- Major US economic releases this week, including JOLTS and ADP data, could bring volatility to the crypto markets as traders assess macro trends.

- Stablecoins are showing resilience in the face of rising inflows, while Bitcoin and Ethereum are responding to increasing liquidity concerns.

This week, the US economic calendar is packed with important events, including the release of employment data, minutes of Fed meetings and labor market surveys.

These developments could strongly influence investor sentiment and drive volatility in the cryptocurrency markets. Understanding these events is critical to predicting potential market movements as crypto increasingly responds to macroeconomic signals.

Major US economic events to watch

The S&P Global Services PMIreleased Monday reflects the health of the services sector, a key driver of the U.S. economy. A strong outcome could indicate economic resilience, potentially reinforcing the Federal Reserve’s hawkish stance.

Crypto markets could react negatively to this economic event in the US as expectations of higher interest rates could reduce liquidity.

Tuesday’s JOLTS Job Opening report will provide insight into labor market demand. An unexpectedly high number of vacancies could fuel fears of further rate hikes, putting downward pressure on cryptocurrencies as investors look for safer assets.

Wednesday will focus on the ADP Nonfarm Employment report and the Fed Meeting Minutes. The ADP report provides a preview of the official jobs report, while the minutes of the Fed meeting will provide insight into policymakers’ views on inflation and interest rates.

An aggressive tone could have a negative impact on risky assets like crypto, while a dovish stance could provide relief and support market recovery.

The December Jobs Report, scheduled for Friday, is the most influential publication of the week. This report includes nonfarm payroll data, unemployment rates, and wage growth rates.

A weaker-than-expected report could boost crypto markets as it increases the chance that the Fed slows rate hikes.

Throughout the week, eight Federal Reserve speaker events will provide additional guidance on the outlook for monetary policy. Hawkish comments could limit any short-term rally in crypto.

Potential Impact on the Crypto Market

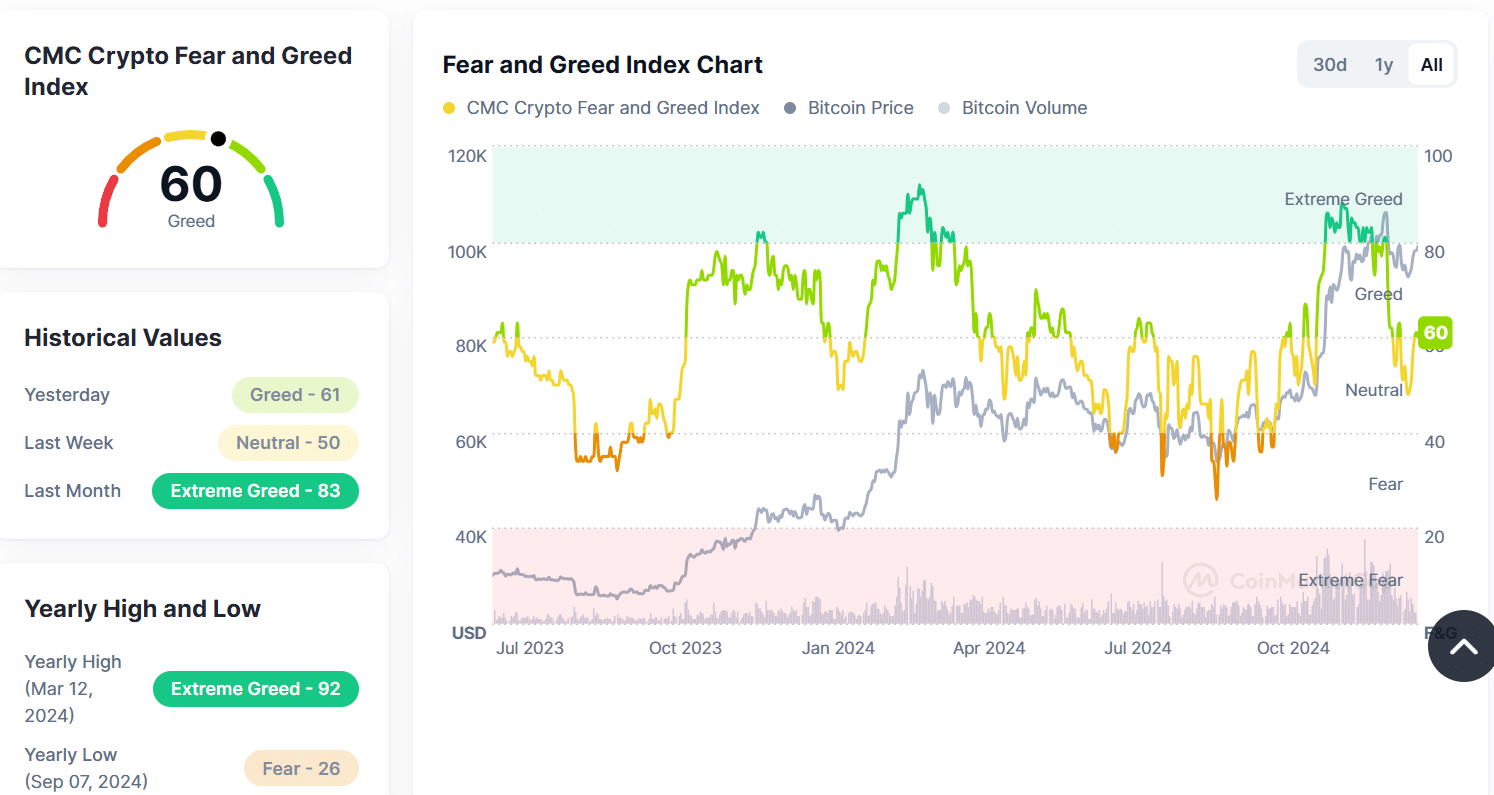

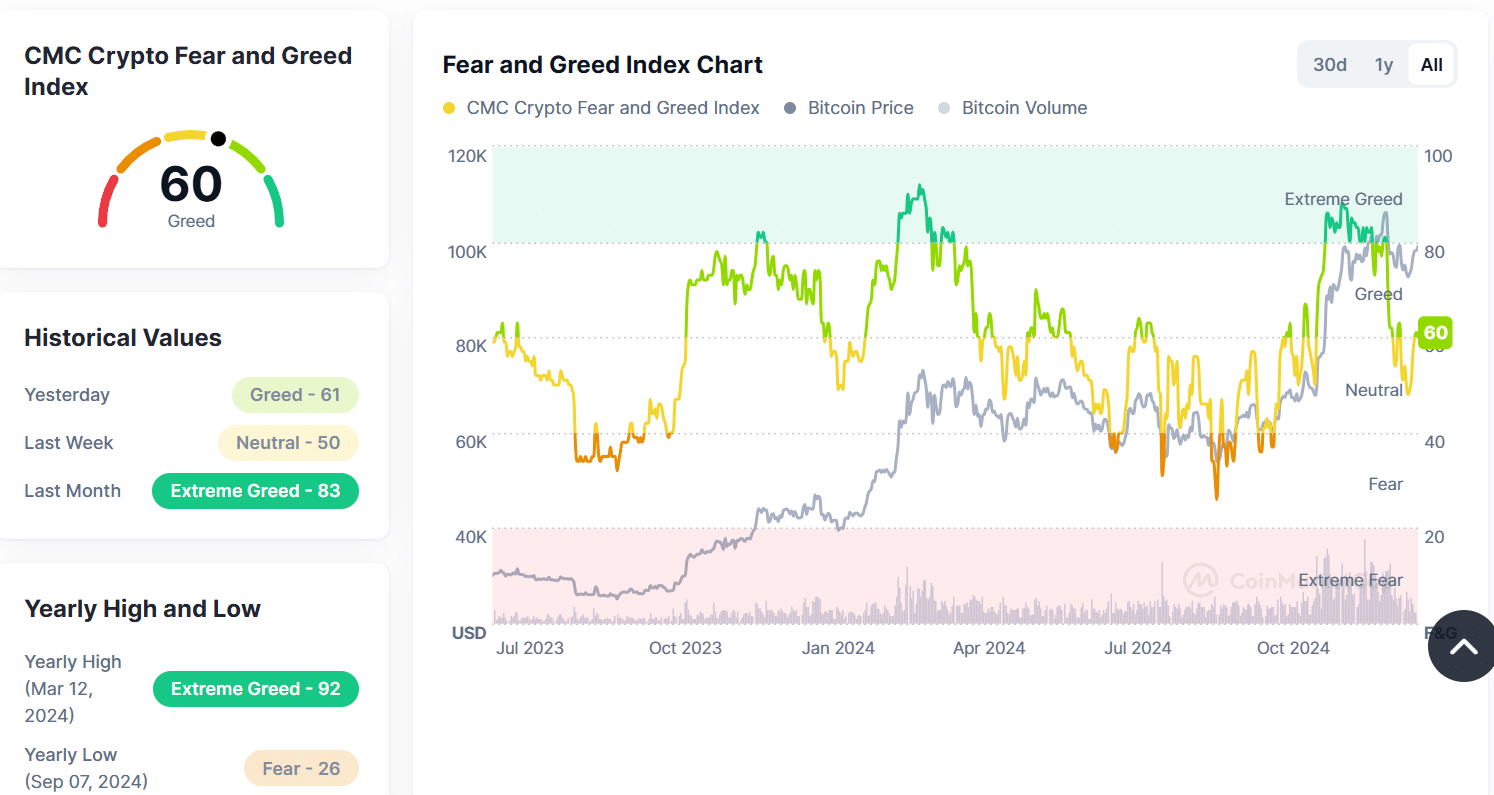

At the time of writing, the Crypto Fear and Greed Index was at 60 (greed), which reflects cautious optimism. This marks a shift from Extreme Greed (83) last month and Neutral (50) last week, indicating more balanced sentiment among traders.

This week’s macroeconomic events could push sentiment toward greed if dovish signals emerge, or toward fear if stronger data support aggressive Fed tightening.

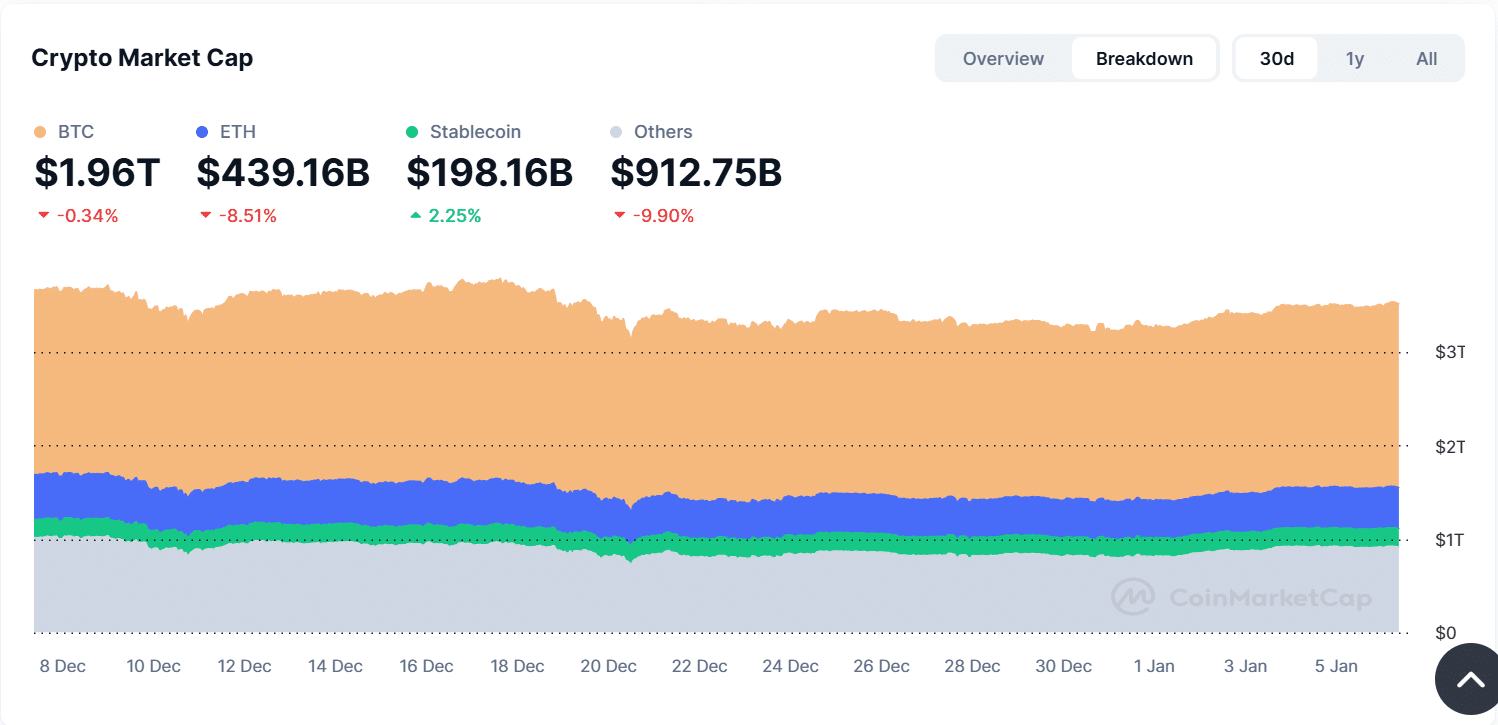

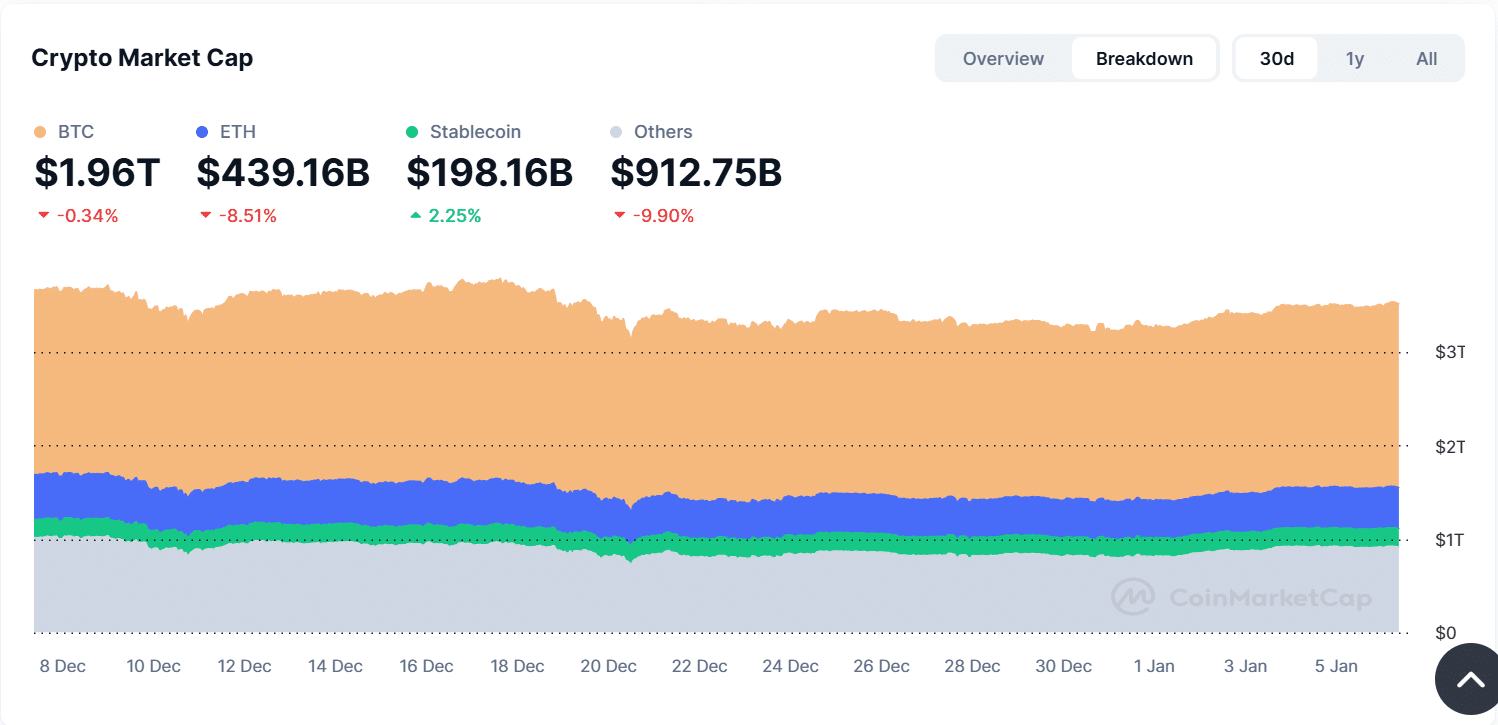

Source: CoinMarketCap

The total cryptocurrency market cap remains $3.51 trillion, with notable differences across asset classes. Bitcoin[BTC] and ether[ETH] have seen declines of 0.34% and 8.51% respectively, indicating sensitivity to macroeconomic conditions.

Meanwhile, stablecoins are up 2.25%, reflecting a cautious turn towards safety. These trends highlight how crypto investors are responding pre-emptively to potential interest rate changes.

Source: CoinMarketCap

Over the past 30 days, the crypto market has consolidated, with the total market capitalization falling to $3.28 trillion on December 22 before recovering. This signals a wait-and-see approach as traders balance macroeconomic uncertainties with potential buying opportunities.

Broader implications of these US economic events

This week’s economic events in the US could significantly impact the crypto market. Strong economic data could support further rate hikes, reducing liquidity and putting pressure on crypto prices.

Softening signals or weaker employment data could increase risk appetite, leading to renewed interest in cryptocurrencies. Stablecoins could continue to see inflows if risk aversion persists, while altcoins could see further sell-offs.

The bottom line

As crypto markets continue to reflect broader economic trends, this week’s US economic events will provide critical signals for traders.

Whether it concerns the health of the labor market or the Federal Reserve’s policy trajectory, these events will likely set the tone for the next phase of market sentiment and price action in cryptocurrencies.