The world of virtual real estate is experiencing significant turbulence as metaverse land prices plummeted over the past year. This contrasts with the rising values last seen during the NFT bull market.

Metaverse land prices are experiencing a significant drop due to several factors. First, the exuberant prices during the NFT bull market created an unsustainable bubble, which eventually led to a correction in the market. In addition, the over-saturation of virtual real estate projects has diluted demand, resulting in more competition and lower prices.

In addition, the initial hype around metaver land has died down, reducing investor interest. Finally, the volatile nature of the cryptocurrency market and the overall uncertainty surrounding regulatory frameworks have also contributed to downward pressure on metaverse land prices.

TL;DR:

- Metaverse land prices currently range from 0.37 to 1.09 ETH, varying between different projects.

- Otherdeeds has the most expensive land at 1.09 ETH, while Voxels offers the most affordable land at 0.16 ETH.

- The drop in metaverse land prices contrasts with the peak of the NFT bull market when prices reached as high as 7.50 ETH. The market has experienced significant declines, with Somnium Space and Voxels seeing declines of -93.9% and -93.8% respectively. Investors should be wary of market volatility in the developing metaverse.

Why is Metaverse Land failing?

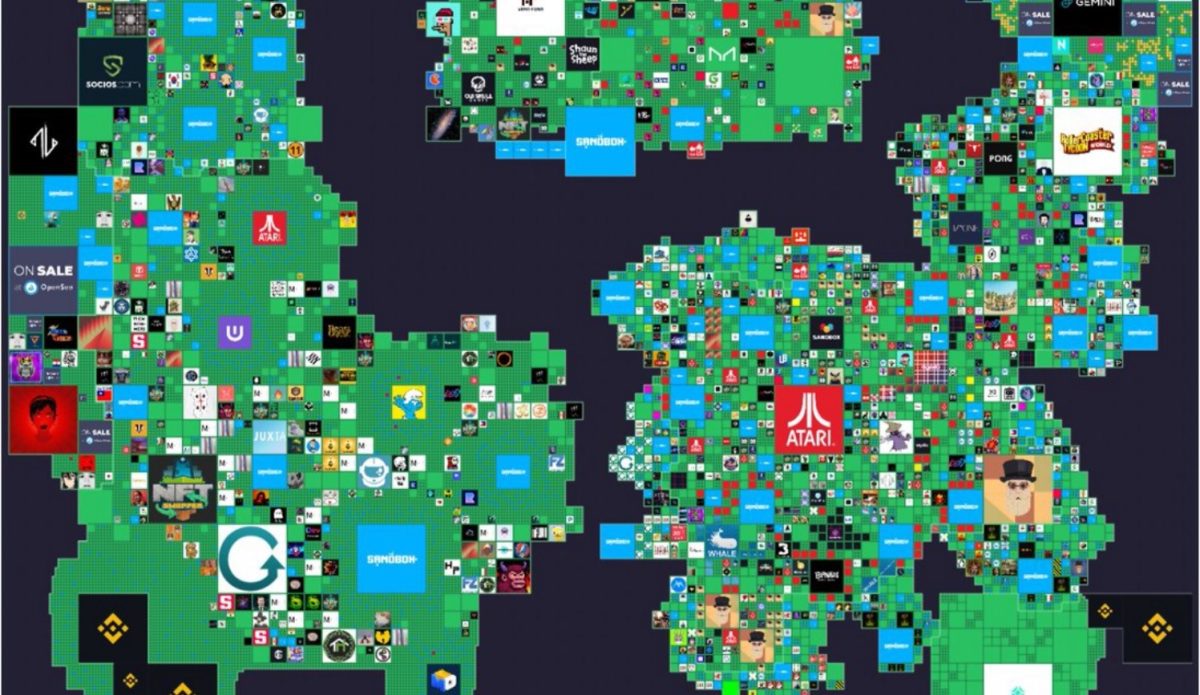

As of this week, the cost of owning a lot in the metaverse ranges from 0.37 to 1.09 ETH. This is with variations between different virtual real estate projects. Interestingly, the highest priced land is found in Yuga Labs’ Otherdeeds realm. A package in this digital domain currently costs 1.09 ETH. Meanwhile, Decentraland, another popular metaverse, follows at 0.64 ETH.

Conversely, the most affordable properties in the metaverse are in Voxels, formerly known as Cryptovoxels, where a lot can be acquired for as little as 0.16 ETH. Somnium Space and The Sandbox also offer relatively inexpensive options, with prices of 0.37 ETH and 0.43 ETH respectively.

These current valuations are a stark contrast to the peak of the NFT bull market when metaverse countries were priced as high as 7.50 ETH. For example, Otherdeeds hit a staggering floor of 7.50 ETH on May 1, 2022, marking the pinnacle of the metaverse land frenzy.

What Happens in the Metaverse?

A closer look shows that other projects also saw significant declines from their respective peaks. Somnium space, which had an impressive 6.05 ETH per lot in early 2022, witnessed a significant drop of -93.9%. Decentraland, on the other hand, dropped -87.8% to 5.24 ETH. In addition, The Sandbox and Voxels experienced declines of -89.8% and -93.8% respectively.

This analysis is based on the study of the top five virtual land prices from January 1, 2022 to May 24, 2023. These are reports of data sourced from CoinGecko and Dune Analytics.

The sharp drop in the metaverse land is a reminder that these digital frontiers are also prone to market volatility. This development raises an important question: what is happening in the digital land market? It highlights the need for investors to exercise caution and consider the digital risks associated with potential rewards as the metaverse continues to evolve.