- The recent transfer of Mount Gox has created a BTC balance of $3 billion.

- BTC continued its sell-off ahead of the July US jobs report due on August 2.

The recent $3.1 billion transfer of Mount Gox Bitcoin [BTC] to BitGo has reduced the balance of the defunct exchange even further, indicating that the supply glut could end soon.

According to Arkham factsthe BitGo transfer, executed on July 30, brought the trustee’s balance to $3.06 billion.

“Last night, Mt. Gox addresses moved 33.96K BTC ($2.25 billion) to addresses we believe are most likely BitGo:… After these transfers, Mt. Gox now has 46.16K BTC ($3.06 billion ), including the new Mt. Gox address.”

The supply pressure on Mount Gox is almost over

The aforementioned significant reduction in the trustees’ holdings meant that, like pressure from the German government, the perceived threat from Mount Gox would soon end.

Interestingly, the recent distribution of the defunct exchange did not put pressure on the market as previously believed.

According to Glassnode factsthere were no significant sales impacts at the major exchanges, Kraken and Bitstamp, which the trustee’s estate used for redemptions.

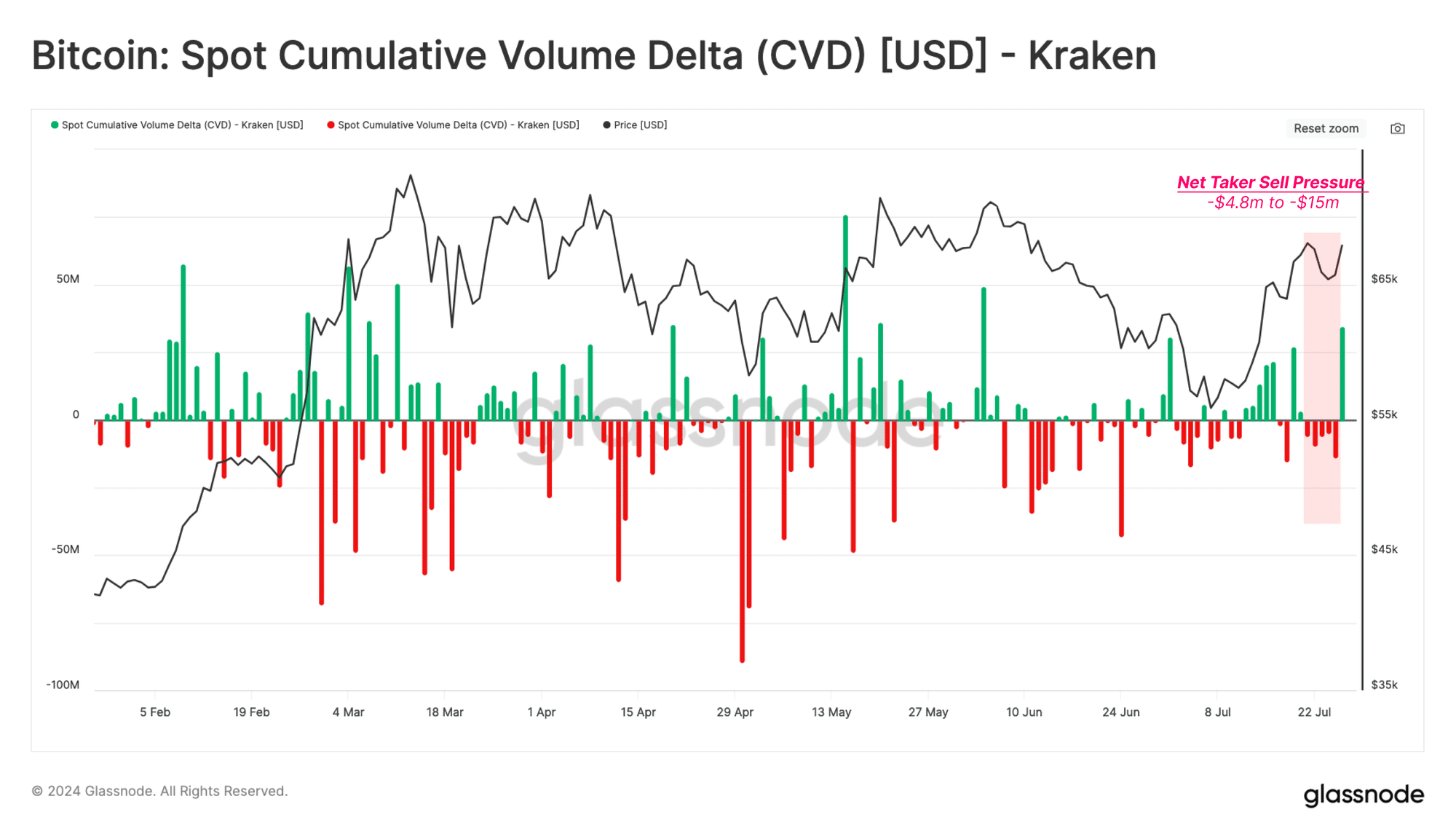

In fact, the Spot Cumulative Volume Delta (CVD) metric on Kraken rose marginally after the distribution, indicating there was no selling pressure after the exchange received the refund.

CVD tracks the net selling or buying volume on the exchange, with a positive value indicating more buying volume on the market order side.

Source: Glassnode

Glassnode has set up a similar scenario on Bitstamp. Therefore, the refund did not drag the market like the German government’s sell-off. In short, the remaining $3 billion BTC could be moved without affecting the market.

However, the main selling pressure at this time came from the US government. It currently has approx $13 billion BTC after moving $2 billion BTC last week and spooking the market.

Since June, fears of sell-offs in Germany and the US have given the bears more of an edge in the market.

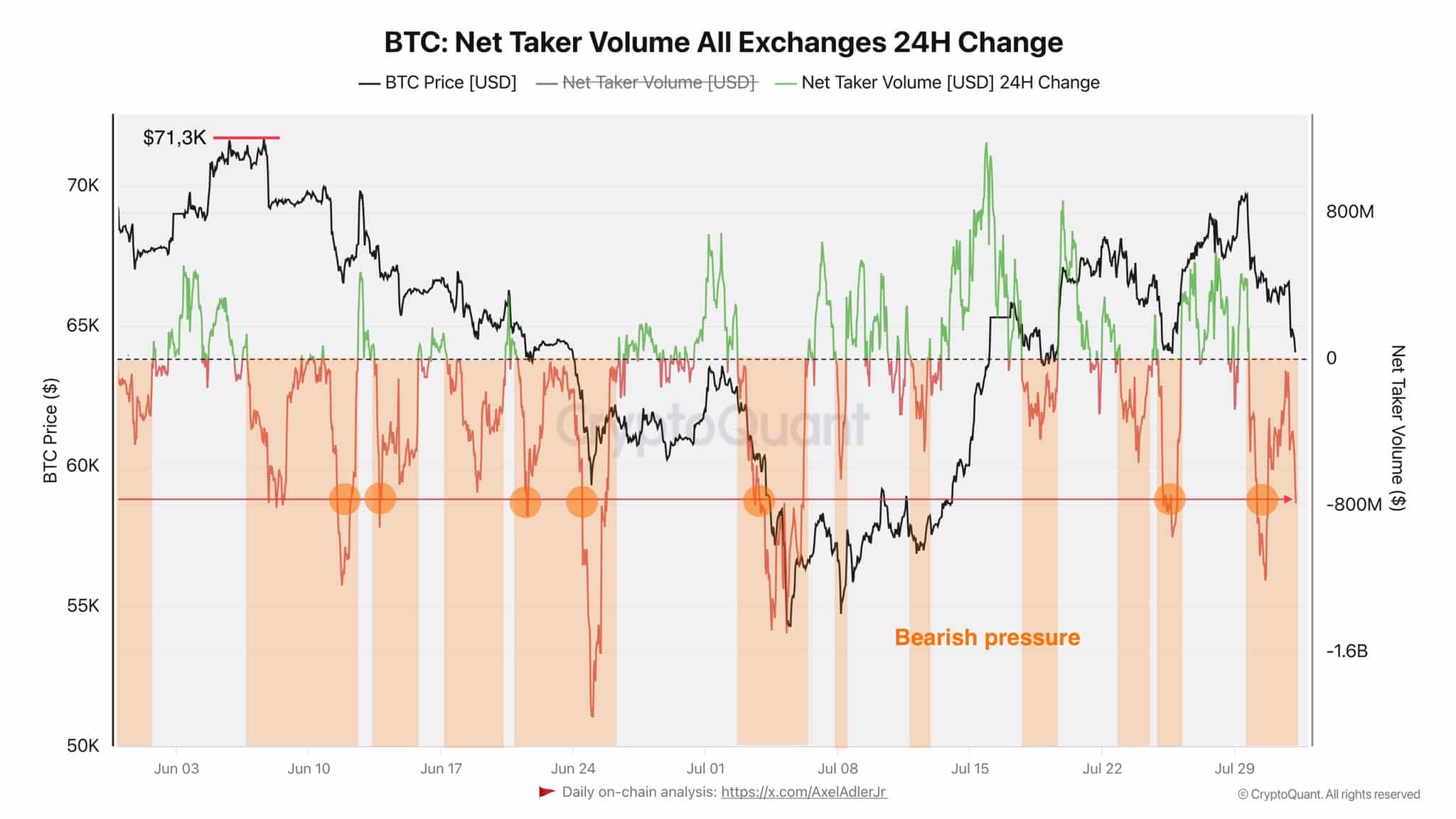

According to CryptoQuant analyst Axel Adler, there is selling pressure encouraged remains stable throughout the summer, as evidenced by Net Taker Volume.

“It must be recognized that the bear pressure has been impressive since the beginning of the summer. Until the benchmark becomes greater than zero, the bulls will have to worry.”

Source: CryptoQuant

The negative Net Taker Volume meant that the market was mainly selling as the buying volumes exceeded the buying side.

At the time of writing, BTC had reached $63.0k and was in danger of weakening further ahead of the July US jobs reports, due on August 2.

It remains to be seen whether the jobs report will ease the accelerated sell-off despite the crisis mild FOMC meeting.