- Bitcoin dominance is a key indicator for determining the future trajectory of altcoins.

- Currently, Bitcoin and altcoins are emerging as two different asset classes.

Many prominent analysts have noted that this market cycle is different from previous ones, with a shift from speculative trading to a more sustainable, fundamentally driven rally. This optimism is fueled by the belief that Bitcoin’s next phase could lead to a $100,000 bull run.

As a result, in just under a week, Bitcoin [BTC] rose to a new all-time high of $93,000, with market dominance around 70%. This was driven by a confluence of factors, including post-election liquidity, FOMC rate cuts and, most significantly, the post-halving impact.

However, despite the initial optimism, speculative pressure has emerged, preventing Bitcoin from reaching its target as it has now consolidated below $90,000 for two consecutive days.

Typically, such consolidation in this ‘high risk’ range could indicate a shift of capital from Bitcoin to other lower risk assets. However, according to AMBCrypto, a hidden pattern suggests that this shift is actually happening.

History shows that altcoins are ready to break the resistance

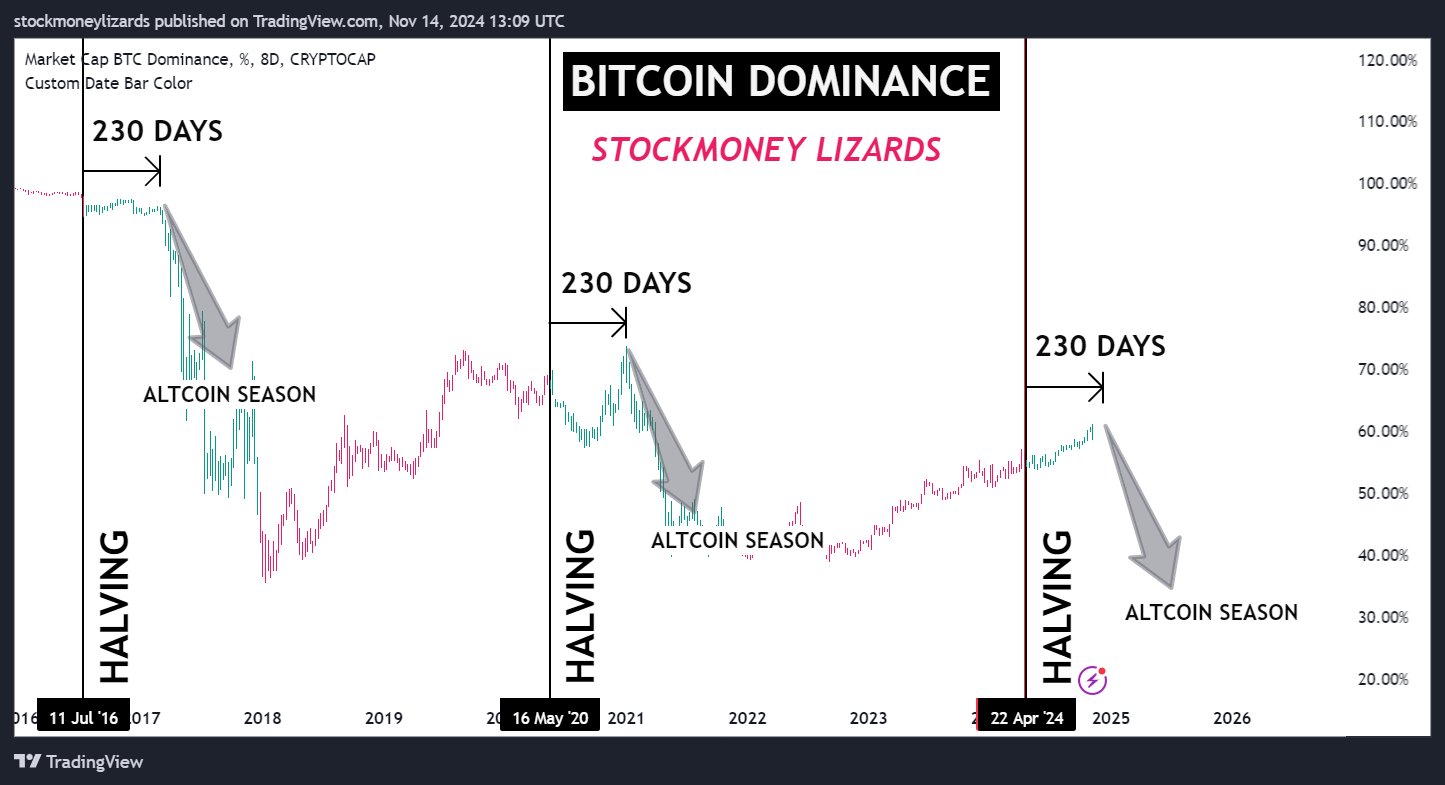

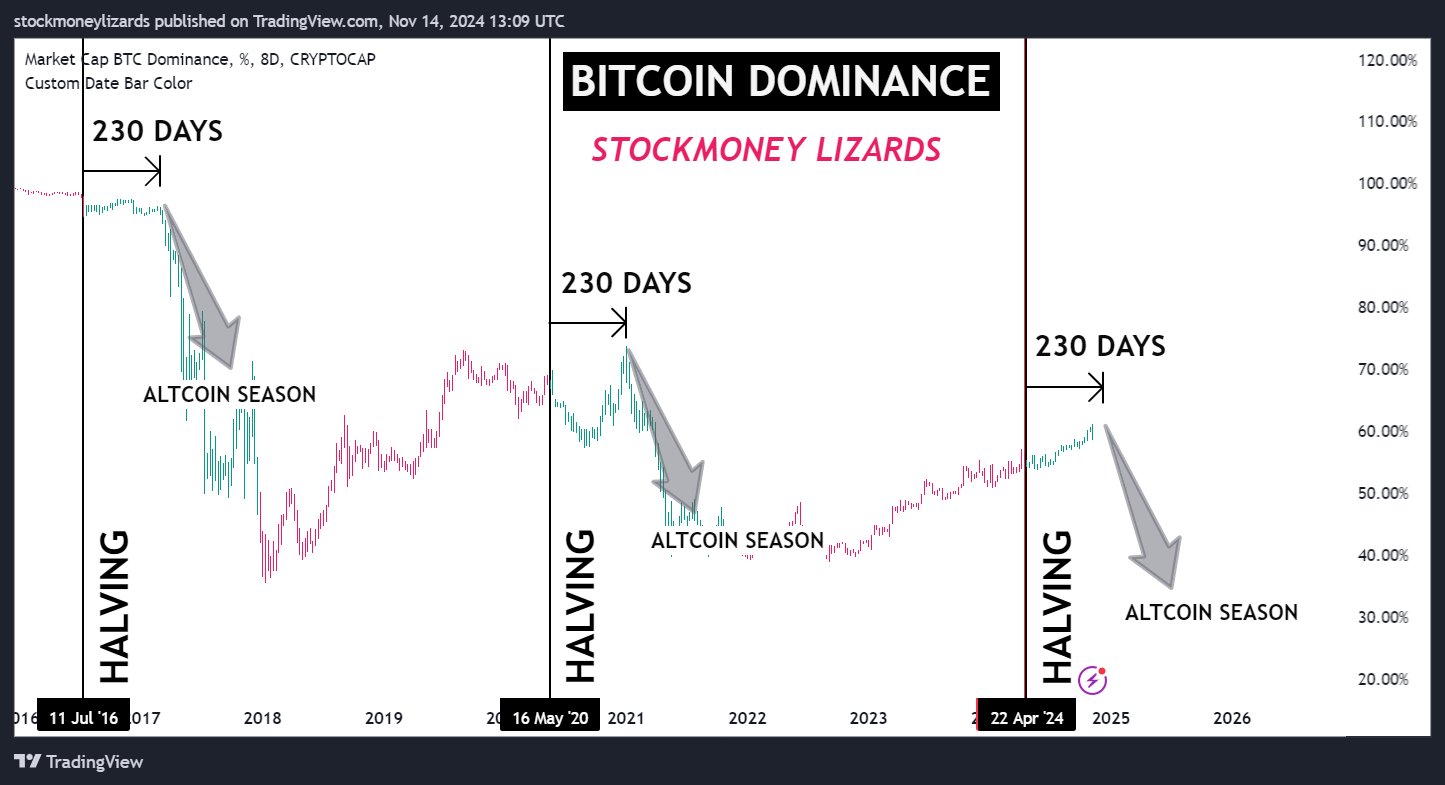

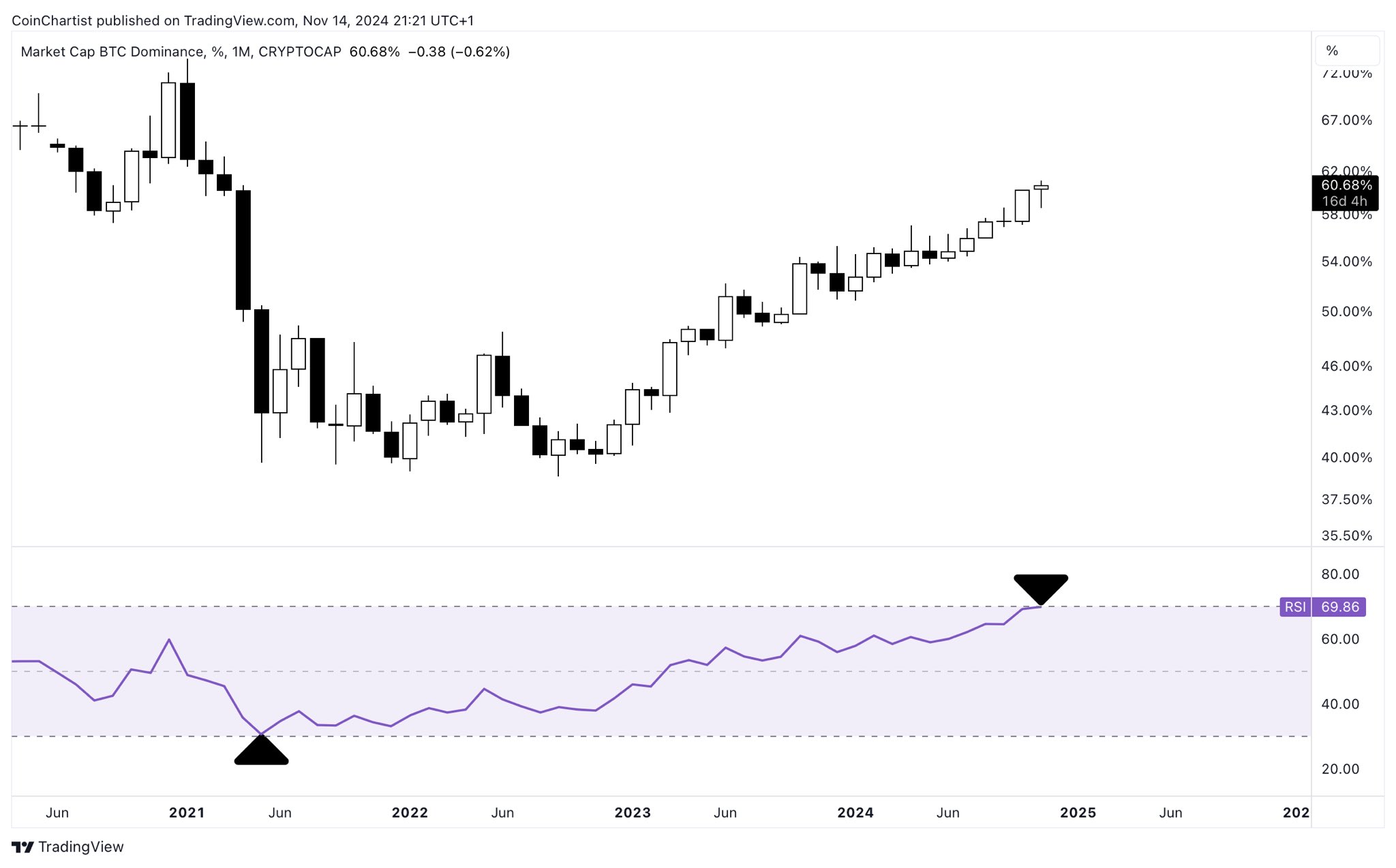

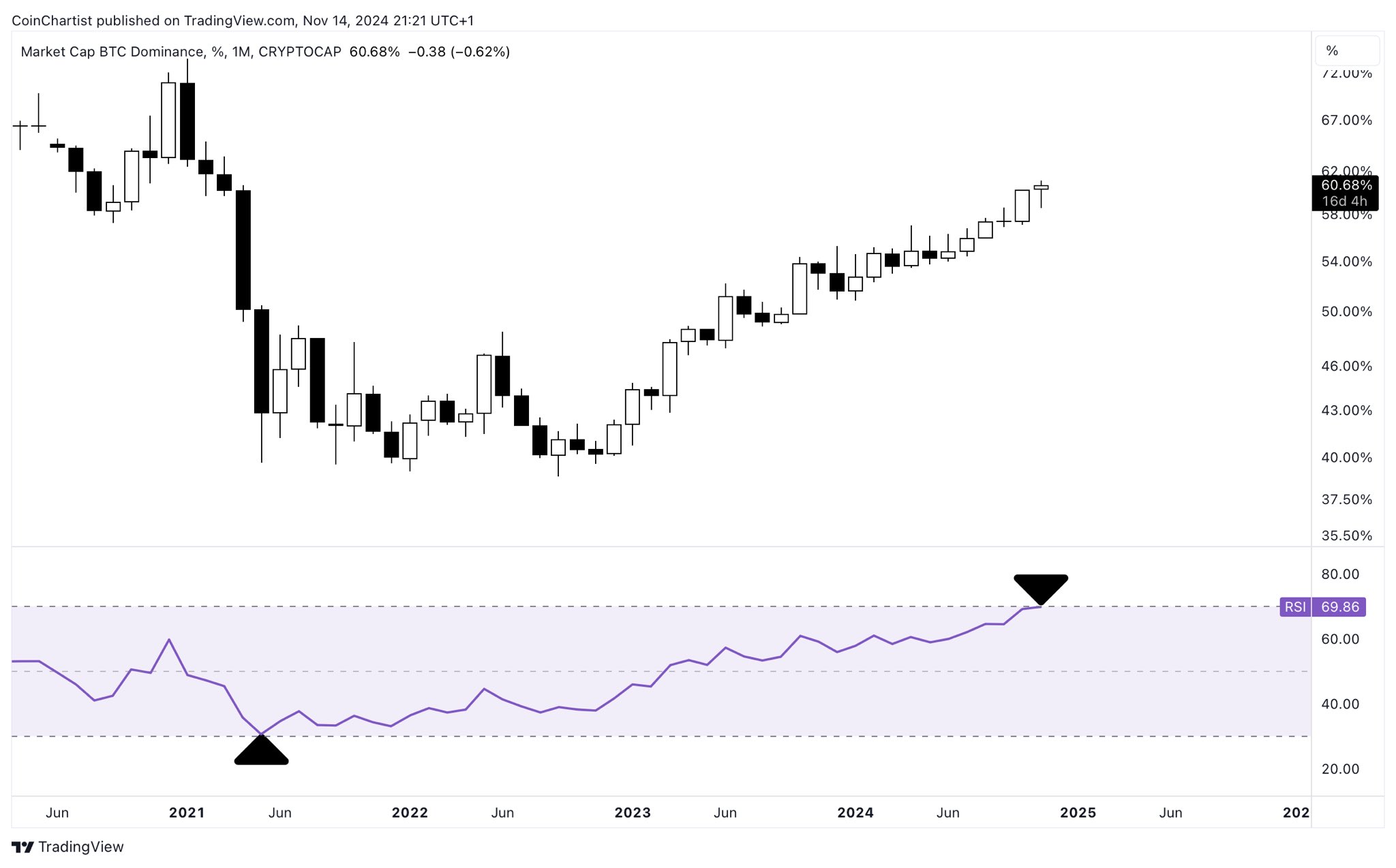

Based on historical patterns observed in previous market cycles, a 230-day pattern has been observed following Bitcoin’s halving.

After the initial post-halving bull run, which often pushes Bitcoin’s dominance to new highs, market participants are looking to altcoins for additional profit opportunities.

Source:

In 2020, the supply shock caused by the post-halving event manifested itself within the first 150 days, with Bitcoin reaching $40,000 for the first time.

However, after Bitcoin’s momentum waned, altcoins began to outperform, with many altcoins posting significant gains about 60 days later.

Similarly, the halving in April this year, which reduced the reward for miners to 3,125 Bitcoins, caused an economic imbalance. This caused a sharp increase in demand, fueled by post-election liquidity, while reduced supply led to tighter market conditions.

The resulting lower liquidity, combined with Bitcoin’s controlled supply, has created the ideal environment to push Bitcoin’s dominance to nearly 70%, further fueling the rise to a new ATH.

So if the aforementioned trend repeats, many altcoins could be in a position to break major resistance levels before the end of the fourth quarter. Of Cardano This gains significant traction and further strengthens AMBCrypto’s hypothesis.

Evidence to support this theory

As previously noted, Bitcoin’s consolidation below $90,000 reflects a growing ‘risk-averse’ sentiment in the market.

Despite the bulls countering the bearish pressure, the inability to trigger a parabolic run – one that many expected given strong support from the new administration and social media buzz around a $100,000 target – is raising concerns.

In other words, the market’s reluctance to break major resistance levels suggests that Bitcoin’s dominance may be stagnating, creating an ideal environment for investors to diversify into highly capitalized tokens.

These tokens, with strong community support and more attractive valuations, could provide an attractive alternative.

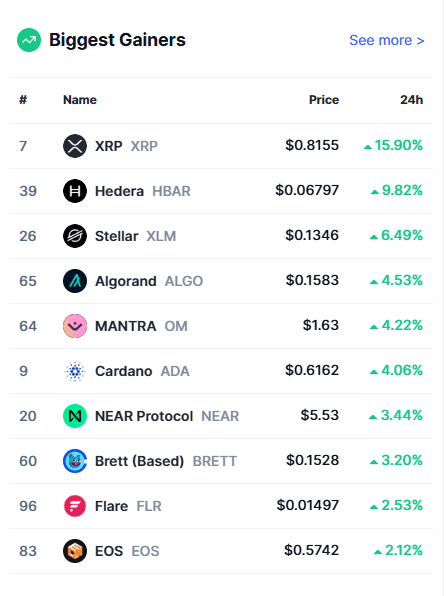

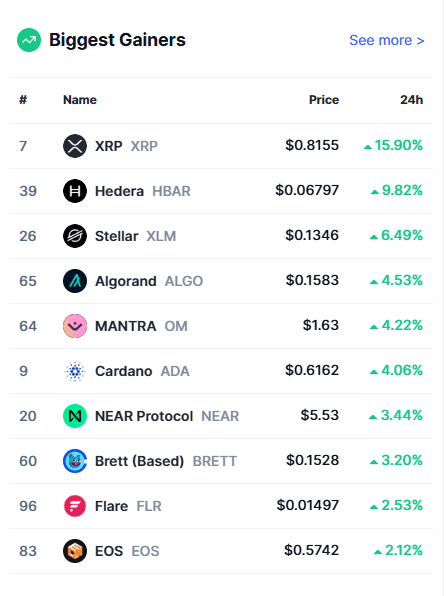

Source: CoinMarketCap

As a result, major altcoins reaped the rewards over the past 24 hours, when Bitcoin tumbled around 4% to fall to $86K – the low of the day – with XRP alone gaining more than 15%.

Unless Bitcoin’s dominance recovers, backed by both institutional and private support to solidify BTC’s long-term prospects, altcoins may continue to dominate the gainer charts.

On the other hand, altcoins could see short-term gains if Bitcoin dominance climbs back to nearly 70%. Still, a full-fledged altcoin season could remain limited, which raises the critical question:

Will Bitcoin regain its weakening dominance?

On the monthly RSI, Bitcoin dominance has entered overbought territory, signaling a possible correction. This could indicate that Bitcoin’s dominance will see a setback soon, potentially paving the way for altcoins to gain traction.

Source: TradingView

Meanwhile, institutional support for Bitcoin is weakening as major players exit the cycle after reaping huge profits from this bull run. To regain control of Bitcoin dominance, these players are likely waiting for a ‘dip’, where prices are more feasible for re-entry.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Until then, it presents an excellent opportunity for bulls to take advantage of an altcoin rally.

With historical patterns supporting this trend, it appears that altcoins will break key resistance levels in the coming days, potentially triggering an altcoin season by the end of the first quarter of next year.