- Bitcoin recorded a slight relapse and fell by 0.66% for the past 24 hours

- The long -term holders of cryptocurrency have been particularly optimistic in the coming year

Bitcoin for almost 2 weeks [BTC] Has acted in an upward trend, where the cryptocurrency also climbed to a new high point of $ 109,000 four days ago.

Since reaching this level, BTC has seen some small falls in the charts. At the time of writing, the cryptocurrency even acted at $ 104,337, after he had fallen slightly at the daily period. And yet the upward trend was just as intact as a few days ago.

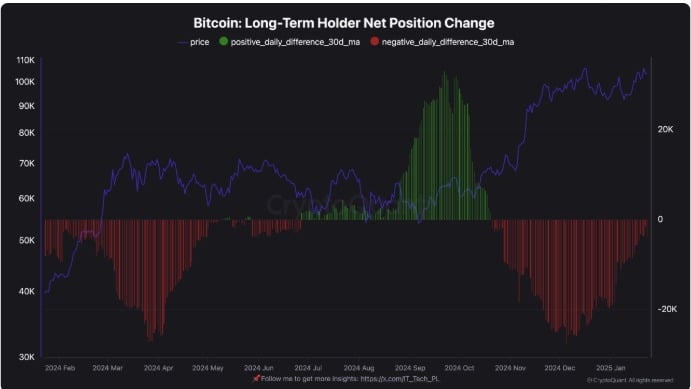

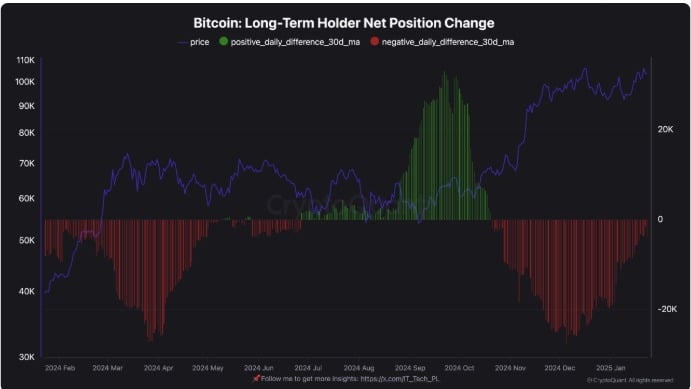

The consistency in the momentum of BTC can be attributed to the behavior of the holders, especially the long -term holders.

Bitcoin holders in the long term lead the market

According to CryptoquantBitcoin is now confronted with a fierce battle between diamond hands and speculative FOMO.

As a result, the supply dominance of the long -term holders has remained high, which indicates a strong long -term conviction. This cohort continues to accumulate BTC when the price drops and take a strategic profit when the price rises. This well -controlled market behavior supports positive long -term prospects by limiting sales pressure on the market.

Source: Cryptuquant

On the contrary, short -term investors have seen an increase in activity during price increases, which indicates speculative interest and accession driven by Fomo.

A significant distribution When the price drops, however, is a sign that weaker hands leave the market, which contributes to volatility in the short term.

Source: Cryptuquant

Now that LTHs are a considerable part of the offer, it seems that the Bitcoin market has now grown up.

That is why the decreasing influence of STHs on the offer can strengthen market stability. Although their speculative behavior could still cause price fluctuations in the short term.

Source: Cryptuquant

This combination positions Bitcoin for a bullish prospect for the whole of 2025. Strategic profit -making by LTH could lead to a healthy relapse, which offers opportunities for new accumulation.

What does this mean for Bitcoin’s graphs?

Although the analysis given above offers us promising prospects, it is essential to check other market indicators to determine what they mean and to which they refer.

Source: Cryptuquant

To begin with, the Bitcoin fund current ratio has risen from 0.05 to 0.11 last week.

Such a revival implies that more capital may flow to BTC than leaves. Such a market approach can be interpreted as a sign of accumulation behavior.

Source: Cryptuquant

In addition, the Soprr fell from Bitcoin from 1.05 to 1.01.

This seemed to imply that the side trade in BTC the holders had been reluctant to sell, which led to the supply scarcity. This in turn results in a price increase. Simply put: the market may absorb potential sales pressure without there being a strong decline in the charts.

Source: Santiment

This scarcity can be confirmed by the rising stock-to-flow ratio. In fact, the SFR peaked from 124 to 599.03. Such a peak means that more and more investors are keeping their assets outside the stock market, either in private portfolios or in cold storage.

Concluding: Now that long -term owners position themselves strategically, the market is mature enough for a potential advantage.

That is why this positive perception of LTHs plays a crucial role in absorbing the sales pressure. If the market meets these conditions, Bitcoin will reclaim $ 107,000 and try to reach $ 110,000. However, a persistent correction will mean a decrease to $ 102,770.