- BTC could be approaching its market top according to the S&P 500 (SPX) correlation.

- However, the MVRV Z-score indicates that bulls still have additional upside potential.

Bitcoins [BTC] The $60,000 to $71,000 price range has entered its third month, and lower chances of Fed rate cuts appear to dampen near-term breakout prospects.

Amid the dull consolidation, one analyst has determined that BTC could be closer to its market top than most think. His evaluation is based on the S&P 500 Index (SPX), crypto analyst CryptoCon noted,

‘Have #Bitcoin tops always been controlled by the stock market? Exactly 134 weeks from each SPX/stock market top to the next Bitcoin top. This makes our next target date range the week of July 29th this year, very soon… interesting.”

Source: X/CryptoCon

According to the analyst, the BTC top always takes place a few weeks after SPX reaches a market cycle top. However, the most intriguing finding was that it took approximately 134 weeks to reach the SPX top from the last BTC cycle top.

Based on this correlation and assumption, BTC could reach the cycle top by the end of July 2024. However, correlations are not the same as causation, and that means an SPX top does not necessarily enable a BTC cycle top.

However, another user seemed to support the SPX/BTC correlation and declared,

‘As the value of SPX rises, investors look further up the risk curve for more profit. This is how liquidity is moving into #BTC and other risky assets

Moreover, there is a recent AMBCrypto report set a warning sign when the Bitcoin network showed stagnation and possible profit-taking activity from the LTH (long-term holders) cohort.

Does BTC have more room to pump?

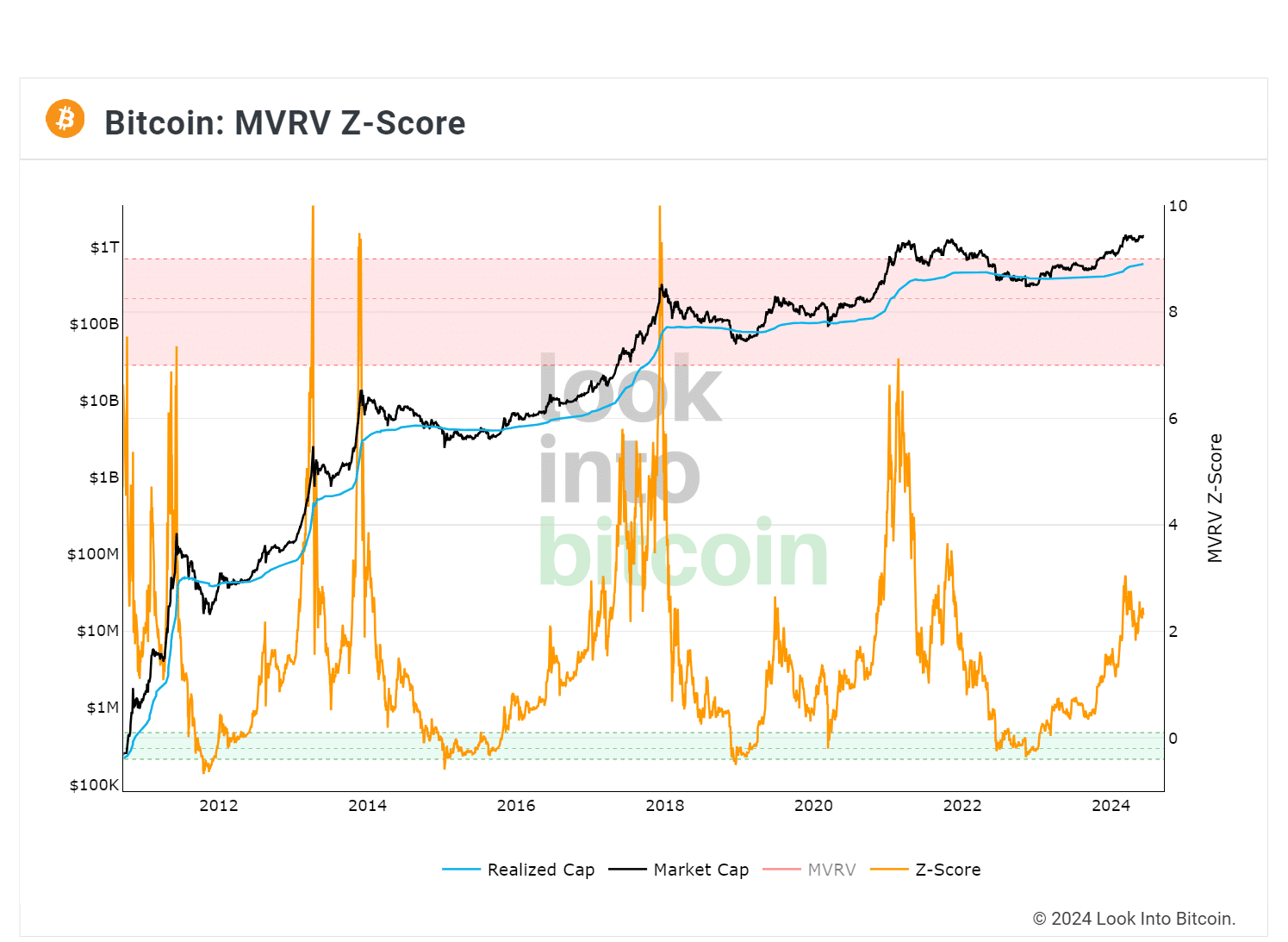

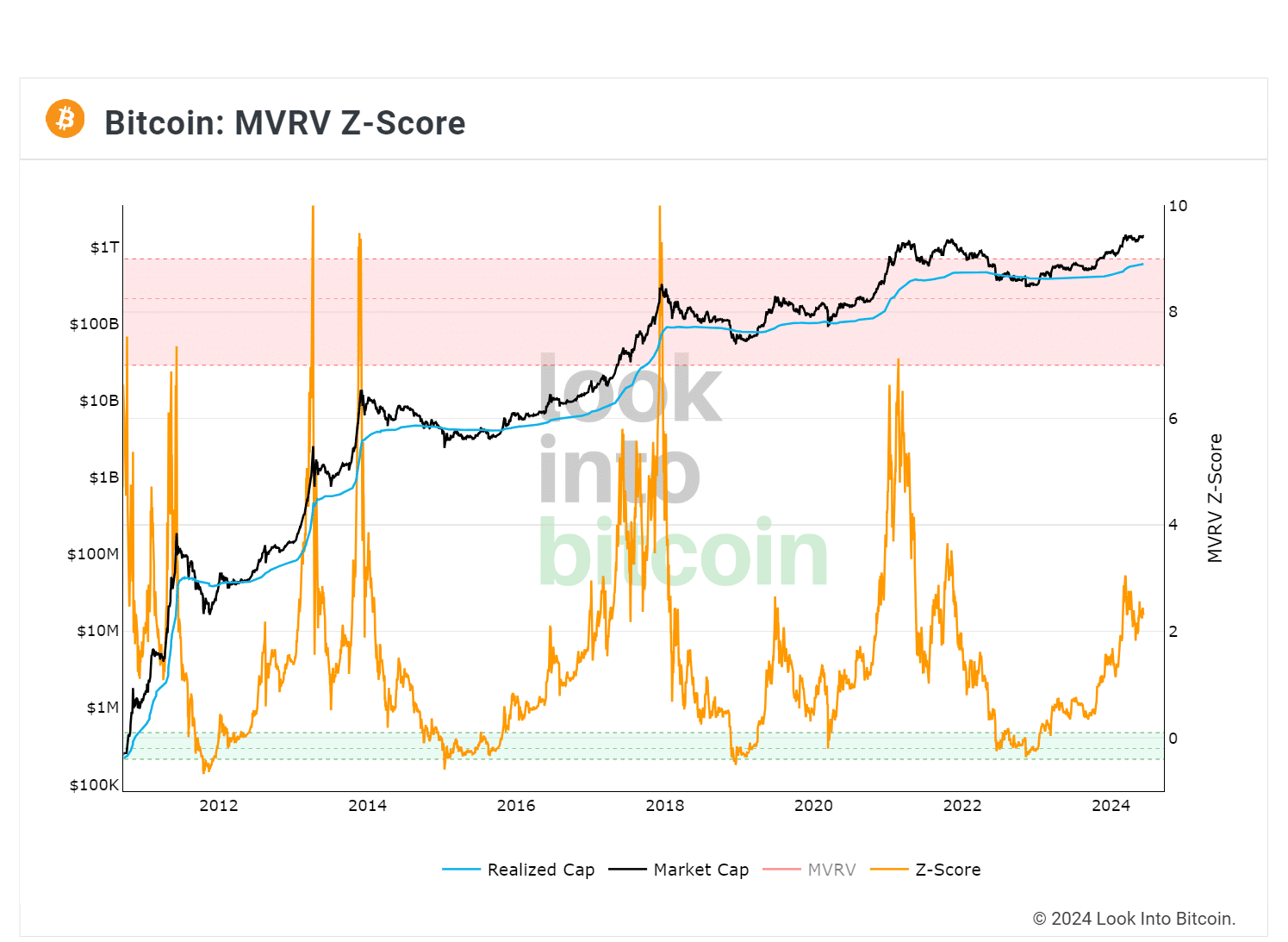

However, the market value to realized value (MVRV) Z-score suggested There was likely more room for upside before the market peaked.

Source: Look at Bitcoin

The MVRV Z-score removes the short-term noise to assess BTC’s undervaluation or overvaluation relative to its ‘fair value’ from a long-term perspective. Historically, BTC topped out when the metric reached the pink area (value 7 – 9).

At the time of writing, the metric was slightly above 2, with plenty of room to reach the pink area if the historical trend were to manifest itself again.

However, another Bitcoin maxi and analyst, Fred Krueger, remained optimistic that BTC would rise if evaluated against gold prices and gold ETF flows. Kruger noted,

Bitcoin has almost doubled in price since the ETF was announced. But this was based on a market cap of 0.7 trillion versus 2.6 trillion for gold. It also suggests that regardless of the flows, we could do another 2x, just as a ‘continuation’.