- Mara wants to give his BTC Treasury a boost via a $ 2B at-the-market equity program.

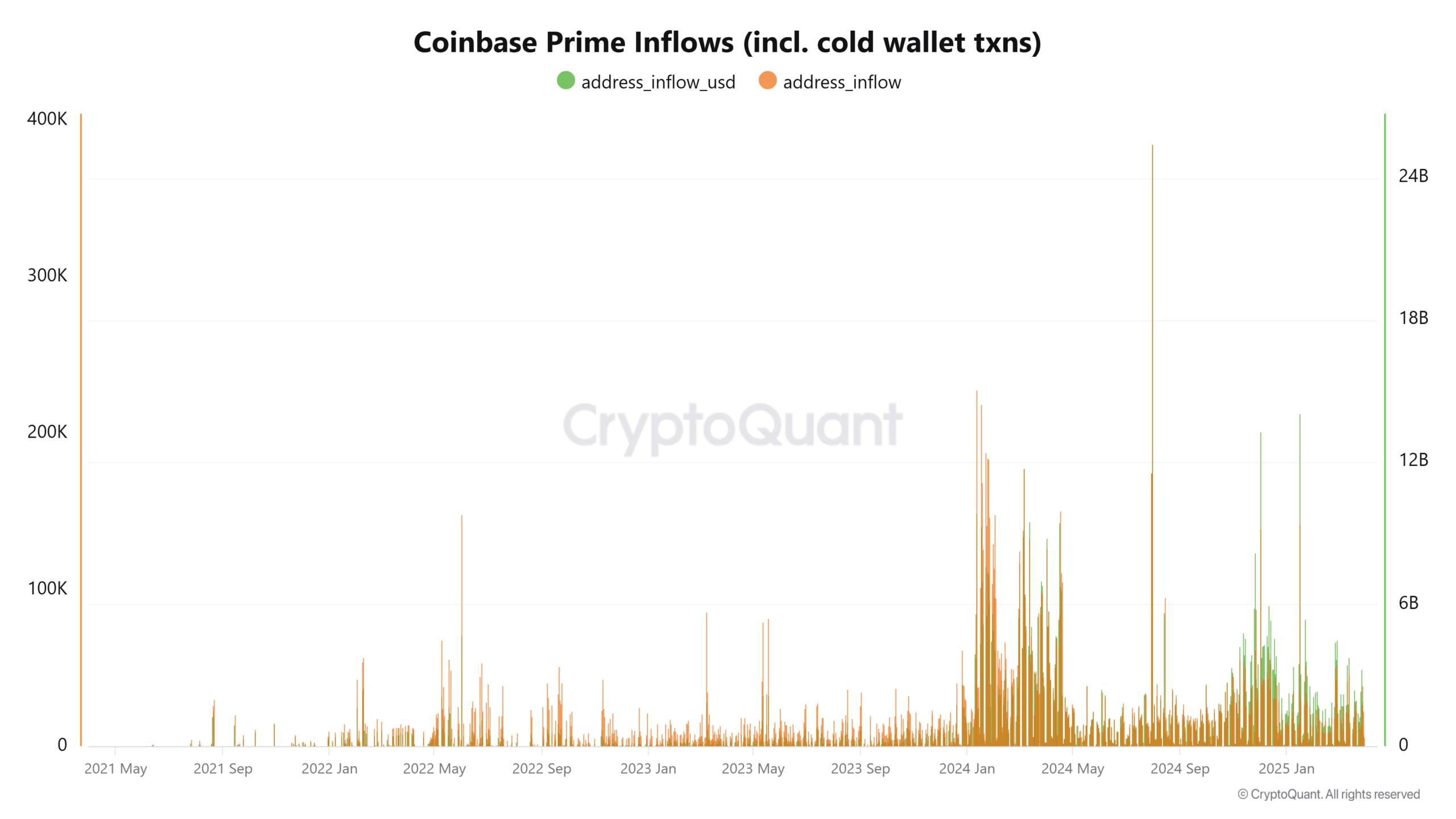

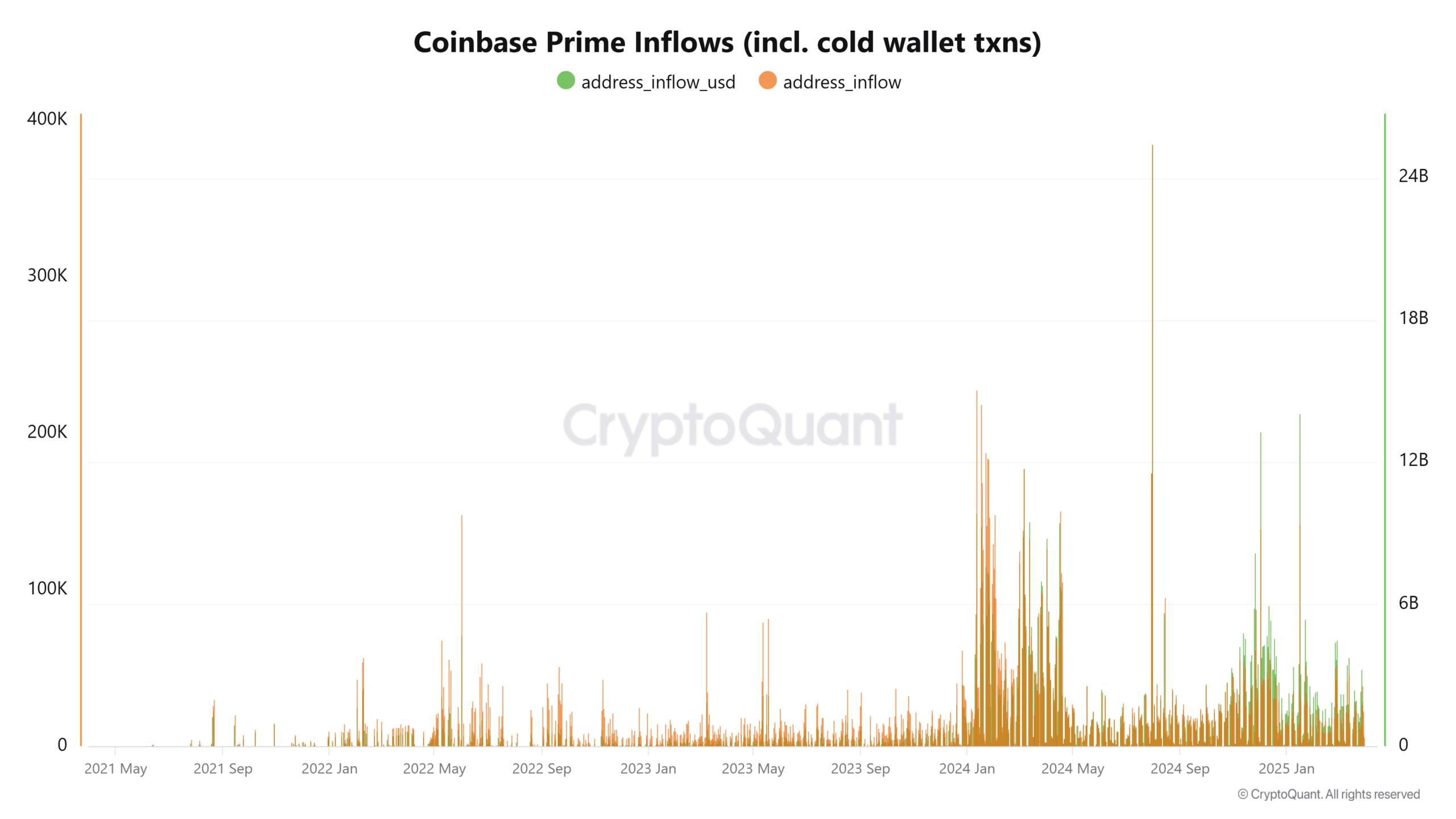

- Coinbase Prime Inflows hints when growing institutional interest via OTC transactions.

Bitcoin[BTC] Miner Mara Holdings is taking a bold step in his Bitcoin accumulation strategy with a newly launched supply of supply of $ 2 billion.

The move reflects a growing trend in public companies that want to increase exposure to BTC through direct market acquisition.

In the Mara $ 2 billion ATM -own capital program

In one March 28 Request to the US Securities and Exchange Commission (SEC), Mara Holdings confirmed that it had introduced an AT-the-Market (ATM) stock program with investment banks, including Barclays, Cantor Fitzgerald, BMO Capital Markets and Btig.

According to this program, up to $ 2 billion in ordinary shares can be sold to discretion.

The company stated that yields would be used for general business purposes, in particular to buy Bitcoin on the open market and to maintain the liquidity. The plan also draws the previous $ 1.5 billion ATM program from Mara, founded in October 2023.

This strategy, which is less dependent on mining and more on acquisition, underlines the conviction of the company that buying Bitcoin has become directly better than mining in the mailing environment.

Institutional accumulation in the turnout: Coinbase Prime Inflow Spike

An important sign that matches the timing of Mara is the recent peak in Coinbase Prime influx, as shown in the cryptoquant card.

Coinbase Prime is a preferred implementation and guardianship location for institutions in the US. When the inflow of this platform current, especially in both BTC [orange] and USD value (green), it usually indicates a wave of freely available (OTC) transactions by large entities.

Source: Cryptuquant

Since the end of 2023 and in Q1 2025, this intake has consistently reached multi-billion dollar levels, with various peaks that suggest that institutional agencies Bitcoin are actively accumulating behind the scenes.

These transactions are often not immediately visible on public order books, as a result of which slipping in the event of large orders.

Mara’s Shares of $ 2 billion that offers corresponds to his strategy for BTC acquisitions during institutional accumulation trends. It emphasizes the use of OTC agencies to discreetly increase the BTC companies, while the impact on the spot prices is minimized.

Mara’s Bitcoin Holdings and HODL strategy

At the time of writing, Mara held 46,376 BTC In his treasury, worth around $ 3.9 billion at today’s prices, so that it was kept the second largest Bitcoin treasure box behind micro strategy.

This is in line with CEO Fred Thiel’s announcement of July 2023 that Mara would shift to a “full HODL” model, which refuses to sell won Bitcoin and to acquire more instead.

By reflecting the blueprint of micro strategy to use business instruments to acquire BTC, Mara positions herself as an institutional player in the Bitcoin economy in the long term.

Mara’s BTC bet

Mara gambles big on Bitcoin by following the acquisition route. The recent increase in Coinbase Prime Inflows supports the story that institutions, including Mara, quietly build their BTC positions through OTC channels.

Although share volatility can frighten some investors in the short term, the company’s long -term game is clear: accumulation, holding and leading.