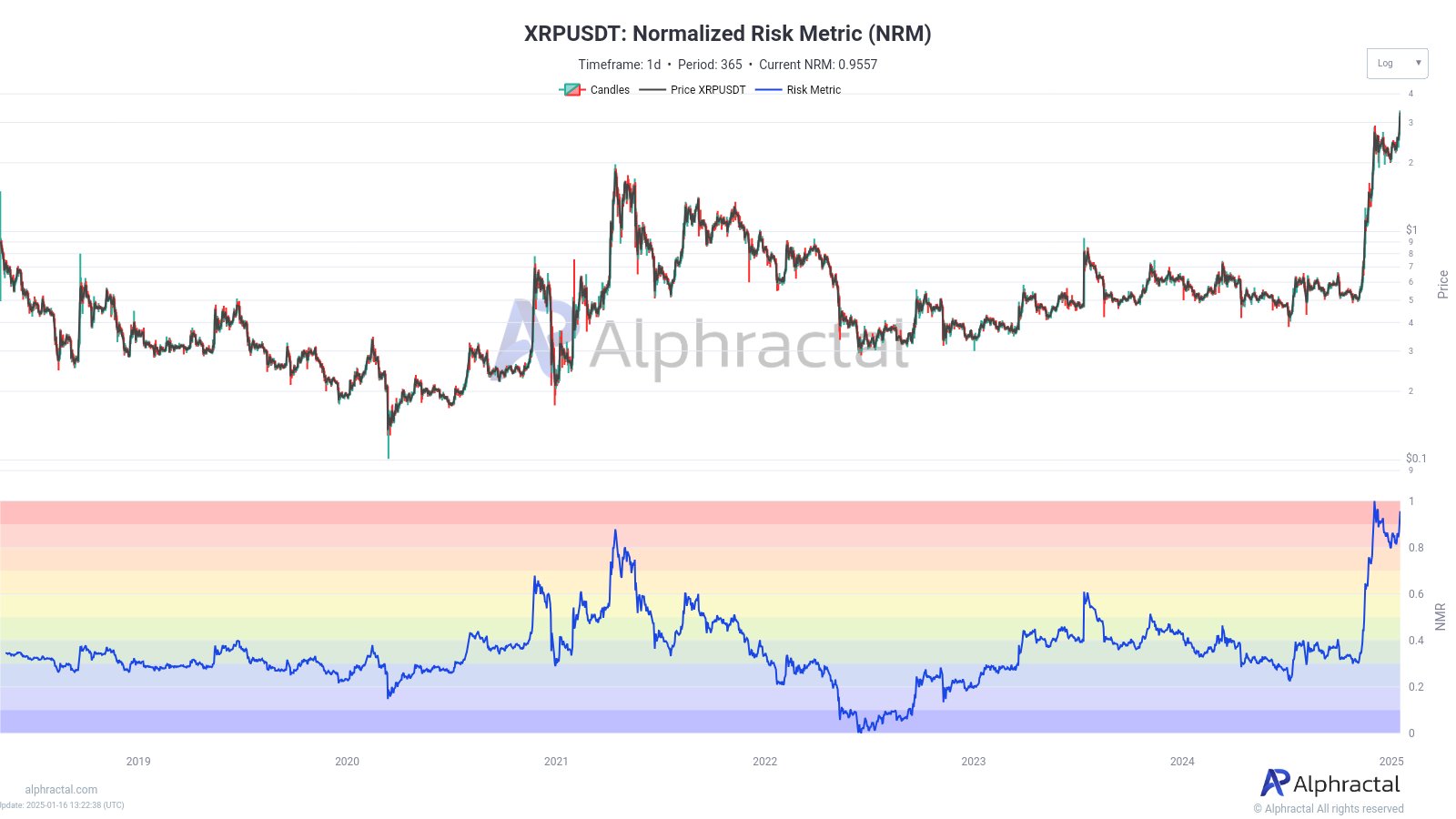

XRP’s recent rally came with worrying signs of increased risk, as both the Normalized Risk Metric and Sharpe Ratio approached extreme levels.

The NRM reading of 0.9557 appeared to be approaching the historic highs that have preceded major market corrections in the past – a sign of overheated conditions. With XRP now firmly in the red zone of the risk chart, the chances of a price drop will be high.

Source: Alpharactal

Similarly, the Sharpe Ratio, which measures risk-adjusted returns, is also reaching unsustainable positive levels – echoing patterns seen before previous market corrections.

Source: Alpharactal

This means that XRP’s risk-reward balance is skewed, making current market dynamics precarious.

A combination of these risk measures, in addition to an already overheated market, increases the likelihood of increased volatility and a possible retracement on the charts.

Realistic or not, here is the XRP market cap in terms of BTC