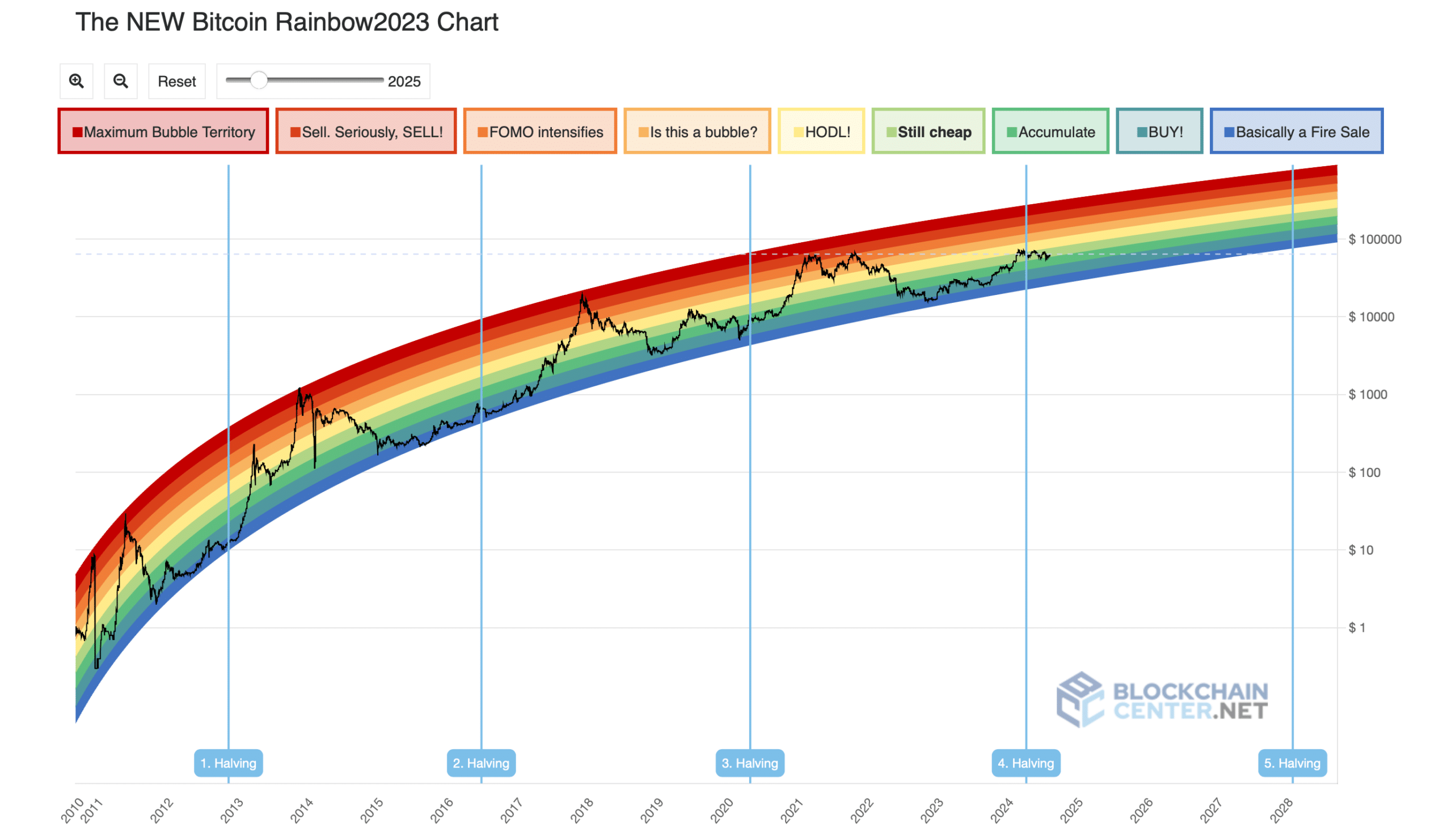

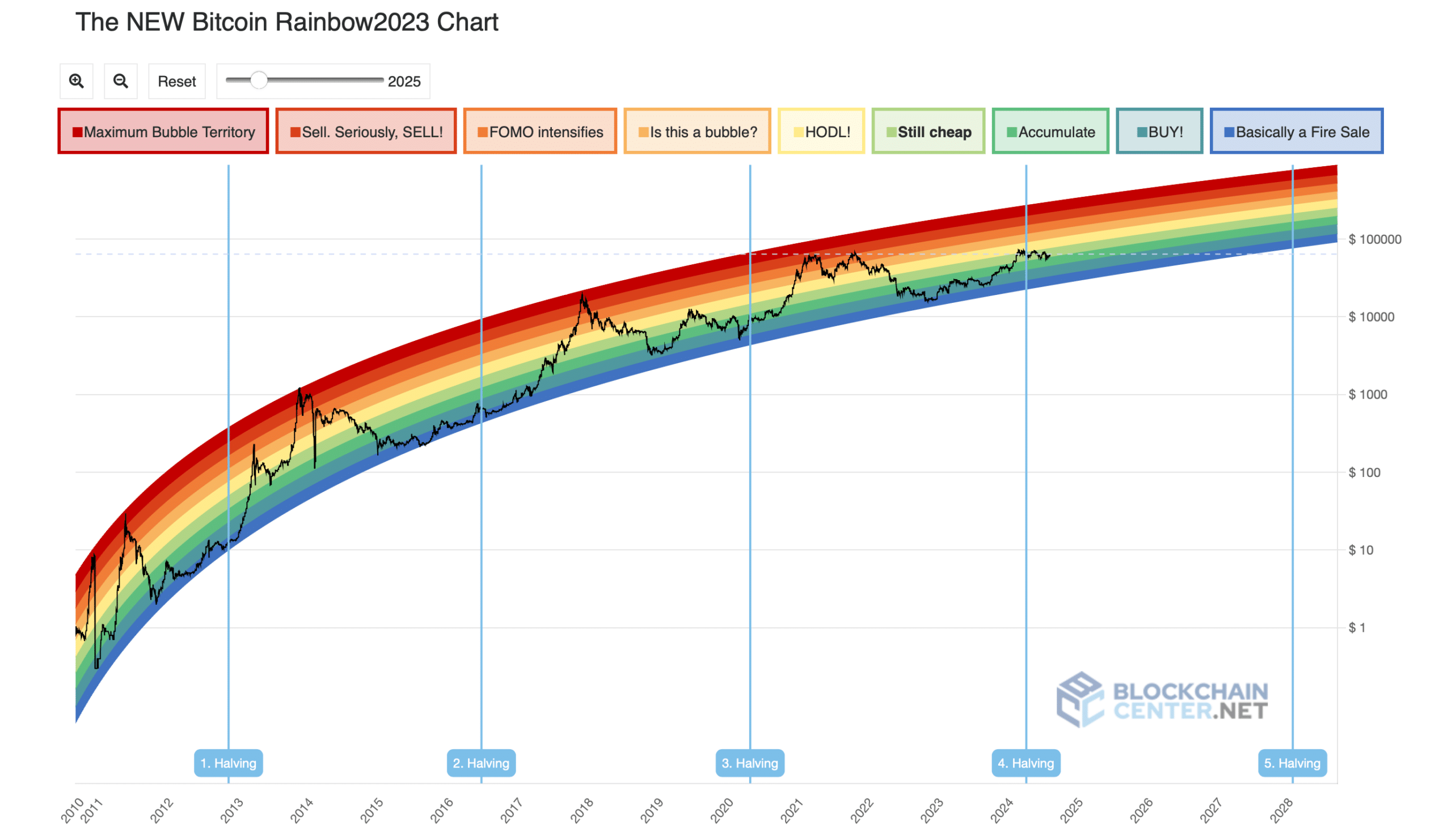

- The Bitcoin Rainbow Chart suggested that BTC was “still cheap.”

- Selling pressure on BTC increased, which could cause problems.

Sentiment around Bitcoin [BTC] remained bullish as the king of cryptos managed to trade well above the $61,000 mark. If we take the latest data into account, things could get even better.

This was the case because there were high chances of a gold crossover, which could further drive up the price of the coin.

Bitcoin’s upcoming gold crossover

CoinMarketCaps facts revealed that BTC bulls dominated last week as the coin’s price rose more than 7%. At the time of writing, BTC was trading at $64,003.47 with a market cap of over $1.2 trillion.

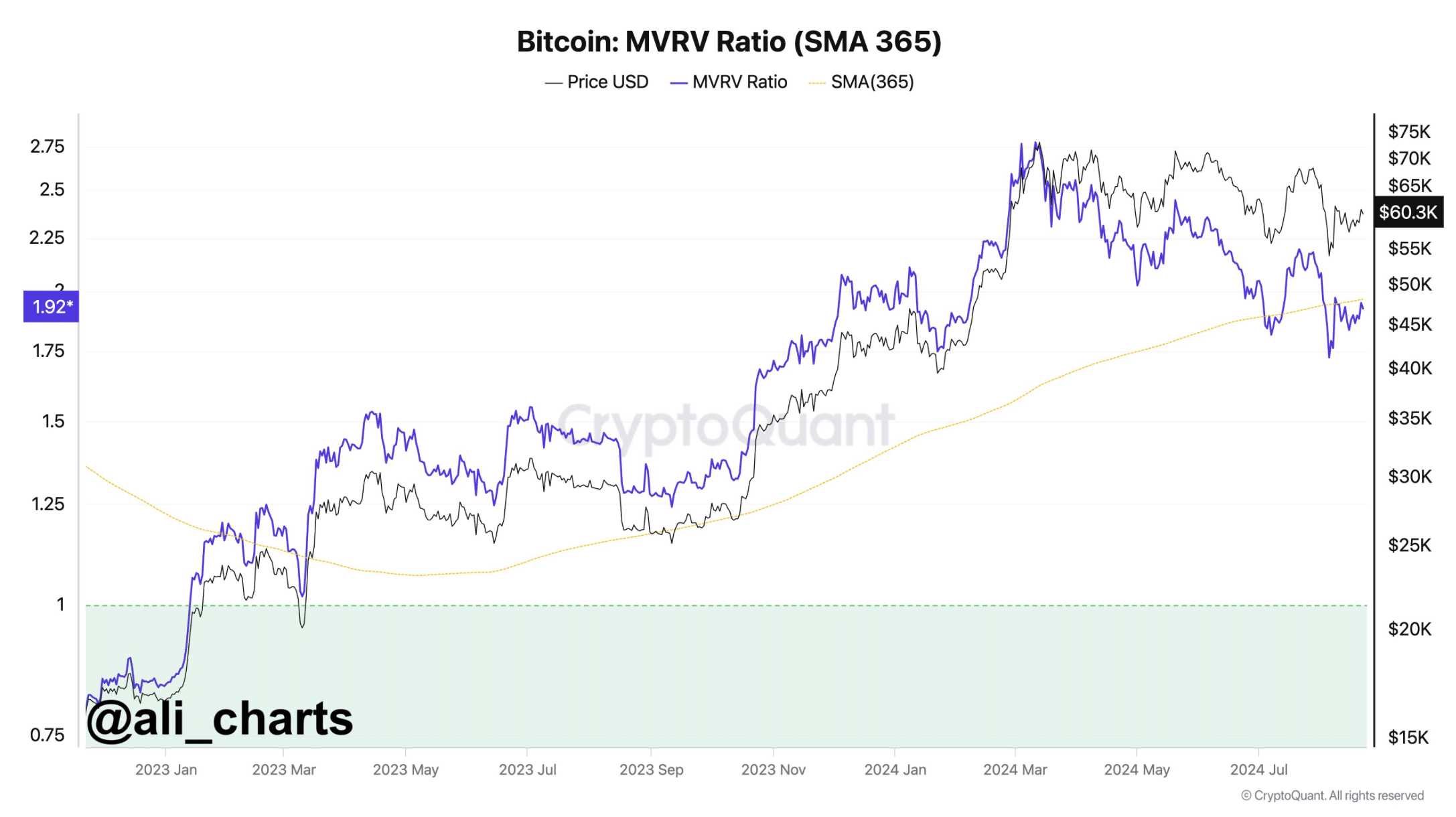

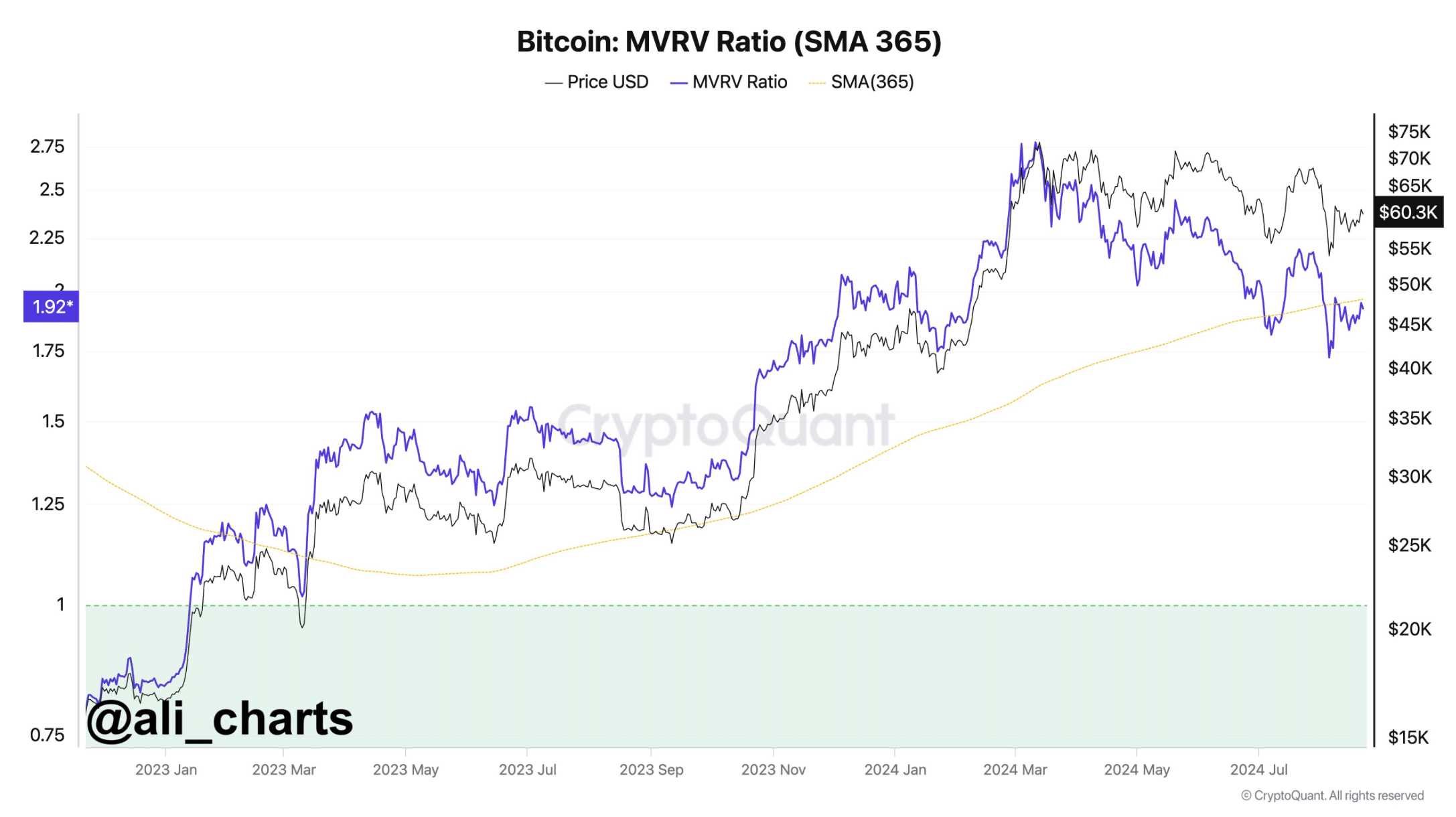

While the bulls were leading the market, Ali, a popular crypto analyst, posted one tweet shows an interesting development. According to the tweet, BTC’s MVRV ratio and its 365-day simple moving average (SMA) were on the verge of a crossover.

If that happens, BTC could see another bull rally, which could further drive up the price of the coin.

Source:

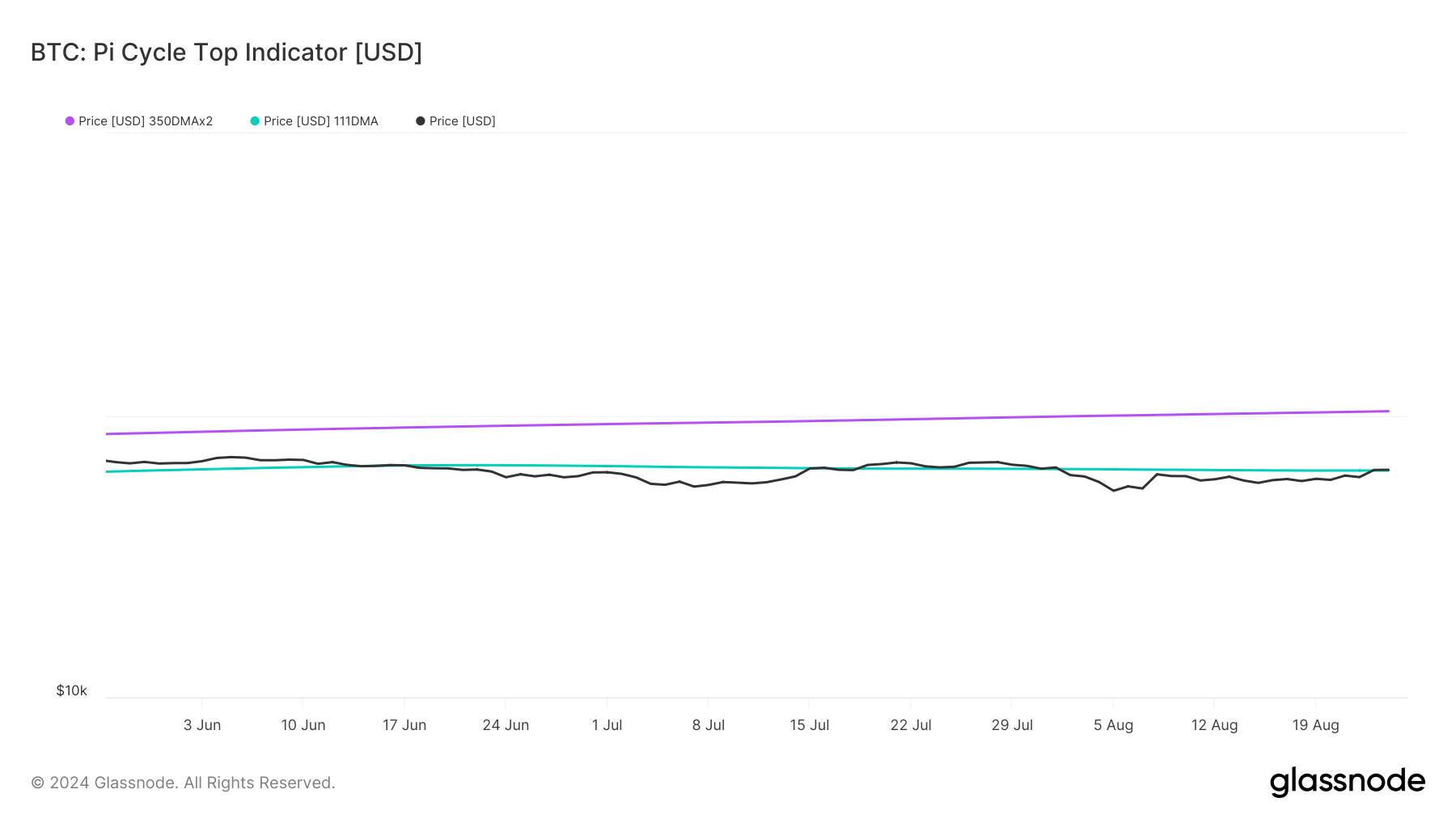

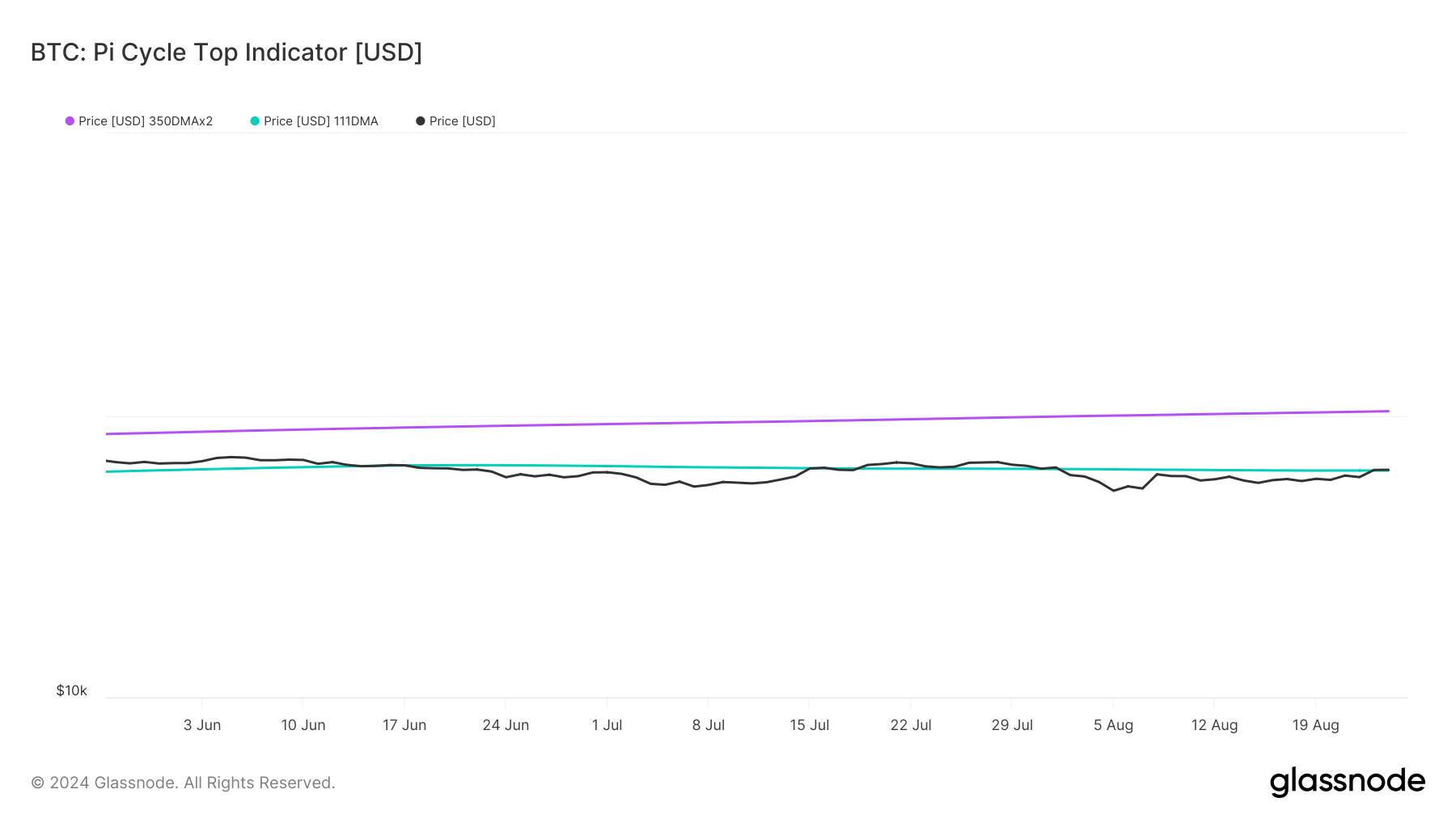

That is why AMBCrypto has done further research to find out the chances of a gold crossover. According to our analysis of Glassnode’s data, the price of BTC has finally reached its possible market bottom, according to the Pi Cycle Top indicator.

In the event of a gold crossover, BTC could quickly rise to the possible market top of $103,000.

Source: Glassnode

The path that BTC has ahead of it

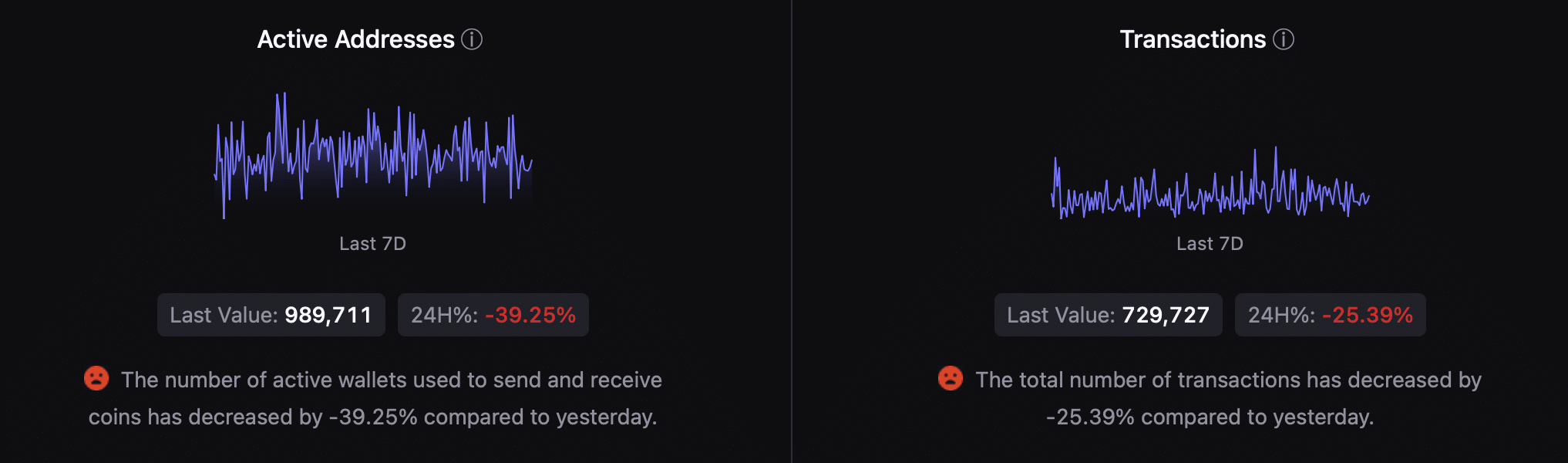

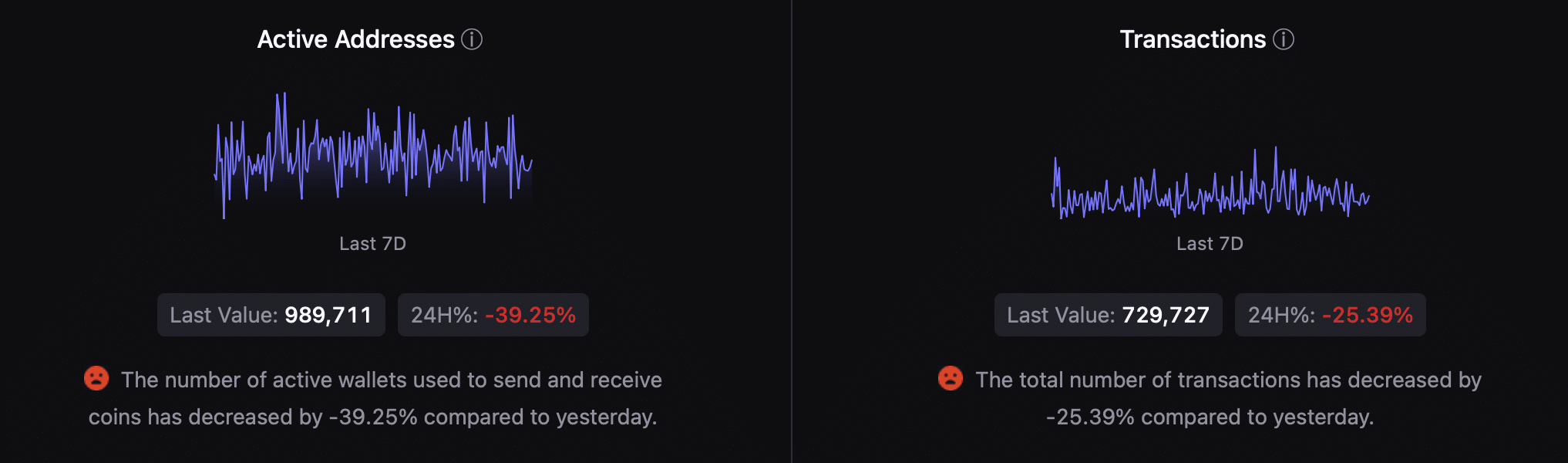

Our analysis of CryptoQuant’s facts showed that BTC’s foreign exchange reserve increased, increasing selling pressure. Apart from this, BTC active addresses are down -39.25% compared to yesterday.

The total number of transactions also decreased by -25.39% compared to yesterday. Both metrics looked bearish on Bitcoin.

Things also looked quite bearish in the derivatives market. This was evident from the buy/sell ratio of red buyers, indicating that selling sentiment was dominant in the futures market.

Source: CryptoQuant

However, a look at the Bitcoin Rainbow Chart indicated that there may still be time for investors to accumulate more. The chart showed that the price of BTC was in the “still cheap” zone at the time of writing.

TThis clearly meant that investors might consider buying the coin before its price rises.

Source: Blockchaincenter

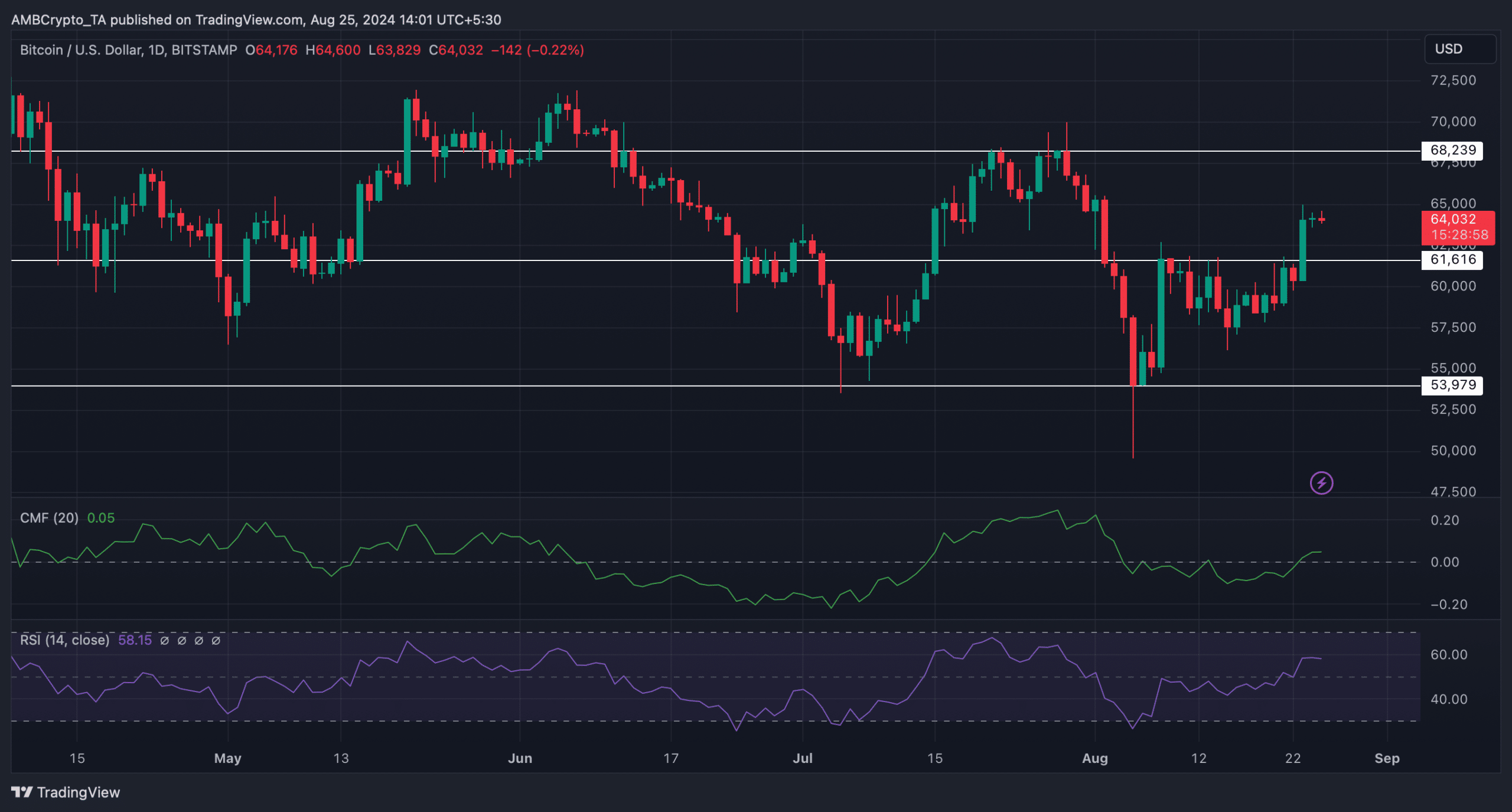

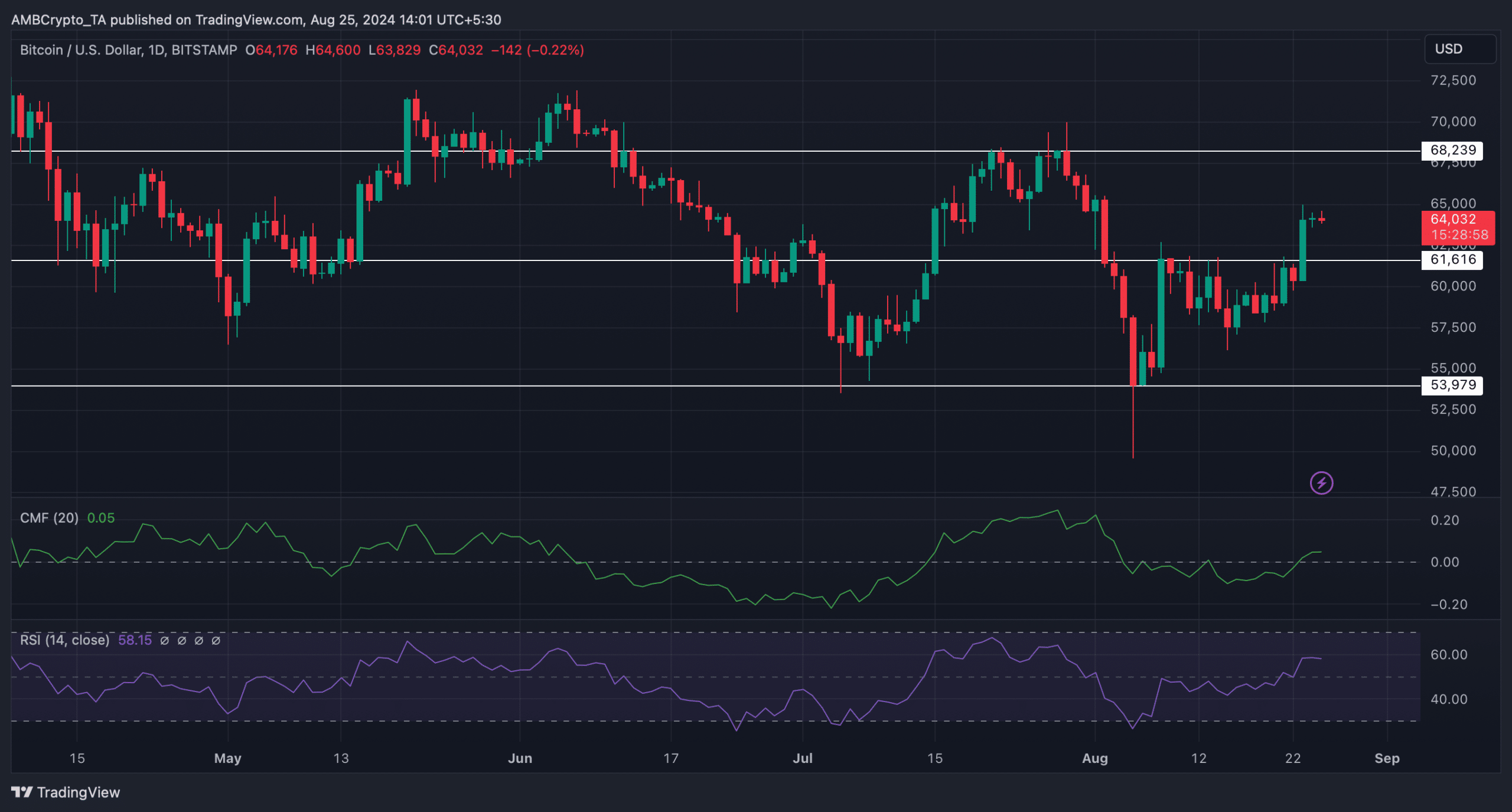

We then reviewed the coin’s daily chart to find out what market indicators were suggesting. The Relative Strength Index (RSI) entered a sideways path after a sharp rise.

Read Bitcoins [BTC] Price prediction 2024-25

BTC’s Chaikin Money Flow (CMF) also followed a similar trend, indicating a few slow-moving days.

In the event of a gold crossover, BTC could first target $68,000 before considering its possible market top of $103,000. However, if the bears take over, the coin could fall back to $54k.

Source: TradingView