- Bitcoin could expand its price range in the near term

- Coinbase analysts cited the Fed’s slow rate cut and increasing BTC selling pressure

Coinbase analysts have warned about this Bitcoin [BTC] could see a turbulent market in the medium term.

In their weekly commentaryAnalysts David Duong and David Han cited the Fed’s slow rate cut and increasing BTC supply in the market.

“The broader macroeconomic backdrop remains a mixed bag. The reduced likelihood of Fed rate cuts due to stronger employment data and inflation risks could dampen the performance of risky assets in the short to medium term.”

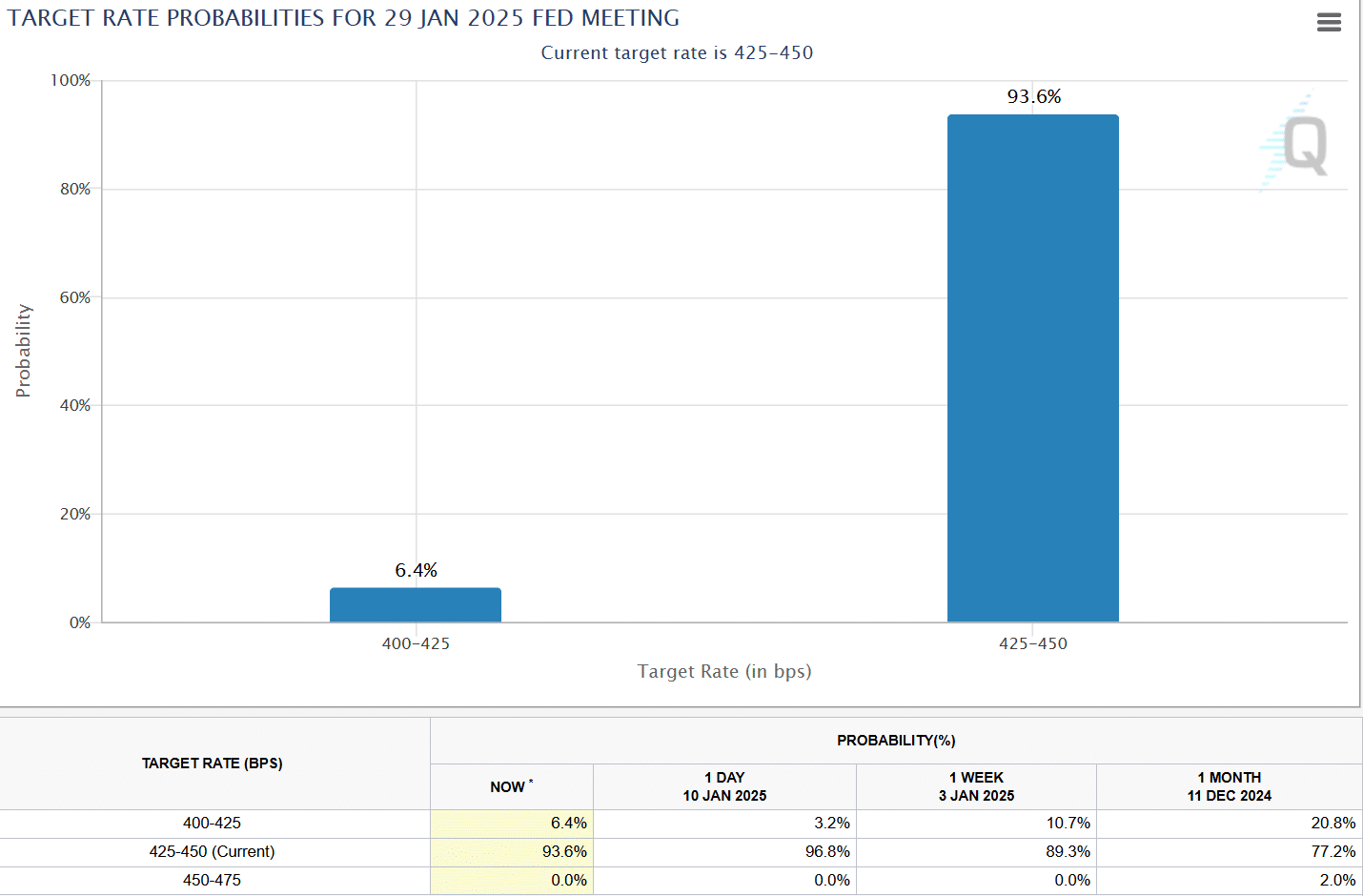

Recent US economic data pointed to persistent inflation and strong labor markets, further dampening expectations of further Fed rate cuts.

In fact, traders have priced in the Fed to leave rates unchanged at 4.25%-4.50% for the next FOMC meeting scheduled for late January.

BTC selling pressure is increasing enormously

The analysts added that a surge in BTC supply could further limit the strong upward momentum on the charts.

“We think the bitcoin supply-side story could also dampen some upside expectations in the near term. Active supply of BTC (moved on-chain in the last three months) increased to 4.6 million, up from 2.7 million in October 2024.”

Source: Coinbase

The report stated that nearly $90 billion worth of BTC has been liquidated by long-term holders (LTH), marking the $100,000 level as a key supply area for early investors. According to the analysts, yes LTH supply pressure could limit BTC in a price range.

“These supply-side dynamics suggest that there could be a period of increasing consolidation for Bitcoin in the coming months, similar to the onchain signals we observed when Bitcoin hit an all-time high in March 2024.”

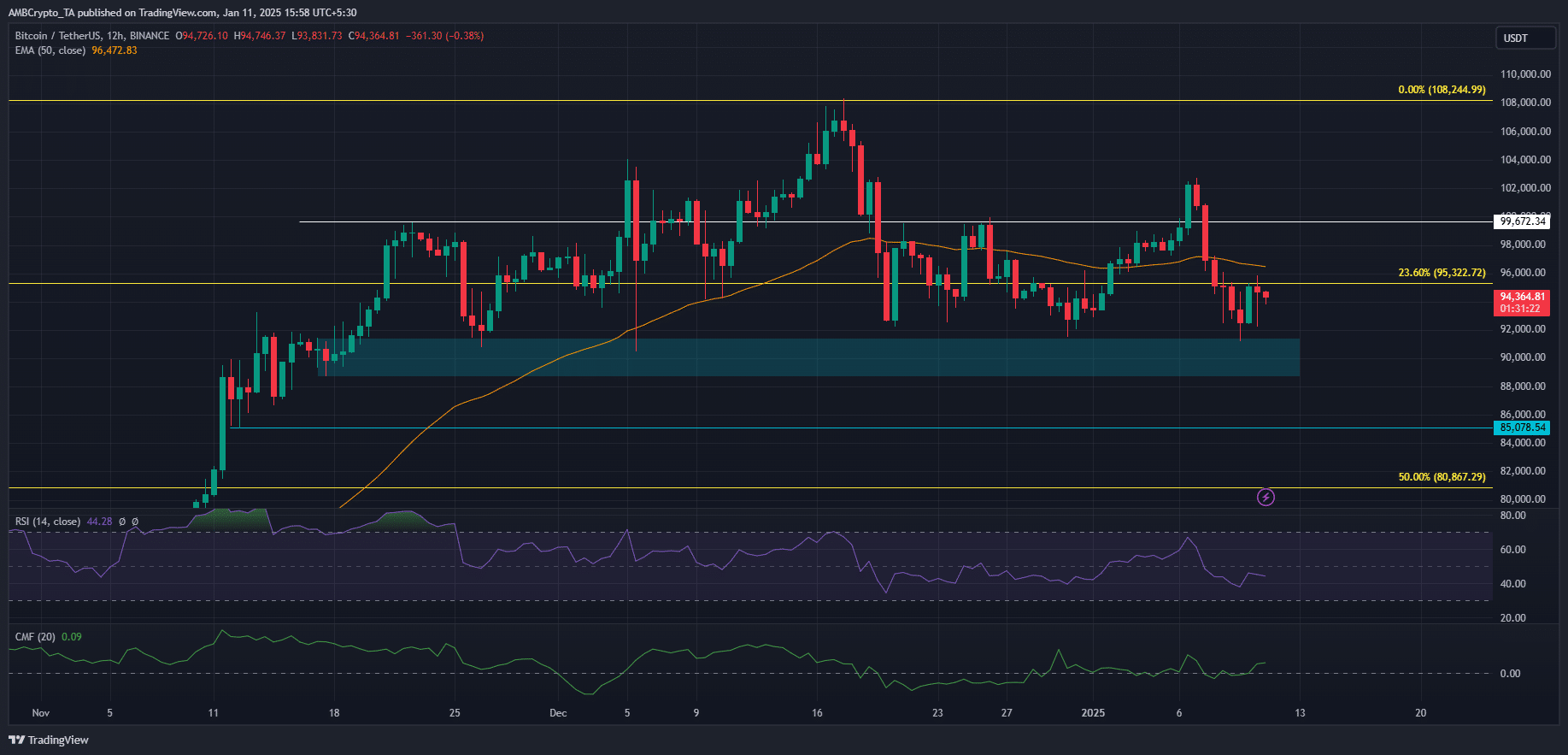

In the meantime, BTC reached the lows in the range and recovered, but the recovery stalled at $95,000. This boosted the consolidation margin quoted by analysts from $90,000 to $100,000.

Source: BTC/USDT, TradingView