- NEAR’s bullish market structure seemed to contradict disappointing market demand

- Spot CVD offered some hope that the bulls could defend $3.85

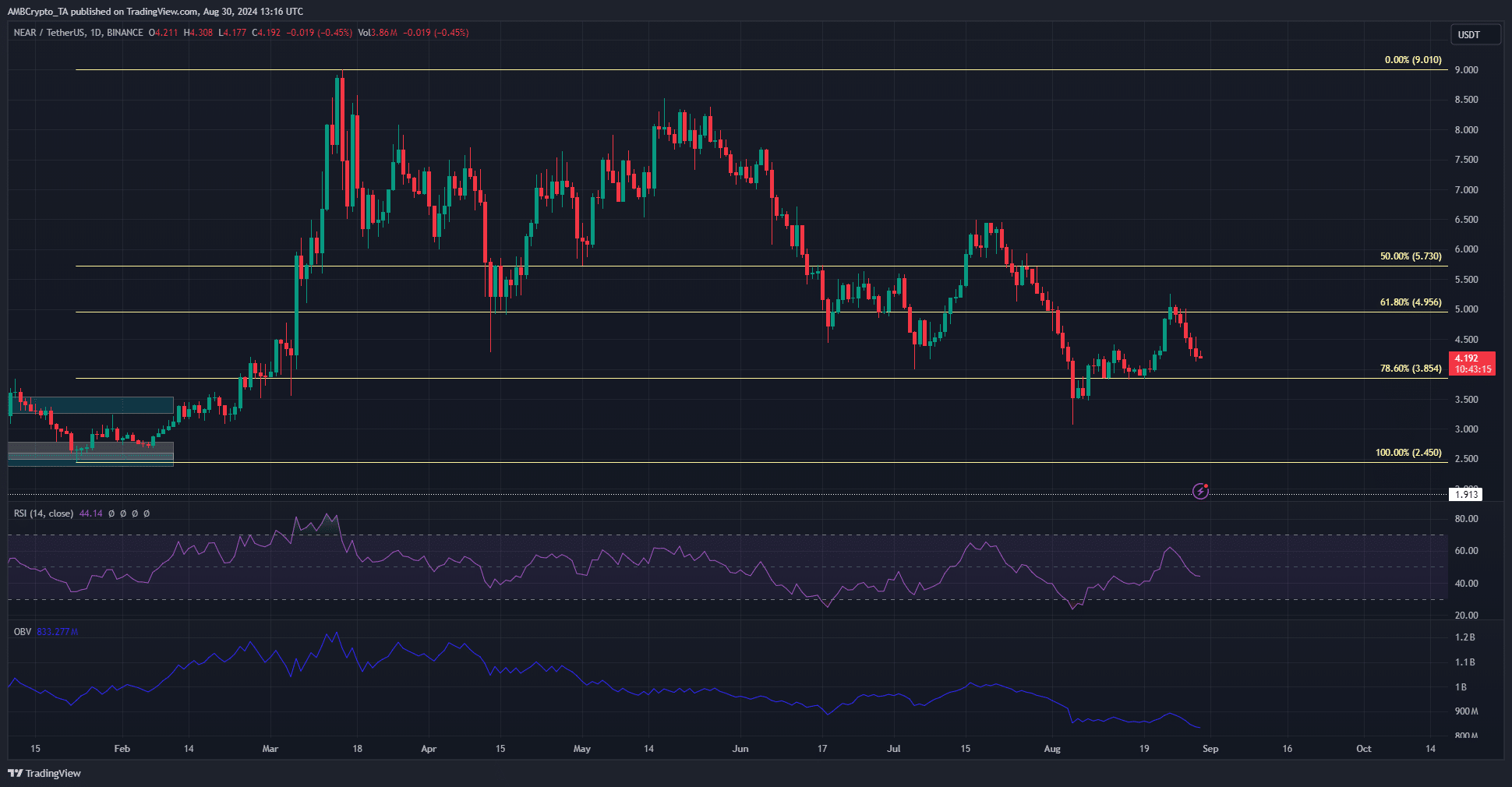

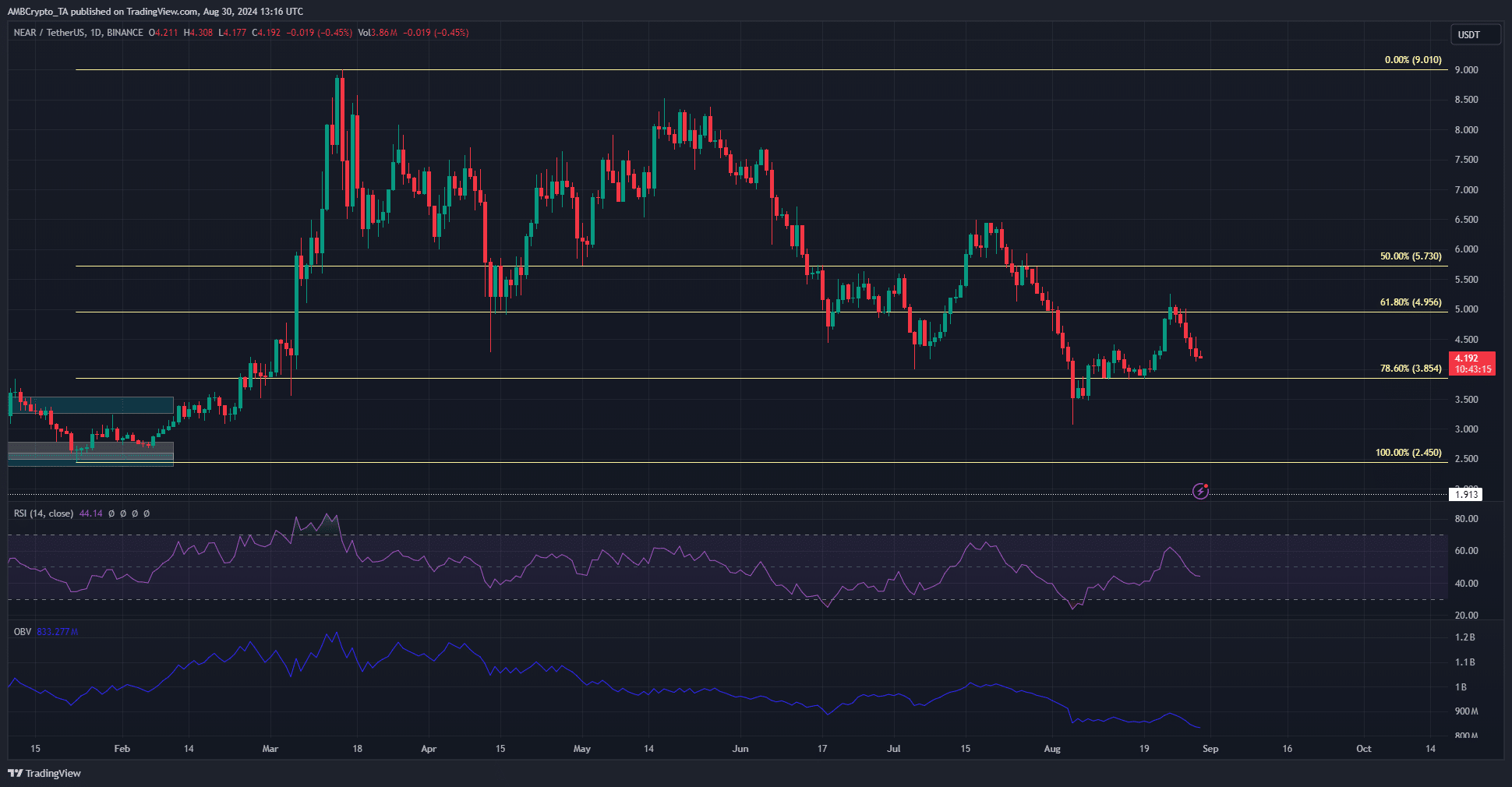

NEAR protocol [NEAR]was in a downtrend across the higher time frames at the time of writing. On the charts, the bulls found refuge at the $3.85 level, which was the 78.6% Fibonacci retracement level based on the rally from $2.45 to $9 in February and March.

Since then, the market structure has flipped bullish a few times. While the structure was bullish at the time of writing, the outlook for the token was bearish.

Rejection of $5 and continued bearish pressure

Source: NEAR/USDT on TradingView

This bearish outlook boils down to the OBV’s consistent downtrend. The steady flow of selling meant that even though NEAR was trading above a higher timeframe, the support level should remain at $3.85.

The price bounced from $3.85 last week and the token rose to $5.25. Unfortunately, it was not possible to reverse the level to support in the following days.

The daily RSI also fell below neutral 50 following the recent price drop, showing a shift in momentum. Investors would be hoping for a range around the $4 zone and a slow increase in OBV, indicating accumulation.

Unless these play out as indicated, the higher time frame outlook would look bleak for NEAR’s price.

See CVD keeping pace despite NEAR’s price drop

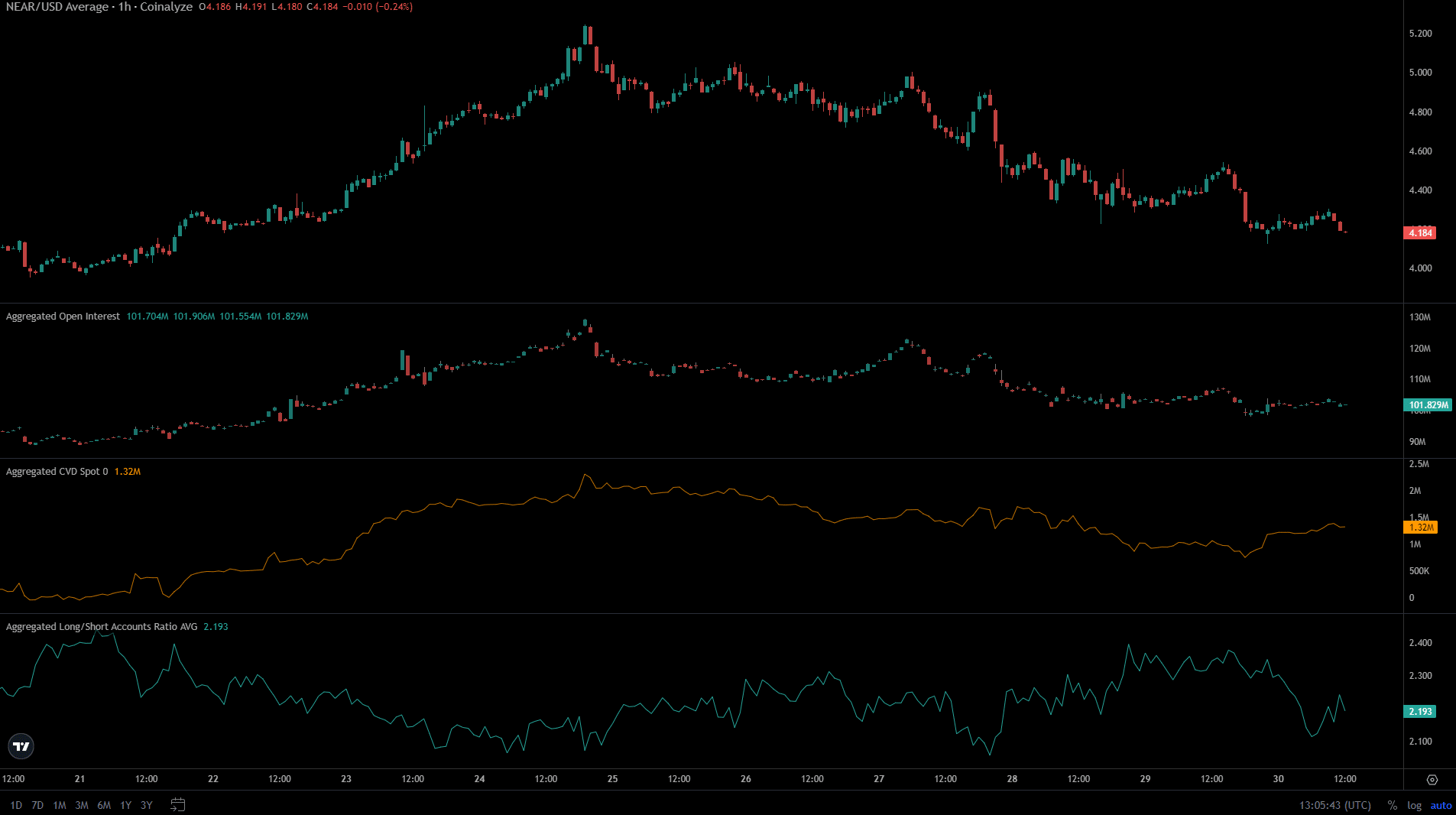

In recent days, the Open Interest behind the NEAR Protocol has fallen along with the price. This indicated bearish sentiment in the futures market.

The long/short account ratio also saw a decline over the past 24 hours, but remained at a healthy 2.19, indicating there were more longs than shorts.

Realistic or not, here is NEAR’s market cap in BTC terms

Surprisingly, spot CVD rose even though the price struggled with a short-term downtrend. This increase in buying pressure could give traders some hope that NEAR could bounce back from the $4 support zone.