- As BTC consolidated, whales bought a significant amount of BTC.

- The RSI revealed there was more room to buy, supporting the possibility of a bull rally.

After putting in impressive performances in November, Bitcoin [BTC] has now entered a consolidation phase. However, a crucial BTC metric gave a signal, indicating a possible change in market sentiment. Will this push be enough to next send BTC to $100,000?

Is this a Bitcoin bottom?

After reaching $99,000 last week, BTC witnessed a major correction as it fell to $91,000. However, things started to look up as BTC hovered around the $96,000 consolidation zone.

At the time of writing, the king coin was trading at $96,431.49 with a market cap of over $1.9 trillion. This all happened amid speculation that BTC was targeting $100,000.

The good news was that the latest analysis pointed to a similar possibility. Glassnode is recent tweet revealed that the Seller Exhaustion Composite for Bitcoin signaled on the weekly time frame, indicating a positive shift in market sentiment.

This could mean that Bitcoin is at the bottom of the market.

Ali Martinez, a popular crypto analyst, also posted one tweet indicating that BTC will reach $99,000 in the coming days. Martinez’s tweet pointed to a falling wedge pattern on BTC’s chart, suggesting a possible Thanksgiving rally.

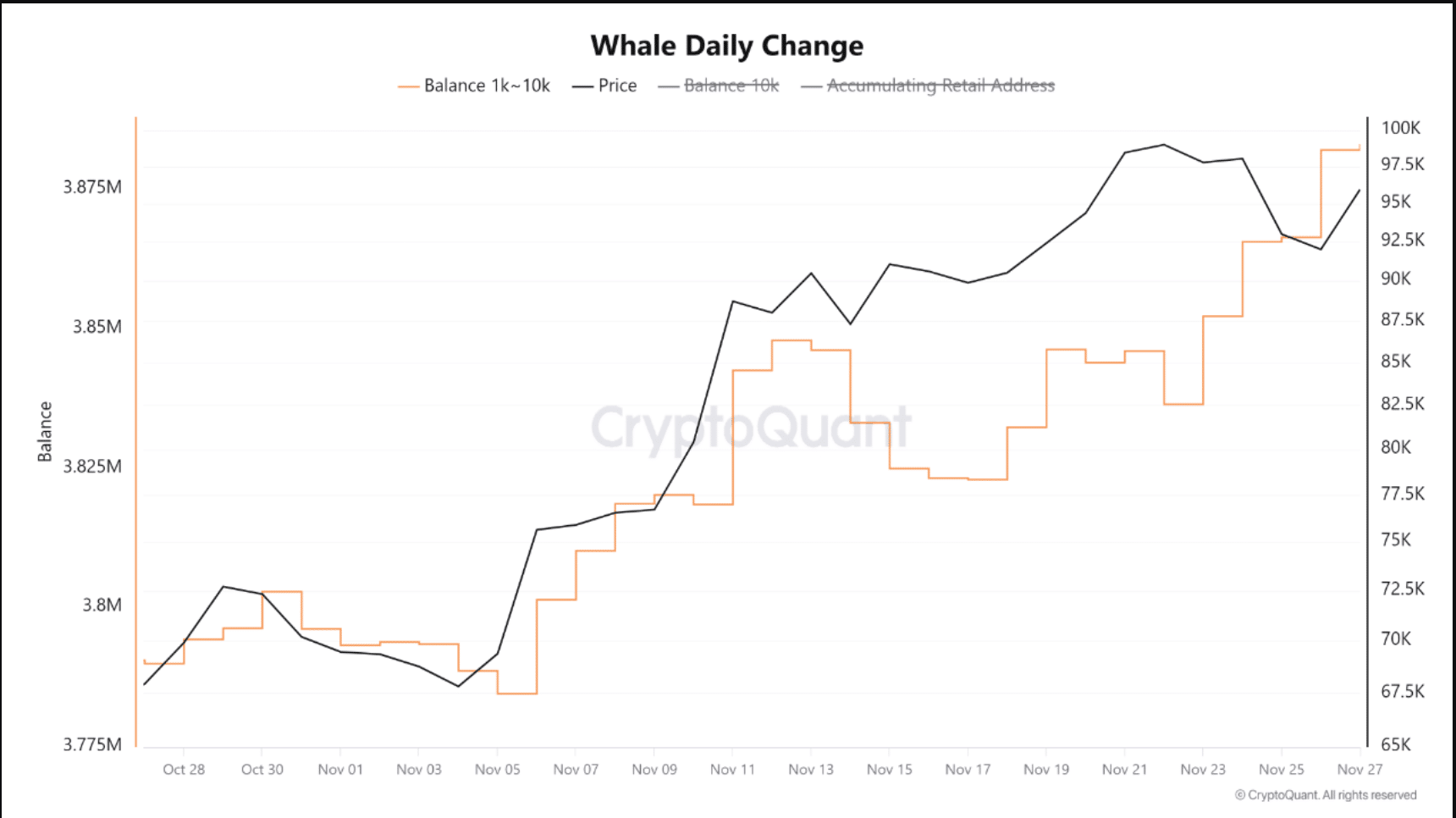

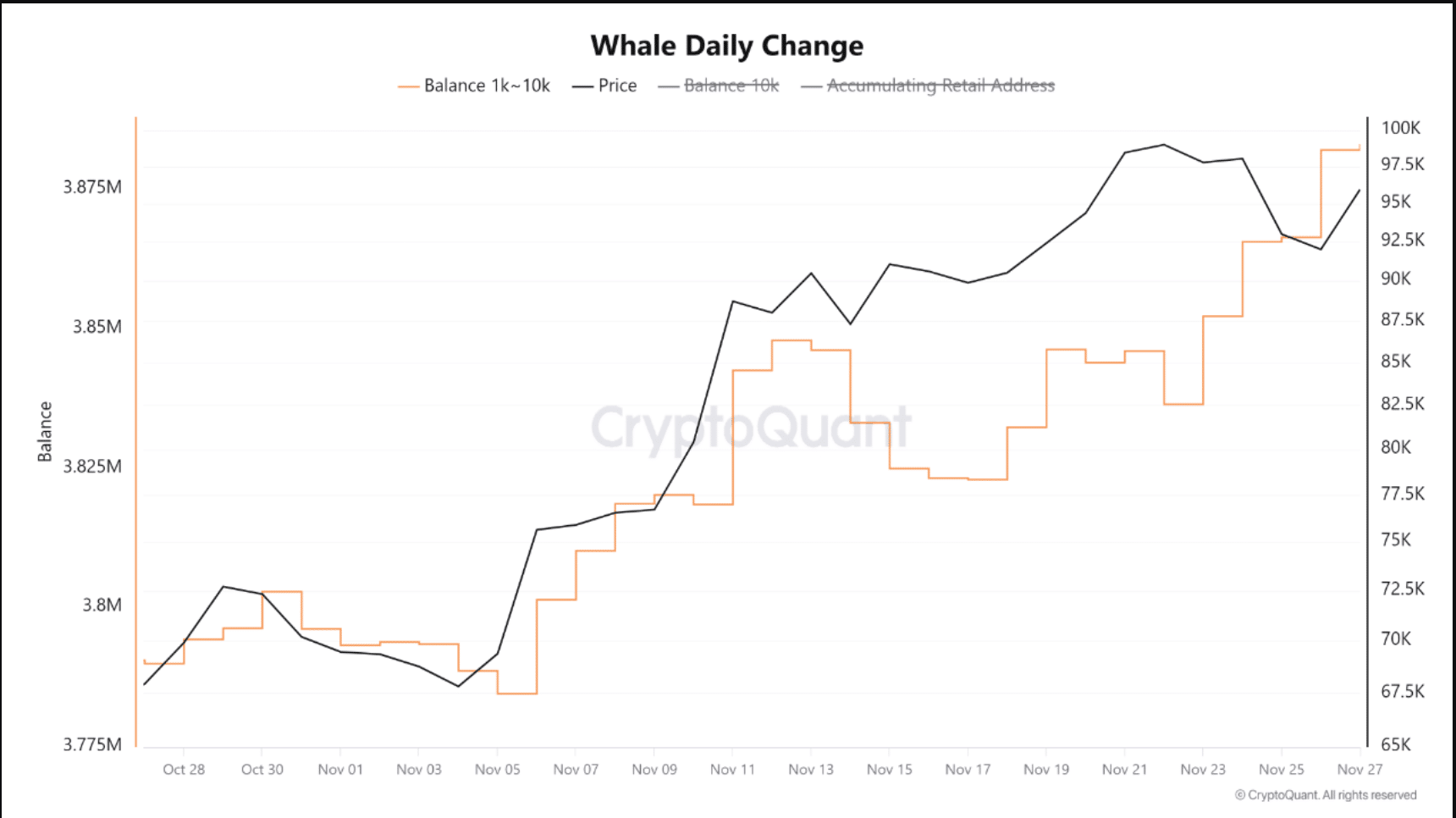

Moreover, BTC whales store the coin. Caueconomy, an author and analyst at CryptoQuant, posted a analysis which showed that almost 16,000 BTC entered whale sanctuaries.

This number continued to rise, equating to nearly $1.5 billion in on-chain accumulation. This was a clear example of the ‘buy the dip’ strategy, which reflected the confidence of the major players in Bitcoin.

Source: CryptoQuant

The probability of BTC moving to $100,000

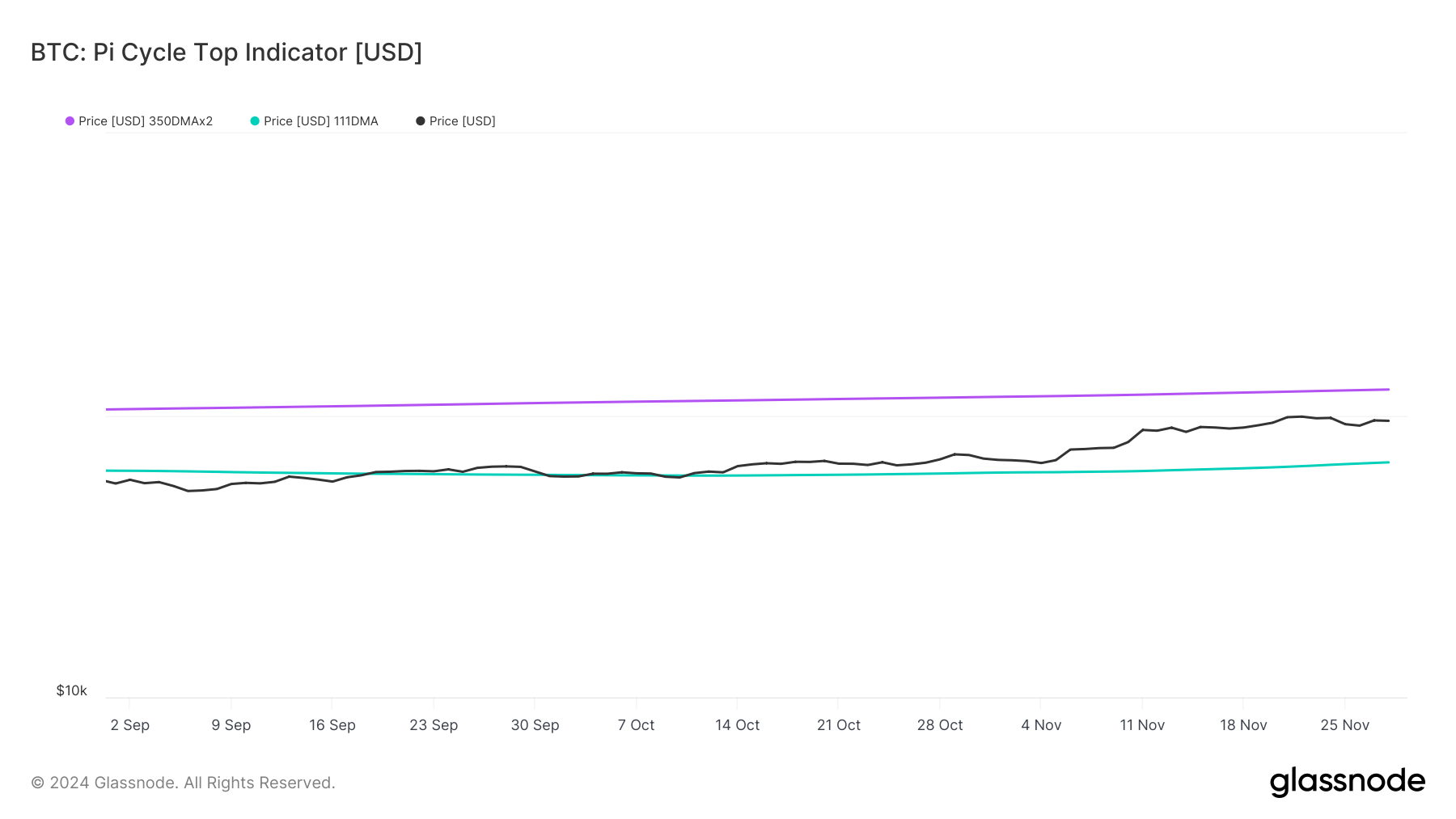

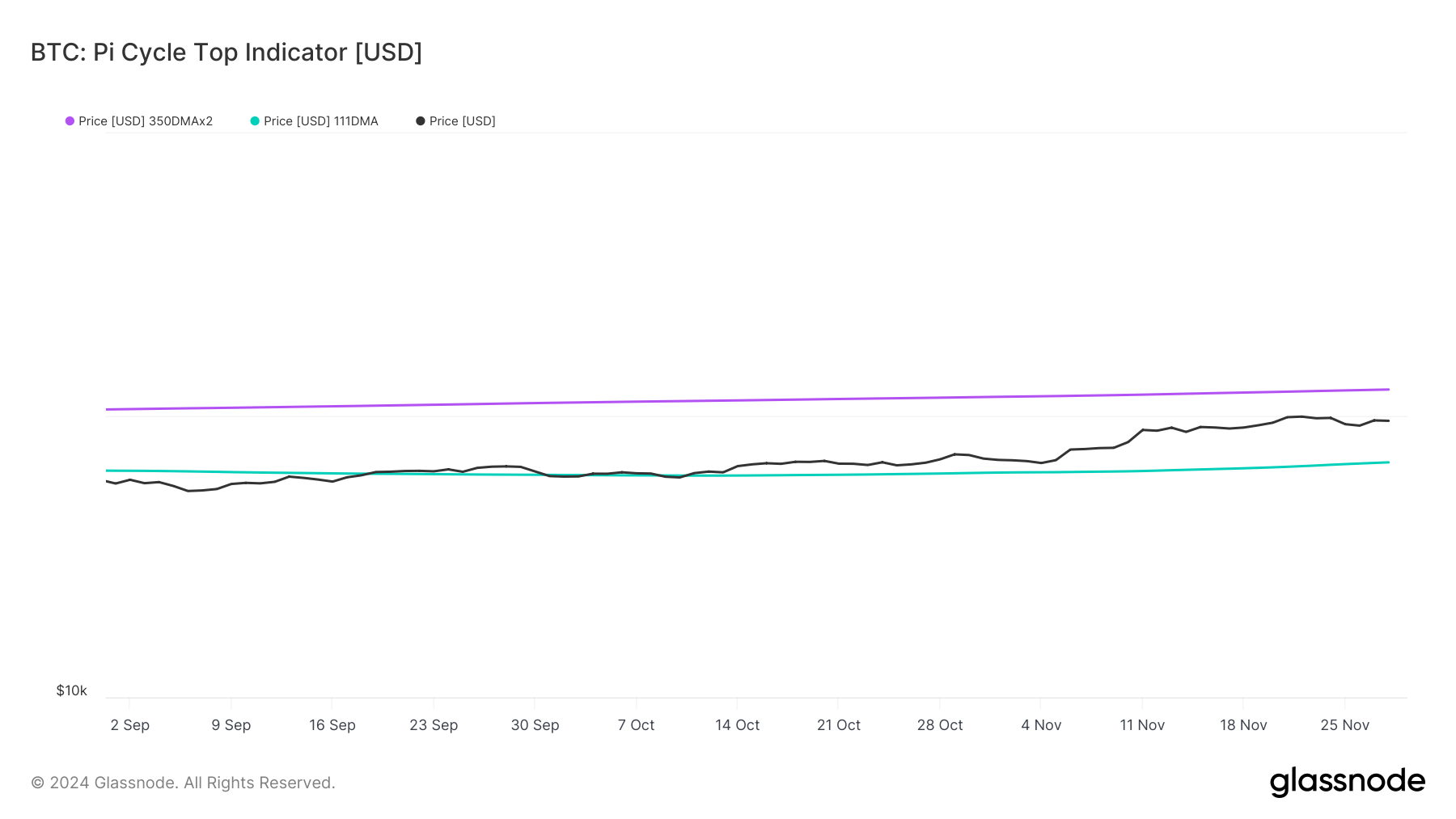

All these numbers suggesting a move towards $100,000 were also supported by Bitcoin’s Pi Cycle top indicator. If the indicator is to be believed, BTC has a possible market top above $123,000.

Conversely, if the current price of BTC has not bottomed out, the king coin could drop to $68,000 as suggested by the same indicator.

Source: Glassnode

AMBCrypto’s analysis of BTC’s daily chart revealed that it was testing its resistance to the 9-day MA. In the event of a bullish breakout, this could trigger another rally to $100,000 as we approach the holiday season.

After reaching 82, Bitcoin’s Relative Strength Index (RSI) even dropped to 66.

Read Bitcoins [BTC] Price prediction 2024–2025

This meant there was more room to buy, which could provide the necessary momentum to break above resistance in the coming days.

However, it will also be crucial for BTC to break the USD 99,000 resistance to reach a triple-digit value.

Source: TradingView