- In the midst of recent market anxiety, whales have demonstrated confidence by including nearly $ 900 million in BTC from fairs.

- Bitcoin traded at a crucial level, which could determine whether it enters a bear market or maintains its bullish trend.

The current market of Bitcoin [BTC] Has been extreme bullish on BTC because traders took almost $ 900 million from fairs. The massive withdrawal was a bullish sign despite the recent market anxiety, as BTC collected under $ 100k.

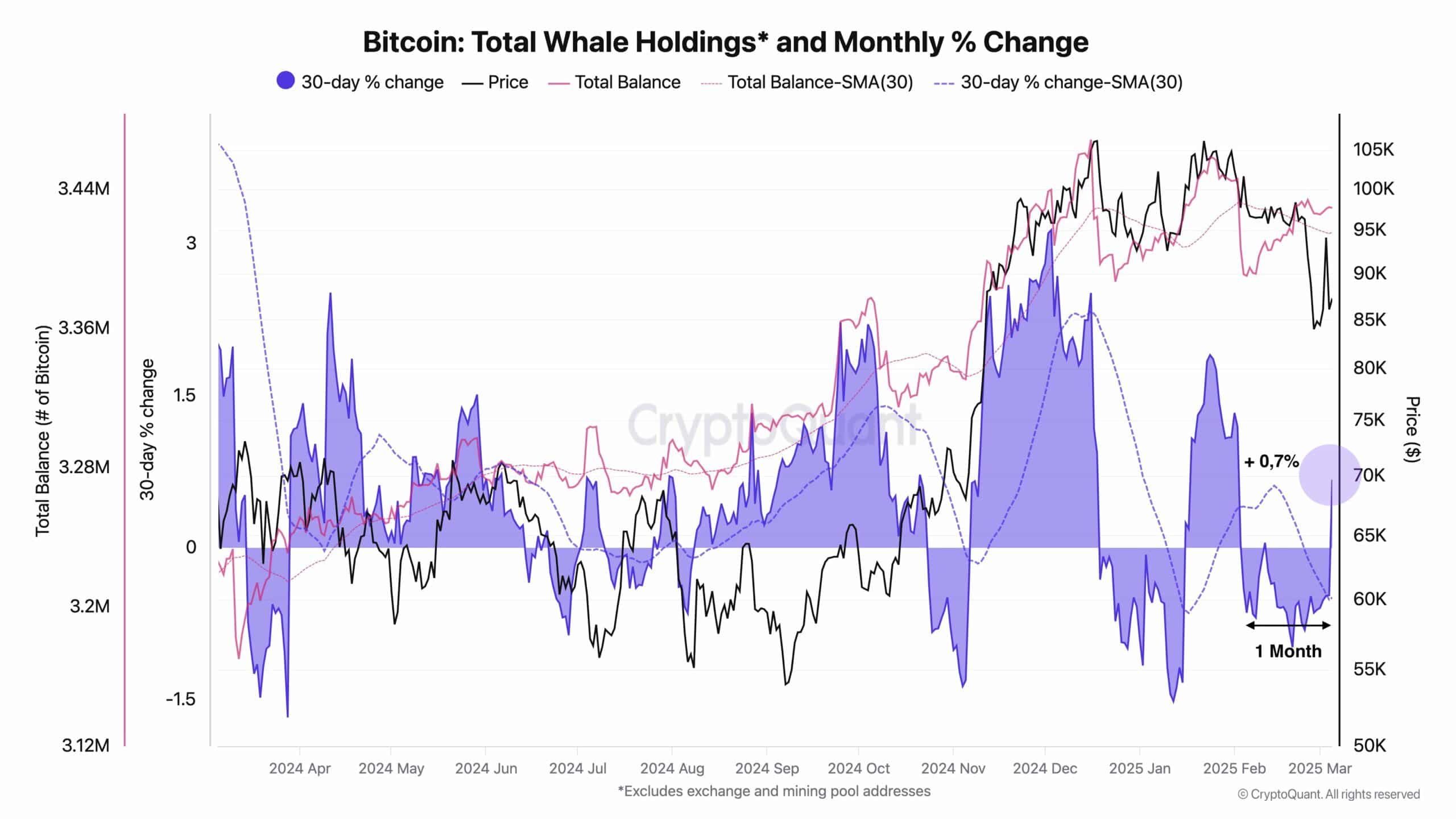

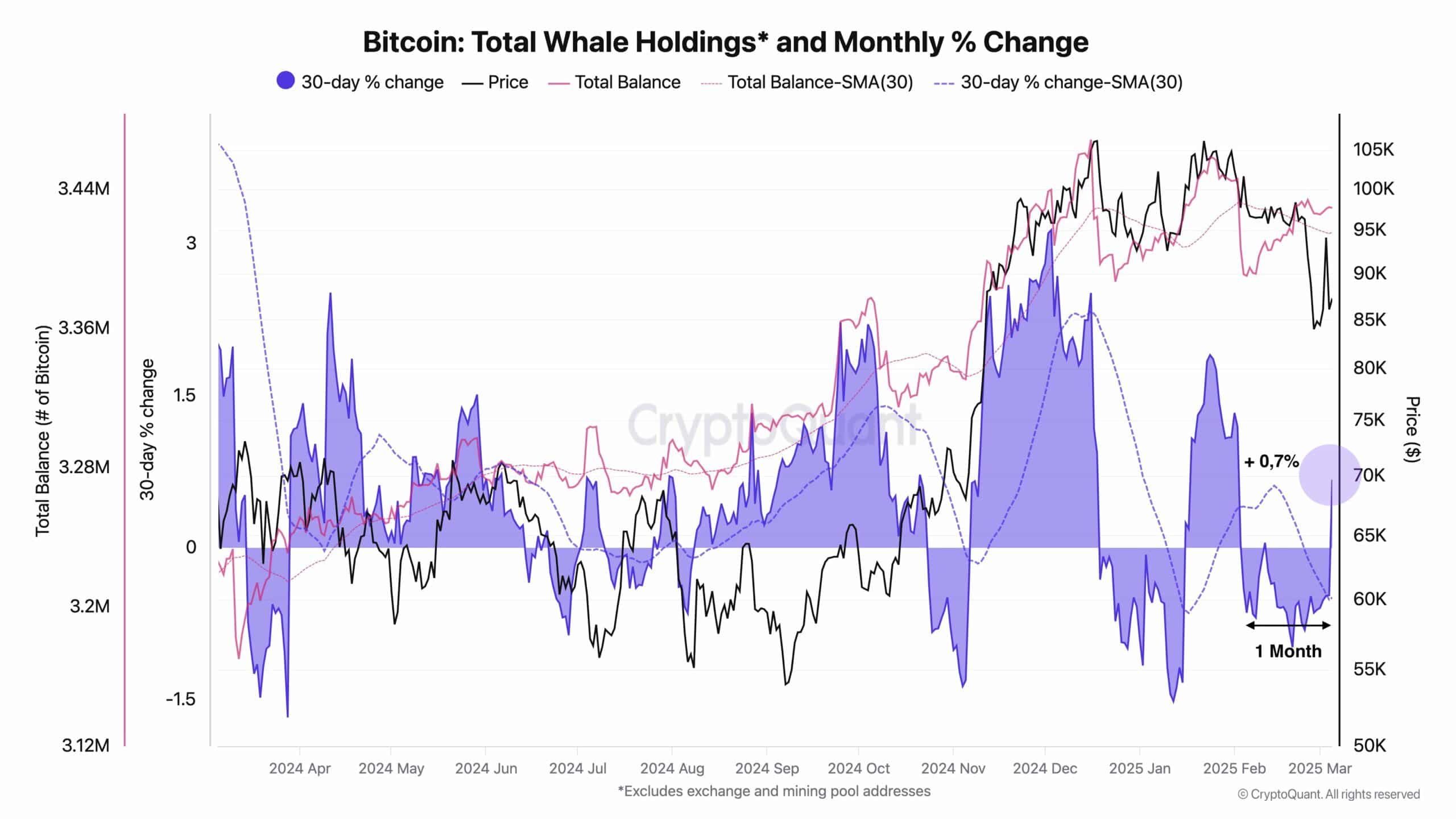

Whale behavior has recently shown a shift, whereby whales sell their positions for more than a month. This period of net exhaustion marked the longest piece in the past year.

However, this trend is now reversed, according to a revival of the activity of whales. The monthly percentage change in whale companies has become positive, indicating a likely accumulation of bullish momentum.

Source: Cryptuquant

Firstly, consistent BTC recordings of trade fairs and renewed whale accumulation can indicate an imminent uprising.

This trend suggests a strong level of support that according to traders will retain, making keeping BTC less risky than selling.

Secondly, the continuous whale recording could cause a bullish response, which pushes the prices higher. However, if the whales stop accumulation or start selling, this may indicate the decreasing trust, which may increase the sales pressure and causes a price decrease.

Will BTC enter a bear market or continue with the Bullish Trend?

Further analysis indicates that Bitcoin (BTC) has reached a critical pivot point that will probably form the direction in the coming months.

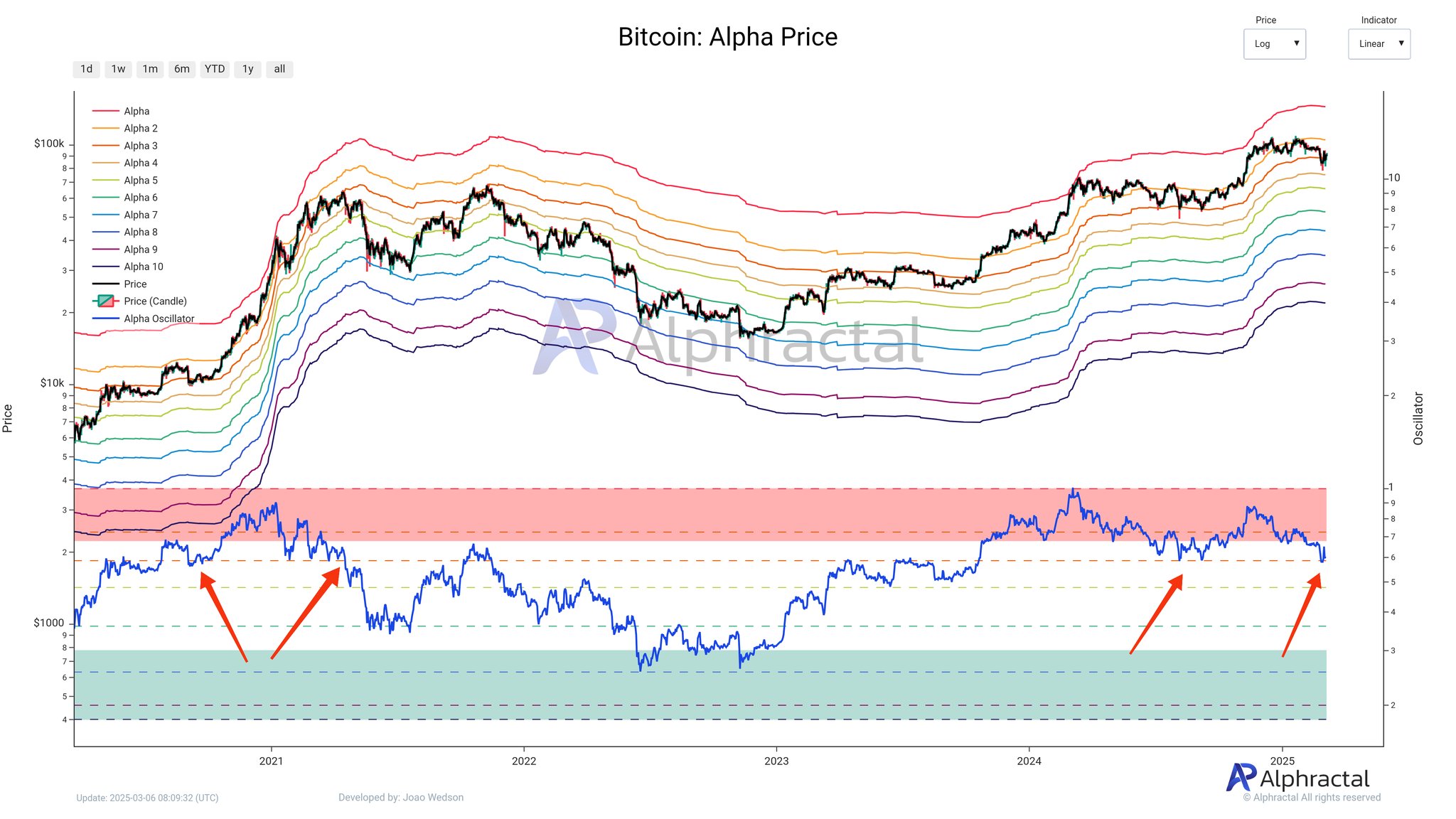

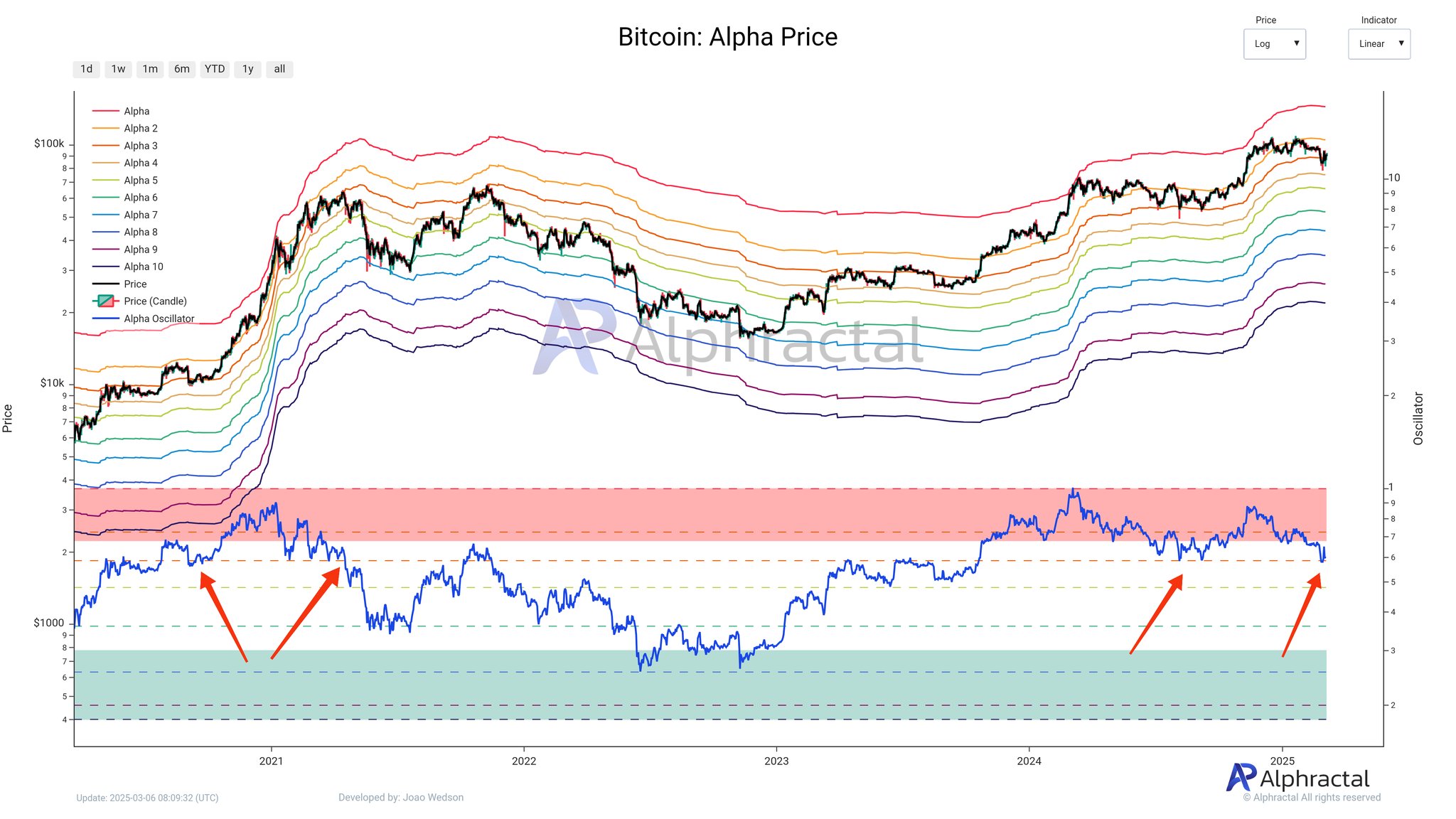

The Alfa price suggests that BTC acts in the vicinity of what many consider the final support line before a potentially important decrease.

Historical data show that not maintaining this important level of support – high -quality if the third dotted line on the graph – could lead to a reversal or price capitulation. Bitcoin’s ability to maintain this level last year, however, offers hope for a more positive prospect this time.

Source: Alfractaal

This month’s price action is similar to that of April and May 2021, characterized by considerable long liquidations instead of a long -term bear run.

If Bitcoin remains above the most important level of support, this can indicate a transition to a new battery phase, which promotes healthy future growth. However, a break below this level could cause a bearish trend, which probably leads to a constant downward movement.

Ultimately, Bitcoin’s ability to maintain a bullish trend or to respond to a Bears Market on his performance related to these critical price levels.