- Mount Gox’s BTC distribution raises concerns about potential market volatility

- Bitcoin showed some resilience despite the continued distribution of assets on Mount Gox

In a recent development regarding the long-defunct Mt. Gox exchange, blockchain analytics company Arkham Intelligence reported that a crypto wallet associated with Mount Gox’s trustee initiated a test transaction involving $2 billion worth of Bitcoin [BTC].

What happened?

This move follows the recent transfer of $3.1 billion in BTC to BitGo, signaling possible preparations for the long-awaited distribution of funds to creditors.

According to Arkham analysts

“This wallet bc1q26 is likely Bitgo, the fifth and final exchange to partner with Mt. Gox Trustee to distribute funds to Mount Gox’s creditors.”

For those who don’t know, BitGo is one of the last remaining distribution partners for Mt. Gox. It plays a crucial role as one of the five service providers in charge of distributing tokens to creditors.

This recent test transaction, initiated after the transfer of 33,100 BTC worth $2.2 billion two weeks ago, underlines the ongoing efforts to prepare for the long-awaited distribution of funds from a Mount Gox cold wallet with creditors’ assets.

Why BitGo?

According to Arkham Intelligence, BitGo is likely the recipient of these transactions due to its role as one of the main distribution partners responsible for handling the complex process of refunding money to Mount Gox’s creditors.

“The address was clustered with a large input cluster that we were able to identify as BitGo due to the custody structure and wallet types used.”

Some users on Reddit have even confirmed their suspicions by claiming that they have already received funds into their BitGo accounts.

Source: Reddit

The story around Mount Gox

For context, the continued distribution of Mount Gox’s remaining 140,000 BTC and Bitcoin Cash (BCH) to creditors has raised concerns in the cryptocurrency market, especially around potential sell-offs by long-pending creditors.

This event has already affected Bitcoin prices, causing them to fall below $54,000 when distributions began in early July.

With 46,000 BTC still sitting at Mount Gox addresses, the continued release of these funds through authorized exchanges such as Bitbank, BitGo and Kraken could lead to further market volatility. This will depend on how creditors want to manage their assets.

Impact on Bitcoin

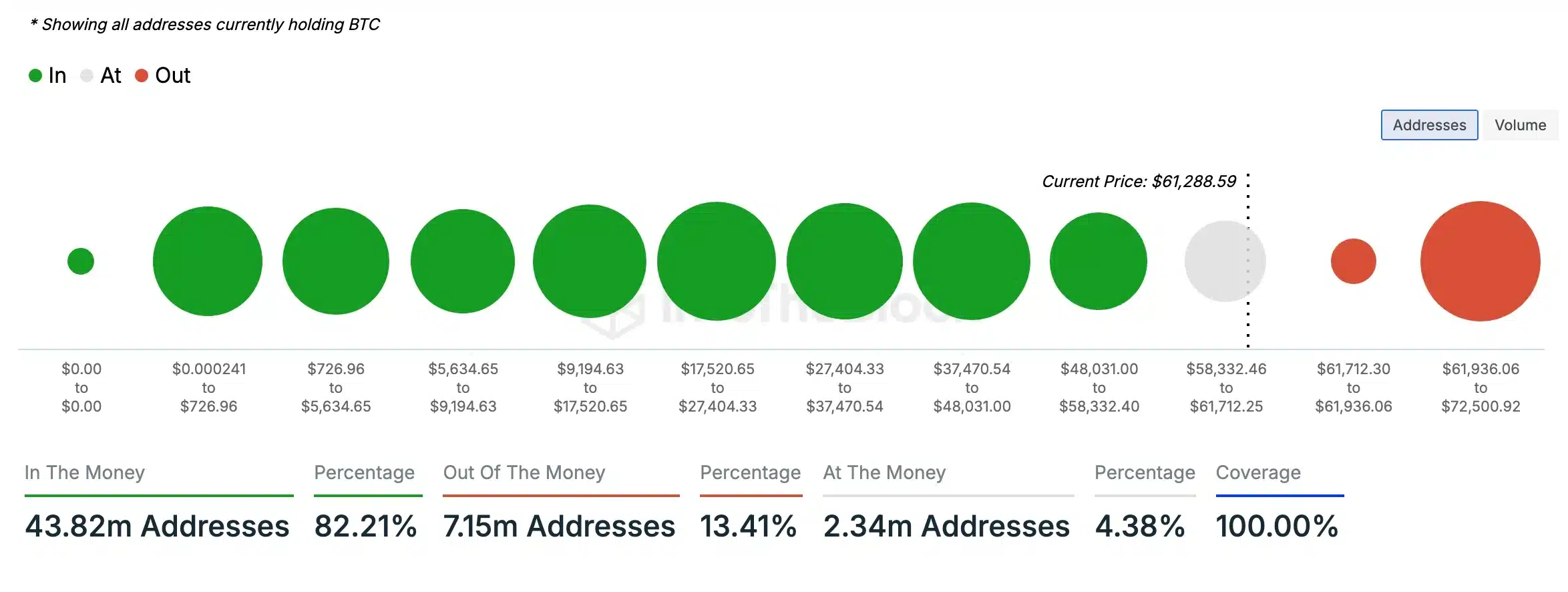

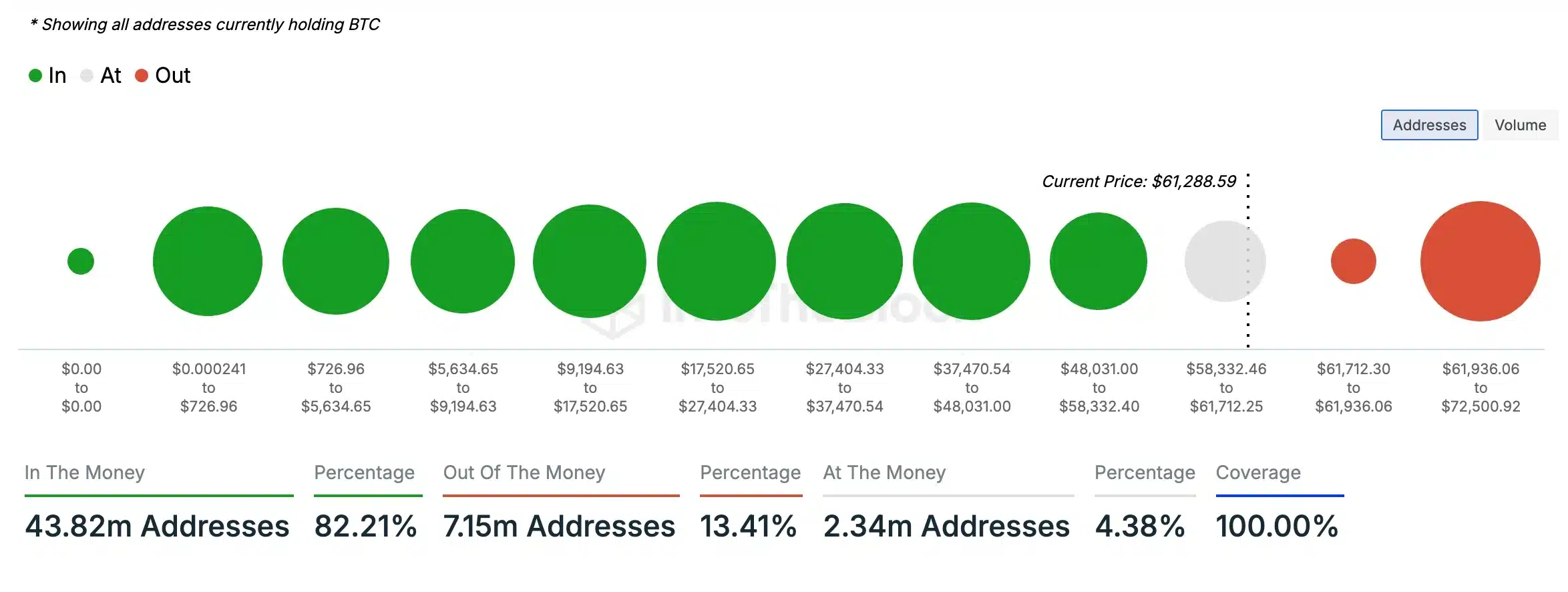

Despite concerns about possible selling pressure, Bitcoin remained resilient on the charts. It was trading at $61,284 at the time of writing, after rising 4.61% in the past 24 hours.

This price stability can be seen as a sign of strong market sentiment. Especially since 82.21% of BTC addresses are currently ‘in the money’, with their assets valued above the purchase price.

On the contrary, only 13.41% of addresses are out of the money, indicating limited downward pressure on the market.

Source: IntoTheBlock