- Bitcoin whales have been aggressively accumulating BTC since the pandemic disrupted traditional assets.

- Is this the harbinger of a massive bull rally?

Bitcoin [BTC] breaks $100,000, proving once again that the crypto market is thriving on its first-quarter bullish streak. But this time, a decade of change lies behind this six-figure milestone.

Just ten years ago, BTC started the year at $314. Fast forward to 2025, and it’s up 29,639%.

But it’s not just about numbers. AMBCrypto reveals the hidden factor behind this wave – one that will reshape the market. But will it be for good or for bad?

Be prepared, a big shock is coming

Although Bitcoin whales only make up 1.25% of the network, they have been crucial in helping BTC break major psychological targets.

This shift really accelerated during the 2020-2021 cycle, as the post-pandemic boom pushed investors away from traditional markets.

In response, BTC broke $20,000 for the first time in 2021, with addresses holding more than 10,000 BTC reaching 150,000.

That’s why, when the market gets tough, retail investors turn to these HODLers for guidance.

Even the $100,000 breakthrough (at the time of writing) happened as major players scooped up more BTC, leading to a huge inflow of retail capital.

But now a growing debate surrounding “centralization” is flaring up on the Bitcoin network. Some argue that if more BTC is concentrated in fewer hands, the market could become more vulnerable to sudden fluctuations.

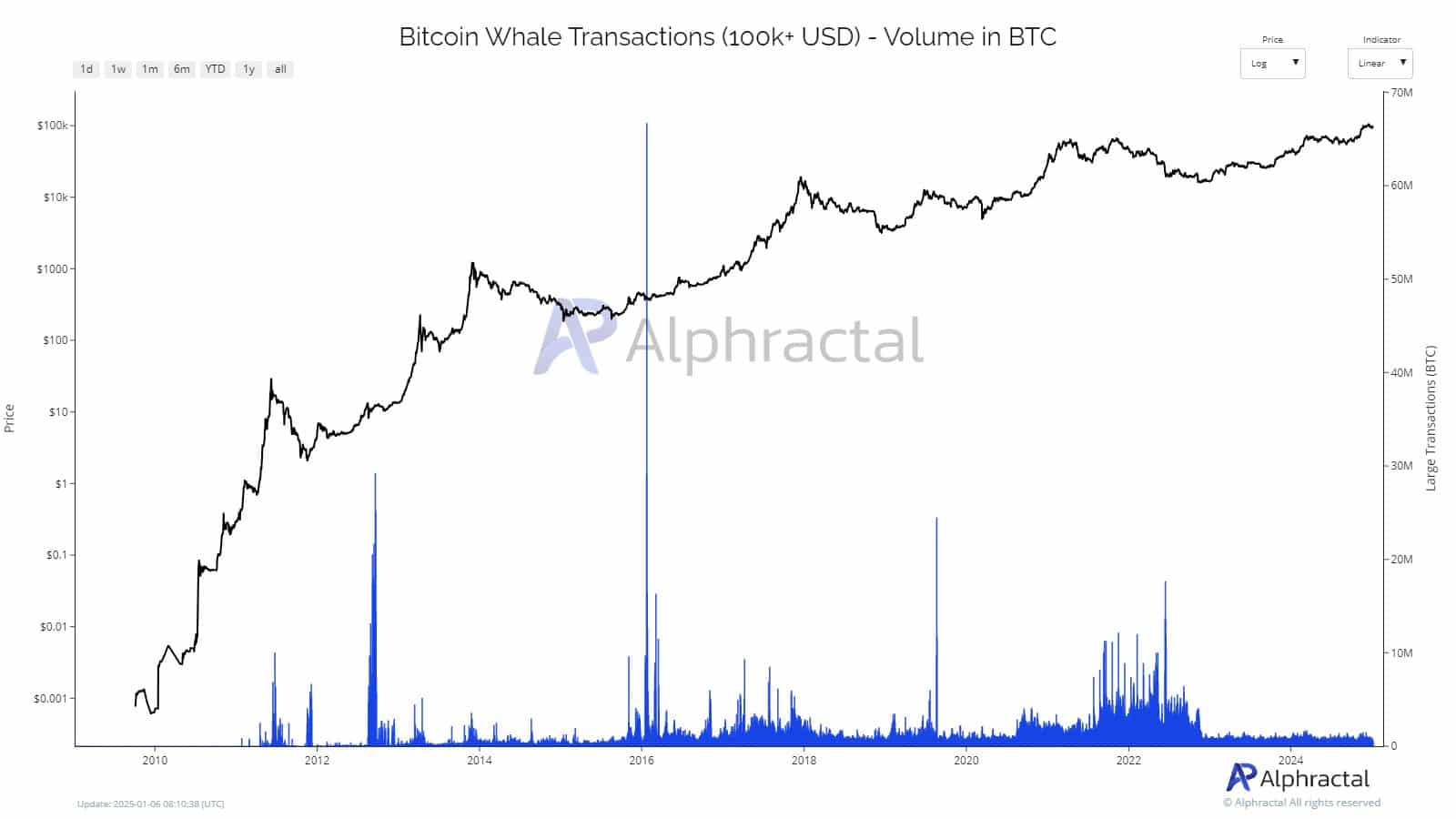

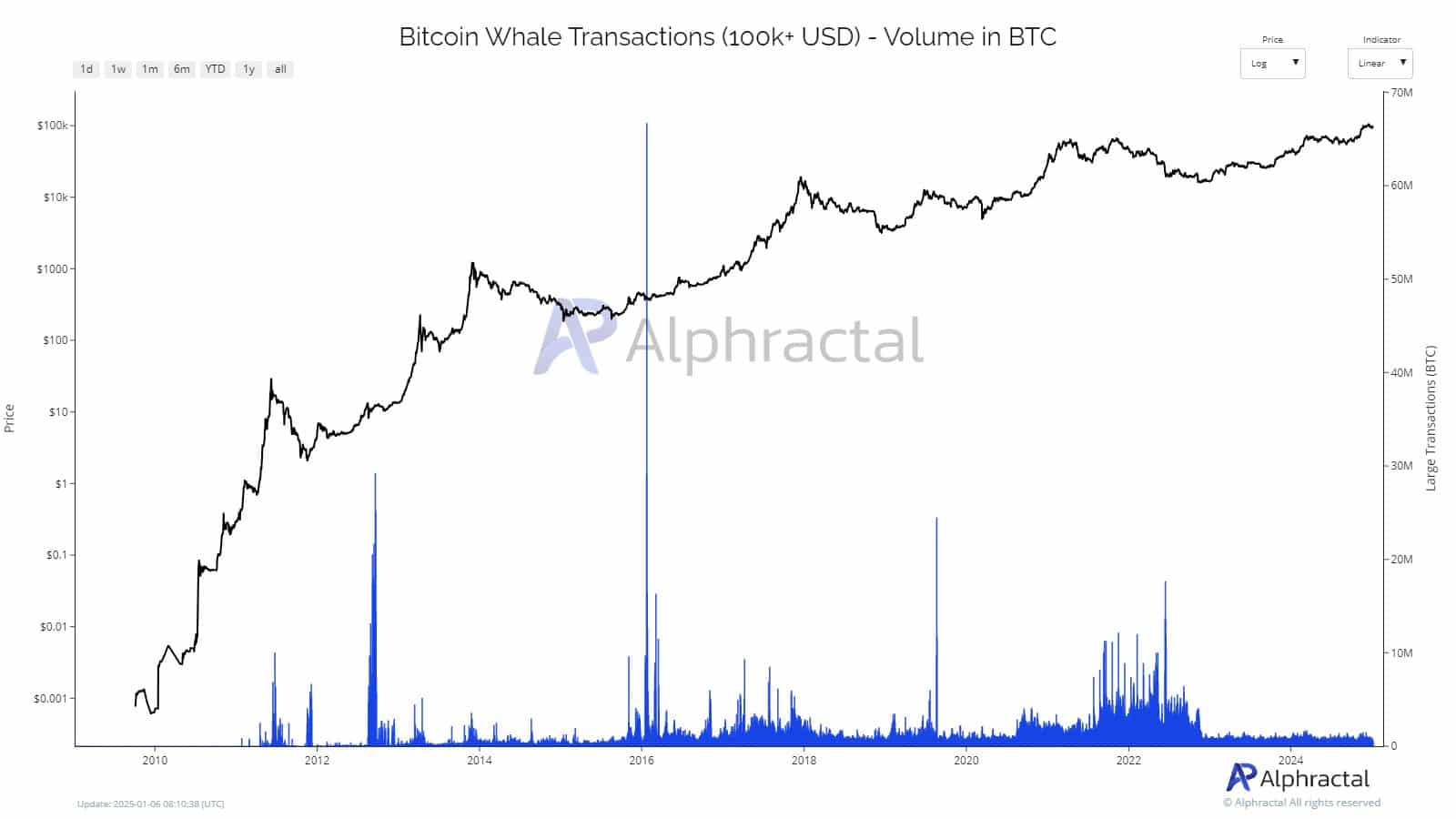

But here’s the twist: the volume of BTC moved by whales has fallen to levels not seen since 2016. In other words, BTC outflows to exchanges have slowed dramatically over the past decade.

Source: Alpharactal.com

Why does this matter? This challenges the idea that Bitcoin whales manipulate the market.

As whales accumulate more BTC and transaction volume decreases, we could actually be on the brink of the biggest supply shock Bitcoin has ever seen.

Bitcoin whales are gearing up for 2025

Right now, the crypto market is in a phase of great euphoria, with BTC having recovered $102,000 after exactly two weeks. A combination of factors is fueling this increase, both inside and outside the market.

This time, however, things look different than the previous cycle, when Bitcoin struggled at $108,000 due to economic concerns and the Fed’s cautious stance.

With Trump’s inauguration around the corner, the history of bullish trends in the first quarter and the massive capital inflows from both institutional and retail investors, the stage is set for a potential rally that could go much higher.

Furthermore, Bitcoin whales show stronger confidence in BTC as a store of value. This shift suggests that the era of wild price swings is behind us.

Read Bitcoin’s [BTC] Price forecast 2025–2026

So as Bitcoin’s distribution becomes more stable, its volatility is steadily decreasing – paving the way for an even bigger cycle ahead.

Because with this shift, BTC is ready to weather the inevitable market storms of 2025. In fact, it could even position BTC as a safer bet, potentially outpacing riskier assets in the coming year.