- Jupiter shot past the local resistance zone at $0.95, and the price was just below the resistance at $1.15 at the time of writing

- There is potential for a decline to $1.06 in the near future

Jupiter [JUP] experienced an increase of 36.76% on Saturday, January 18. The last 24 trading hours saw a 34% gain and a 678% increase in daily trading volume for Jupiter. This seemed like a strong bullish sign for the altcoin.

The altcoin’s market structure was bullish on the daily chart and the 4-hour charts. However, there could be potential for a retracement towards $1. How deep can this dip go? Strong support was at $1.06, almost 9% below the market price at the time of writing.

JUP bulls are challenging the $1.15 resistance

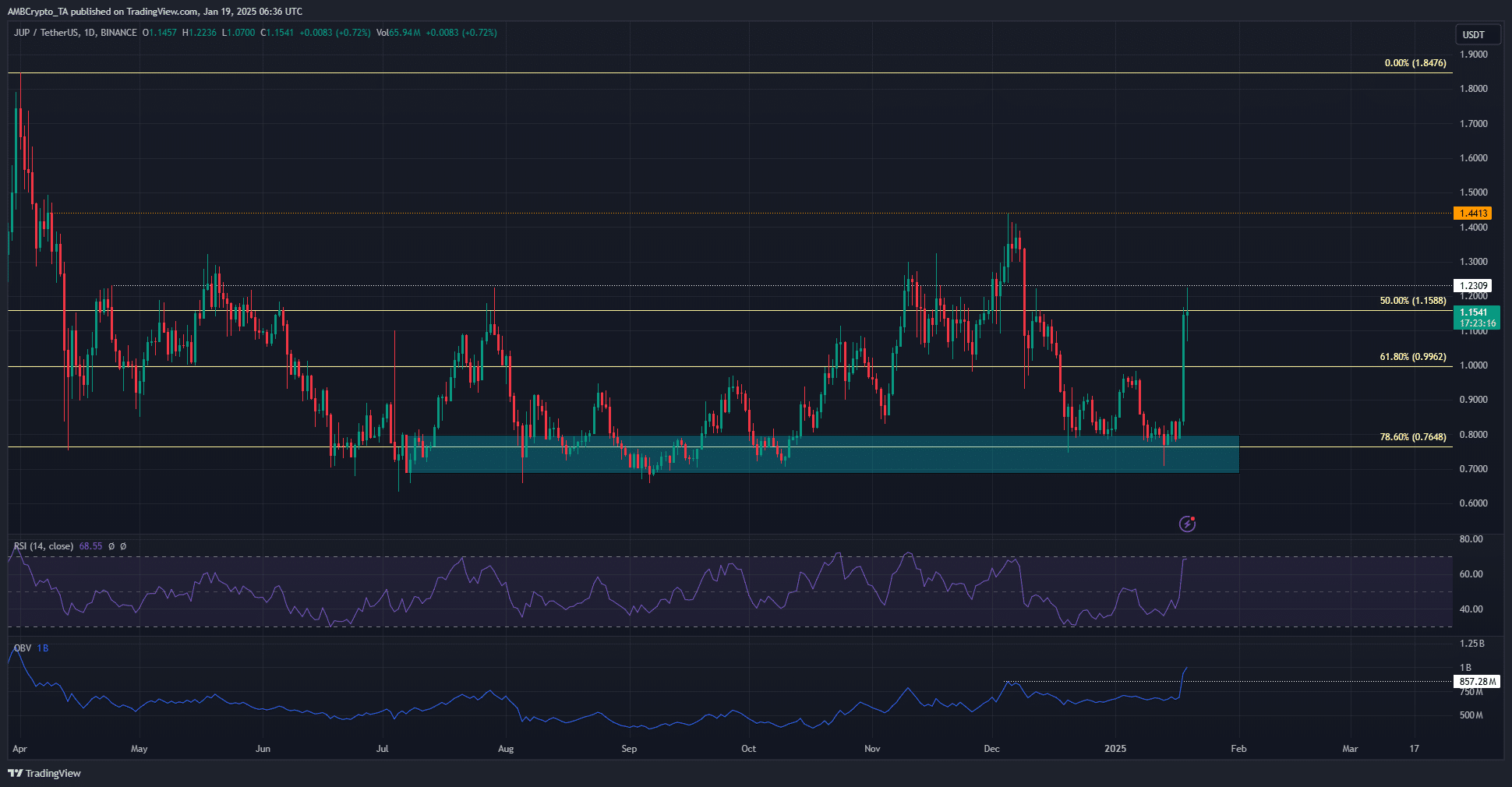

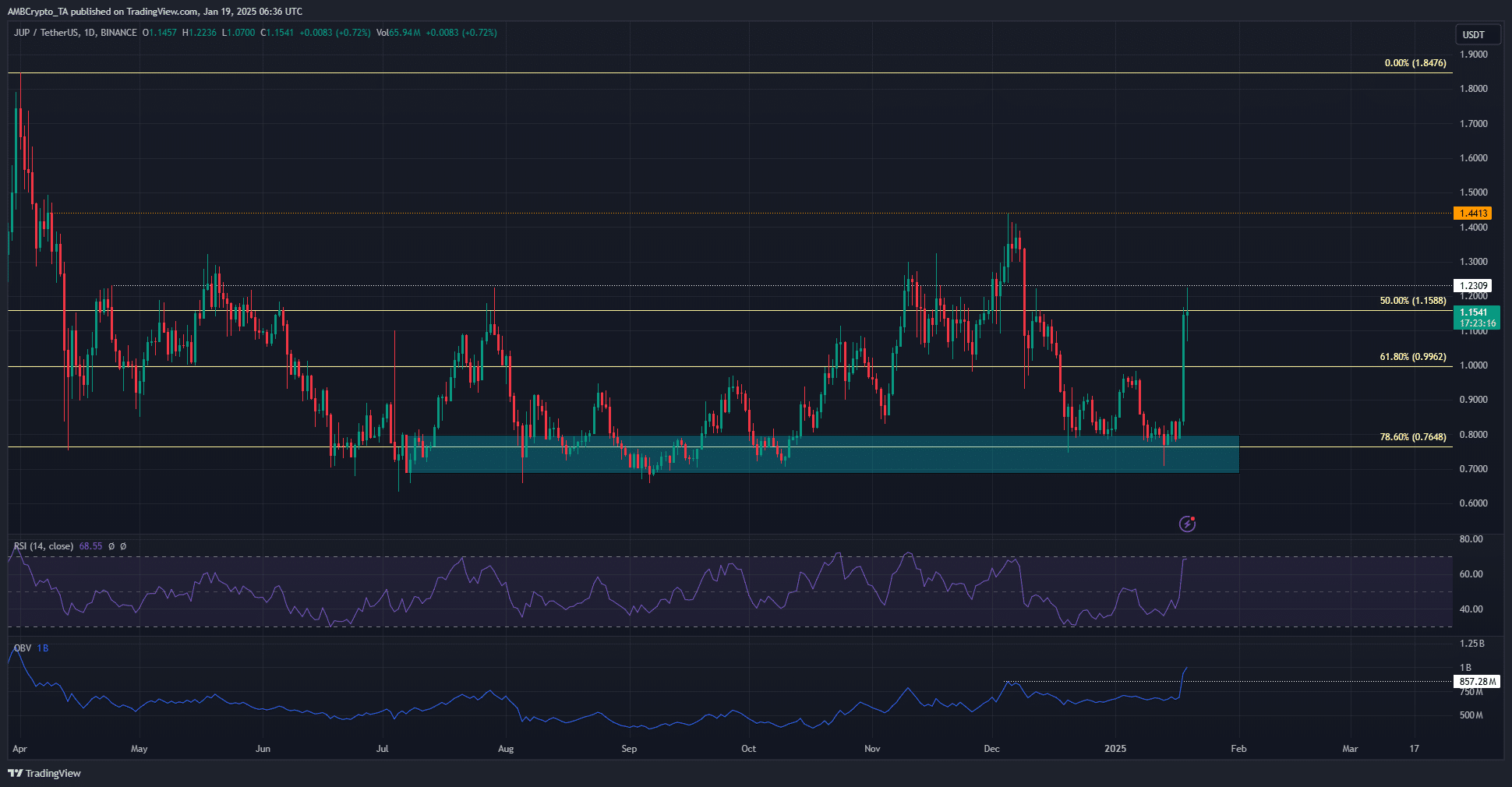

Source: JUP/USDT on TradingView

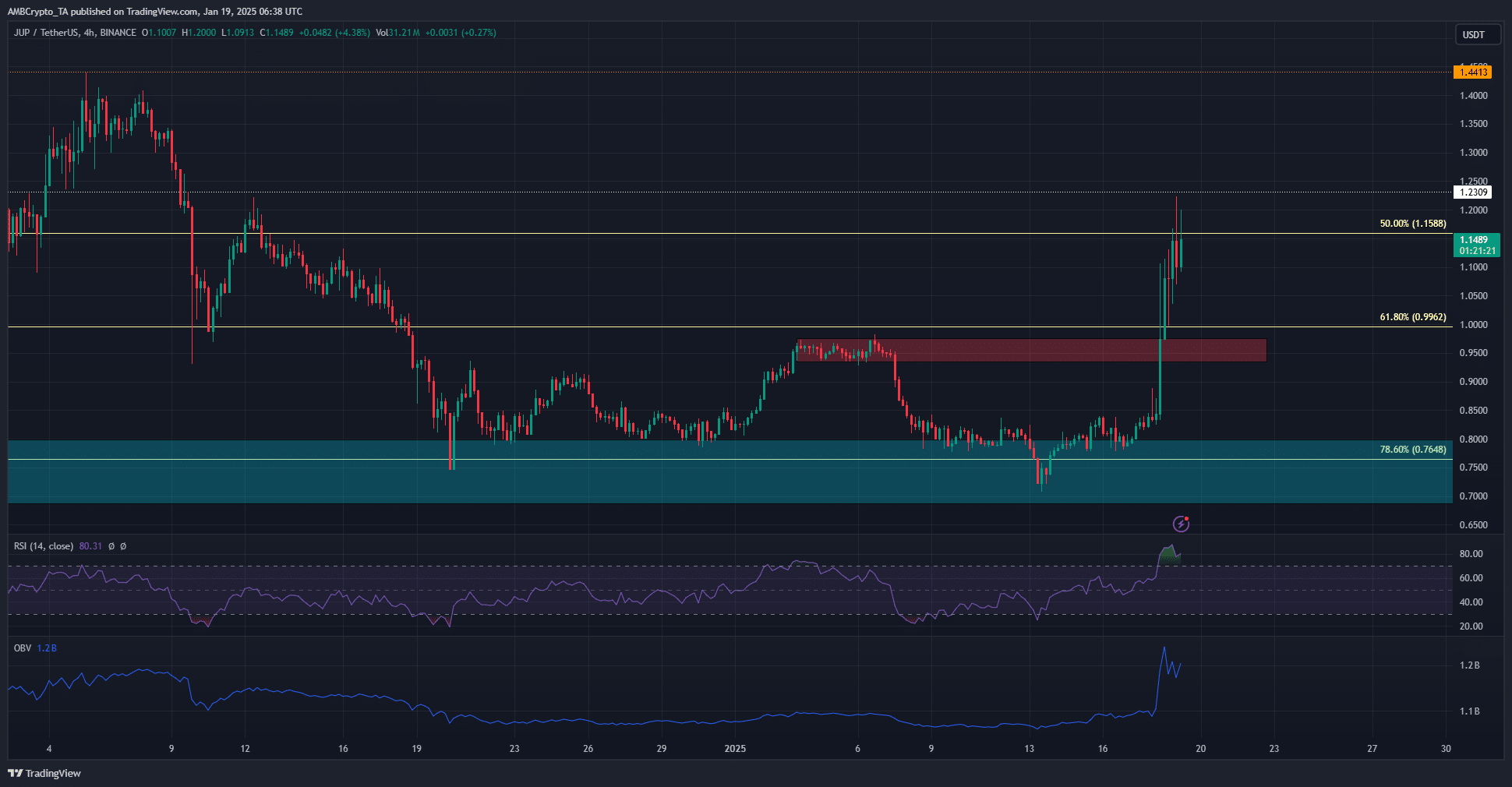

Over the past nine months, bulls have vigorously defended the 78.6% retracement level at $0.76. These retracement levels were plotted based on Jupiter’s March rally from $0.47 to $1.84.

The bullish daily structure was encouraging and the RSI was well above the neutral 50, indicating strong upside momentum. This momentum has been accompanied by increased demand. The OBV shot past a local high, also reflecting increased buying pressure.

The rising demand and momentum could be enough to push the JUP past its local resistances at $1.15 and $1.23. Over the next two weeks, local highs of $1.44 are likely to be tested again.

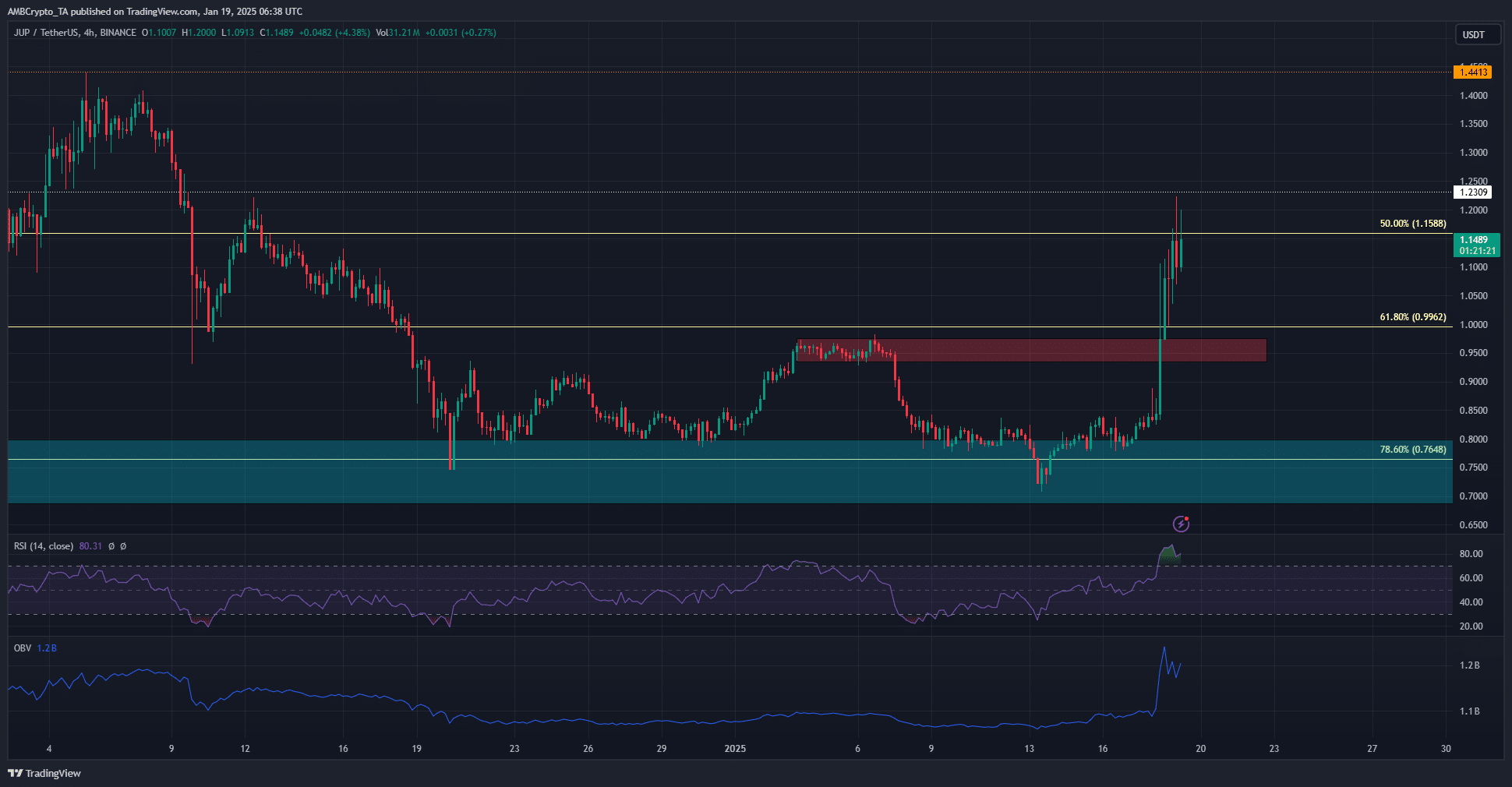

Source: JUP/USDT on TradingView

The H4 chart highlighted the intense momentum of the past few days. The local resistance of $0.95 and $0.99 was easily pushed aside and was barely retested as the crypto price continued to climb higher.

Momentum on the 4-hour chart was oversold, which was not necessarily bearish. However, the OBV dip over the past few sessions indicated some profit taking. A move towards the $0.95-$1 support zone could be possible in the coming days. If tested, this area would present a buying opportunity.

Read Jupiter [JUP] Price forecast 2025-26

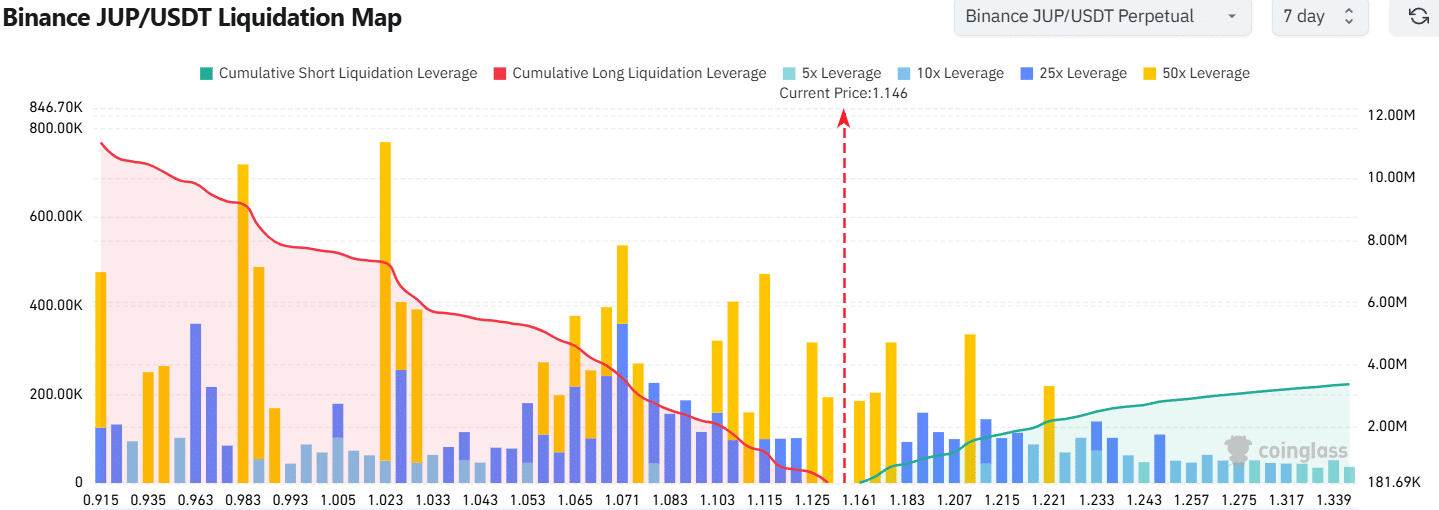

The liquidation map recorded more cumulative liquidation pressure in the south than in the north. Therefore, it is possible that a liquidity chase and a short-term price decline may begin. The $1.11 and $1.06 levels would be the short-term targets in case of such a dip.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer

![Jupiter [JUP] price forecast – 36% increase, but is the risk of profit taking still there?](https://bitcoinplatform.com/wp-content/uploads/2025/01/Jupiter-Featured-1000x600.webp)