Markets expect the Federal Open Market Committee to cut rates at its next meeting on September 18. However, escalating geopolitical tensions in the Middle East and Africa are making investors anxious.

Think about this: After the easing of US inflation, traders expected BTC to change hands at a premium. However, the coin lost its psychological support at $60,000 and was trading at a discount of 3.10% at the time of writing.

A silver lining emerges

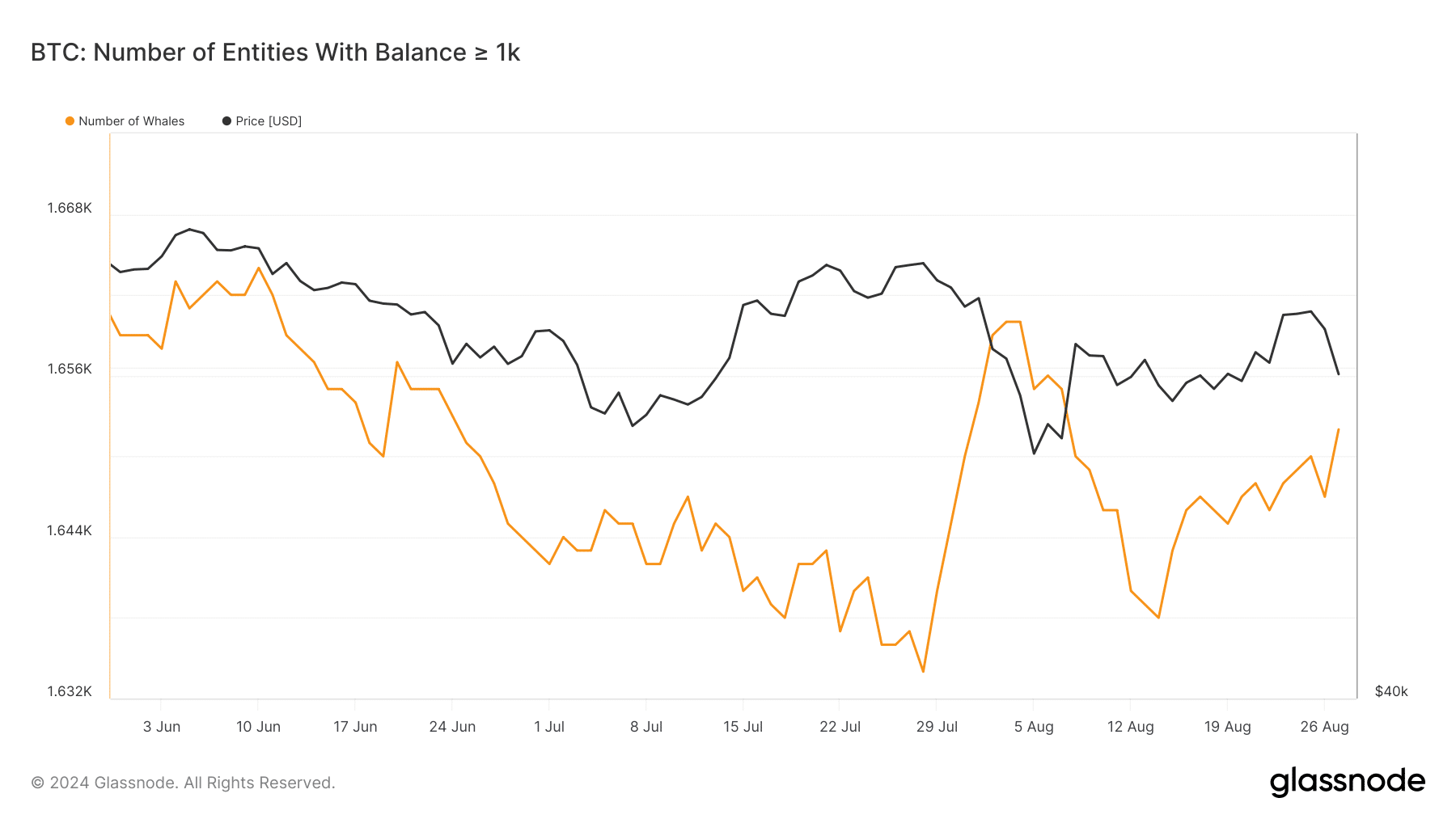

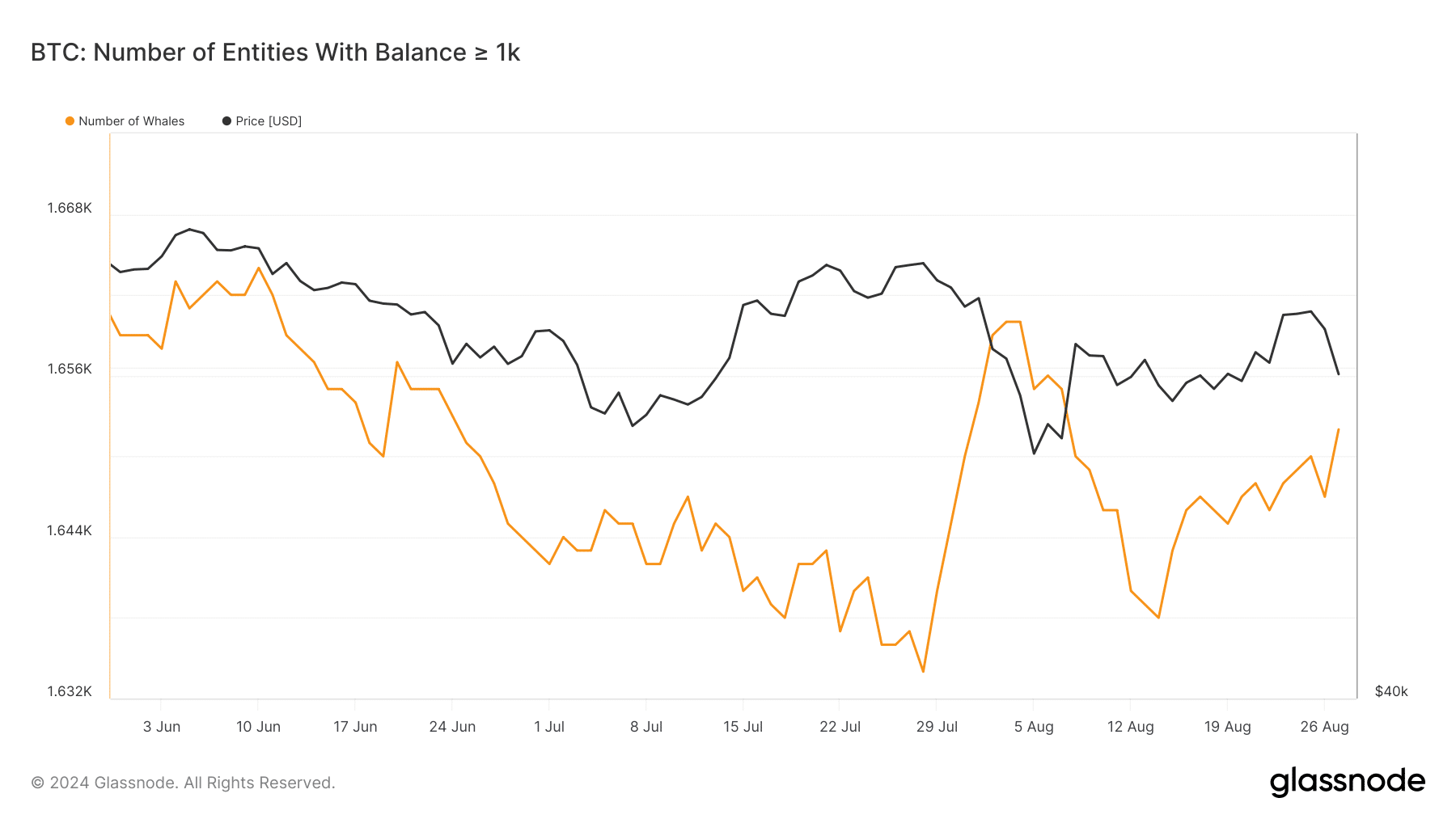

Interestingly, AMBCrypto’s August 2024 report found that whales have bought the dip and adopted a HODLing strategy. In fact, after falling to a low of 1,638, the number of whales has also gradually increased.

Certainly, major investors see current market conditions as an opportunity to go long.

Source: Glassnode

Despite the bullish belief of the whales, interest in Bitcoin trading declined in early August as retail investors preferred altcoins to the king coin. But after August 25, sentiment changed in favor of BTC as active addresses recorded a sharp increase.

On the other hand, BRC-20 inscription activity cooled in August from the April peak of 18,085. Although new registrations increased in August (552), total volume was still well below the previous peak.

Amid all the developments in the chain, a worrying factor emerged on August 28 when the BTC OI-weighted funding rate moved to the negative side. This implied that traders in perpetual contracts were leaning towards a bearish outlook.

Factors that could trigger a bullish reversal in the near term

In an exclusive conversation with AMBCrypto, Federico Brokate, head of 21Shares’ US operations, revealed that ETF inflows could be a turning point for Bitcoin’s price trajectory. According to the director

“The players who will be the longest or largest buyers in the long term haven’t actually even started participating in BTC spot ETFs yet.”

So once pension funds and asset managers start investing more money in risky assets, BTC’s $100,000 target won’t be far away. The upcoming launch of Solana-based ETFs could also have significant implications for the broader crypto market.

In anticipation of this, AMBCrypto asked 21Shares about the possibility of SHIB or DOGE ETFs. While Brokate acknowledges the cultural influence of memecoins, he stated that the company is prioritizing more established cryptocurrencies for its current ETF offering.

While not dismissing the potential for future memecoin ETFs, the executive emphasized the need for clear usability and value propositions when developing ETF products.

Headwinds for the crypto market

While on-chain indicators and the macroeconomic outlook appear to be moving in favor of cryptocurrencies, incidents of hacks, thefts, and ransomware attacks are emerging as the biggest challenge facing the crypto market.

Crypto hackers made a dramatic comeback in 2024, stealing more than $1.58 billion in digital assets through July. This marked an increase of 84% compared to last year, when hacking activity had decreased significantly.

To better understand investors’ defenses against crypto hacks, AMBCrypto conducted an exclusive study. The results showed that 78% of respondents considered Binance and Coinbase to be the safest cryptocurrency exchanges.

And, more than 43% prioritize hardware wallets to protect their digital assets. This insightful research was fully discussed in AMBCrypto’s August 2024 report.

Dive into AMBCrypto’s August 2024 crypto market report

This comprehensive report goes deeper than just Bitcoin and security. It explores emerging trends, such as the increase in staking and reinstatement on Ethereum, and the growing popularity of memecoins on Solana.

In fact, the report talks about a major development in the world of stablecoins and discusses factors that could help the NFT market recover.

You can download the full report here.