- Bitcoin is under pressure amid the Mount Gox refunds, with experts like Alex Thorn highlighting the potential impact on Bitcoin Cash.

- Contrasting redemption strategies by Mount Gox, Gemini and FTX raised questions about market stability and investor sentiment.

The year 2024 was considered one of the happiest years for Bitcoin [BTC]especially with the launch of Bitcoin ETF, which hit a new all-time high of $73,000, and the expected halving of Bitcoin.

However, as the crypto community prepares for the full and final approval of the spot Ethereum [ETH] ETF in July, BTC seems to have taken a back seat.

While ETH was up 1.58% over the past 24 hours at the time of writing, BTC was flashing red candlesticks on its daily charts trading at $61,000.

What’s Behind Bitcoin’s Demise?

While many blame Mt.Gox’s redemption plan as the reason behind Bitcoin’s decline, Alex Doornhead of Firmwide Research at Galaxy Digital, offered a different perspective.

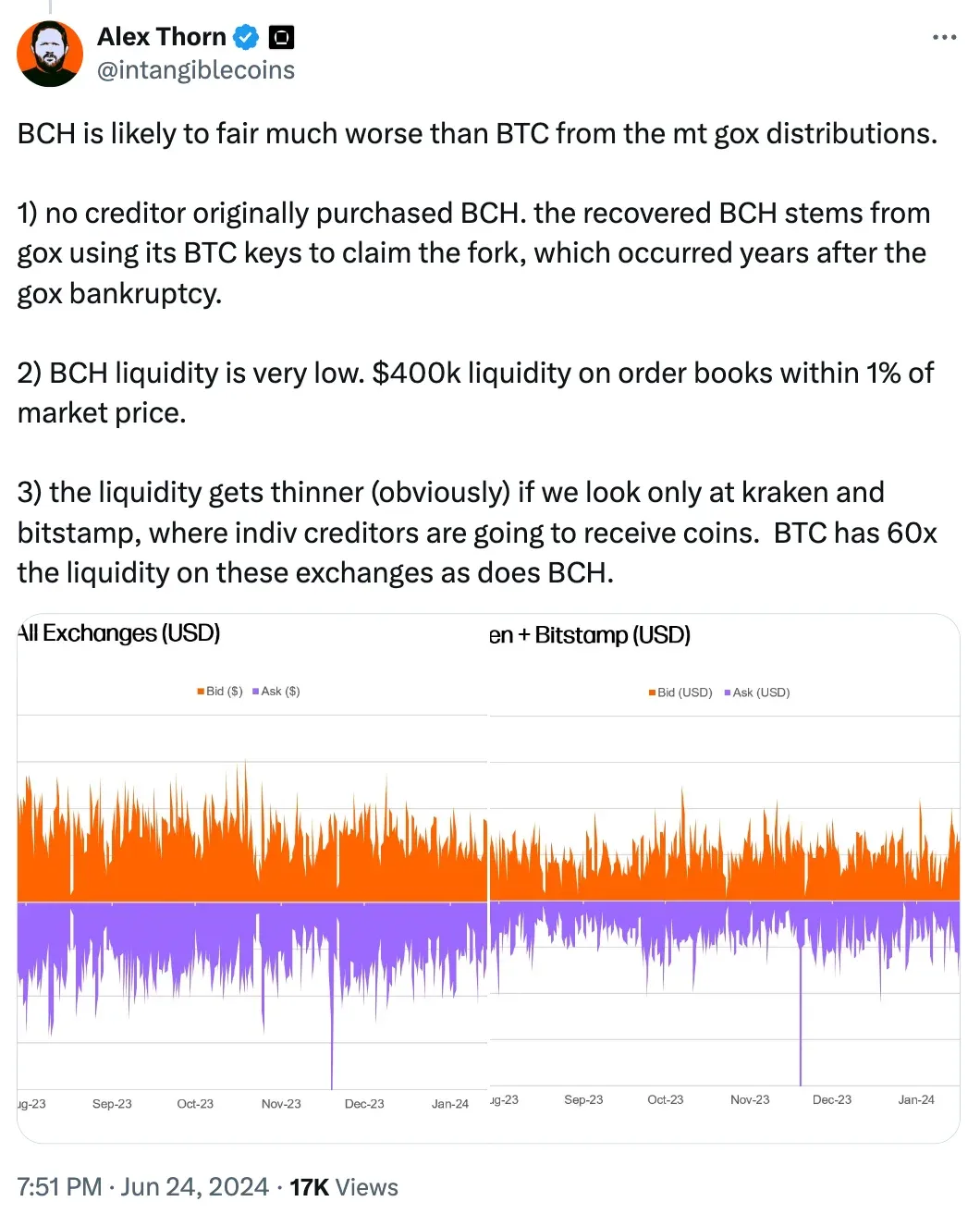

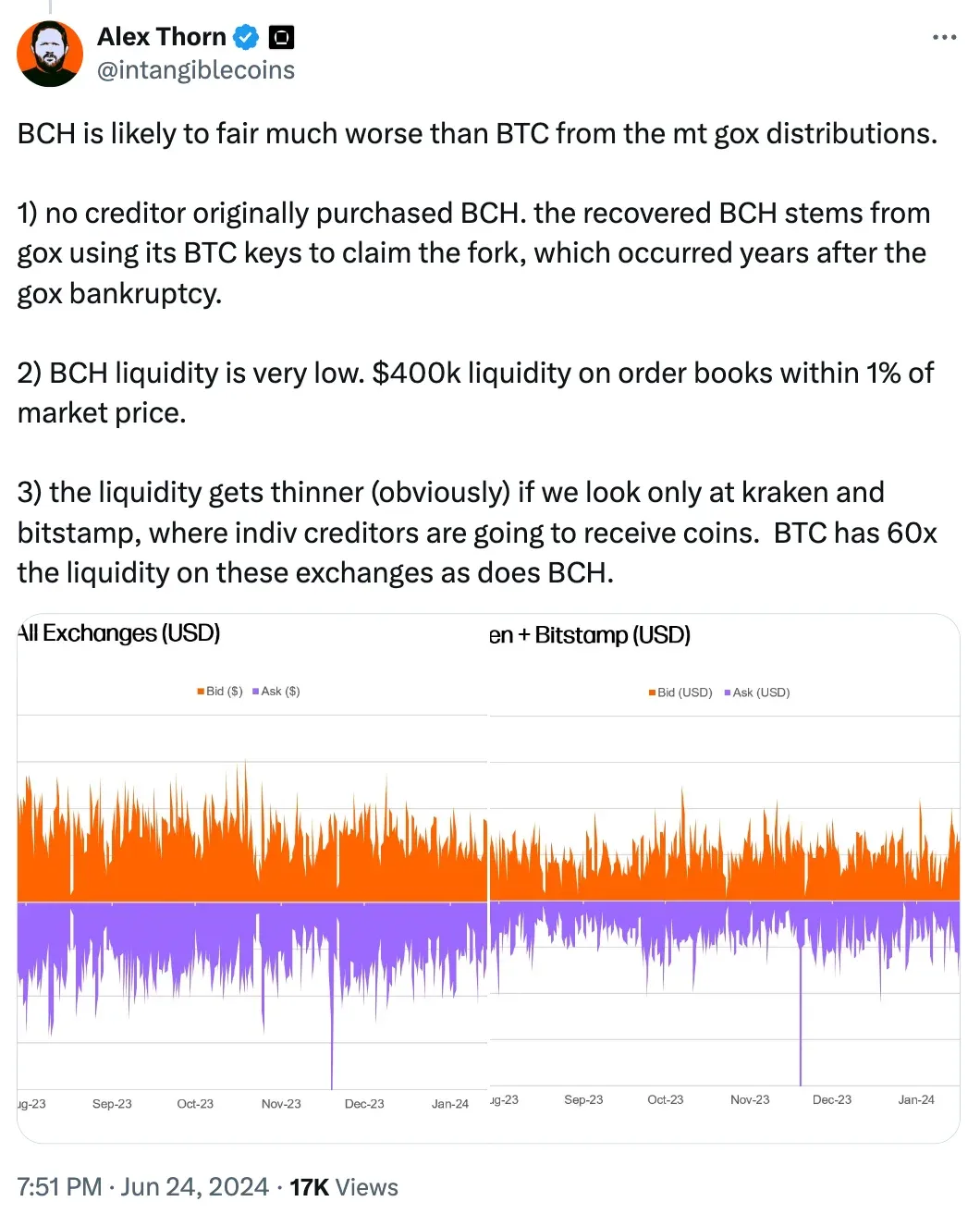

Per Thorn, Bitcoin Cash [BCH] was more affected. Expanding on his stance further, he turned to X (formerly Twitter) and said:

Source: Alex Thorn/X

Here, Thorn is referring to a massive hack that Mount Gox suffered in 2014, resulting in the loss of 740,000 BTC (worth $15 billion today).

Repayments will take place in Bitcoin and BCH from July 2024. This could increase selling pressure on these cryptocurrencies as creditors will receive and potentially sell their newly acquired assets.

The possible solution

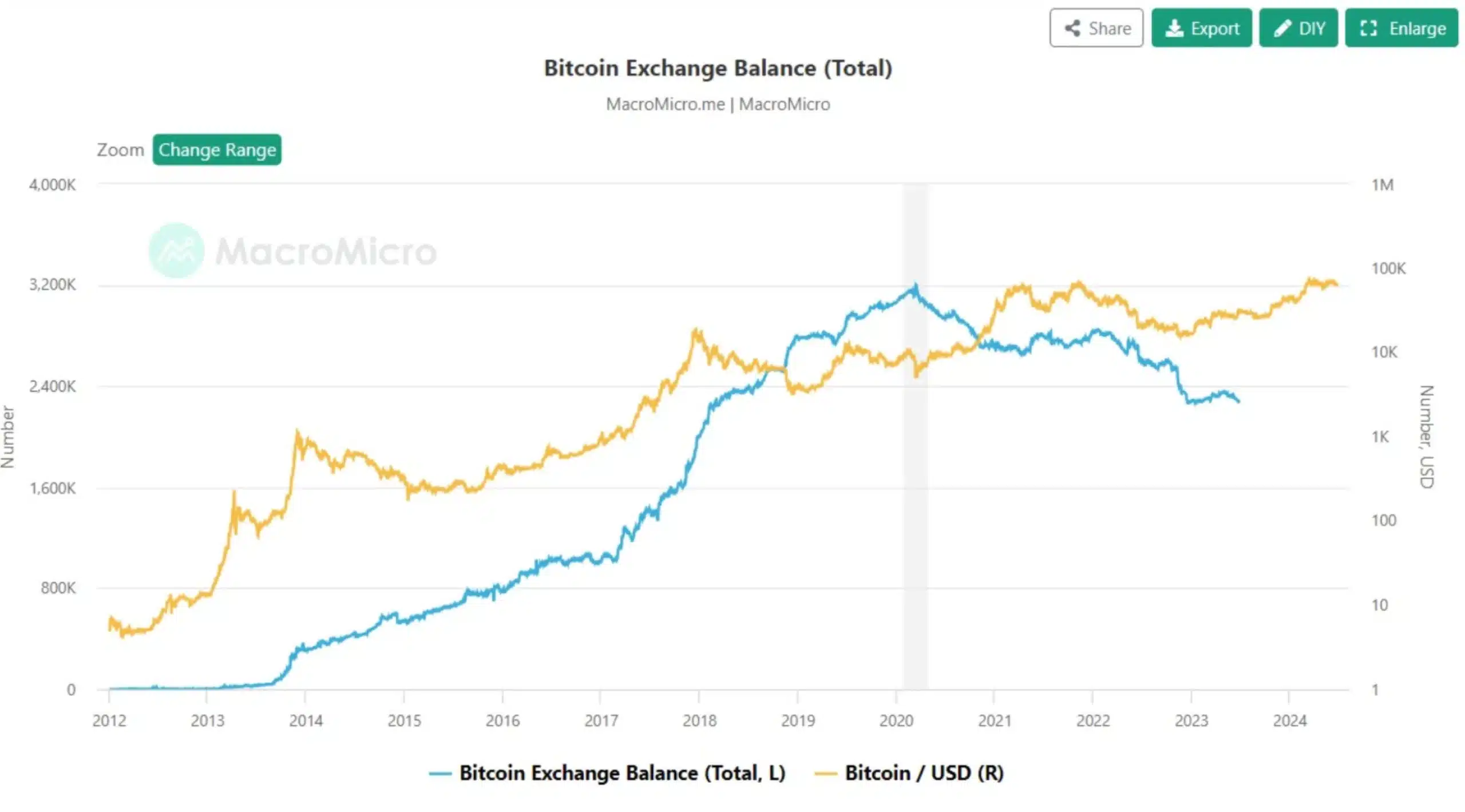

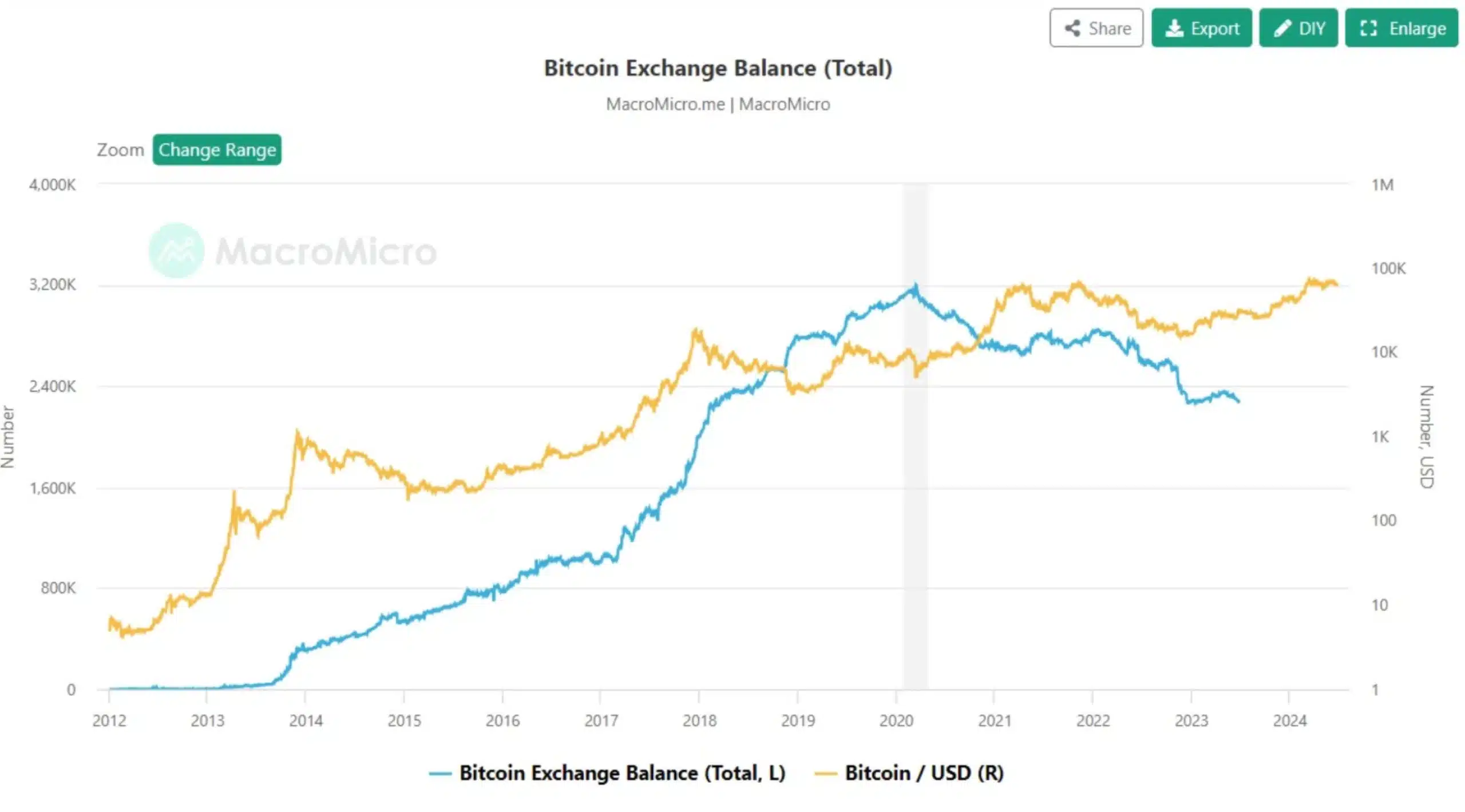

To monitor this situation, many executives suggested relying on Bitcoin exchange balances as a reliable indicator of Bitcoin price strength.

However, in a recent post on X, popular commenter Matthew Hyland criticized the importance of the declining exchange supply, calling it “overestimated.” He elaborated,

“The supply aspect is overestimated IMO. BTC on the exchanges fell during the entire bear market, but the BTC price continued to fall along with it. It is important in the long term, but within a number of years it has become apparent that this is not the case.”

Source: Matthew Hyland/X

It’s important to note that this isn’t the first time Mount Gox has done something like this.

Source: Pat/X

Mt.Gox, not the only one!

In addition to Mount Gox, Gemini also announced its plans to reimburse users affected by their discontinued Gemini Earn program.

The founders took to X (formerly Twitter) and highlighted that Earn users received $2.18 billion in digital assets on May 29.

Moreover, FTX, a crypto exchange that underwent bankruptcy proceedings last year, also revealed its plan to pay off its debts.

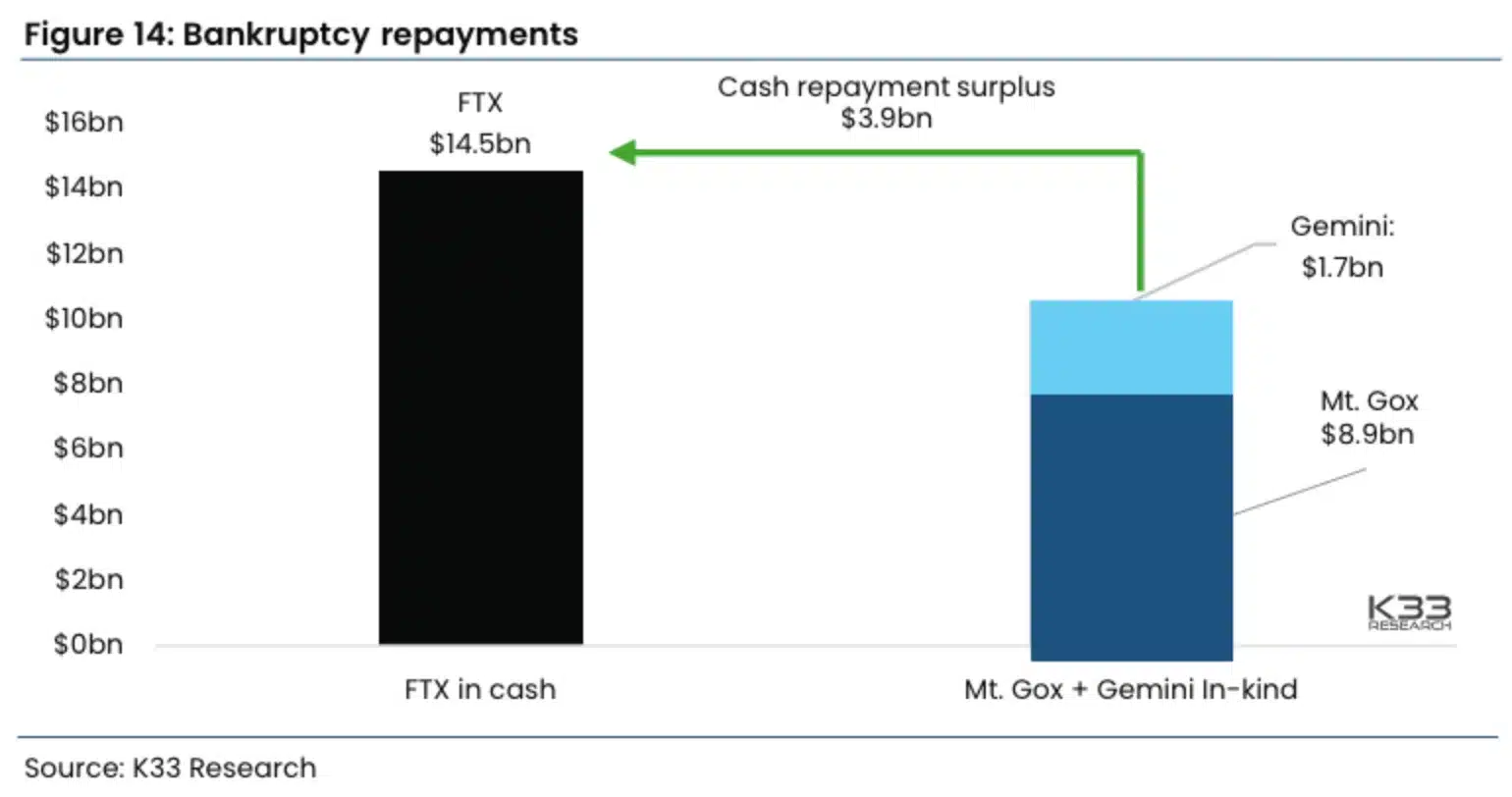

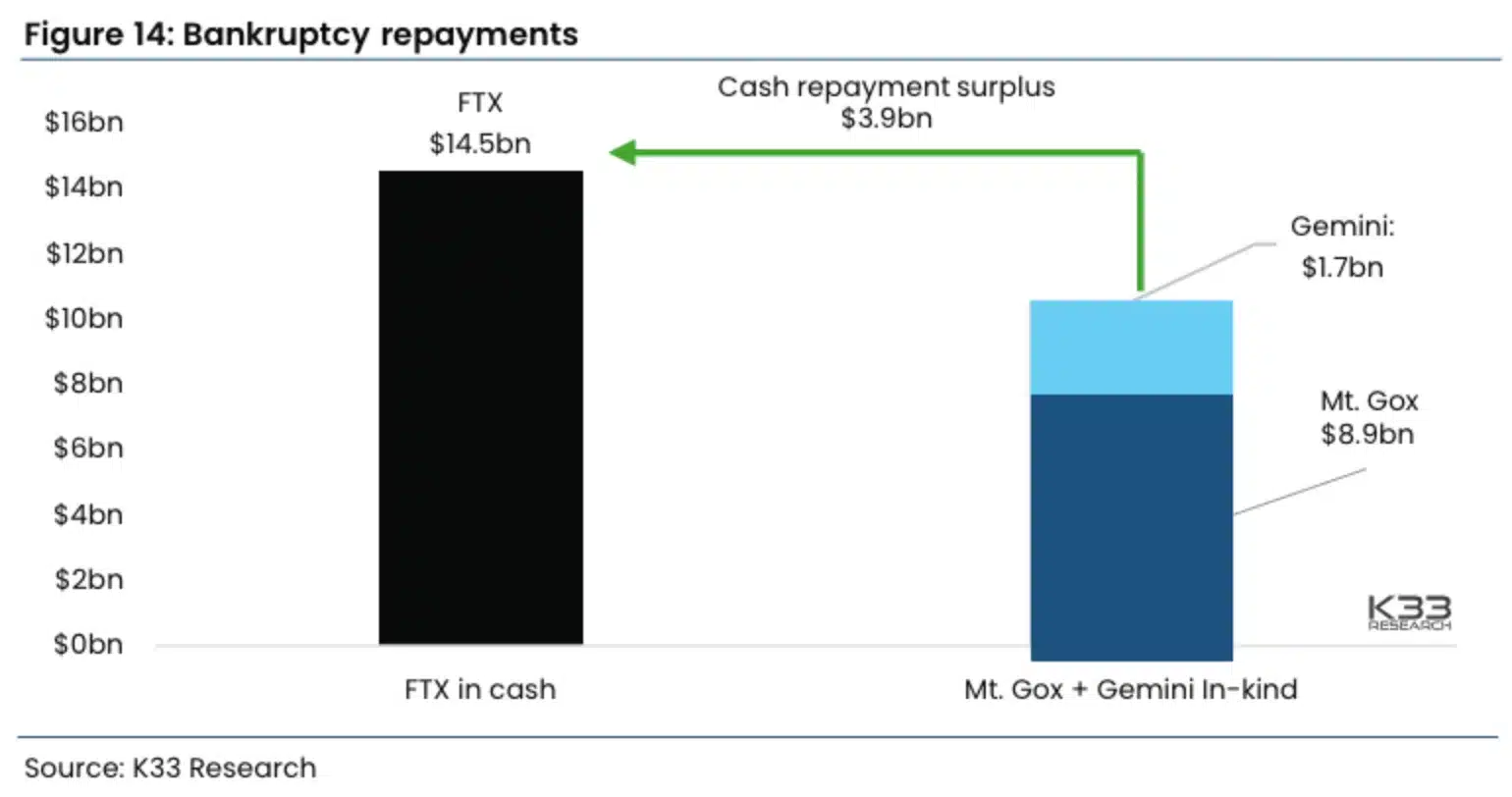

According to analysts from K33 Researchthe impact of these refunds on market sentiment may differ from that of other creditor settlements.

Unlike entities like Mount Gox and Gemini, which plan to repay creditors with cryptocurrencies, FTX plans to make cash-based repayments.

Source: K33 Research

This difference in repayment methods could impact investor views and market stability in several ways.