The Bitcoin (BTC) price is currently on a significant uptrend and shows no signs of slowing down. The cryptocurrency has already started fifth bull runwith impressive price targets expected for the coming year.

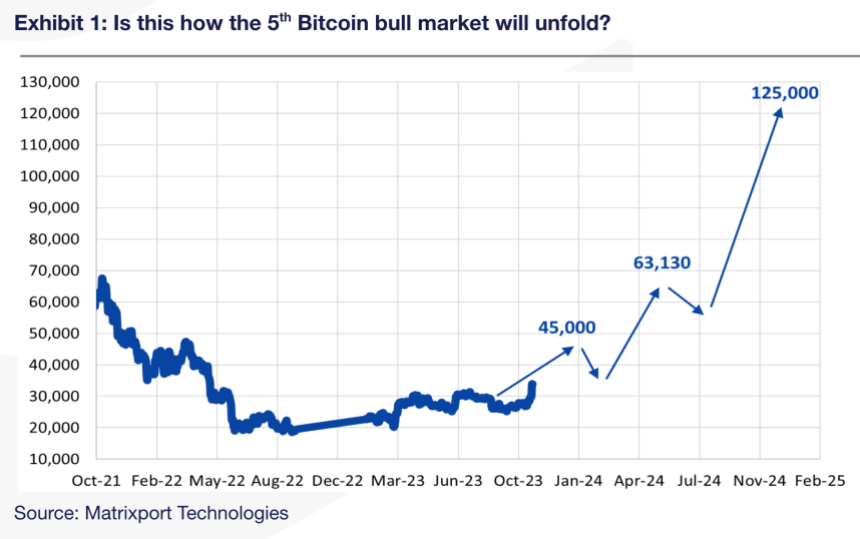

A recent one report from Matrixport highlights BTC’s history of four different bull market cycles, each driven by a unique story. However, the latest bull market, which started on June 22, 2023, stands out for its main driving force: institutional adoption.

According to the report, this increase in institutional interest can be attributed to Bitcoin’s characteristics, which are traditionally associated with safe-haven investments such as gold, and growing concerns about the United States’ debt-to-GDP ratio. Matrixport’s report predicts that Bitcoin’s price could reach an impressive $125,000 by December 2024.

Bitcoin Price Rise Corresponds to Rising US Debt

Matrixport suggests its emergence as a new payment mechanism that fueled the first Bitcoin bull market in 2011. The second cycle was driven by China, where Bitcoin gained recognition as an alternative form of money.

The rise of Initial Coin Offerings (ICOs) marked the third cycle and provided a new way to form and finance businesses. The fourth cycle saw the summer of decentralized finance (DeFi) and the NFT craze dominates the market.

However, according to the report, Bitcoin’s current bull market is driven by institutional adoption. Institutions are considering Bitcoin for diversifying their asset allocation due to its similar characteristics safe haven investments.

Notably, Bitcoin’s rise in value coincides with the United States’ escalating debt-to-GDP ratio, making it an attractive choice for institutions looking to hedge against potential economic instability.

Based on historical price signals, Matrixport estimates that Bitcoin’s price could reach $125,000 by December 2024.

Interestingly, the report suggests that the beginning of this bull market was officially recognized when BTC hit a new annual high on June 22, 2023.

Additionally, Matrixport advises that the optimal entry point to purchase Bitcoin is ideally 14-16 months before the next halving. The report suggested that late October 2022 was an opportune time to enter the market when Bitcoin was trading at $17,000.

Potential BTC correction on the horizon?

Despite the hype surrounding the current experience an uptrend by most cryptocurrencies on the market, crypto analyst “Crypto Soulz” presents a contrasting vision about the future of the Bitcoin price.

In a recent analysis from X (formerly Twitter), the analyst gives several reasons to consider shorting BTC. According to Crypto Soulz, the next significant resistance level is at $37,330, but Soulz doubts the possibility of retesting this in current market conditions.

Bitcoin recently reached a local high of $35,300, leading Crypto Soulz to believe a price drop could follow. The analyst highlights the retesting of the $31,500 level as crucial support, which Bitcoin has not revisited during the recent price surge.

Crypto Soulz notes that spot and perpetual contracts rose at the pump, indicating potential market instability. Additionally, the futures market experienced significant liquidations during the rally, similar to previous bankruptcies in January and August.

When examining the liquidation heatmap, Crypto Soulz identifies liquidity below the current price, implying potential downside movement. Soulz is targeting specific liquidity pools of $32,300 and $30,800 as potential areas for the price drop.

Based on its analysis, Crypto Soulz expects Bitcoin to “cool down” from its current levels and target lower prices.

At the time of writing, Bitcoin’s price currently stands at $34,000, marking a 2.5% retracement over the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com