- L2 solutions have challenged L1’s dominance.

- A surge in L2 dominance impacted NFT activity and generated fees.

The ever-evolving landscape of the cryptocurrency sector continues to captivate enthusiasts around the world. An intriguing development is the burgeoning rivalry between Layer 1 (L1) networks and Layer 2 (L2) solutions.

Is your wallet green? Check out the Ethereum Profit Calculator

Revealing L2’s ascent amidst L1’s dominance

In an industry notorious for fierce competition, the recent proliferation of L2 solutions has led to speculation about its potential to disrupt prevailing L1 networks.

Despite the established dominance of L1 networks and cryptocurrencies, the spotlight shifted to the rising prominence of L2s, casting a shadow over the market share of their predecessors.

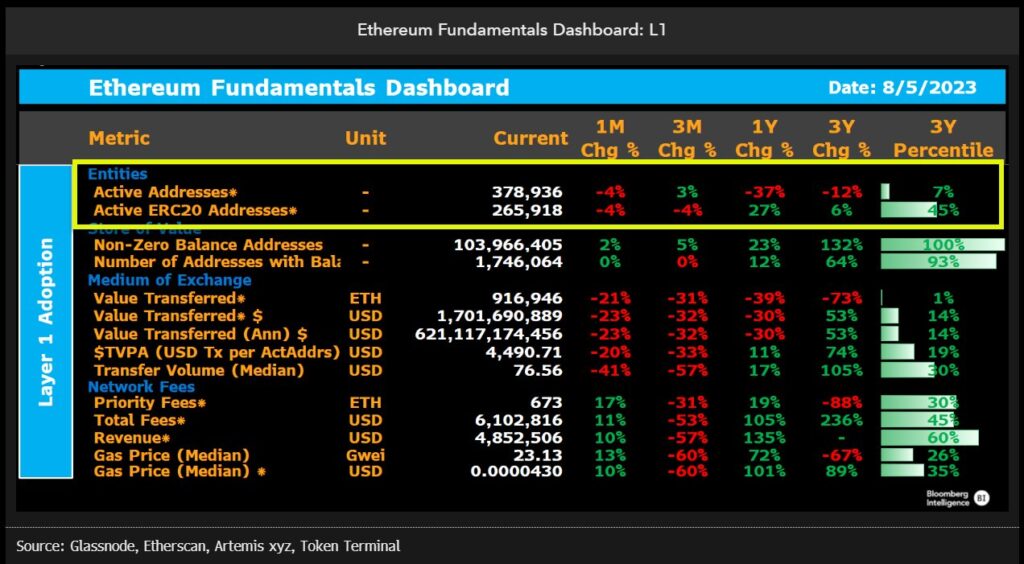

Crypto analyst Jamie Coutts’ data indicated L2 adoption was growing faster than expected. This growth could be beneficial for Ethereum [ETH] network. However, it may cause damage to L1’s cryptocurrencies in the short term.

The double surprise of faster L2 adoption and less-than-expected cannibalization of L1 finances has ⬆️our confidence in #Ethereumthe potential to build more value over the cycle than alternative L1s.

A🧵 about the changing dynamics of $ETHs network fundamentals of the⬆️in L2s pic.twitter.com/LVDsvDkI3m— Jamie Coutts CMT (@Jamie1Coutts) August 9, 2023

Take a deeper look

Within an intricate web of cryptocurrency dynamics, the value below the surface is often masked by price swings. The revival of growth in L1 networks is due to the fast-growing influence of L2 solutions, coupled with a milder monetary tightening.

Surprisingly, the industry managed to remain deflationary even during the bear market, with pre-merger inflation at 4%. Remarkably, despite cooling market activity, Ethereum witnessed a remarkable 38% strike entrance over a period of just three months.

Ethereum’s resolute ambition to increase its scalability via L2 rollups became evident through insights into the chain. Amid a decline in L1 activity over the past year, usage of the network soared, propelling the financial position into a phase of unprecedented prosperity.

The past year saw a migration of activity to L2 solutions, remarkably reshaping the Ethereum landscape. With a staggering 245% increase in active addresses, the adoption of L2 has introduced hundreds of thousands of new users to Web3.

Source: Bloomberg

Fees and NFTs

As L2 adoption gained momentum, the Ethereum economic landscape also underwent a fee transformation. The rise in L2 fees, averaging $600,000 per day, has not only reduced cannibalized L1 revenue, but has also catalyzed the amplification of network effects.

L1 fees, supported by rollups, were expected to represent a significant portion of total fees, rising to 20% by the end of the year and as much as 50% within the next three years, according to data. However, this growth may be hampered by the progression of L2s.

The predominance of L2s also brought shifts in NFTs. The lower fee costs of L2 NFT marketplaces led to an 80% reduction in total NFT activity on L1 networks, reducing sales volumes for the same.

Source: Artemis

Analysis of the tokenomics

In terms of market cap, both L1 and L2 tokens experienced similar levels of growth. However, optimism [OP] stood out in this regard, witnessing the most activity on a monthly basis according to Santiment’s data.

Source: Sentiment

Socially, weighted sentiment for both protocols was seen to be improving. The one exception, however, was Arbitrum, the only protocol that saw a decline in this area.

Source; Sanitation

The impact of L2 on Ethereum

Beyond the confines of the L2 domain, the Ethereum ecosystem will benefit from the burgeoning growth of L2 solutions, ushering in a potential era of prosperity.

Due to the progress made by Layer 2 solutions, the volume of activity they could bring to the Ethereum network could be extremely large. This keeps Ethereum’s gas usage and earnings consistent.

At the time of writing, ETH was trading at USD 1850. The number of addresses with ETH has increased over the past week, indicating an increased interest in cryptocurrency.

Realistic or not, here is the market cap of ETH in terms of BTC

The MVRV ratio for Ethereum fell during this period, showing that most addresses with ETH were not profitable at the time of writing.

ETH’s declining MVRV ratio suggested that the probability of ETH being sold was relatively much lower due to the lack of incentive to sell.

Source: Sentiment