- The MANTRA token has a strong bullish outlook for the coming weeks

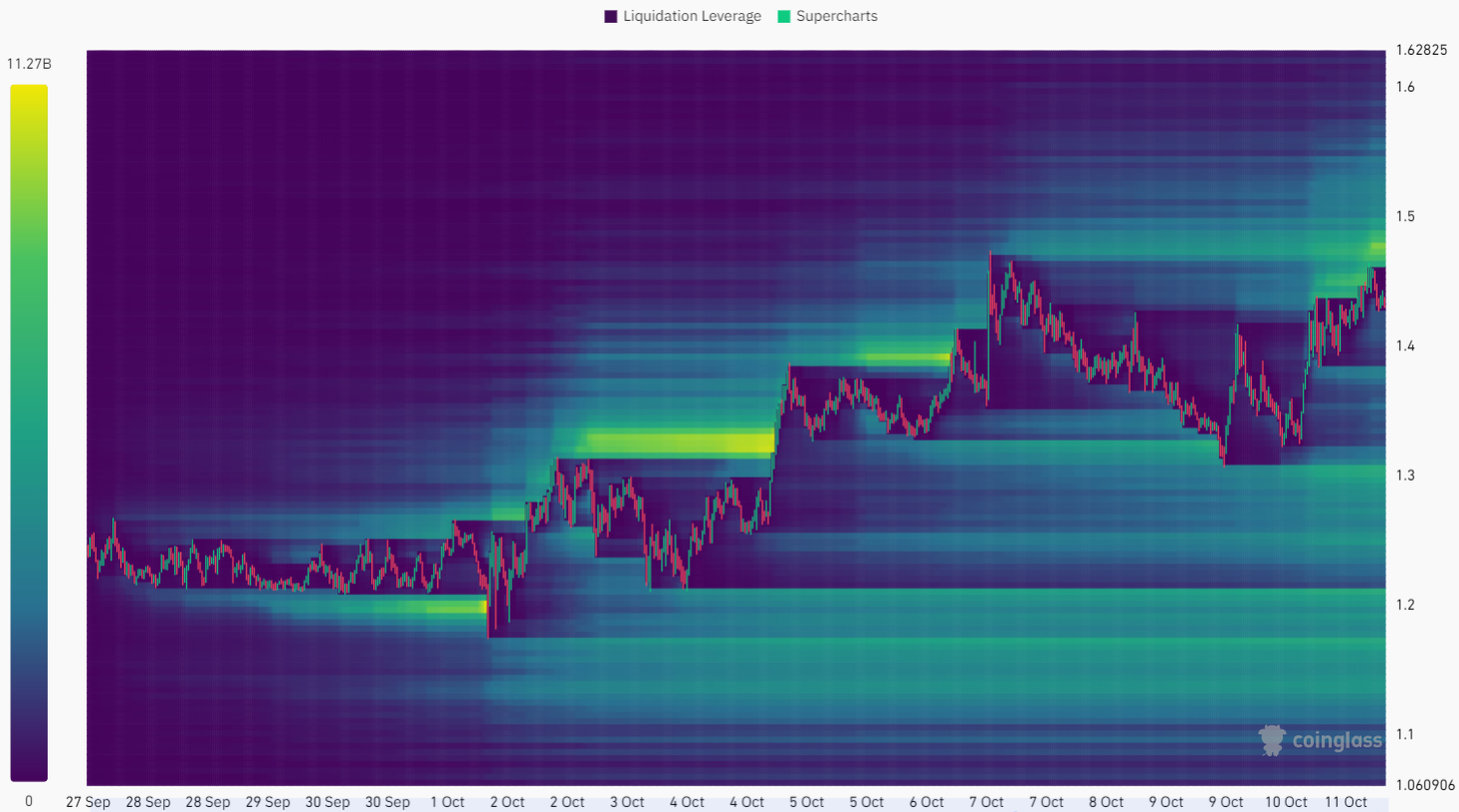

- The liquidation heatmap noted a magnetic zone at $1.5 that could slow the trend

MANTRA [OM]was past its July high at the time of writing, following a 69% rally since September 8. The selling pressure on Bitcoin [BTC] That forced the price from $66.5,000 to $59,000 in October to hardly detract from OM’s bullishness.

The breakout past recent highs, combined with steady buying pressure, meant bulls could aim for bigger gains. It may take some time for such a move to materialize if the price then gravitates towards the $1.3 liquidity pocket.

Chance of continued price gains for OM

Source: OM/USDT on TradingView

As things stand, the evidence points to a continuation of an upward trend. The market structure on the daily chart has been bullish since the first week of September. The CMF has been above +0.05 for most of the past two weeks.

This showed significant buying pressure behind OM. The moving averages formed a bullish crossover, indicating upward momentum on the daily chart.

In the event of a price recovery, the $1.25 and $1.1 levels are expected to serve as support. It is more likely that the $1.41 level will reverse to support in the coming days and Fibonacci overhead levels at $1.6 and $1.9 will be targeted.

The liquidation levels showed that a small price drop was looming

The two-week lookback period showed that the $1.48 zone has a noticeable cluster of liquidation levels. It is possible that the price will gravitate towards this zone before being forced down.

Is your portfolio green? Check out the MANTRA profit calculator

And yet it is also possible that the strong bullishness forces the price far beyond the cluster of liquidity overheads, as it did on October 4. Overall, OM is expected to see a small dip towards $1.3-$1.35 in the coming days.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer

![MANTRA [OM] Price Prediction – New Highs After Crossing July Levels?](https://bitcoinplatform.com/wp-content/uploads/2024/10/OM-Featured.webp)