- Japan’s ‘MicroStrategy’ plans to buy more BTC for its reserves

- Continued market dynamics could dictate widespread adoption by companies

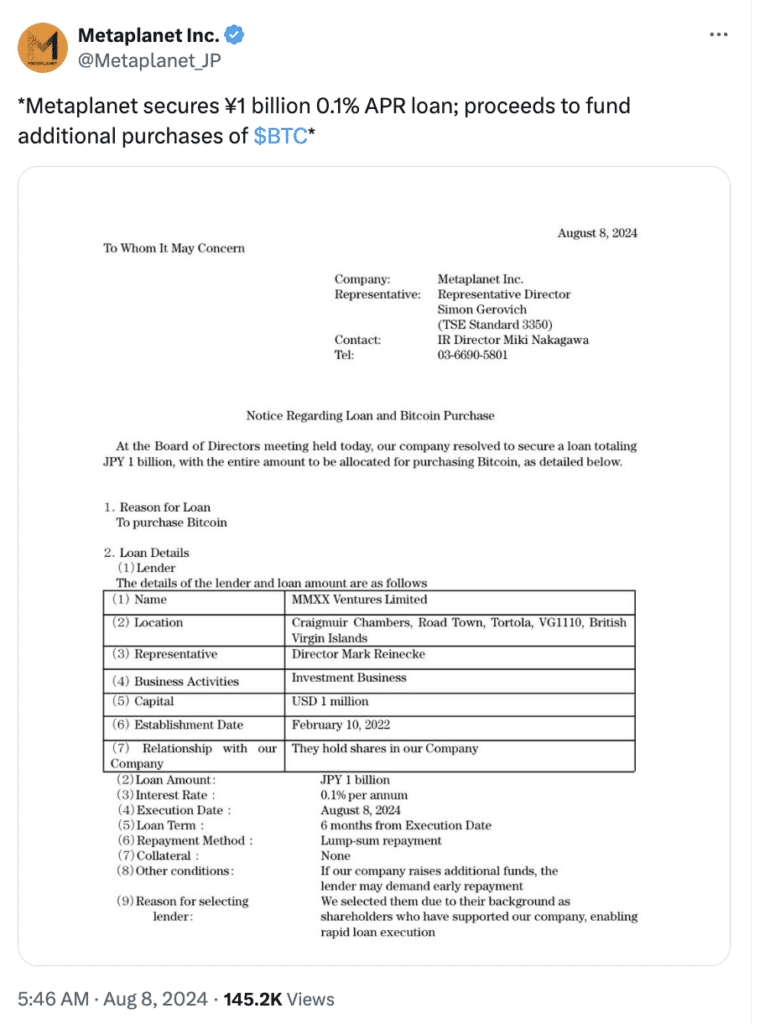

Japan’s Metaplanet has secured a significant loan of JPY 1 billion from MMXX Ventures Limited, a major shareholder of the company, to finance the purchase of additional Bitcoin (BTC). This loan will allow Metaplanet to acquire over 110 BTC, significantly strengthening its cryptocurrency holdings.

Source: X

Not the first step…

This move follows a series of strategic decisions aimed at increasing the company’s BTC reserves. For example, a few days ago Metaplanet announced a free allocation of stock acquisition rights of JPY 10.08 billion, also intended to facilitate the purchase of more BTC.

In addition, the company recently connected the ‘Bitcoin for Corporations’ initiative, which joins a growing number of corporations that view Bitcoin as a viable treasury asset.

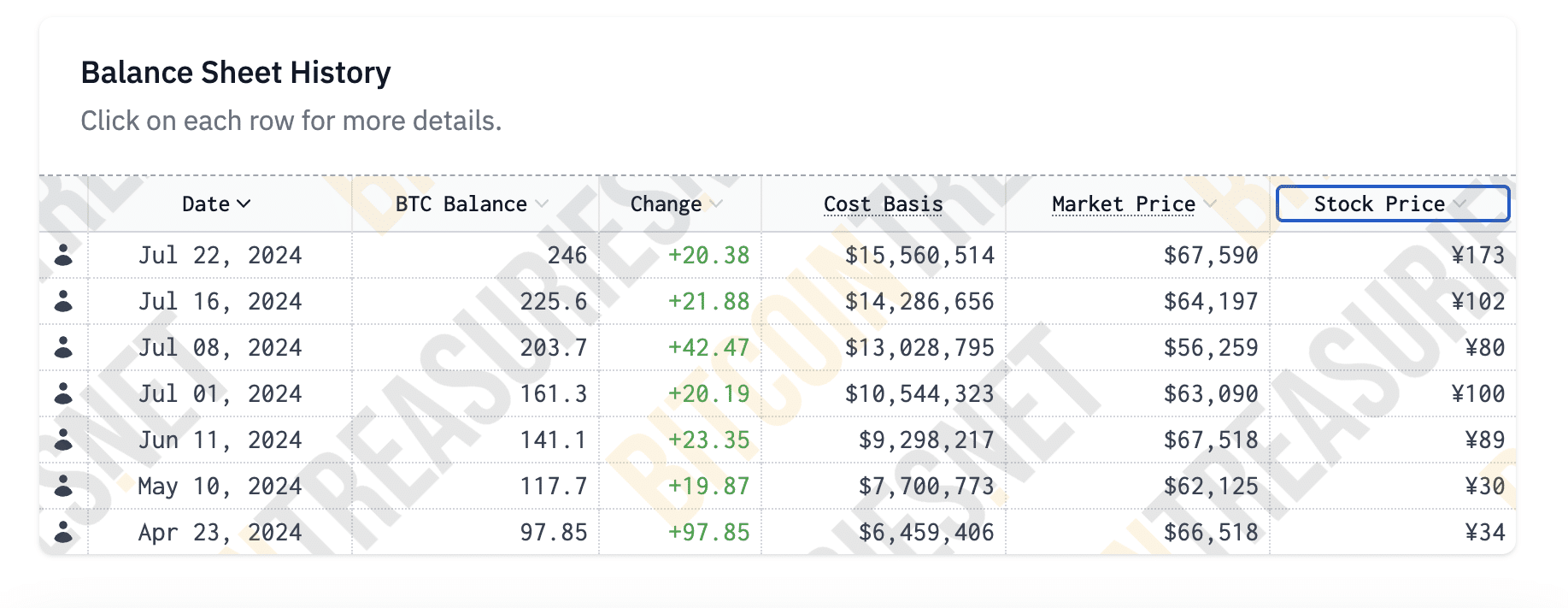

According to Bitcoin Treasuries, Metaplanet currently owns approximately 246 Bitcoin. The company’s aggressive accumulation strategy is a sign of a strong belief in Bitcoin’s long-term value and stability.

By increasing its BTC holdings, Metaplanet aims to hedge against inflation and diversify its asset base, capitalizing on Bitcoin’s potential for high returns and its growing acceptance as a store of value.

However, the decision to dive deeper into Bitcoin and cryptocurrency is determined by several factors.

For starters, Bitcoin’s limited supply and decentralized nature make it an attractive hedge against traditional volatility and inflation in financial markets.

Second, as central banks continue to pursue expansionary monetary policies, companies like Metaplanet see Bitcoin as a hedge against currency devaluation and economic instability.

A trend in the making?

Metaplanet’s bold steps may inspire other listed companies to follow suit. If more companies start holding BTC treasury reserves, it could have a significant impact on Bitcoin’s price. Not only that, but this trend could also burnish Bitcoin’s legitimacy as a credible and mainstream financial asset.

Take MicroStrategy for example: the business intelligence company has already set a precedent by converting a significant portion of its cash reserves into Bitcoin. This move not only increased MicroStrategy’s stock value, but also signaled a shift in the way companies view Bitcoin.

Similarly, Tesla’s announcement of a major Bitcoin purchase also led to a notable price increase.

Moves like this can help companies feel more confident in adopting Bitcoin, an asset that has long faced skepticism from many quarters. Especially in the field of regulations and government.