- Doge has been consolidating for more than a month around the level of $ 0.16, which suggests a possible travel phase.

- Vigilance is advised because market dynamics can change quickly.

Dogecoin [DOGE] has withdrawn into the critical 50% -61.8% Fibonacci retracement zone, a historically strong level of support. This pullback has been fueled speculation With regard to an imminent outbreak.

At the time of the press, Doge acted at the same level that it held before the election rally, so that all the profit knew from his peak of $ 0.48.

However, the monthly consolidation of approximately $ 0.16 suggests a travel accumulation phase, in which RSI reflects back from over -sold territory, which points to potential bullish divergence.

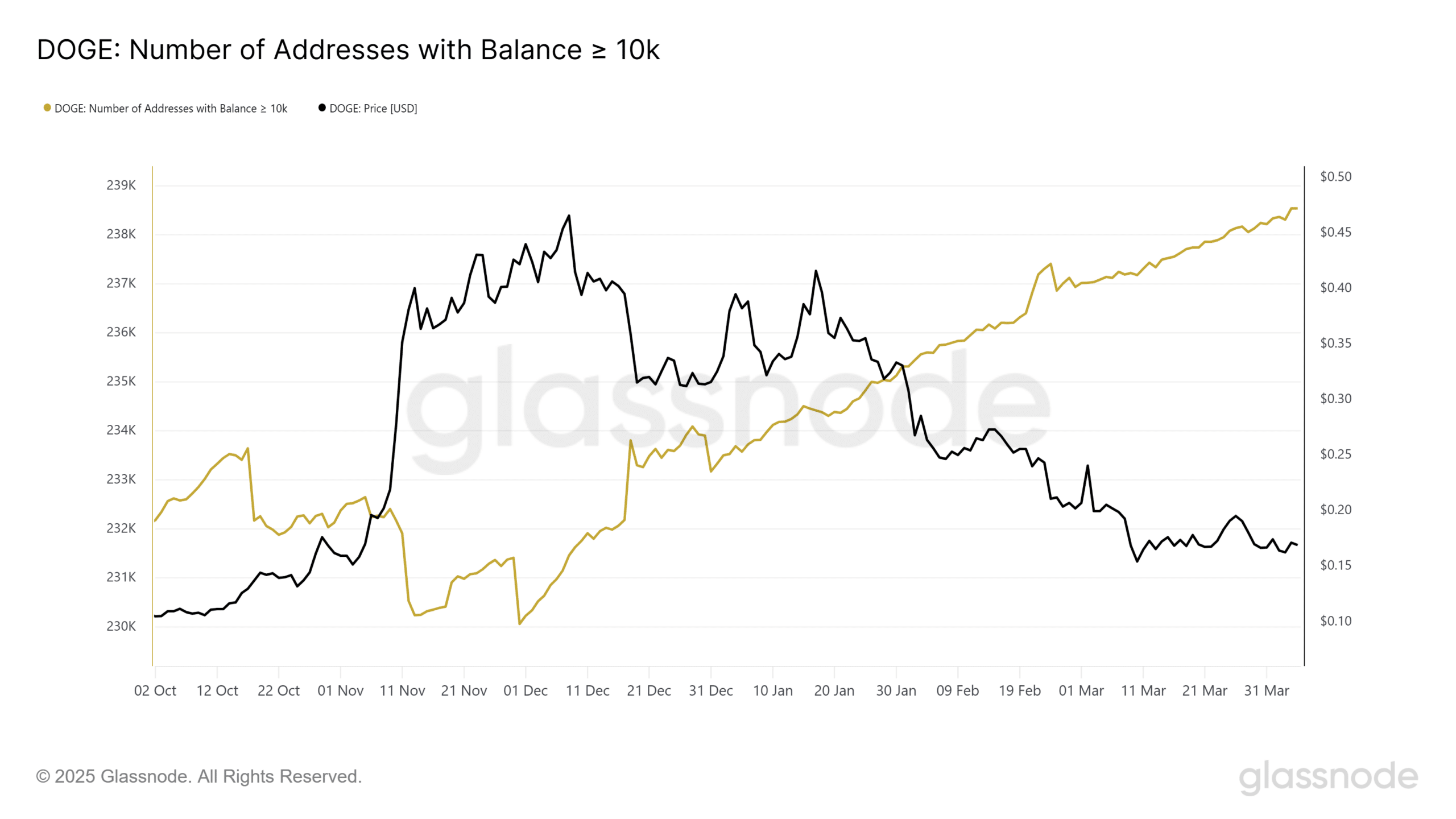

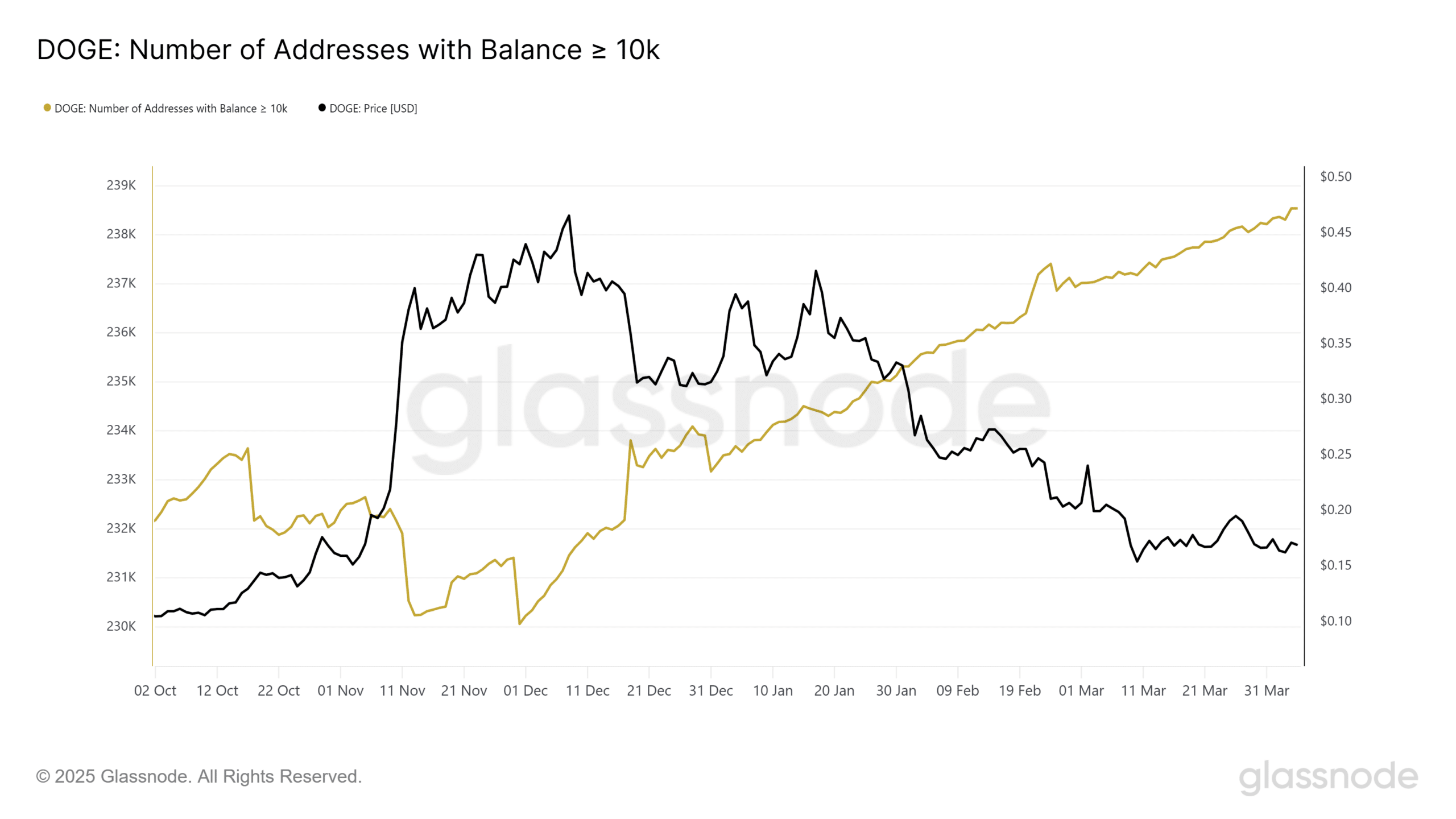

On-chain statistics reinforce this accumulation cancellation. As illustrated in the graph below, the number of unique addresses with at least 10,000 doge has risen from 236k to 240K last month.

Source: Glassnode

In fact, this increase of six months is high. Hence a strong indication of increasing middle and whale participation.

Given the strong historical attraction of Doge with large holders, an outbreak has merit after this battery phase.

However, the high-risk, High-Baarding character, however, leaves it exposed to short -term volatilityAs can be seen in his recent 2% dip. Can Dogecoin defy the opportunities in Q2?

Doge’s historical price promotion indicates a parabolic movement

A similar pattern was created in his B1 outbreak in 2024. During that cycle, the DOGE consolidation phase acted as a precursor of volatility stabs.

By the end of the quarter, Dogecoin hit $ 0.22 and a market capitalization of $ 28 billion, which kept his place as the 10th largest cryptocurrency.

Source: TradingView (Doge/USDT)

With the alignment of the technical and institutional interest rate that increases, a potential repetition of his earlier Bullish Cycli is plausible. In particular open interest (OI) The rally mirrorsMaintaining levels above $ 1 billion.

For a memecoin whose earlier increase was fed by high -profile ‘hype’, his core driver seems to have decreased. The result has been considerable: Doge has seen more than $ 3 billion in liquidations in Q1 alone.

Although historical patterns suggest a potential recovery, these liquidations must be absorbed to form a bullish market structure at both spot and futures markets for Doge to break from its current consolidation phase.