- iShares Bitcoin Trust shares rose 13% in five days.

- The possible political partnership between Blackrock and Trump and ETF inflows are some of the factors driving this increase.

At the beginning of this year, iShares Bitcoin was released [BTC] Confidence soared following the approval of Bitcoin spot ETFs. Additionally, Blackrock has experienced exponential growth, achieving a record $10.6 trillion in assets under management.

According to the report, the company has added $83 billion in ETFs, with the CEO attributing the company’s growth to strong ETF inflows.

Source: Google Finance

Despite the company’s growth, shares of iShares BTC Trust are down 1.69% over the past six months, according to Google Finance.

However, in a reversal of fortunes, there has been a sustained rise in recent weeks. Over the past five days, shares have risen 13.08%, while they have risen 13.68% over the past 30 days.

The recent increase has led to speculation about the cause of this increase. Therefore, several recent developments have changed the narrative in favor of iShares BTC Trust.

Partnership of BlackRock CEO and Trump

The US political space is currently facing significant influence from the crypto community. As the country prepares for the 2024 presidential elections, crypto is taking center stage.

In a dramatic turn of events, Donald Trump became a pro-crypto candidate. Based on his current position, there are continued reports that he is considering BlackRock CEO Larry Fink for Treasury Secretary.

As reported on various X pages (formerly Twitter), as noted by Satyam Singh,

“Donald Trump Considers #BlackRock CEO Larry Fink for Treasury Secretary.”

These rumors have been received with enthusiasm by various stakeholders within the crypto community. Many believe that appointing a pro-crypto Treasury Secretary is the only way to end the current SEC war on crypto.

iShares BTC Trust: increased inflow

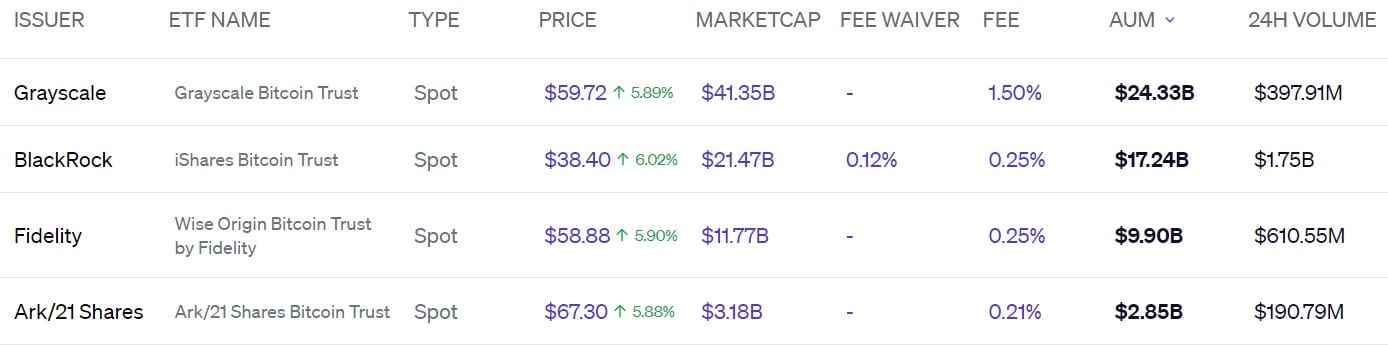

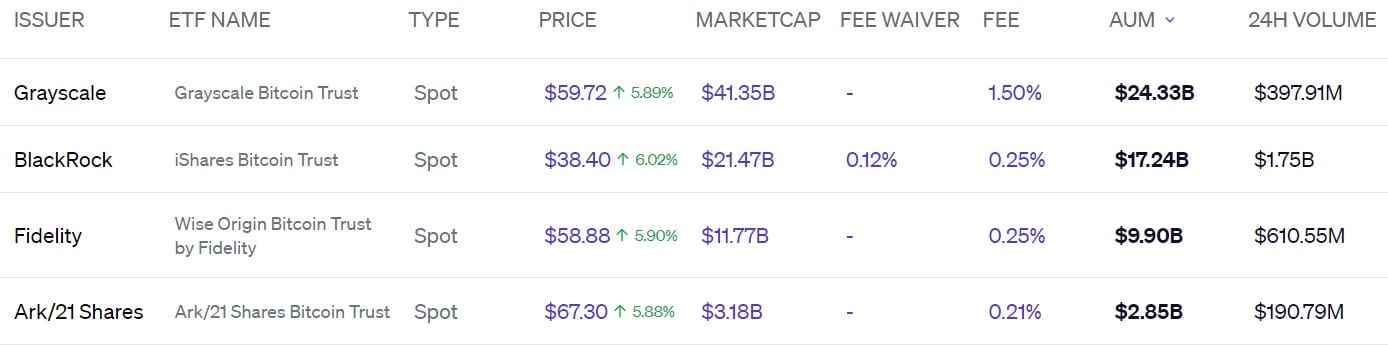

Source: Blokwerken

The adoption of BTC ETFs has undoubtedly become a game changer for several institutional investors. For example, a week ago, BTC ETF inflows reached $310 million in one day, with iShares leading the way.

Increased inflows for iShares BTC Trust rose mainly because it is cheap, with an expense ratio of 0.25%, and investors pay $25 per year for a $10,000 fund.

This affordability has prompted several investors to buy iShares and others, such as Nvidia, to sell. Over the past week, notable individuals have purchased iShares BTC Trust.

First, Ken Griffin of Citadel Advisors started buying iShares’ BTC Trust shares after selling NVIDIA’s stake.

Subsequently, David Shaw and Israel Englander started a significant portion of the iShares BTC trust share, making it one of the largest holdings.

This increased inflow has brought assets under management to $17.24 billion, with a trading volume of $1.78 billion more than other firms.

Bitcoin, a legitimate financial instrument?

Finally, market sentiment towards BTC among institutional investors has changed dramatically. Most institutions investing in BTC are racing to accumulate and anticipate higher returns.

For example, BlackRock has distinguished itself as a vocal proponent of BTC, encouraging recent inflows into iShares BTC Trust.

Read Bitcoin’s [BTC] Price forecast 2024-25

In a recent interview on CNBC, BlackRock CEO Larry Fink acknowledged that BTC can be a legitimate financial instrument.

This endorsement by Larry is important because it provides comfort to investors considering adding BTC ETFs to their portfolio. With this trajectory, iShares Bitcoin stock is well positioned to rise as many investors join the race.