- Saylor owns 17,732 Bitcoin, which amounts to 10% of MicroStrategy’s total holdings.

- MicroStrategy shares are up 1,000% since Bitcoin’s introduction, but recently saw a decline of more than 90%.

Michael Saylor, the co-founder and chairman of MicroStrategy, known for his unwavering support of Bitcoin [BTC]recently announced that he has made a significant personal investment in the cryptocurrency.

Saylor’s Bitcoin Holdings Revealed

In a recent interview with BloombergSaylor revealed that he owns 17,732 BTC and emphasized that he has not sold any of these digital assets.

“I keep acquiring more and more. I think it is a great capital investment for an individual, family, institutional company or country. I can’t think of a better place to put my money.”

This announcement attracted a lot of attention because it marks the first time in four years that Saylor has made public details about his personal Bitcoin holdings.

While Saylor did not specify the exact amount of his current BTC holdings, he did confirm that he has not parted with his tokens since his initial disclosure.

MicroStrategy’s current Bitcoin holdings

In addition to Saylor’s personal investments, his company, MicroStrategy, has become the largest public company holder of Bitcoin, having amassed 226,500 tokens as of the end of July.

At today’s market value, this expanded reserve is worth approximately $12.7 billion.

That being said, Saylor’s individual BTC holdings are remarkably significant, representing approximately 10% of MicroStrategy’s entire Bitcoin portfolio.

Saying the same about this: an Yakuza said,

“Really not surprised. He has been a true supporter of #bitcoin for as long as I can remember.”

Saylor’s comment on Senator Lummis’ BTC bill

This revelation coincides with Saylor’s recent interview with CNBC, where he referred to Senator Lummis’ strategic BTC reserve account as a “Louisiana buying” moment for the digital asset.

When using this term to describe Lummis’ Bitcoin Reserve AccountSaylor implies that this could have a transformative impact on BTC adoption in the US, potentially positioning the nation as a leader in the cryptocurrency space.

This not only underlines Saylor’s personal investment in Bitcoin, but also his advocacy for both his company and the nation to embrace and appreciate its value.

Market trends

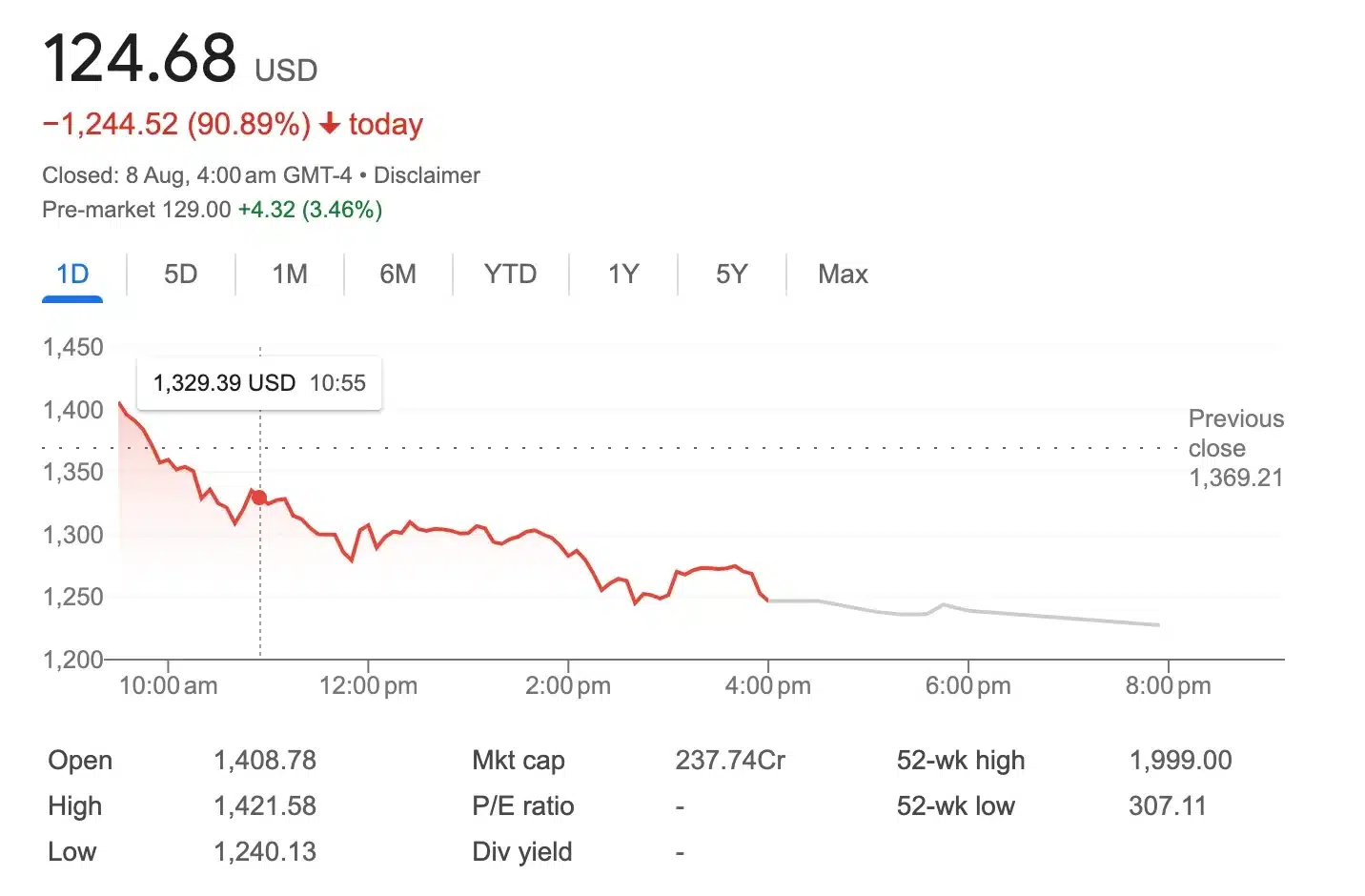

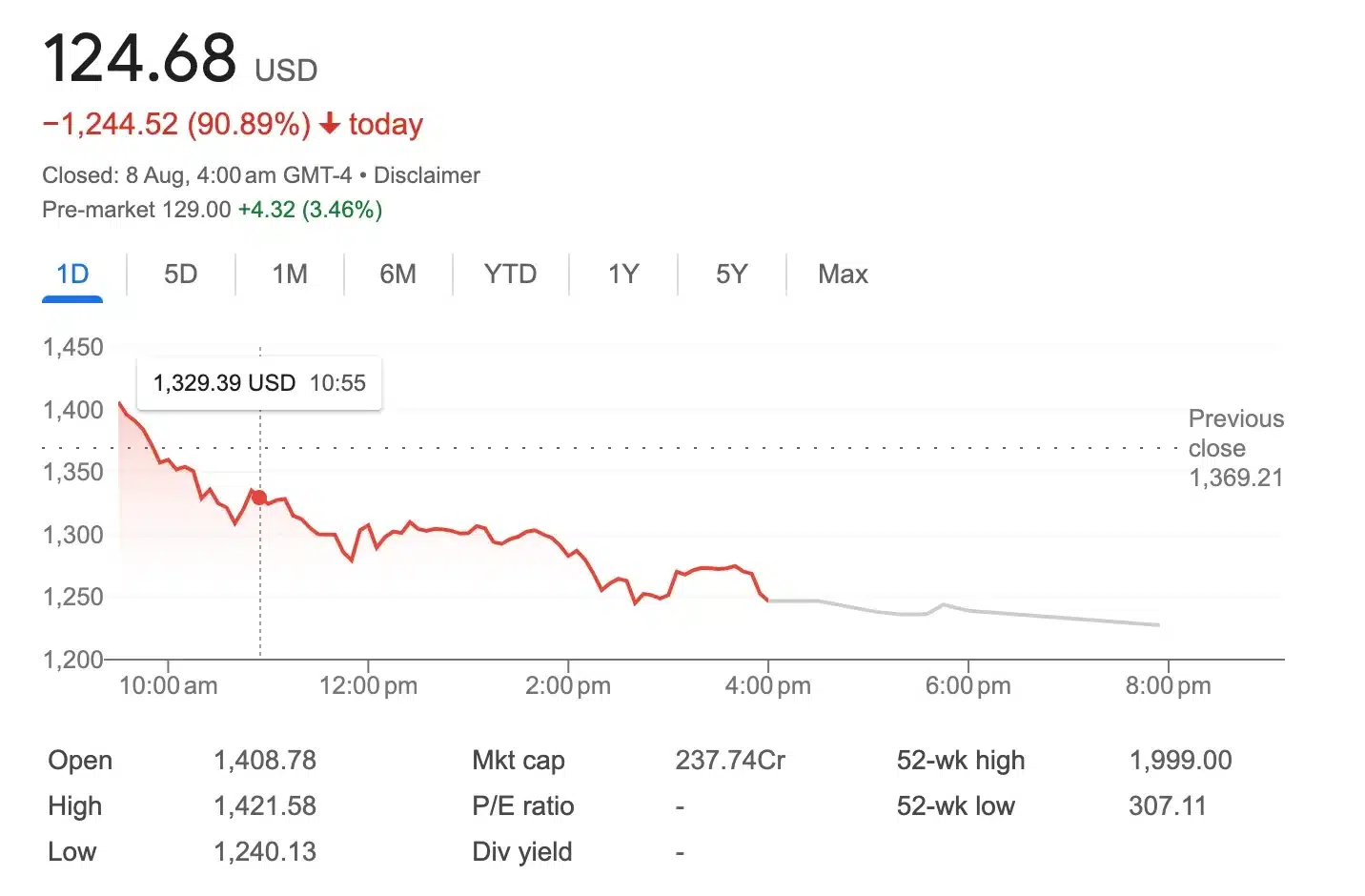

As expected, MicroStrategy shares have skyrocketed nearly 1,000% since the company started its Bitcoin acquisition strategy.

Over the same period, BTC itself has seen a significant increase of over 500%.

However, despite Michael Saylor’s bold Bitcoin investment and MicroStrategy’s remarkable stock rise, the current market is in stark contrast.

Source: Google Finance

Since the last update, MicroStrategy shares have plummeted more than 90%, while Bitcoin, trading at $57,000saw only a modest increase of 0.53%.