- The SEC has approved the first leveraged MicroStrategy ETF

- Market indicators suggested an upward move for Bitcoin

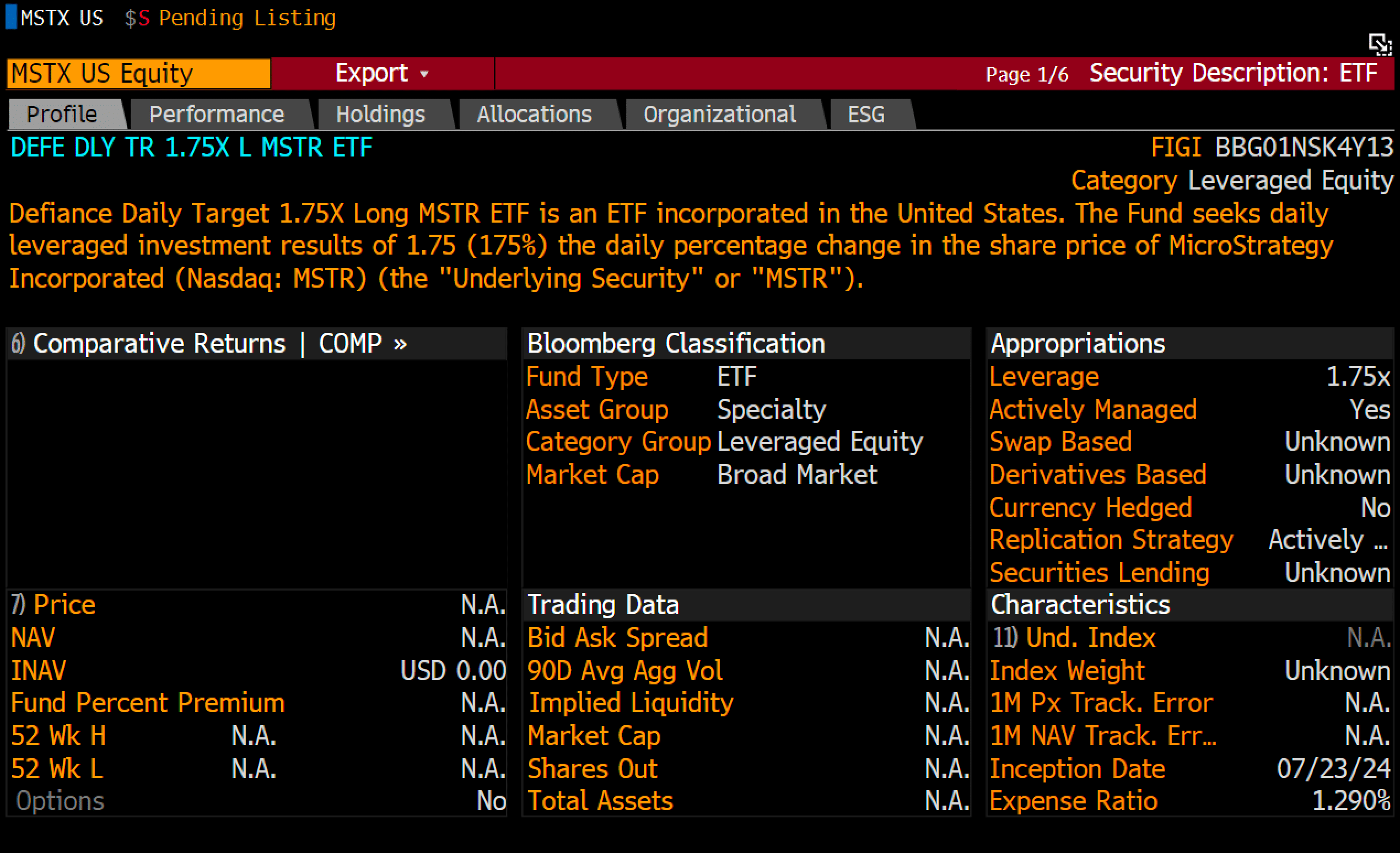

The SEC is in the news today after approving the first leveraged MicroStrategy ETF, launched by Defiance as a 1.75x fund ($MSTX). This update was first shared by Bloomberg’s ETF analyst Eric Balchunas on X.

Although initially intended as a 2x ETF, SEC restrictions limit leverage. This ETF will be highly volatile, comparable to a 13x SPY ETF, and even surpass the $MSOX (2x weed ETF) in risk.

Source: Eric Balchunas about X

Defiance has beaten Tuttle to the market with this product, although Tuttle is also trying a 2x MicroStrategy ETF.

The market for highly volatile ETFs is strong, evidenced by the $5 billion Nvidia 2x ETF. This approval could be a sign of greater buying pressure and bullish sentiment for Bitcoin.

USD cycles, treasury and BTC bull markets

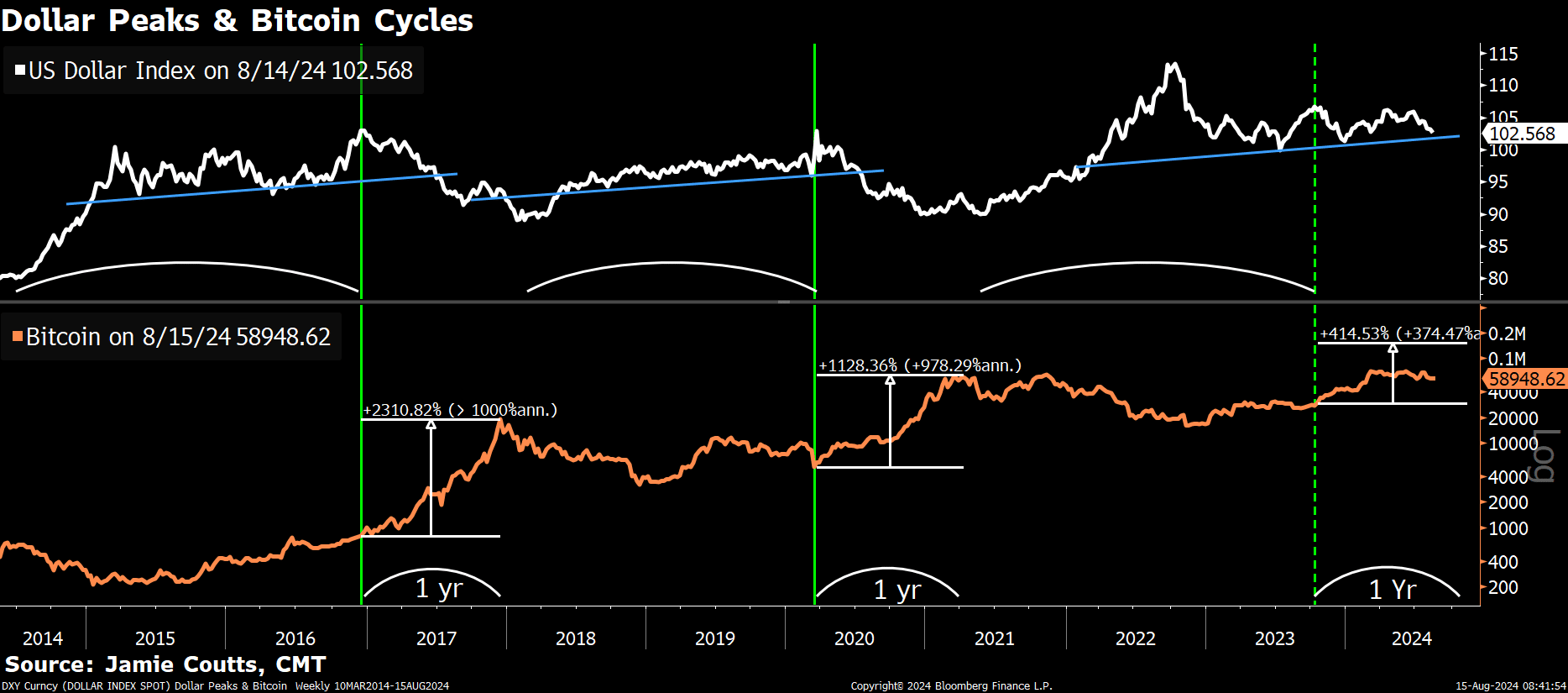

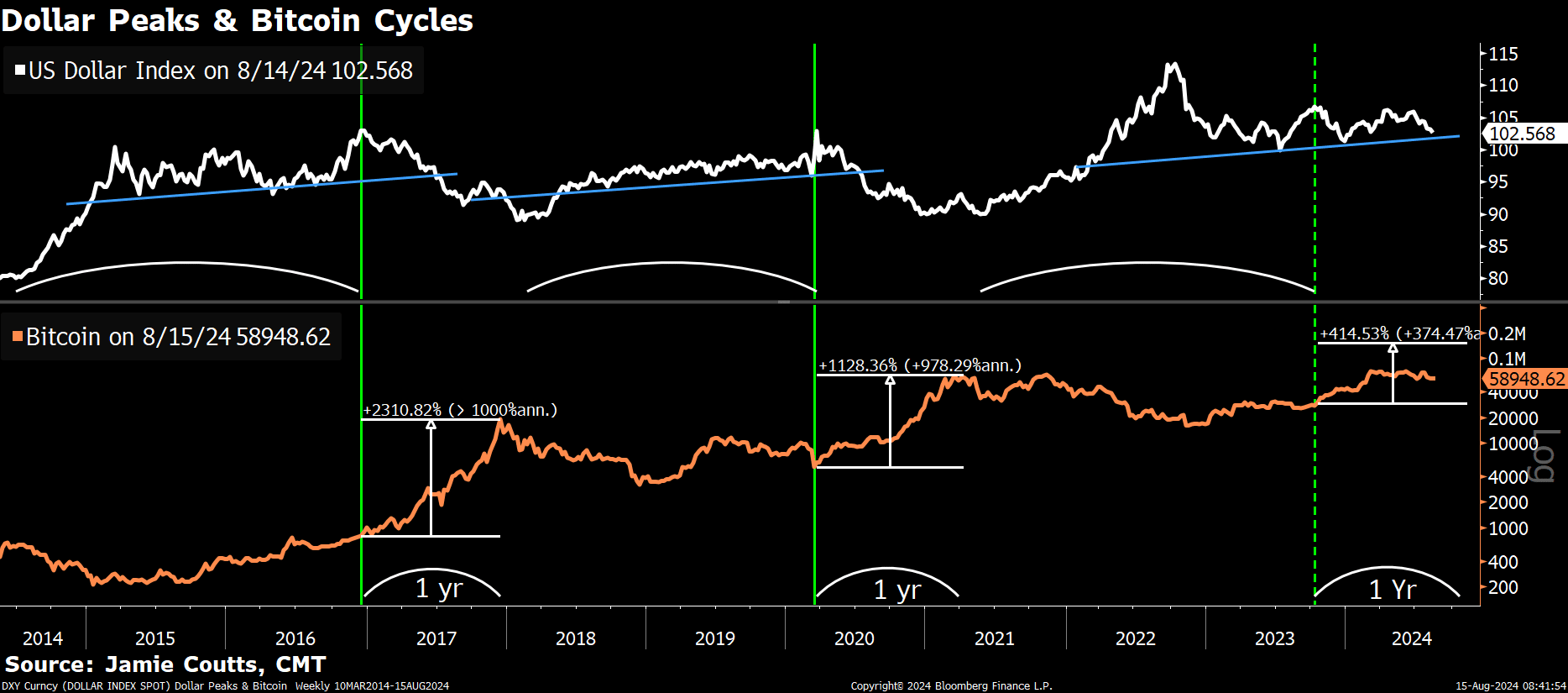

Bitcoin [BTC] tends to rise the most when the US dollar ($DXY) weakens. The Federal Reserve’s actions and increased global liquidity will likely cause the DXY to decline.

The DXY has now reached equal highs, indicating a possible reversal. As the DXY falls, Bitcoin is expected to move higher and possibly surpass its all-time high on the charts.

Source: Bloomberg

Volatility in the government bond market is a crucial but often overlooked factor in shaping risk asset strategies. It’s a major concern for Federal Reserve Chairman Jerome Powell and his team.

To avoid market instability, they aim to reduce the volatility of government bonds. As a result, this suppressed volatility could shift to Bitcoin, potentially driving its price higher.

Source: Bloomberg

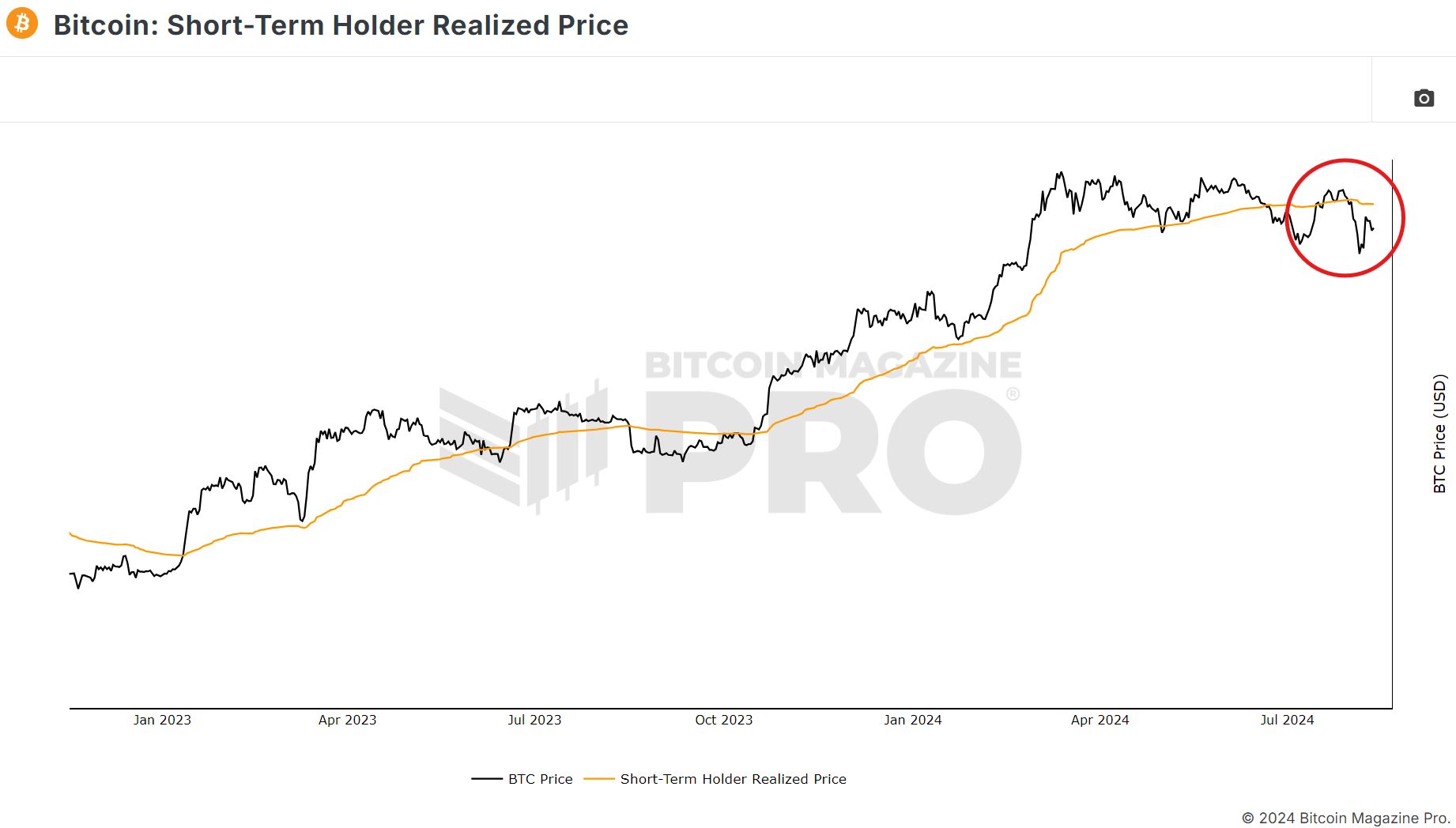

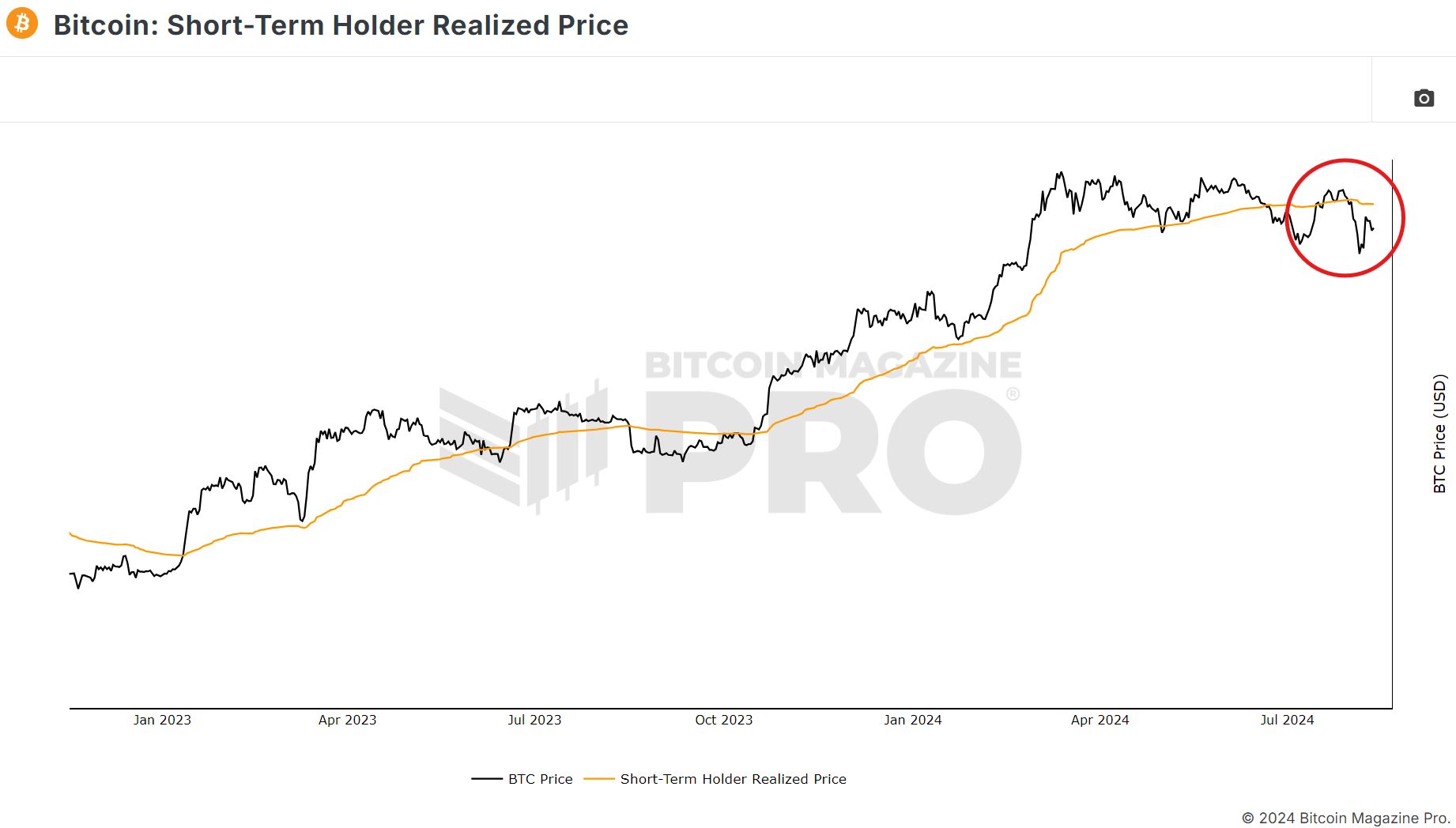

Bitcoin is also showing strong momentum, breaking above the Short-Term Holder Realized Price of around $65,000.

If this level makes it back onto the charts, it could serve as a foundation for Bitcoin to push towards the $70,000 mark and possibly beyond. This achievement strengthens Bitcoin’s position as a top choice for crypto investments.

Source: Bitcoin Magazine PRO

Leverage liquidations and RSI indicate bullish sentiment

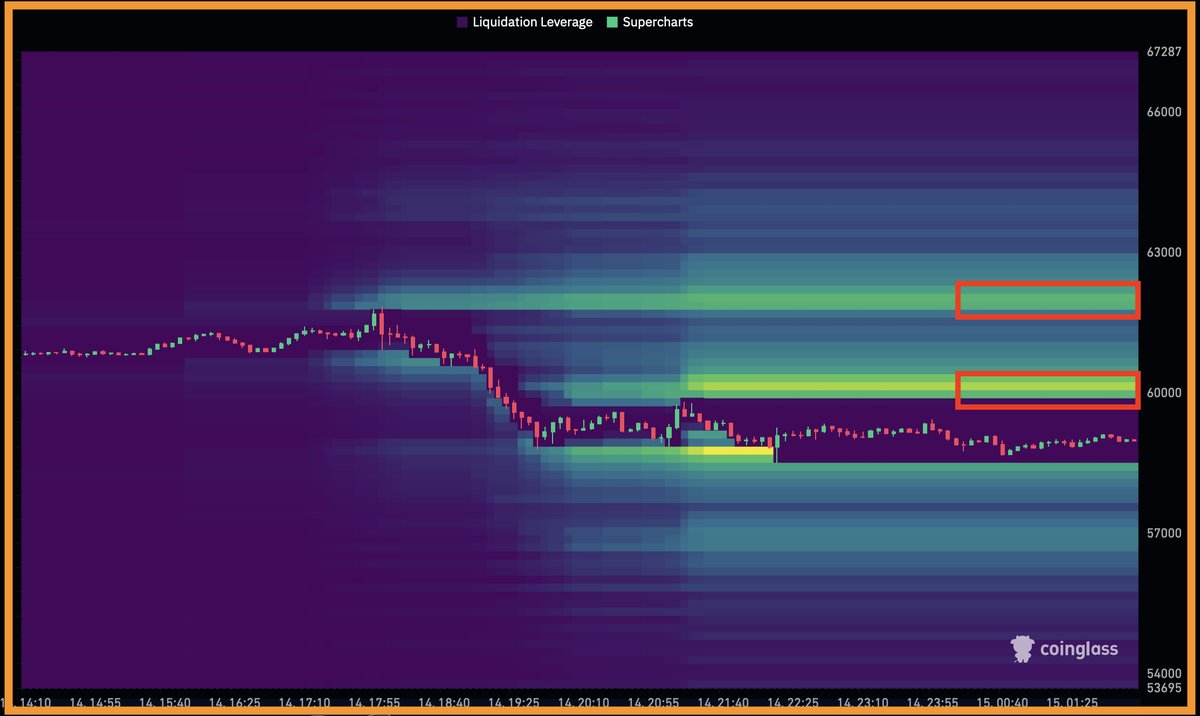

Leverage liquidation hunting is a key factor that causes price movements over long time frames.

Bitcoin could rise and remain above $60,000, triggering liquidations, with $93 million between $60-60.4K, and another $75 million between $61.8-62.2K.

This could see Bitcoin surpass its previous all-time high of $74,000, potentially leading to even higher prices.

Source: Coinglass

Finally, Bitcoin’s Stochastic RSI indicated that BTC will enter a “Rebound Zone” in the coming months. TThis is an important opportunity for traders and investors to accumulate Bitcoin before its price potentially rises.

What this indicator also implies is that there is a good chance that BTC will reach new highs, reinforcing the idea that this is a strategic time to invest in Bitcoin.

Source: Trader Tardigrade, TradingView