- Despite high network activity, LTC is down nearly 15% over the past 30 days.

- Most figures and indicators pointed to a continued price decline.

Litecoin [LTC] has failed to achieve investor gains as it continues to fall on the list of the top 30 cryptos. However, the coin managed to excel on one front.

In fact, Litecoin surpassed both Bitcoin [BTC] And Ethereum [ETH]which looked quite optimistic for the future of the blockchain.

Litecoin surpasses Bitcoin, Ethereum

Litecoin recently added a tweet point to an interesting development. According to the tweet, LTC continued to dominate BTC and ETH in terms of authentic active addresses.

This was a clear indication of the increase in LTC use and high network usage in recent months.

In fact, AMBCrypto’s analysis of Santiment’s data revealed a similar picture. Litecoin’s daily active addresses have remained high over the past 30 days as the number surpassed 858,000 on June 6.

Source: Santiment

LTC bulls take a backseat

While the network activity and use of the blockchain have been commendable, the same cannot be said about LTC’s price action. CoinMarketCaps facts revealed that the price of LTC has fallen nearly 15% in the past 30 days.

At the time of writing, LTC was trading at $70.61 with a market cap of over $5.27 billion, making it the 22nd largest crypto.

Things could get worse for LTC in the coming days as a key metric indicated a price correction.

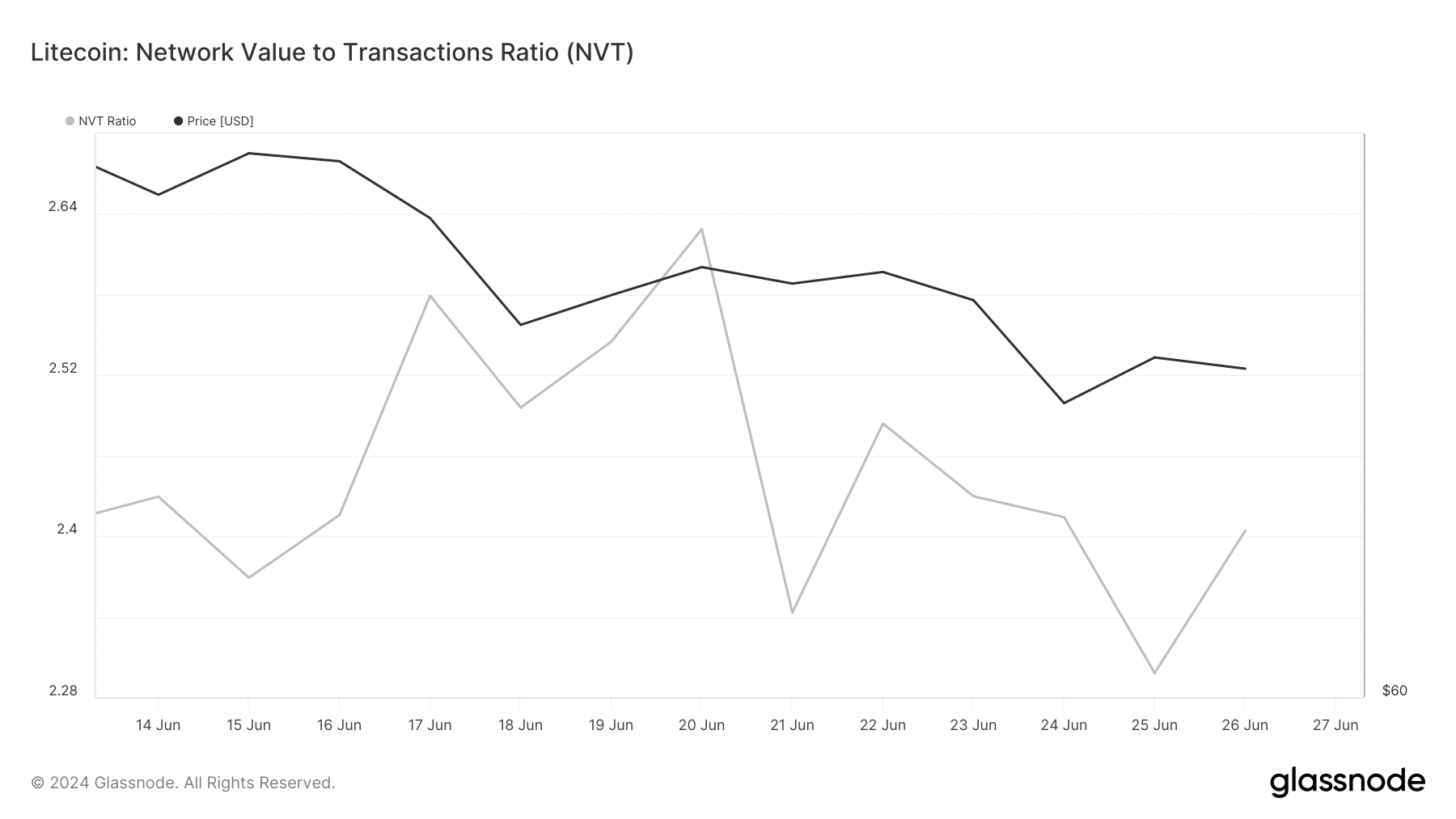

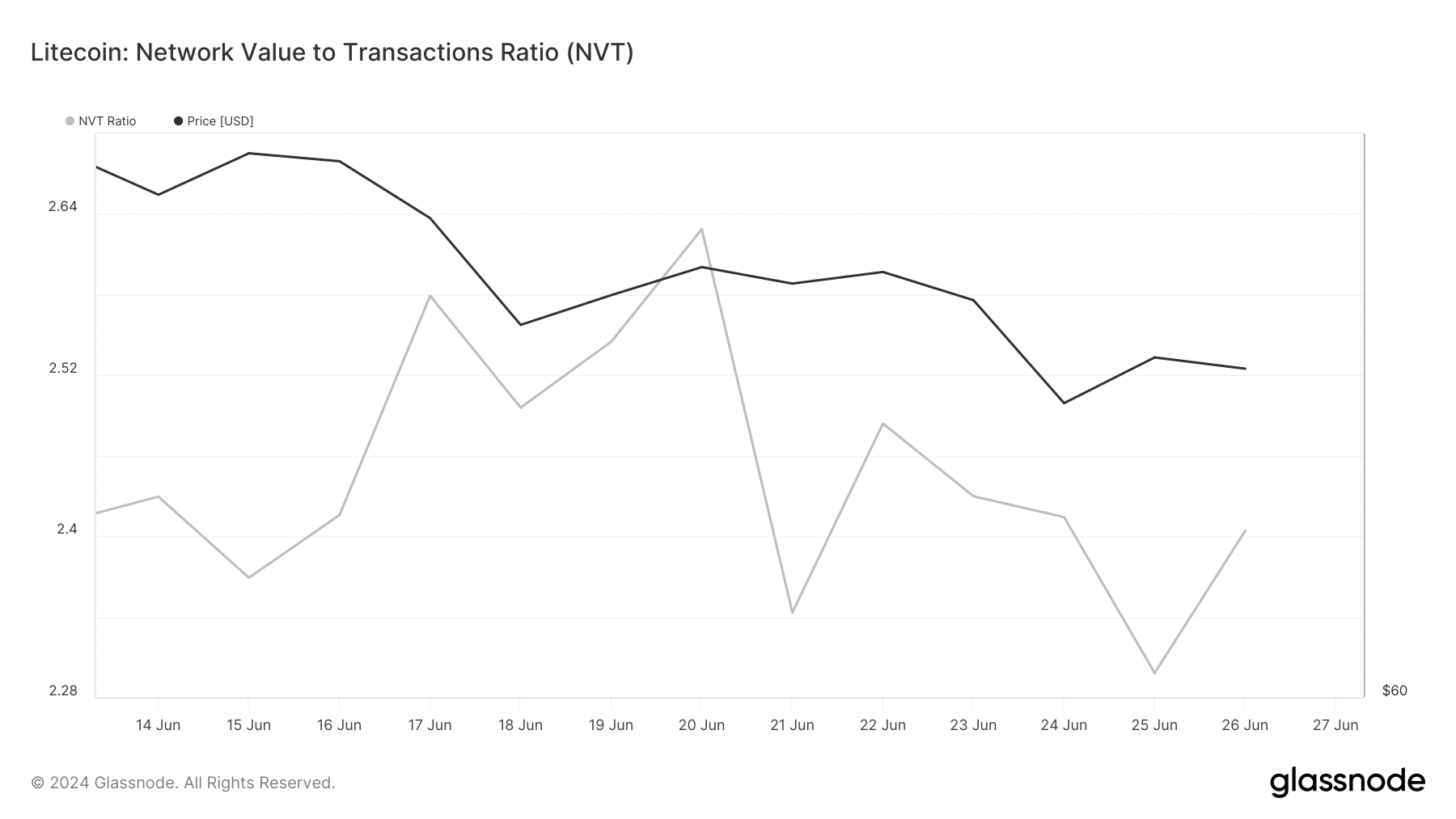

AMBCrypto’s look at Glassnode’s data clearly revealed an increase in the coin’s NVT ratio. Typically, an increase in value indicates that an asset is overvalued, increasing the likelihood of a price drop in the following days or weeks.

For the uninitiated, the NVT ratio is calculated by dividing the market capitalization by the on-chain volume transferred, measured in USD.

Source: Glassnode

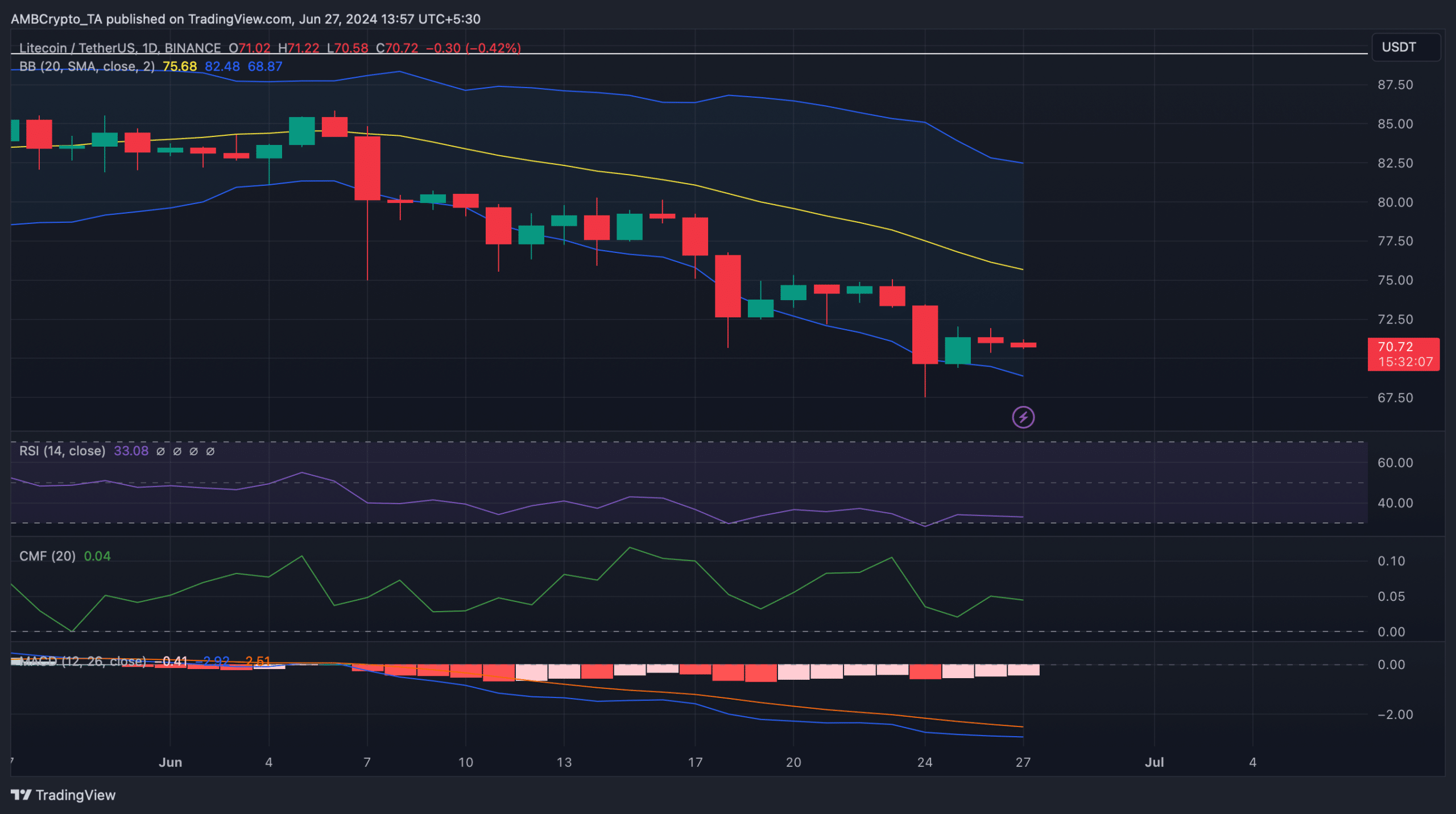

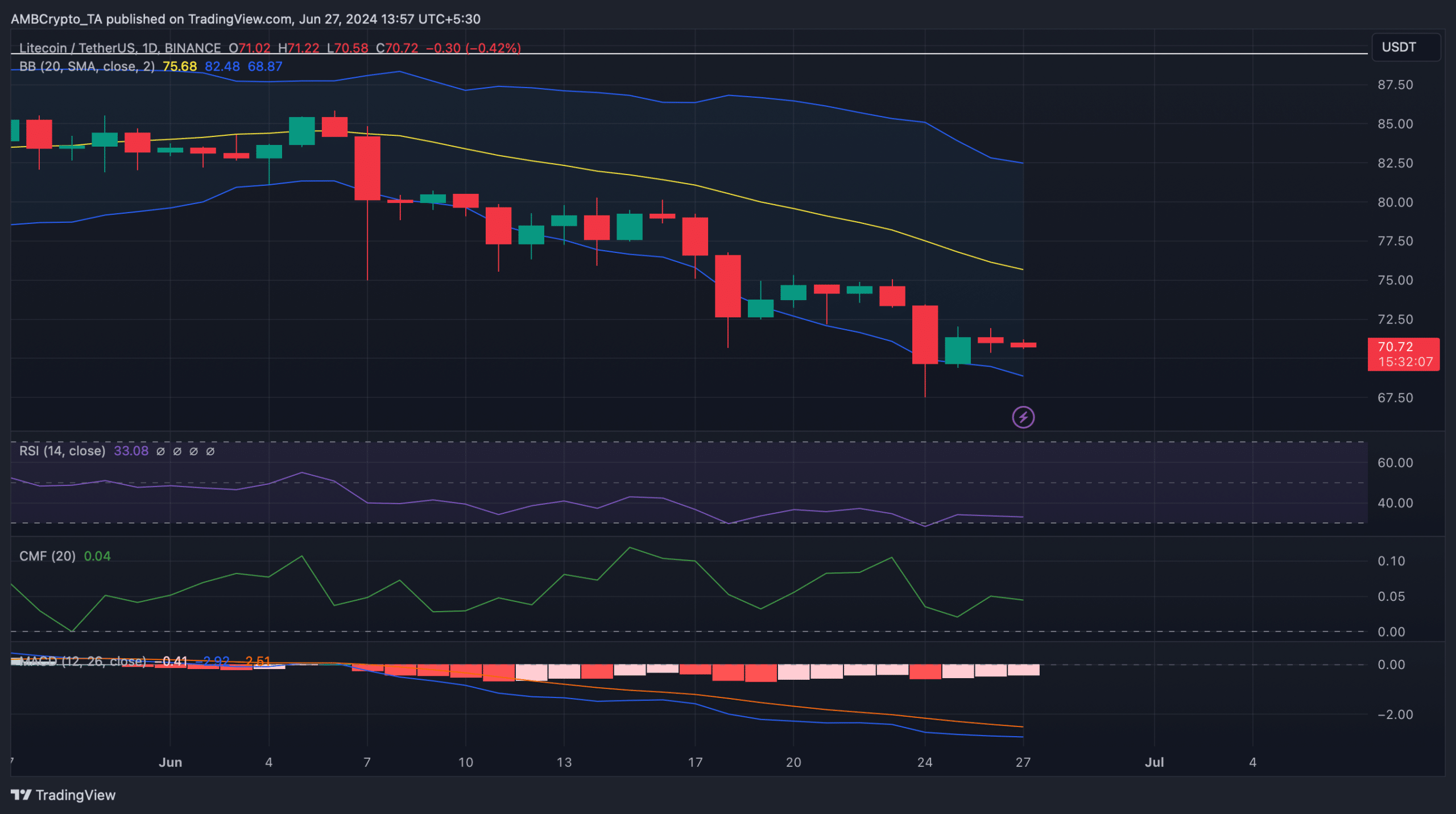

To see if the bears would continue to dominate, AMBCrypto then analyzed Litecoin’s daily chart. We found that most market indicators were in favor of the sellers.

For example, the MACD showed a bearish advantage in the market. The Chaikin Money Flow (CMF) registered a downward trend and headed towards the neutral rate.

A similar downward trend was also seen on the Relative Strength Index (RSI) chart, indicating a continued decline in prices.

Nevertheless, the price of LTC had reached the lower bound of the Bollinger Bands, indicating a possible soon recovery.

Source: TradingView

Realistic or not, here it is The market cap of LTC in BTC terms

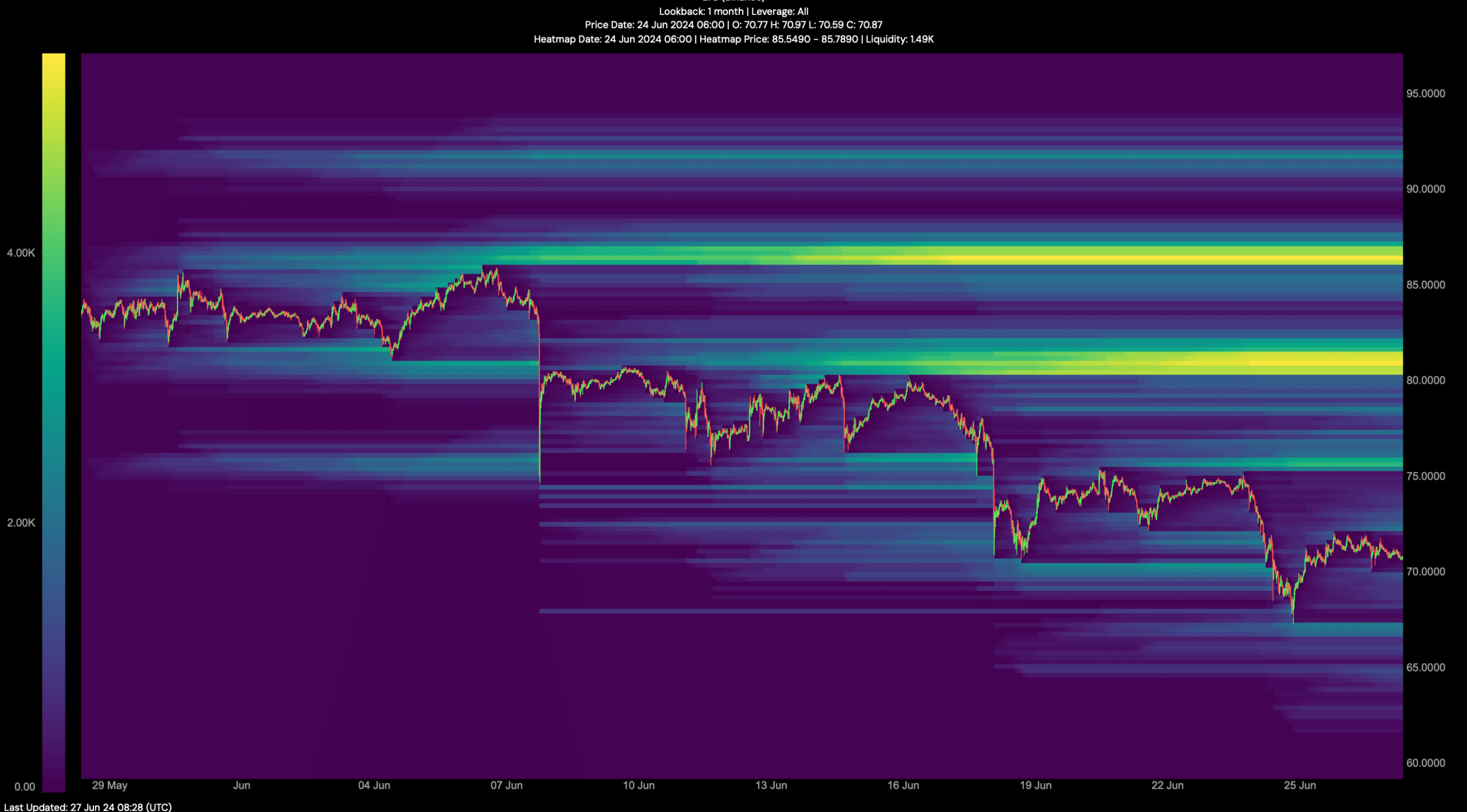

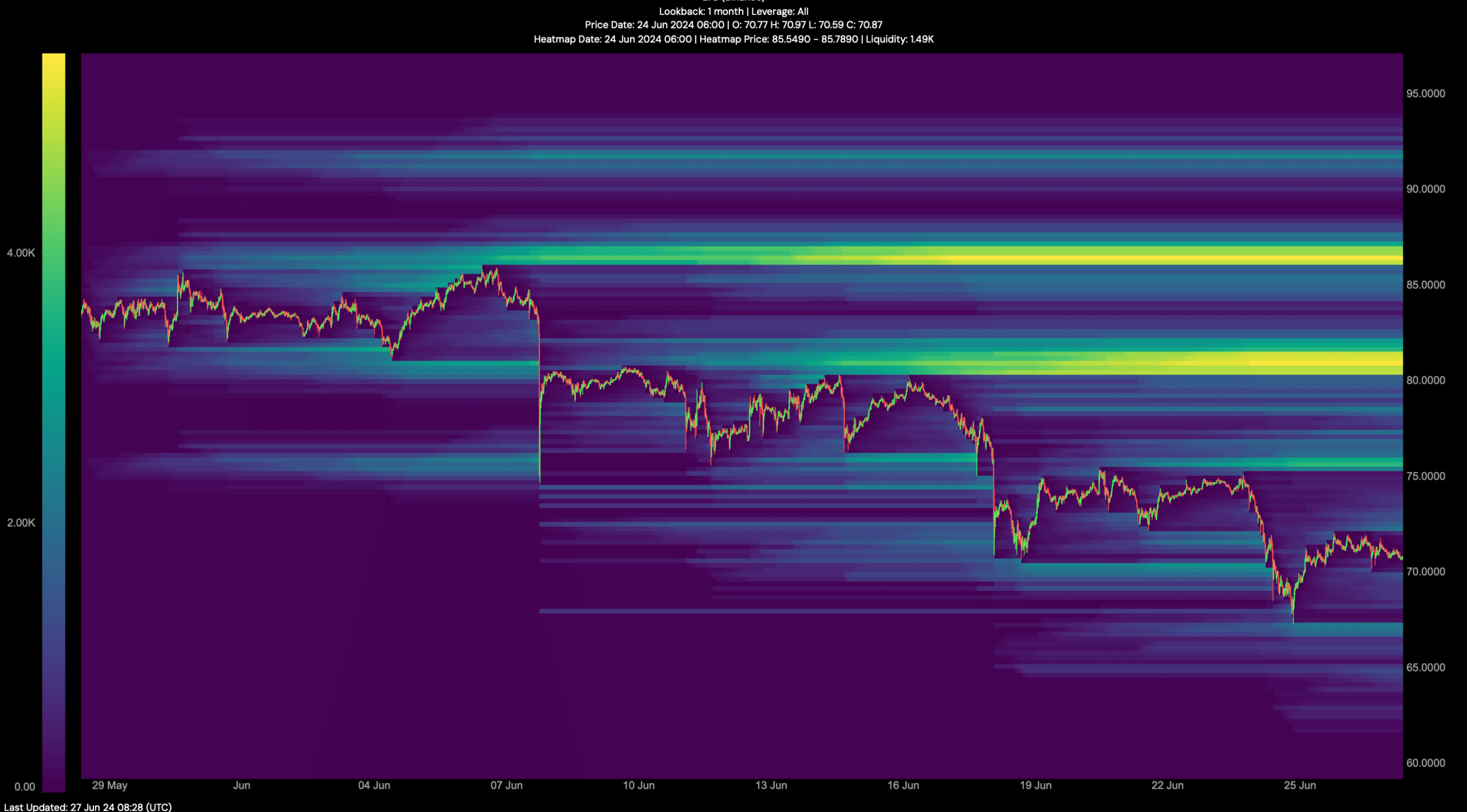

Our analysis of Hyblock Capital’s data found that if the price decline continues, investors could see the LTC fall to $67 in the coming days.

However, in the event of a trend reversal, LTC could first look at $81.4 to begin a full-fledged recovery.

Source: Hyblock Capital