- Litecoin showed resilience with positive metrics across segments.

- However, challenges loomed in terms of mining profitability and trading speed.

Compared to Bitcoin[BTC] and ether[ETH]Litecoin[LTC] has not experienced the same level of growth since its inception. However, despite the challenges, Litecoin has persisted and seen growth in 2023.

Litecoin shows off its progress

Litecoin’s recent tweet touts its position as one of the leading blockchains and highlights a wave of activity and development that is reaching an all-time high.

Achieving 100% uptime over twelve years underlines the network’s resilience and commitment to operational excellence.

#Litecoin is the #⃣1⃣ #crypto of your choice for payments!! Last month, $LTC surpassed all others @BitPay The world’s largest crypto payment processor!! Becoming a market leader in real use.

What is in your wallet? #PayWithLITECOIN ⚡️ pic.twitter.com/QyKdbEmDFU

— Litecoin (@litecoin) December 30, 2023

Increasing adoption

This robust performance could potentially propel Litecoin forward. The increased activity and development indicate a dynamic ecosystem, which inspires confidence among both users and developers.

The long-standing operational stability further enhances the network’s credibility and paves the way for potential growth opportunities.

Litecoin’s dominance over BitPay added a new layer to this story. LTC surpassed other cryptocurrencies and claimed the top spot over BitPay, one of the world’s largest crypto payment processors.

This not only demonstrates market leadership, but also underlines the practicality and adoption of Litecoin, setting it apart in terms of practical use.

Miners suffer

Research into Litecoin’s hashrate, which was 900+ TH/s, revealed the network’s computing power. A robust hashrate is vital for network security and efficiency, and Litecoin’s substantial hashrate positions it as a formidable player in the blockchain space.

However, the profitability landscape for miners came with a warning.

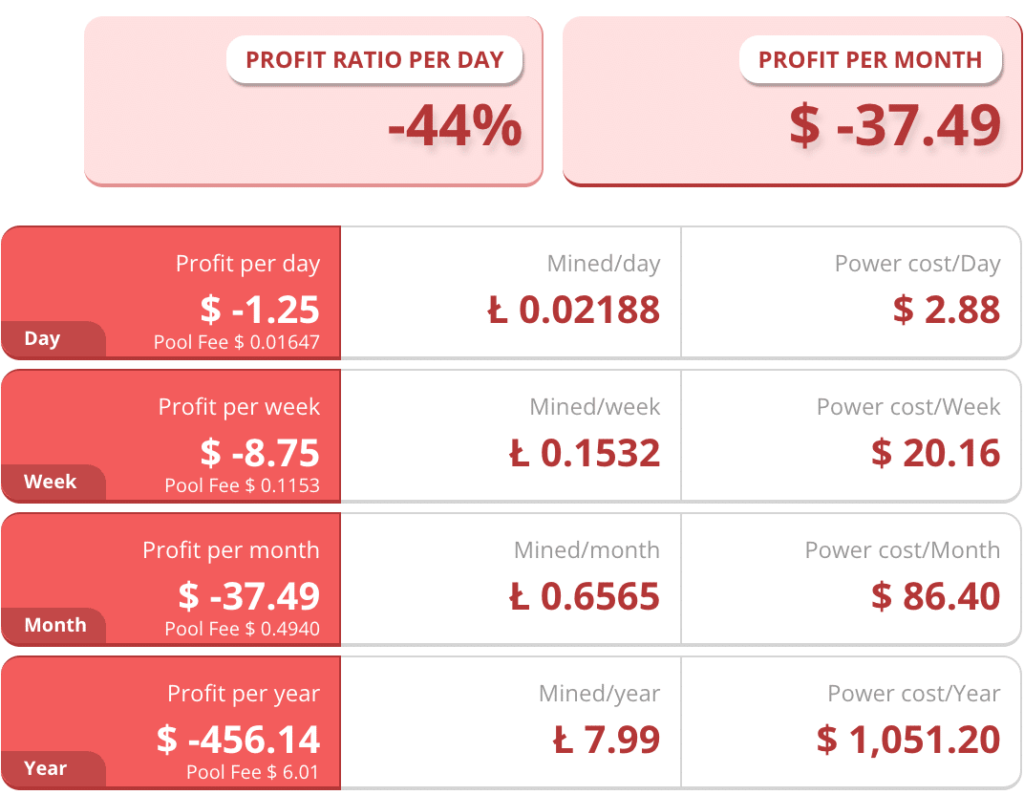

According to data from CryptoCompare, a mining rig with 5 Gh/s of hashing power would suffer a 43% loss when mining LTC.

This adverse scenario could have a negative impact on the network and potentially affect miners’ interest. It could also increase selling pressure on LTC.

Source: Cryptocomparison

Read Litecoins [LTC] Price forecast 2023-24

State of the price of LTC

As for LTC’s price movement, it was trading at $75.22 at the time of writing, reflecting a modest growth of 2.52% over the past 24 hours.

However, a notable drop in trading speed indicates a reduced frequency of LTC transactions. While the price growth is a positive sign, the decline in trading activity suggests that a correction for LTC is likely in the future.

Source: Santiment