Retail investment is still the driving force behind Bitcoin (BTC) exchange-traded funds (ETFs), but more institutions are pouring capital into the new products, according to a senior analyst at crypto intelligence platform K33 Research.

K33’s Vetle Lunde notes on the social media platform

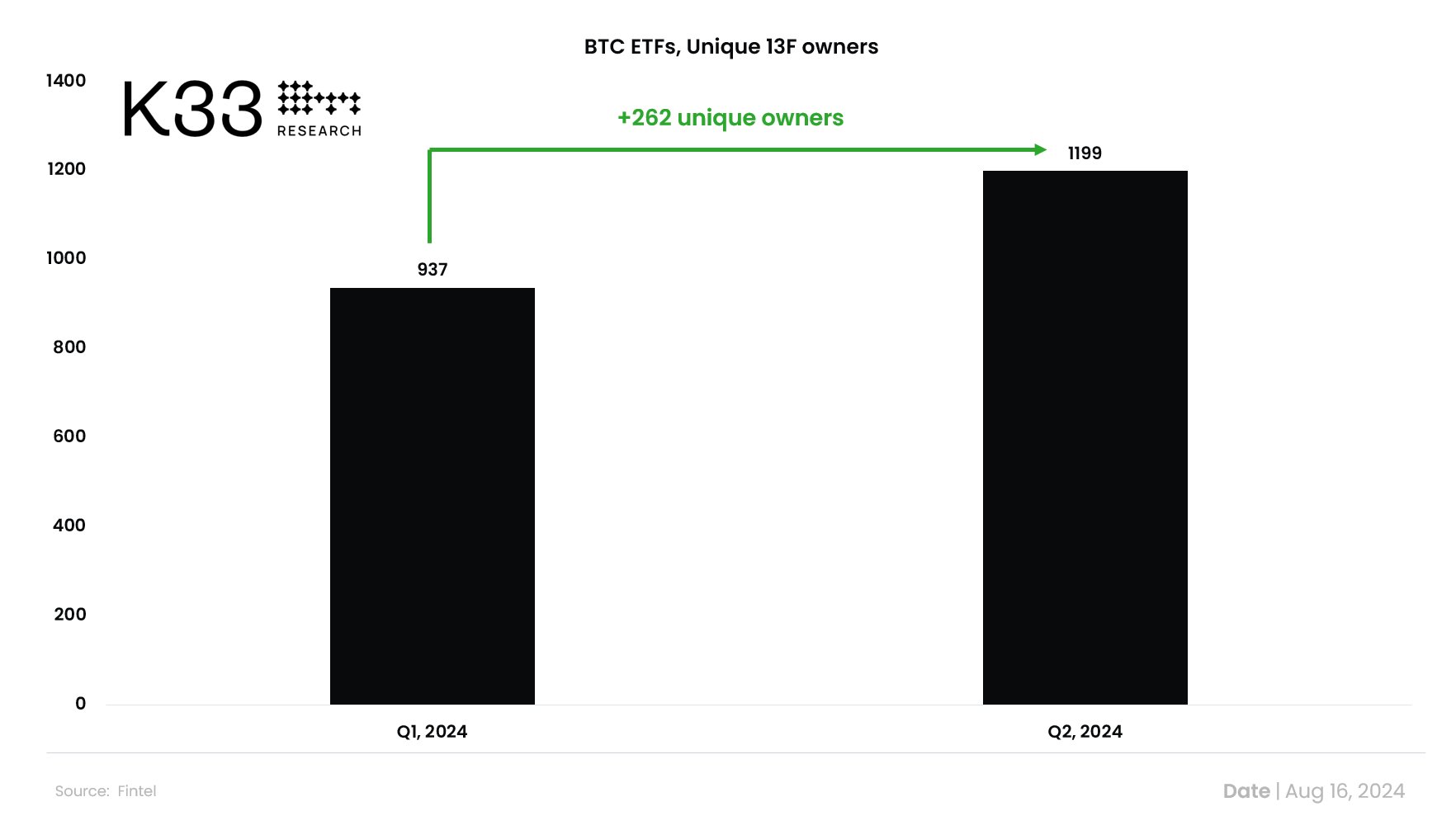

“While retail investors still hold the majority of capital, institutional investors increased their share of total AUM (assets under management) by 2.41 percentage points, now accounting for 21.15% in the second quarter .

GBTC (Grayscale Bitcoin Trust) saw a substantial reduction in their institutional capital, while IBIT and FBTC saw pronounced growth in the dominance of professional investors.”

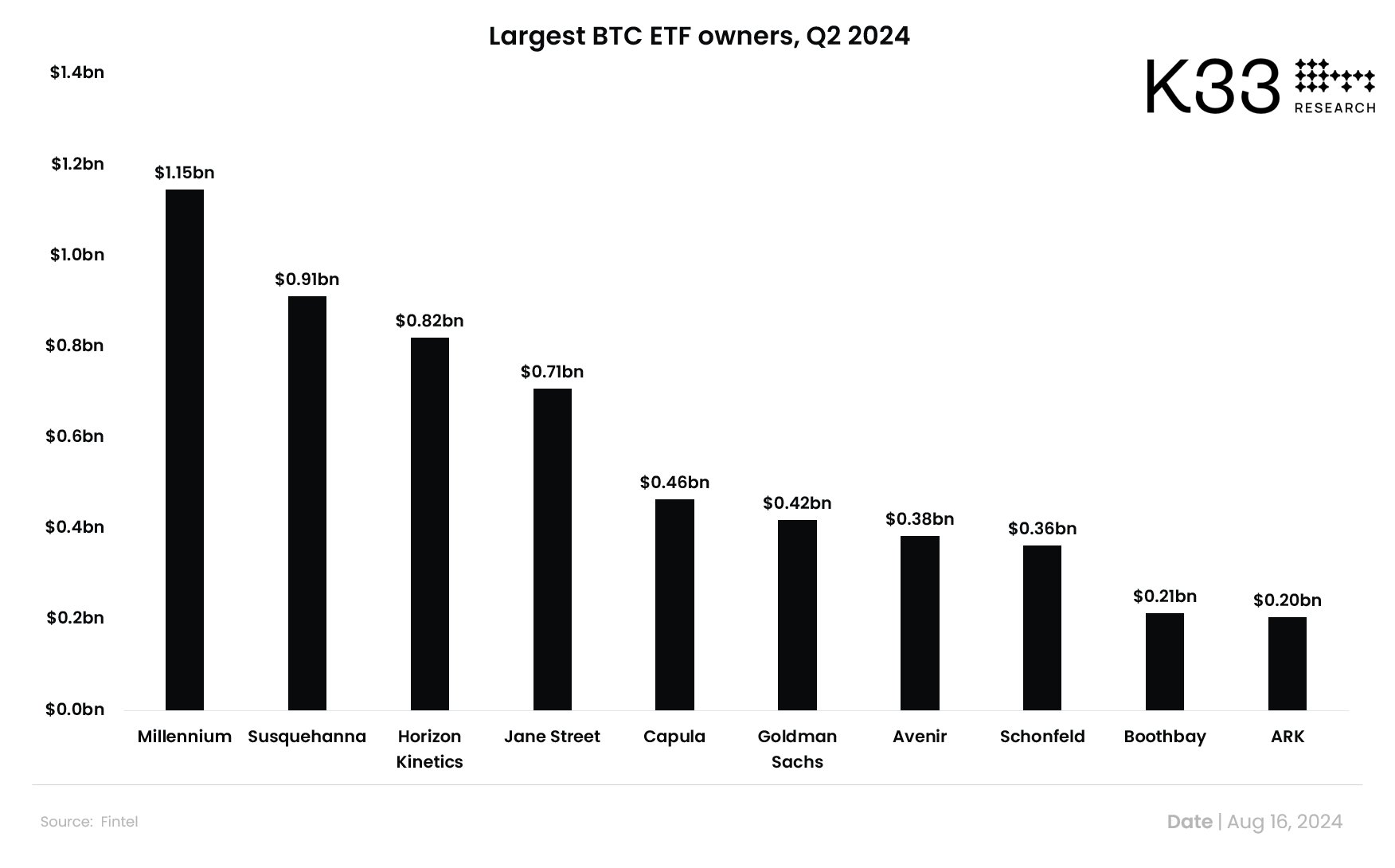

The analyst too notes that the largest institutional owners of spot BTC ETFs are market makers.

“Millennium and Susquehanna remain the largest holders, but have reduced their exposure compared to the first quarter. Two factors likely led to this reduction:

1) increasing competition as Jane Street entered the market in the second quarter

2) calming market conditions, leading to less juicy returns – annualized CME premiums closed at 8.6% on June 30, up from 14% on March 31.”

Bitcoin is trading at $59,141 at the time of writing. The highest-ranked crypto asset by market capitalization is up more than 2.6% in the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney