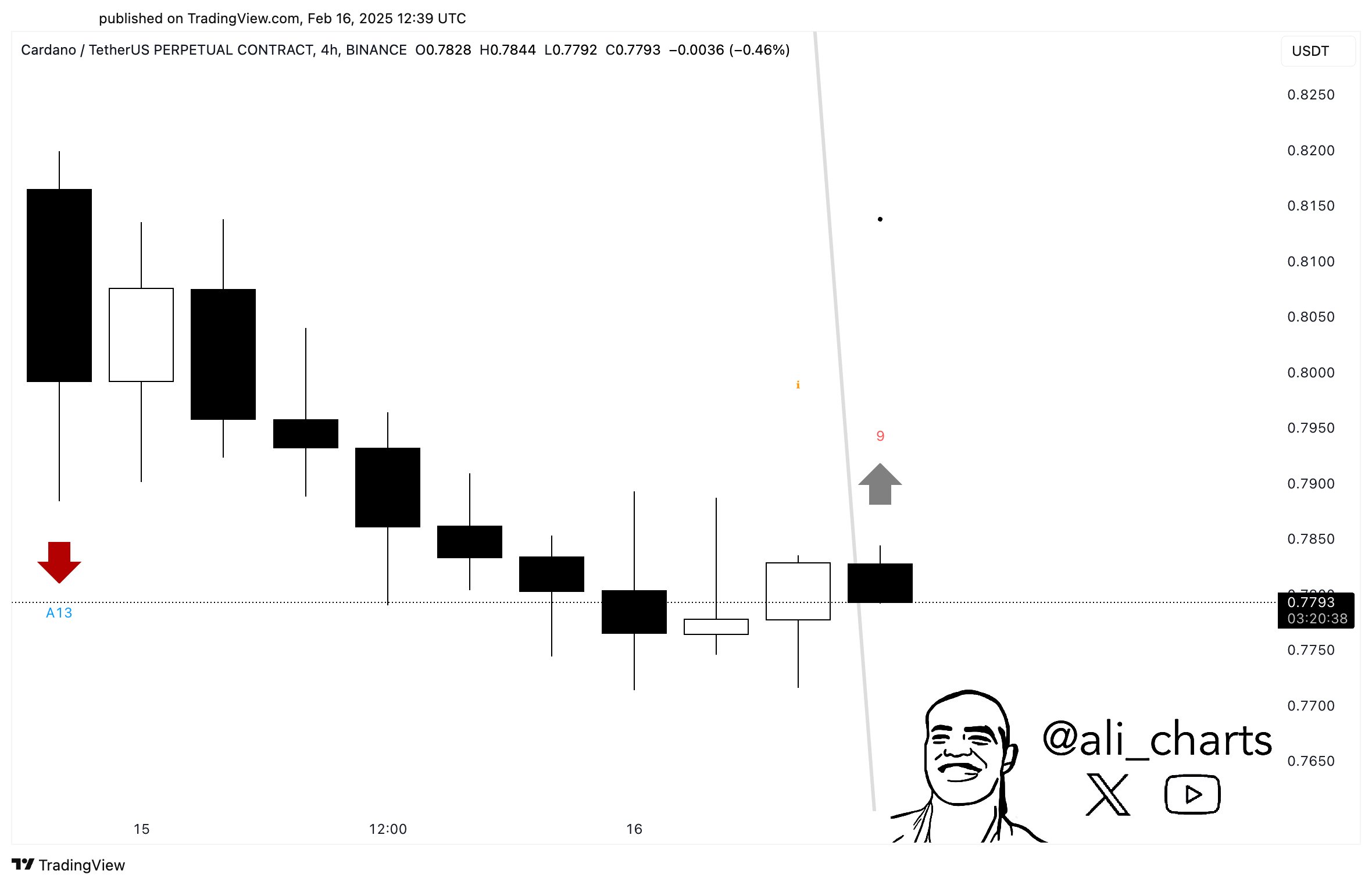

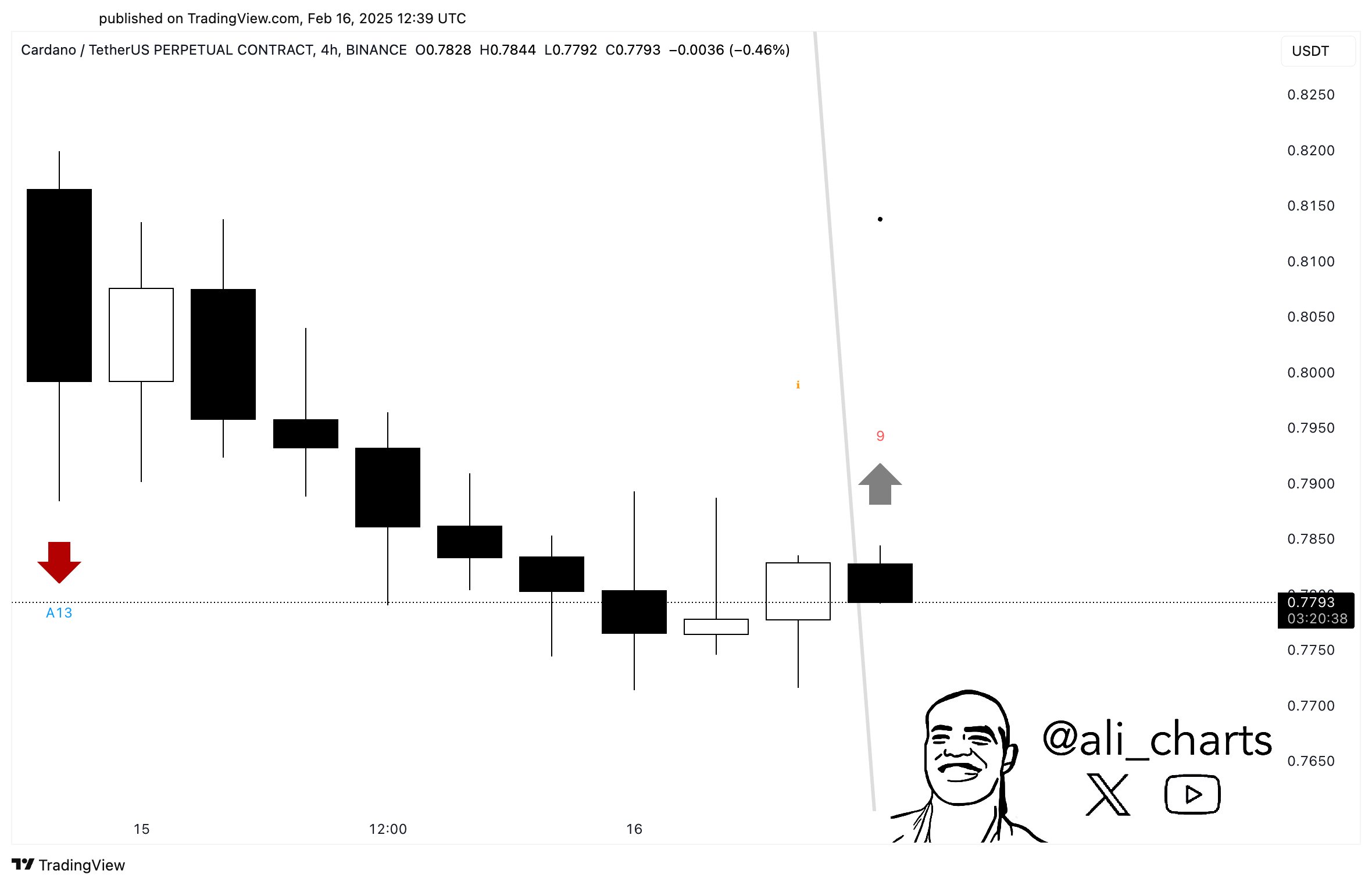

- Ada seems ready to rebound, because the TD sequential indicator flashes a purchase signal on the 4-hour graph.

- Will Ada rise further and achieve higher goals?

Cardano [ADA] Formed a symmetrical triangle at the time of the press, which indicates a consolidation phase before a potential outbreak. This triangular pattern is a typical precursor of a considerable price movement.

This also suggests that Ada can break out to higher levels once the top is reached.

Source: Coinglass

The price action within the Triangle indicated a balance between buying and selling pressure, but the final outbreak will probably offer the necessary momentum for an increase.

Moreover, the EMA-Kruis visibly demonstrated in the beginning that the EMA of 9 years was above the EMA of 26-periods, which indicates a Bullish Crossover.

This suggests that the short -term trend goes up, which further supports the possibility of an outbreak. The cross implies a shift in Momentum to the buyers, which indicates that Ada will soon be able to experience a price increase.

The Crypto Fear & Greed Index at 51 further confirms the neutral sentiment, which corresponds to the stability in the triangle.

Although this index does not indicate extreme bullishness, it reflects a cautious optimism that can push ADA higher as the market conditions stabilize.

A reversal on the horizon

Also, per analyst Ali Martinez, he flashed a Sequential Indicator a purchase signal (A13) on the 4-hour graph of ADA. The TD sequentially is used to identify trend exhausting points and potential reversations.

Source: Ali -Hitlists

That is why the appearance of a purchase signal indicates that the Bearish trend may be over for bullish reversal.

This is in line with the price promotion and the EMA Crossover and supports the case for ADA to break out of its consolidation and goes to higher goals of $ 0.85 and $ 0.90.

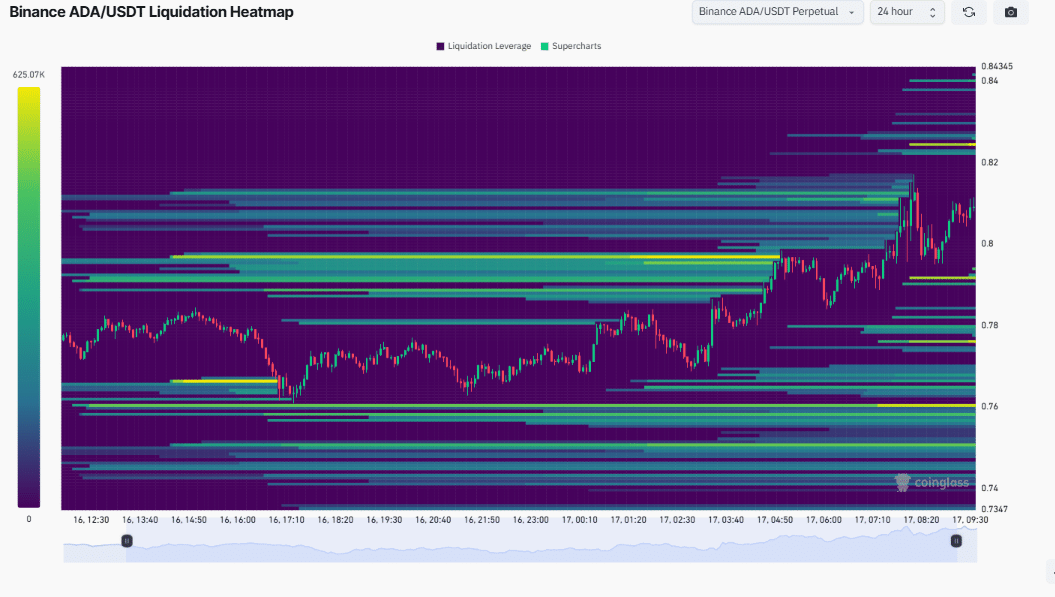

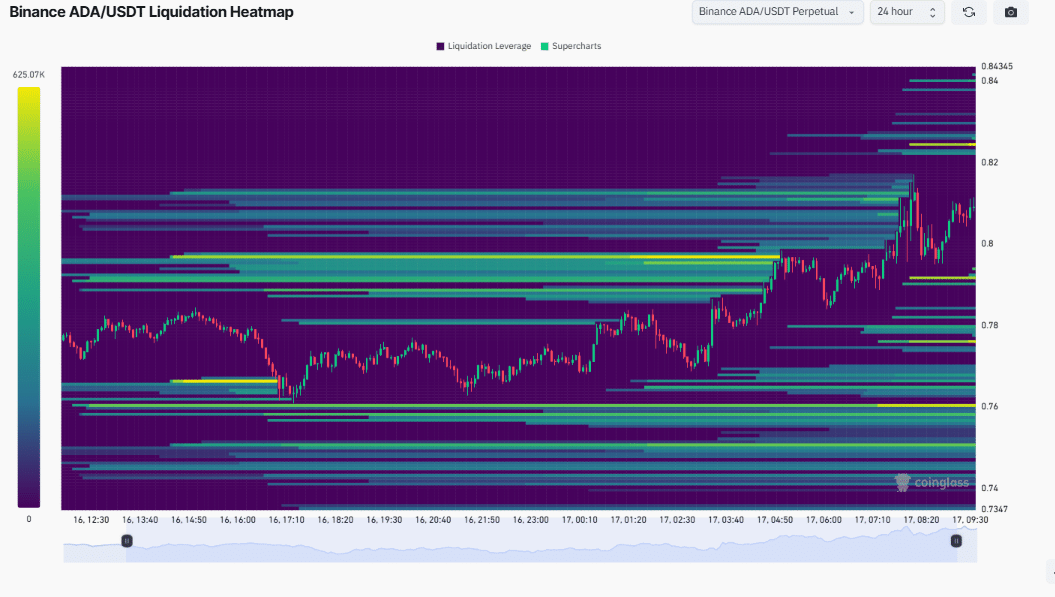

Can short pressing Ada ride higher?

Surely, Ada’s liquidation Heatmap emphasized a strong concentration of liquidations around the range from $ 0.80 to $ 0.82, suggesting that a considerable number of traders in this area had been placed.

Source: Coinglass

If Ada breaks this reach, this can cause extra purchasing pressure due to the forced closure of short positions. This creates a feedback job that pushes the price even higher.

The heat folder also revealed substantial liquidation levels under the current price. Although there is some sales pressure, the market has more room for the benefit before the liquidation cascades are activated.

This is in line with the potential outbreak that we expect from the symmetrical triangular pattern.

Most important indicators for a bullish

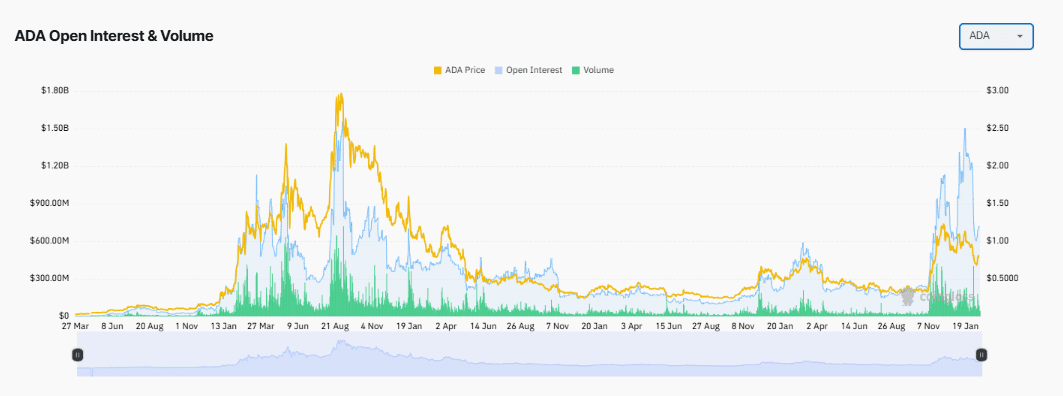

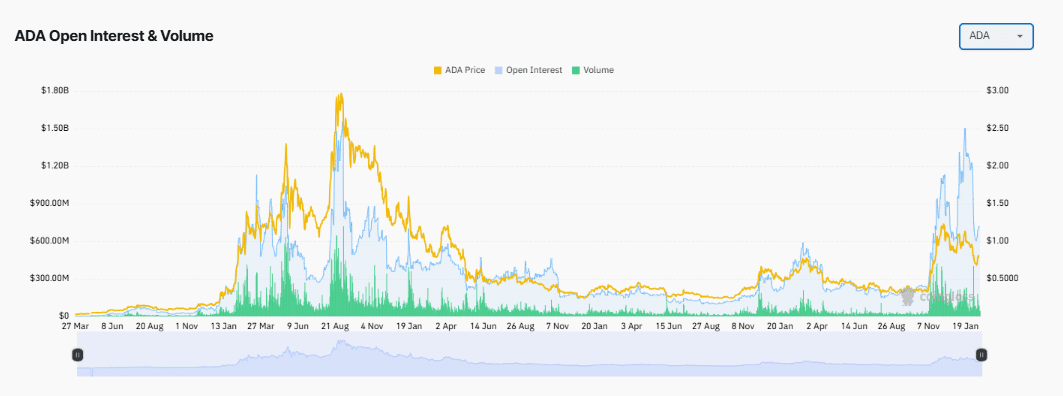

Analysis of the open interest and volume of ADA means that more traders enter the market and take positions in actively, which indicates trust in its price movement.

Source: Coinglass

In combination with an increasing volume, which is a sign of active participation, this suggests that there is strong support for the bullish prospects of ADA.

As more positions are opened, the liquidity and momentum Ada can push to its goals.

The graph also shows a substantial volume in recent trade sessions, and emphasizes that the purchasing interest is intensify.

This volume wave provides confirmation of the price action and the TD sequentially buying signal. It suggests that Ada could indeed be on the edge of an outbreak, especially if the current trend continues.

In conclusion, if Ada breaks above the upper limit of the triangle, this can focus on $ 0.85 in the short term.