- We investigate the possibility of a Bitcoin supply shock following recent market observations.

- The Bitcoin rate is running, indicating that Bitcoin is well into a highly volatile phase.

When Bitcoin [BTC] suffered another halving earlier this year, there was speculation that a supply shock would soon follow. Nowadays the possibility of one Bitcoin supply shock is much higher, especially after the recent crash.

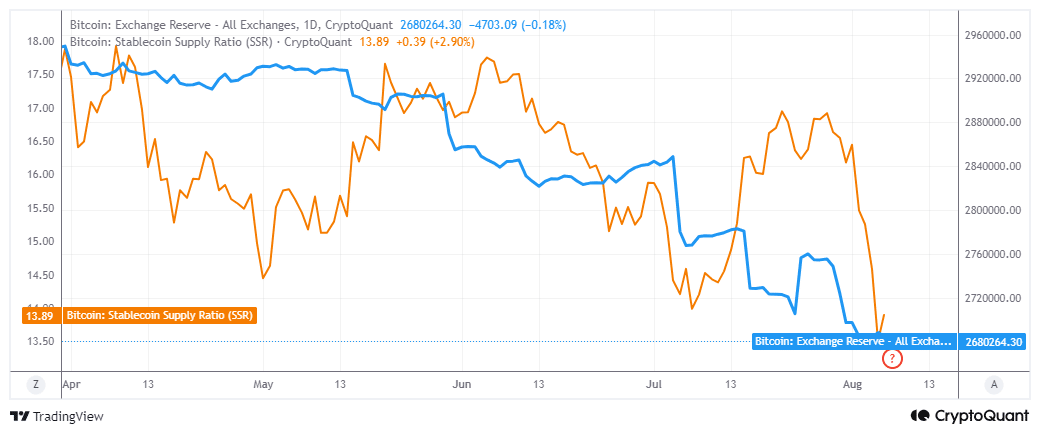

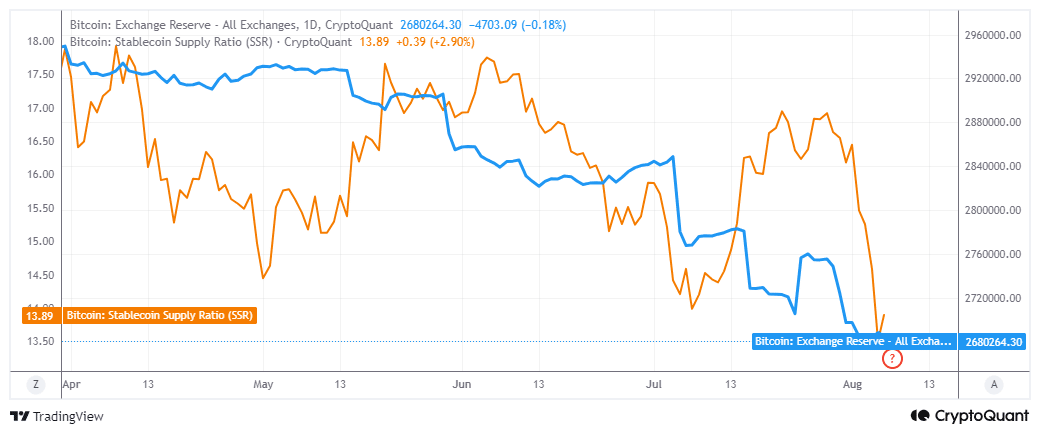

In the case of Bitcoin, a supply shock would occur if foreign exchange reserves fell to extremely low levels. At the same time, demand can remain constant or increase further.

Such a scenario would likely lead to an imbalance in favor of a rapid recovery.

Bitcoin’s behavior during the last crash offered some indication that a supply shock may be looming.

The first major sign supporting this expectation was the observation that the Bitcoin exchange reserves indicator is now lower than last week.

In fact, the price only stabilized during the crash, with no significant increase despite the massive increase in sell-side pressure.

Source: CryptoQuant

However, AMBCrypto has observed a spike in the Bitcoin stablecoin supply ratio over the past two days, following the previous decline.

This was an important observation because every time this indicator rose in the past, it was accompanied by a rise in the price of BTC. So, it could mark the star of another relief rally for the cryptocurrency.

Bitcoin speed runs

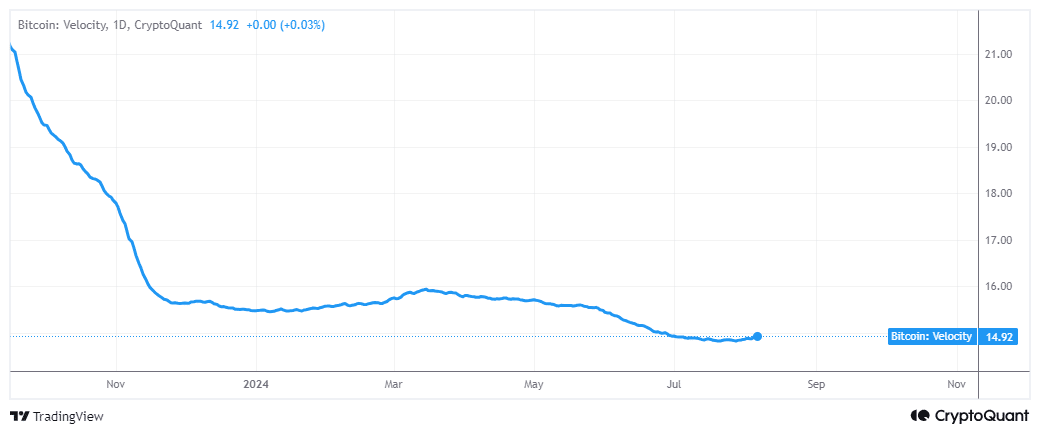

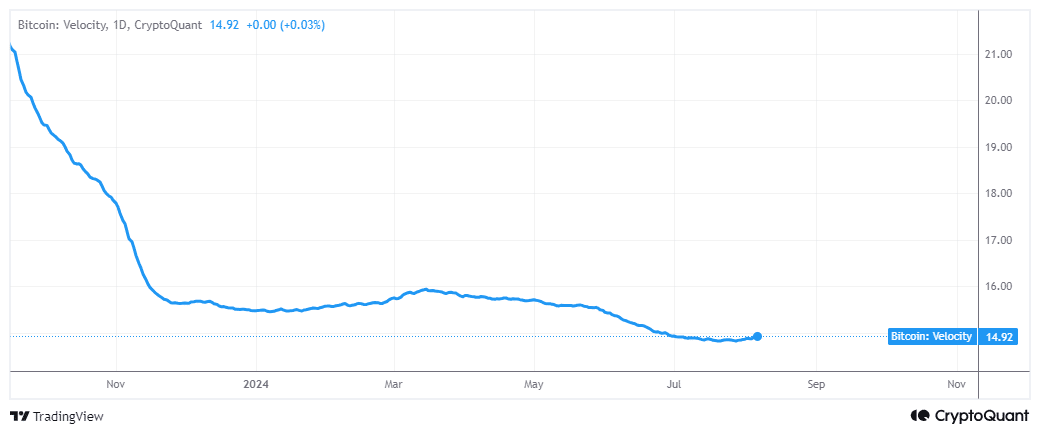

There are several reasons why Bitcoin’s velocity (the rate at which it exchanges hands) is changing. A peak in excitement, whether negative or positive, can lead to more speed.

When liquidity flows out of the market and demand for BTC becomes low, the price tends to fall.

The last major uptrend started in 2020 as excitement and liquidity flooded the crypto world. It peaked in August 2022 after the FTX crash and stablecoin depegging that year.

The last BTC rate increase started in January and ended in March as liquidity tested the waters, leading to an uptrend.

Source: Cryptoquant

Bitcoin’s speed marked a reversal to the uptrend at the time of writing. If this uptrend continues, it could indicate that BTC is heading into a new season of excitement and highly volatile price changes.

This will all depend on the level of liquidity in the market.

But what would happen in the market if there was a strong Bitcoin rate increase?

Well, the fact that BTC supply on the exchanges continues to decline indicates that there is strong bullish optimism in the longer term, largely because ETFs are now involved and crazy high forecasts have yet to be realized.

Is your portfolio green? Check out the BTC profit calculator

Higher velocity combined with strong demand could favor the bulls. It would also likely be accompanied by major dips, such as those that have occurred recently.

Huge price movements would occur if a supply shock were to occur, which would likely increase Bitcoin’s velocity.