- Dormant addresses have moved their coins to exchanges amid rising social dominance.

- ETH’s volatility increased as traders continued to bet on a price increase.

Lately the attention has been Ethereum [ETH] has received from market participants is extremely high, according to the on-chain analysis platform Santiment. To reach this conclusion, Santiment took advantage of the social dominance surrounding the project.

How many Worth 1,10,100 ETHs today?

Social dominance is measured by looking at the percentage of discussions about one asset compared to others in the top 100 market capitalization lists.

Change in the status quo

According to the on-chain info provider, discussions around Ethereum have been very active on crypto-friendly social media, including Telegram, X (formerly Twitter), Discord and Telegram.

🗣️📊 The rate of #Ethereum discussions about #X, #Disagreement, #Telegram, #RedditAnd #4chan have been much higher than normal since the end of September. Moreover, there has been a peak in age consumption, with the most dormant peak visible $ETH moved within a month. https://t.co/jDtfuB9yeI pic.twitter.com/4tP0GrXNcr

— Santiment (@santimentfeed) October 12, 2023

However, the rise in social dominance has not occurred without a jump in another metric. Another statistic that rose from the above post was the age consumed. As a benchmark for tracking long-term behavior, the Age Consumed measures the movement of previously dormant addresses.

When Ethereum is held in dormant wallets, the Age Consumed value typically increases. On October 11, ETH’s Age Consumed was 205.32 million. The increase implies a revival of Ethereum’s network. It also reflects how ETH holders are transitioning from long-term holdings to active trade.

Between June and August there were only mild peaks in age consumed. But since September there has been a significant increase in the number of static addresses that have woken up.

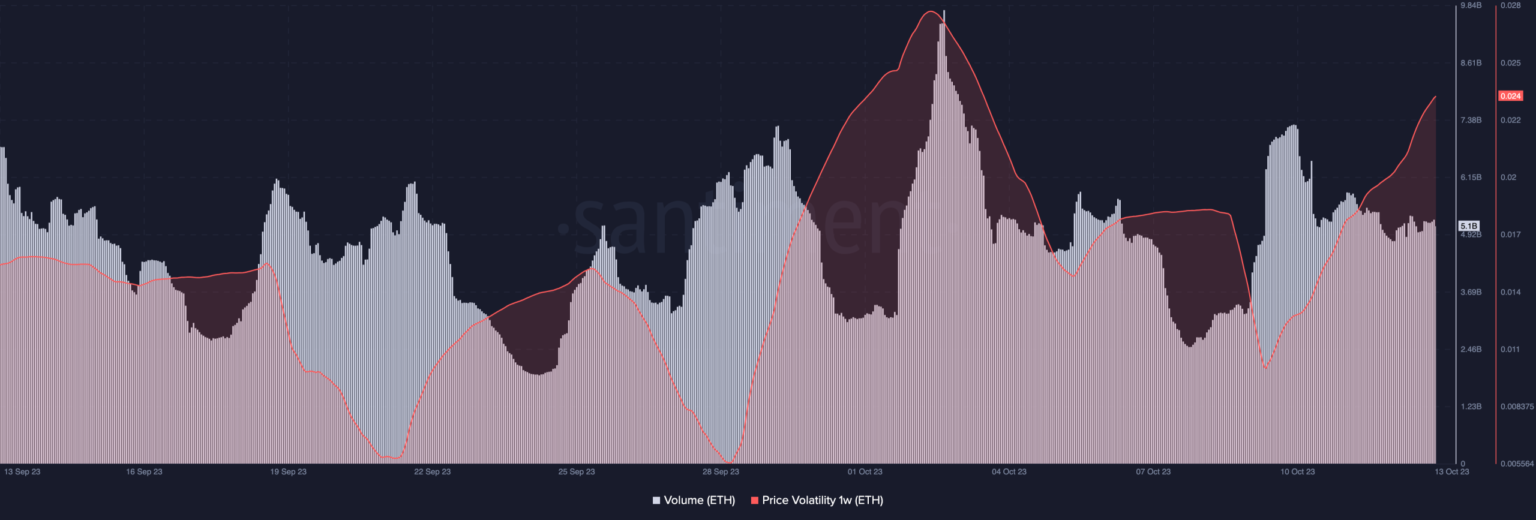

It is therefore not out of place to conclude that these Ethereum investors may be trying to profit from short-term price movements. This increase was also obvious in the volume on the chain. According to Santiment data, ETH’s volume exceeded five billion several times over the past thirty days.

Source: Santiment

Risk sometimes brings reward

The increase in on-chain volume indicates a sharp increase in the transfer of ETH from external sources to exchanges. Historically, it is known that the increase in the number of ages consumed produces an increase in the number of ages consumed inconstancy. It was no different this time.

At the time of writing, ETH’s seven-day price volatility was at a maximum of 0.024 (as shown above). In general, the higher the volatility, the riskier it is to trade the asset.

However, the rise in volatility also creates a high degree of rapid price movement that traders willing to take the risk can benefit from.

Well, ETH lasts a week financing rate showed that traders are more likely to see a price increase rather than a significant decrease. Financing fees are a small percentage of a position’s value paid to traders on the other side of the trade.

Read Ethereums [ETH] Price prediction 2023-2024

When the funding rate is positive, it means longs are paying a fee to shorts, and broader sentiment is bullish. Conversely, a negative funding ratio means short pay periods and the expected trend for the asset is downward.

At the time of writing, ETH’s funding rate was 0.004%, implying that traders to expect the altcoin value will move towards $1,600 in the short term.

Source: TradingView