The total amount of Ethereum (ETH) staked on Lido Finance, one of the many liquidity staking protocols available, is got up steadily in recent years. Surprisingly, the revenue generated by the platform (compared to the wagering rewards distributed) remains relatively low.

Lido Finance’s revenues are not growing as quickly as expected

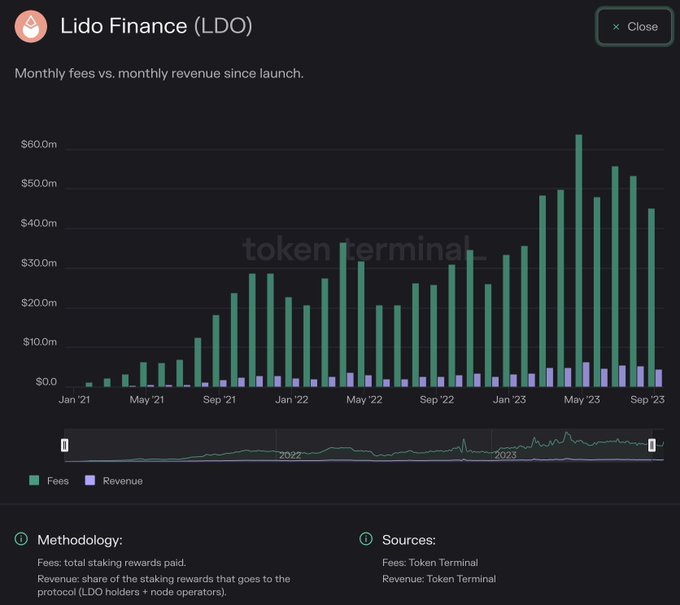

Looking at Token Terminal data shared on October 19, the blockchain analytics platform found that while stake rewards paid, counted as ‘fees’ by Lido Finance, grew from less than $10 million in early 2021 to more than $60 million in June 2023, sales have grown at a much slower pace. To illustrate, Lido Finance’s average turnover during this period is approximately less than $5 million.

Overall, Lido Finance is a liquidity staking protocol that supports staking multiple proof-of-stake (PoS) coins such as Ethereum (ETH) without necessarily tying them up. Users can simultaneously earn staking rewards while gaining access to their hard-earned ETH – or any other supported coin.

The protocol issues a different derivative, stETH, for every ETH staked to achieve this. This token can be traded freely on exchanges. It can even be used as collateral for users who would like to take out reliable loans on supported platforms.

Ethereum recently turned into a proof-of-stake blockchain to be greener and save the environment. This transition was a boon for protocols that supported the first smart contract platform to confirm transactions and stay secure, especially after Shanghai’s activation in April 2023.

The Shanghai upgrade allowed Ethereum validators to withdraw their staked ETH for the first time, allowing them to use alternatives, of which Lido Finance, looking at the total value locked (TVL), was favored. As of October 19, Lido Finance had a TVL of $13.913 billion, most of which are assets on Ethereum.

Concerns About Ethereum Centralization: How Will This Be Addressed?

Lido Finance makes staking more accessible to everyone while improving liquidity. However, the revenue generated seems low compared to the amount of staking rewards handed out to stakers, most of whom come from Ethereum. A portion of the revenue generated by the network is also distributed to LDO holders and node operators. Or the liquidity staking protocol that plans increase the 10% fee charged to increase earned revenue remains to be seen.

Currently, there are concerns that Lido Finance’s role on Ethereum could lead to centralization. Ethereum has been accused of being ‘centralized’, mainly because of the way it is built. Critics argue that reliance on co-founder Vitalik Buterin for support and guidance could slow development in the future.

Feature image from Canva, chart from TradingView