- The price of Notcoin has risen by more than 14% in the past 24 hours.

- Figures on the derivatives market pointed to a price correction.

Non-coin [NOT] Bulls clearly dominated the market last week as the price of the newly launched token rose by double digits.

This could be the tip of the iceberg, as the regular uptrend indicated a massive bull rally in the coming weeks or months. Let’s see what’s going on.

Notcoin is pumping

CoinMarketCaps facts revealed that Notcoin’s price had fallen to last week’s low of $0.0093 on July 5. However, since then the token has gained bullish momentum.

In the last seven days, the price of NOT has risen by more than 14%. In the last 24 hours alone, NOT’s value has increased by more than 4%.

At the time of writing, NOT was trading at $0.01596 with a market cap of over $1.63 billion.

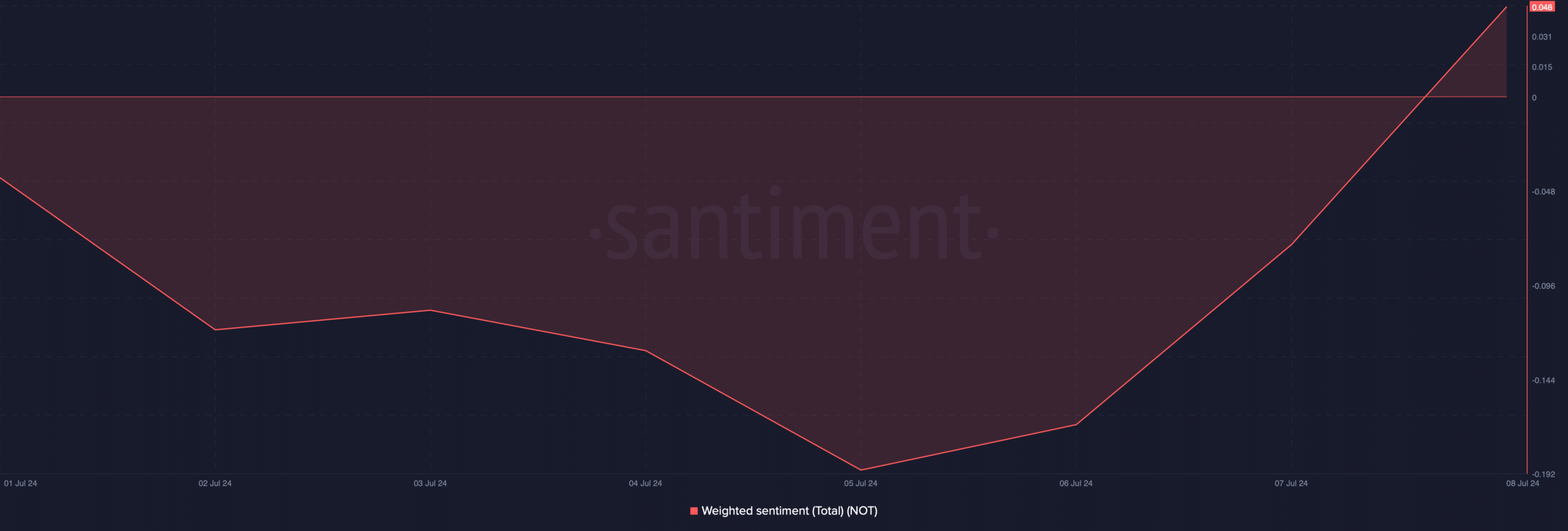

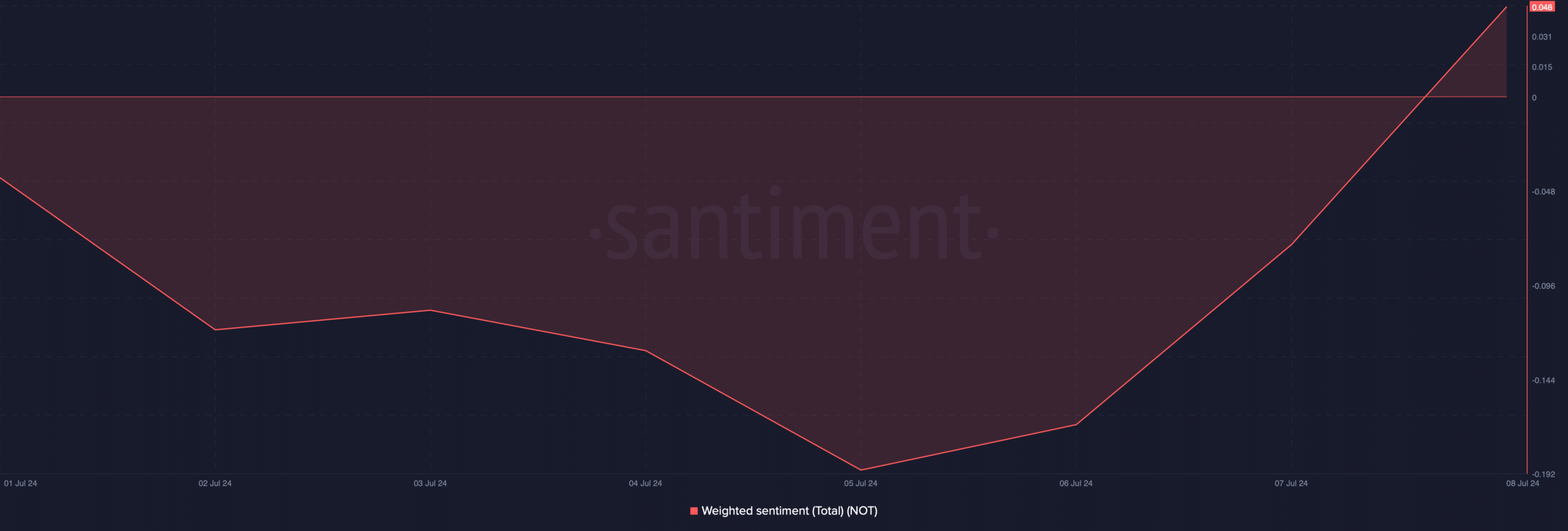

AMBCrypto’s look at Santiment’s data showed that the bullish price action had a positive impact on the token’s social metrics as weighted sentiment improved.

This meant that bullish sentiment around the token was high.

Source: Santiment

Meanwhile, World Of Charts, a popular crypto analyst, recently posted a tweet highlighting the fact that NOT has successfully broken out above a descending channel pattern.

The token has been consolidating within the pattern since June, after hitting an all-time high. If the pattern is to be believed, investors may NOT rise 80% to 90% in the coming months.

Source:

NOT’s upcoming goals

Since the aforementioned breakout looked bullish, AMBCrypto planned to dive deeper into NOT’s metrics to see if they also support a price increase.

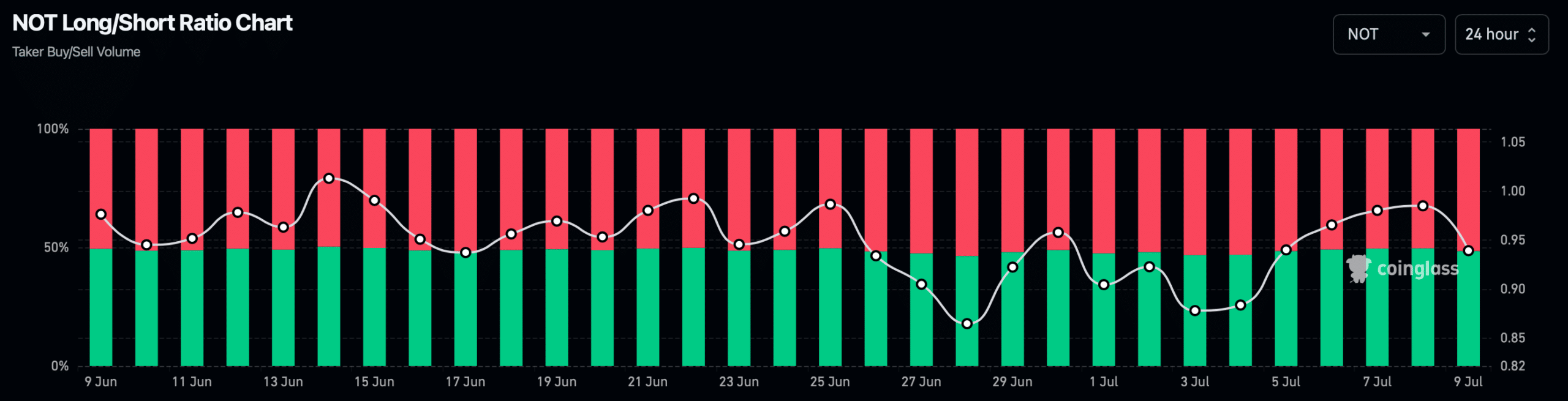

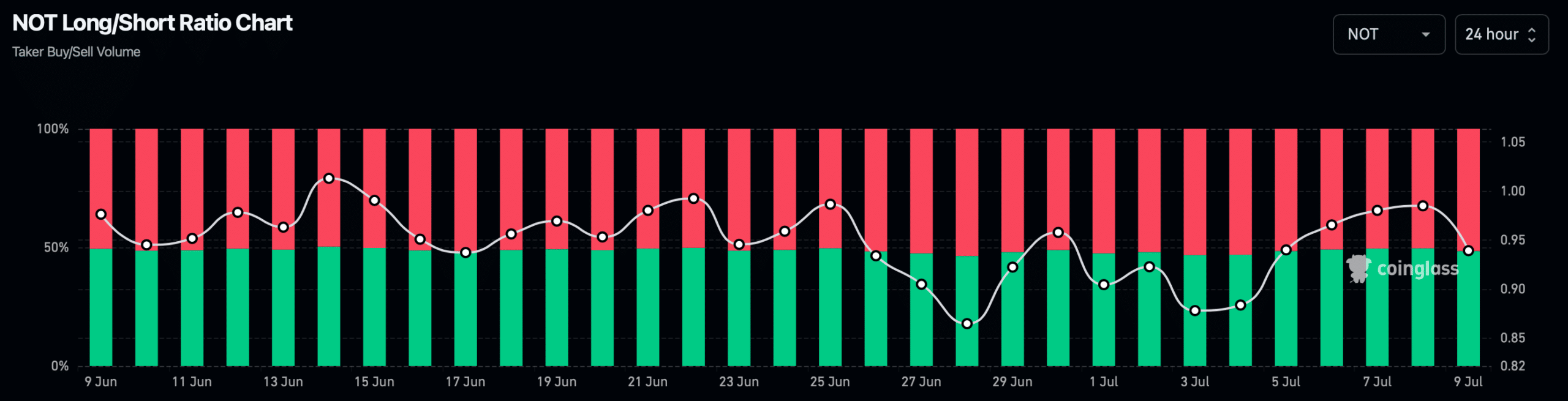

Our analysis of Glassnode’s data showed that Notcoin’s long/short ratio fell.

A decline in the ratio means that there are more short positions in the market than long positions, meaning that bearish sentiment was dominant in the market.

Source: Coinglass

Moreover, NOT’s financing rate has also been increased. In general, prices tend to move in a different direction than the financing rate, indicating a price decline in the coming days.

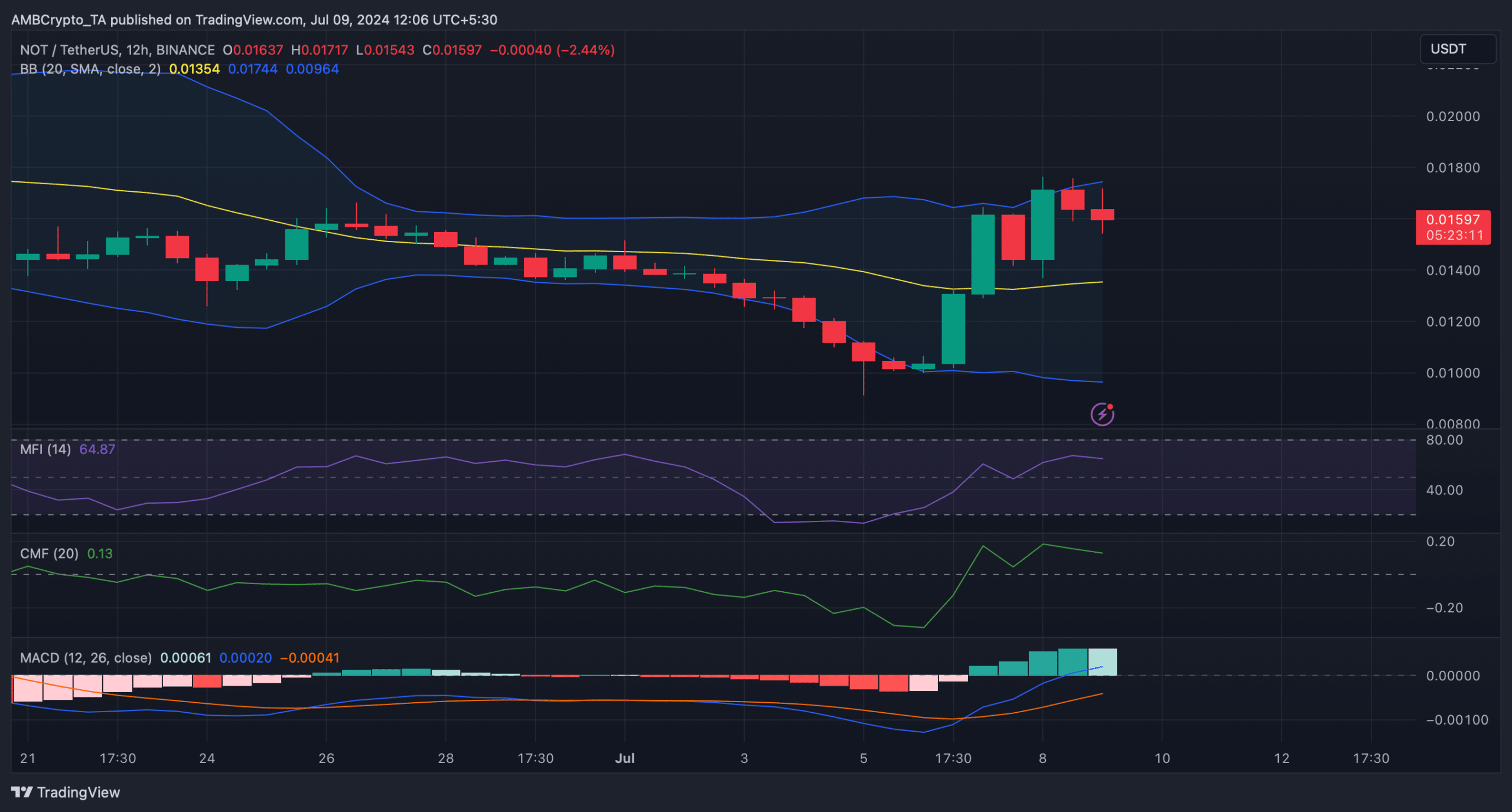

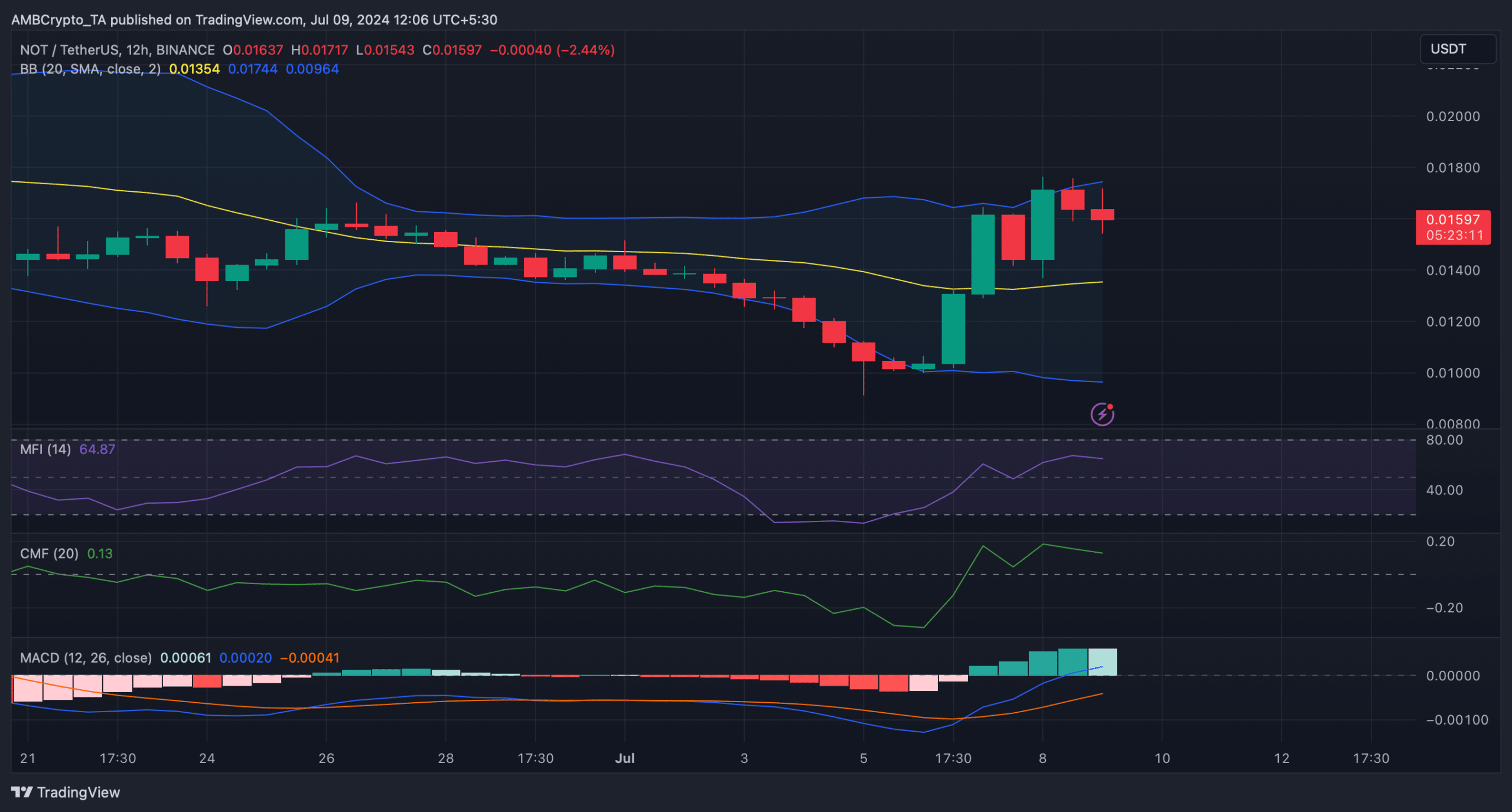

We next checked the token’s daily chart, which showed that the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both recorded downticks.

The Bollinger Bands revealed that the price of NOT has reached the upper limit of the indicator. This usually results in a price correction.

Realistic or not, here it is NOT’s market capitalization in terms of TON

Nevertheless, the technical indicator MACD supported the buyers as it showed a clear bullish advantage in the market.

Source: TradingView

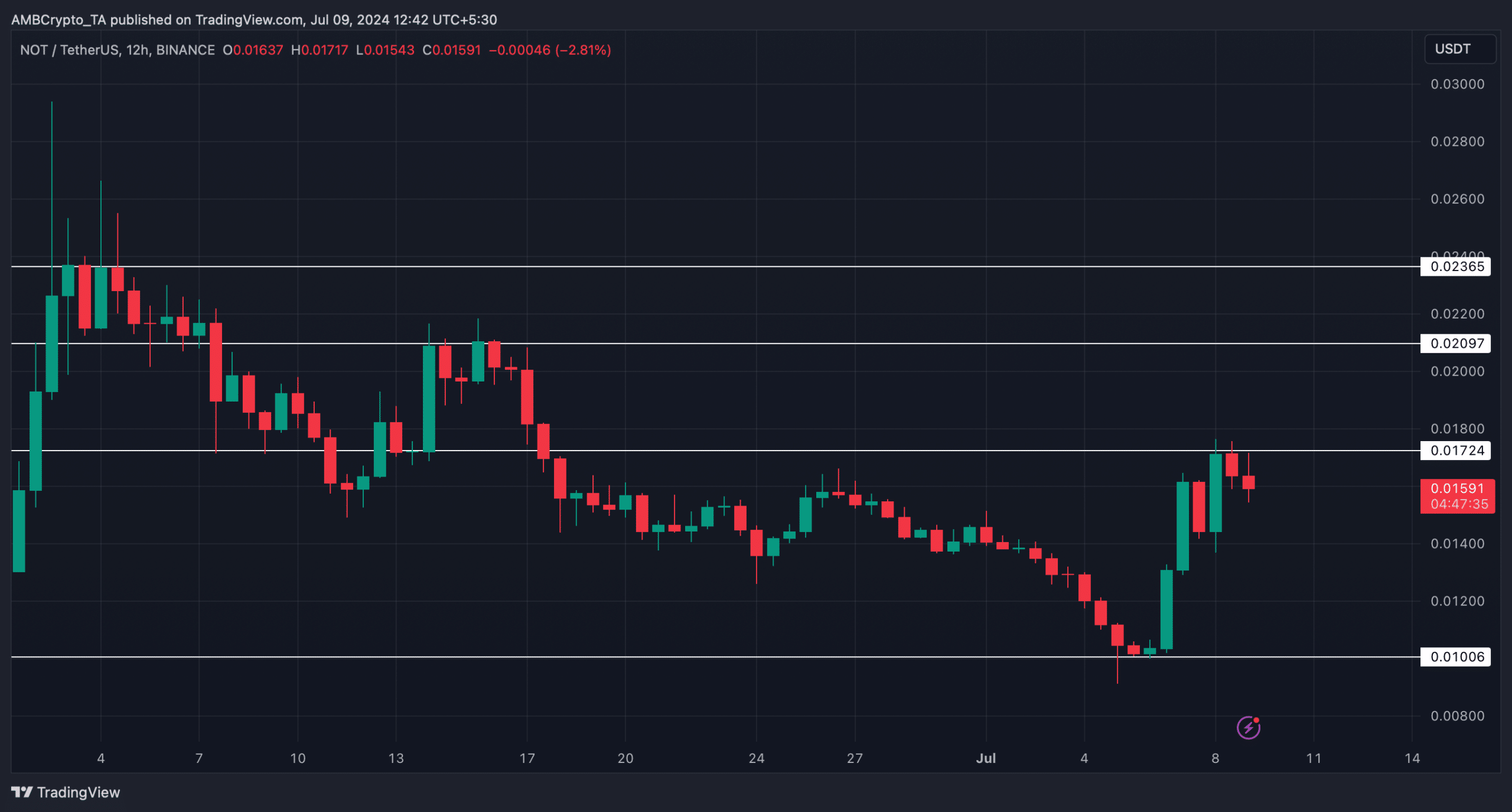

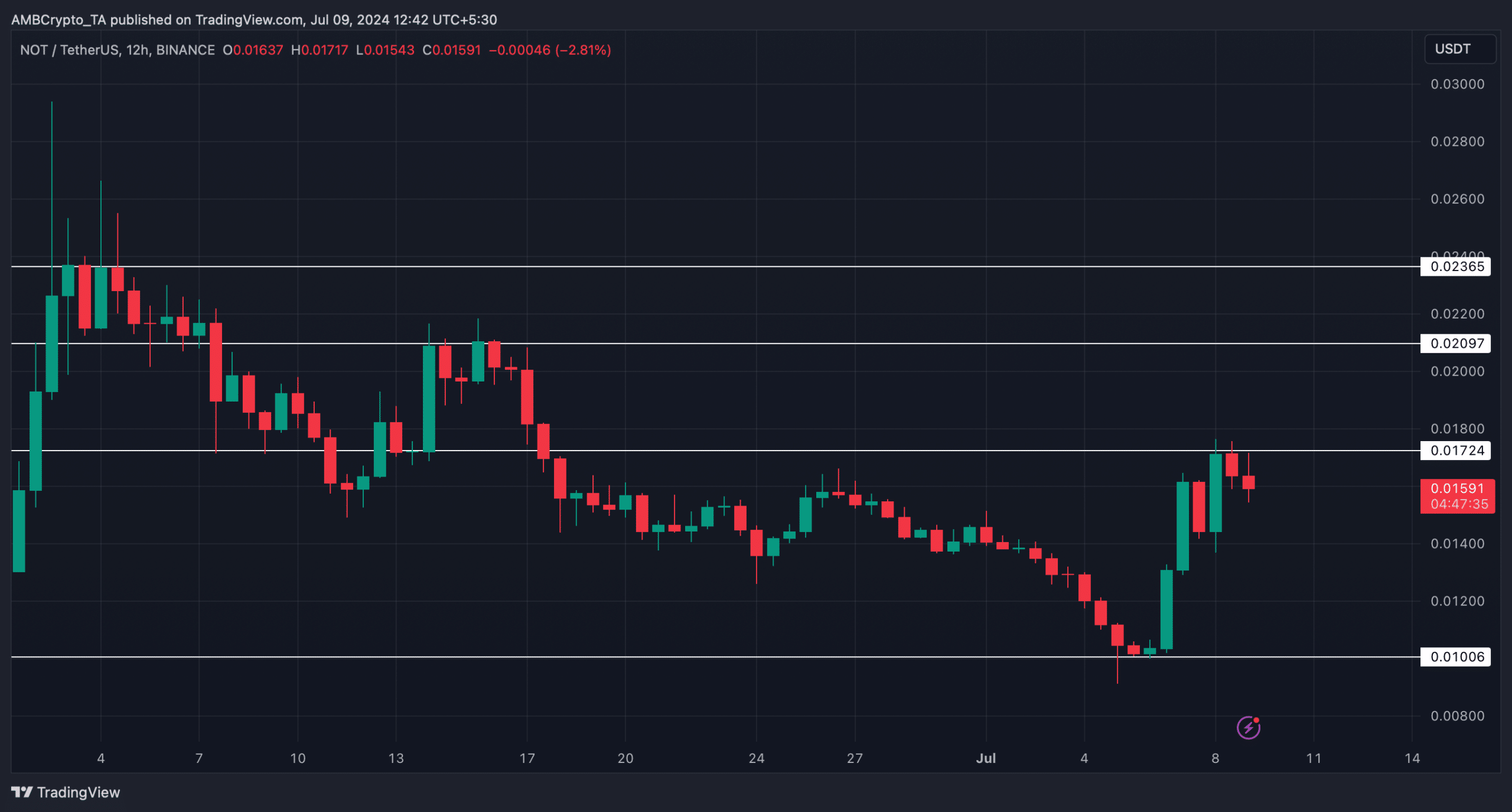

For Notcoin to maintain its bull rally, it is important that it rises above $0.0172. A successful jump above that level would allow it to reach $0.02 before retesting the ATH.

Source: TradingView