- USTC and LUNC both registered double-digit growth in recent days.

- However, LUNC’s market indicator suggested that the token could witness a price correction.

Terra Classic [LUNA] And TerraUSD [USTC] have taken a huge hit in recent years since the depegging of the stablecoin. In fact, this episode led to a disastrous bear market, the consequences of which are still visible today.

However, Binance, the largest crypto exchange in the world, recently made an announcement that gave some hope of a trend reversal. Here’s a closer look at the Terra ecosystem to better understand what investors can expect from LUNC in the coming months.

Why is Terra suffering?

To give some perspective, TerraUSD fell from its $1 value in May 2022, causing a blowout across the entire crypto market. Not only did the Terra ecosystem tokens fall, but top coins like Bitcoin and Ethereum also took a hit.

Since then, the entire Terra ecosystem has been struggling, including LUNC. But things may look different for Terra in the coming months as Binance has made a major announcement.

Binance Futures launched the USD-M USTC Perpetual Contract on November 27, 2023 with up to 50x leverage. The maximum funding rate of the USTCUSDT perpetual contract at the time of launch was +2.00% or -2.00%.

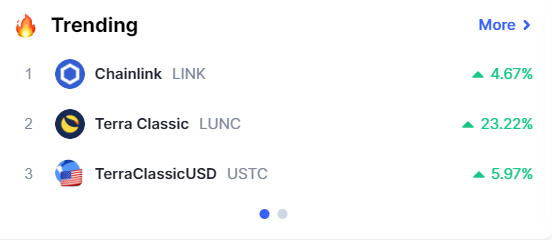

Thanks to that, moist Terra ecosystem tokens like USTC and LUNC gained bullish momentum. To be precise, both tokens were popular on CoinMarketCap at the time this article was written.

This is how Terra Classic and TerraUSD do it

According to CoinMarketCap, USTC is up more than 36% in the last 24 hours. At the time of writing, it was valued at $0.05032 with a market cap of over $451 million.

Thanks to the spike in positive sentiment around the currency, overall investor confidence was also high. This was evident from the increase in the total number of holders.

However, AMBCrypto’s analysis showed that the Whales did not have much confidence in USTC as the supply of top addresses fell in the recent past.

Like it USTCTerra Classic also initiated a promising bull rally. If reported Previously by AMBCrypto, LUNC showed commendable performance in the recent past as its price rose by double digits.

To be specific, LUNC is up over 23% in the last 24 hours. At the time of writing this was the case trade at $0.0001194 with a market cap of over $394 million, making it the 71st largest crypto.

The token burn rate was also relatively high over the past week as a significant number of tokens were burned.

According to the latest tweet from LunaClassic headquarters, almost 29 billion LUNCs have been burned, accounting for almost 37% of the supply.

$LUNC Keep burning 🔥 🔥🔥🔥

Soon on our way to 80B. pic.twitter.com/ojgK3IgqJ8

— LunaClassic HQ 🌕 ™ (@LunaClassicHQ) November 28, 2023

AMBCrypto then looked at LUNC’s derivatives metrics to see what they suggested. According to our analysis, Terra Classic’s open interest skyrocketed along with its price.

When open interest rises, it increases the chance that the current price trend will continue. Therefore, it seems likely that LUNC will continue its bull rally in the coming days.

Moving forward

With open interest growth looking ambitious, AMBCrypto then checked LUNC’s daily chart to see if the token would maintain its uptrend in the coming weeks. At first glance, the MACD showed a clear bullish upper hand on the market.

Realistic or not, here it is LUNC market cap in BTC‘s conditions

The rest of the statistics, however, had a different story to tell. LUNCThe price of LUNC reached the upper limit of the Bollinger Bands, which caused a trend reversal and pushed the price of LUNC down. The Money Flow Index (MFI) ended up in an overbought position.

Moreover, the Relative Strength Index (RSI) is also entering a similar zone. This could cause selling pressure on Terra Classic, which could be concerning given the ongoing bull rally.