- MicroStrategy adds 122 BTC to its holdings, which now totals 214,400 Bitcoins.

- Despite negative broader Bitcoin metrics, a possible rebound is on the horizon.

In a strategic addition to its cryptocurrency holdings, MicroStrategy, the software giant turned Bitcoin [BTC] advocate, recently extensive his wallet.

On April 30, the company, led by founder Michael Saylor, announced the purchase of an additional 122 Bitcoins, purchased for approximately $7.8 million.

This latest transaction increases MicroStrategy’s total Bitcoin holdings to approximately 214,400 units.

This purchase was part of MicroStrategy’s continued commitment to Bitcoin, which has been a central aspect of their business model in recent years.

Despite the volatility and recent downward trends in the cryptocurrency market, MicroStrategy has released its first quarter financial report for 2024detailing their assets at $7.54 billion.

This values their extensive Bitcoin inventory at an average price of $35,180 per unit.

The company has been consistently bullish on Bitcoin, accumulating 25,250 Bitcoins since the last quarter of 2023 at an average price of $65,232 per BTC.

Bitcoin’s bumpy road

Despite MicroStrategy’s optimistic accumulation, the broader market continues to face challenges.

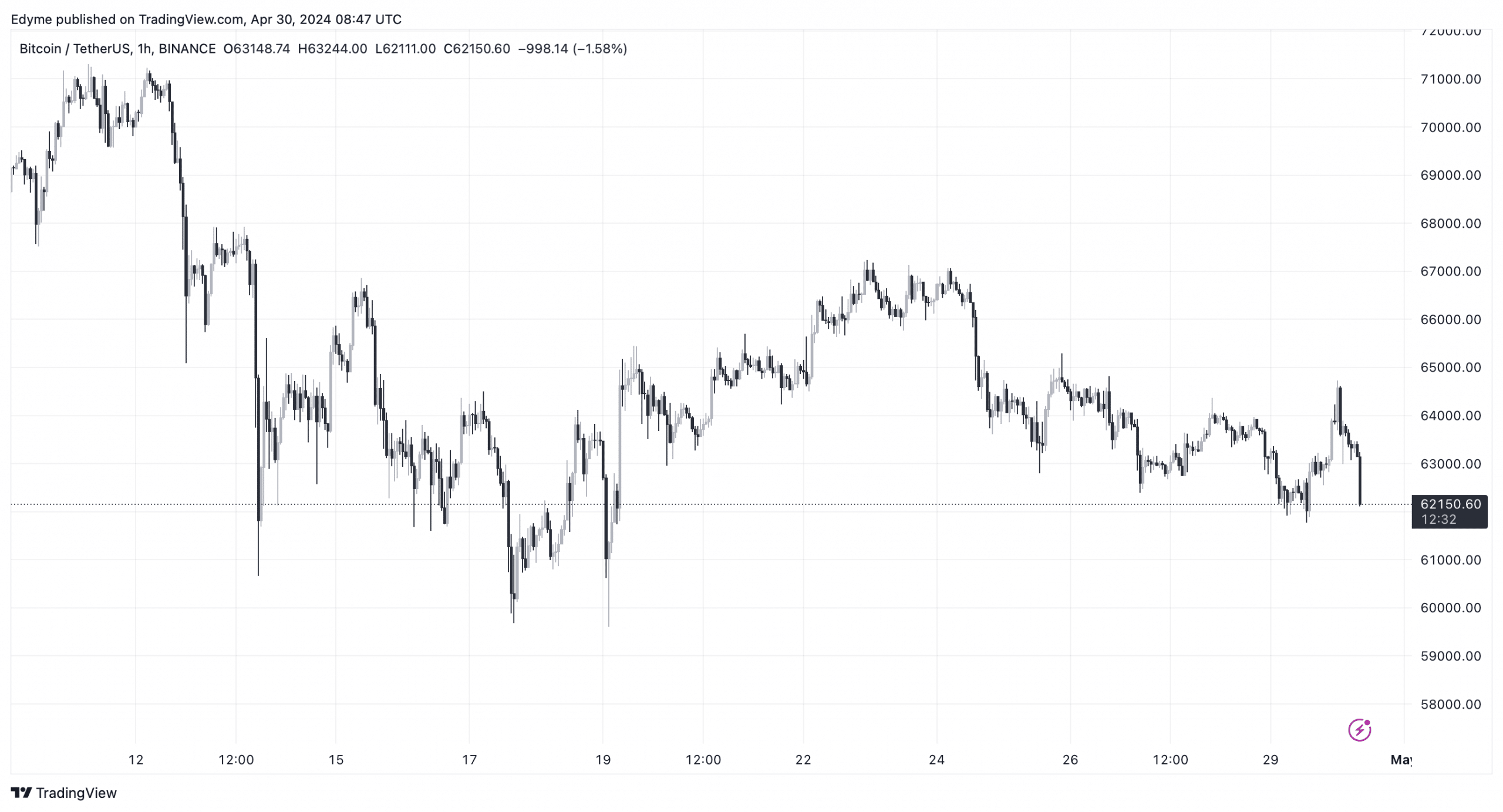

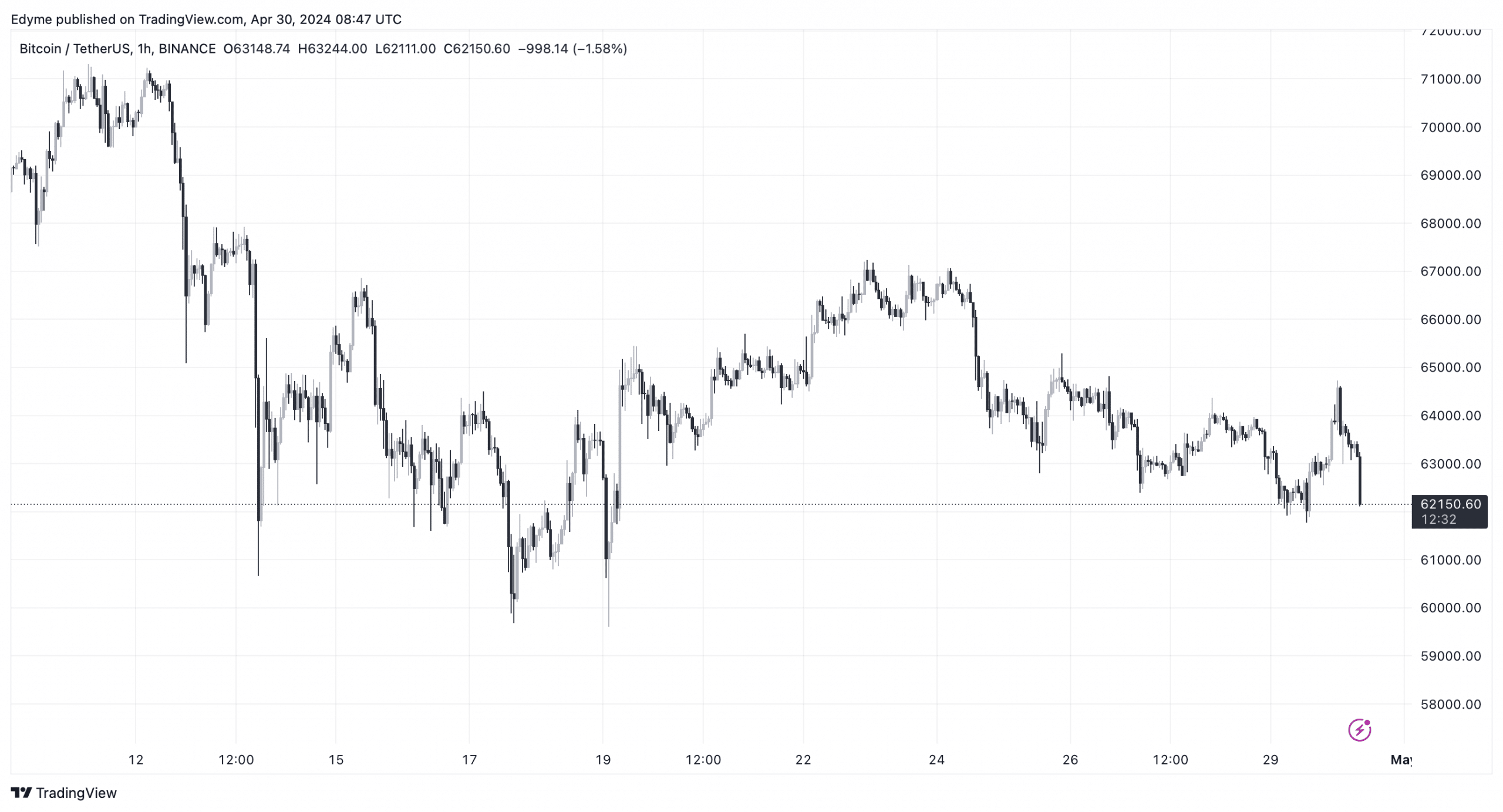

Bitcoin’s price is on a downward trajectory, down a significant 4.5% in the past week.

Recent data from CoinGecko pointed to a 24-hour low of $61,890 for Bitcoin, although there was a small recovery of 1.5%, bringing the price to $63,226 at the time of writing.

Source: TradingView

The ongoing challenges are not limited to immediate price fluctuations. A broader perspective revealed significant declines in several core Bitcoin metrics, such as the hash price, especially after the cryptocurrency’s fourth halving on April 20.

Notably, the decline in Bitcoin’s price appears to be mirrored by a decline in the hash price, which recently bottomed out.

It fell below $50 per PH/s per day for the first time ever, signaling a difficult period for miners, whose profitability is now under severe pressure.

Source: Hashrate index

This decline has not only affected the profitability of mining operations, but has also raised concerns about the long-term viability of mining, contributing to negative investor sentiment.

However, amid the prevailing bearish trends, some analysts remain optimistic about Bitcoin’s future prospects.

For example, AMBCrypto suggested that Bitcoin could test support levels around $61,000 in the near term, whileA successful recovery from this point could be possible sparking another bull rally.

Such a rally could potentially send prices soaring to $66,000, and possibly even escalating to $71,000, ahead of hitting new all-time highs.