Ethereum (ETH) disappeared from centralized exchanges this week, potentially easing selling pressure in the ETH market, according to crypto analytics firm IntoTheBlock.

In a new analysisLucas Outumuro, head of research at IntoTheBlock, tracked Ethereum’s net flows, which measure the ETH moving in and out of centralized crypto exchanges by subtracting the amount of ETH withdrawals from deposits.

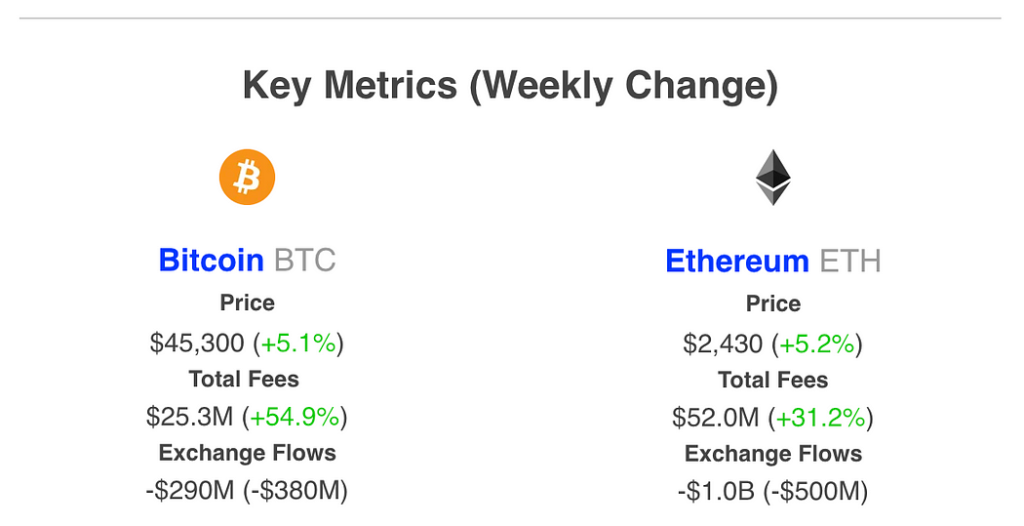

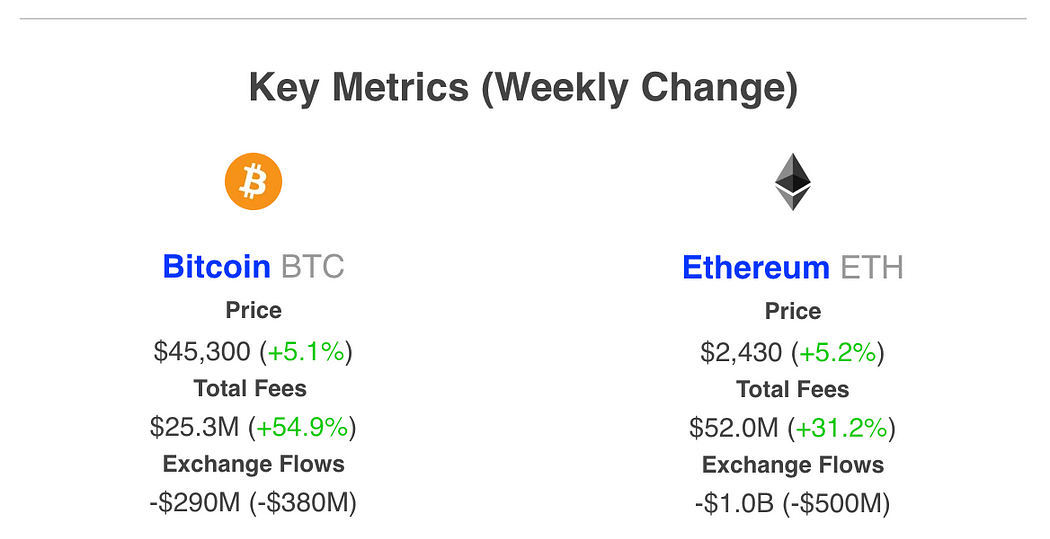

Outumuro notes that more than $1 billion worth of Ethereum net flows left centralized exchanges this week. ETH’s network fees, which indicate willingness to spend money and demand to use the asset, increased by more than 30% over the same period.

Bitcoin (BTC) also flowed through centralized exchanges, creating a net outflow worth $300 million and breaking an eight-week trend of inflows on exchanges. Bitcoin network fees have also increased by more than 50% this week.

Large increases in currency inflows typically lead to an average price drop of 5% for crypto assets, according to a 2021 study published by fellow crypto analytics firm Santiment.

ETH is trading at $2,512 at the time of writing. The second-ranked crypto asset by market capitalization is up 2.64% in the past 24 hours.

BTC is trading at $47,478 at the time of writing. The highest-ranked crypto asset by market capitalization is up almost 3% in the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney